简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FPG EURUSD Market Report December 9, 2025

Sommario:EURUSD on the M30 timeframe, an analysis intended for mid-term trading. The price is moving within a slightly bearish channel. After a previous rejection around 1.1681, the pair has been gradually mov

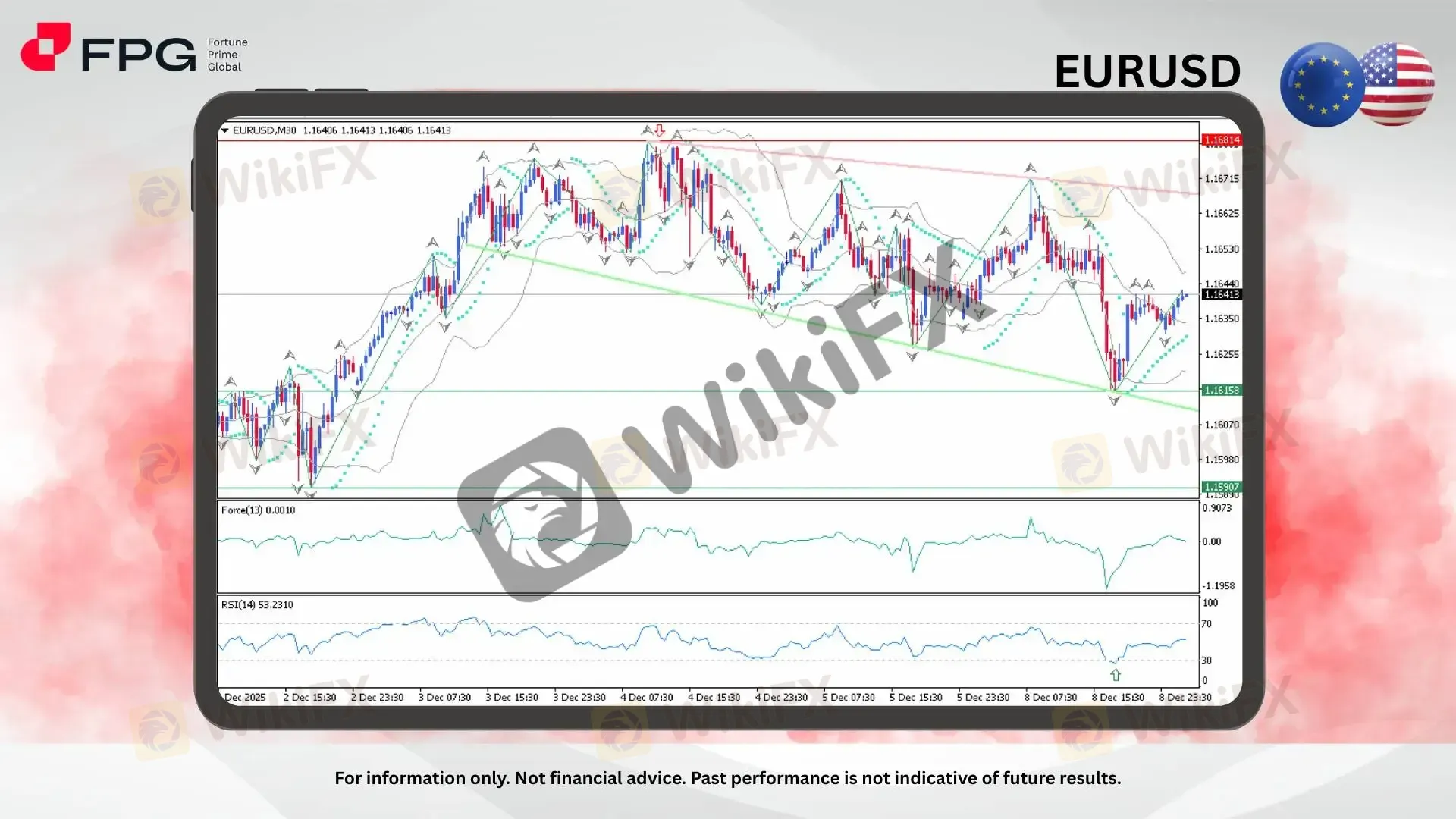

EURUSD on the M30 timeframe, an analysis intended for mid-term trading. The price is moving within a slightly bearish channel. After a previous rejection around 1.1681, the pair has been gradually moving lower, with the current price hovering near 1.1641. This structure indicates that EURUSD is still under mild selling pressure while attempting to stabilize above a short-term demand zone.

EURUSD is currently trading near the mid-lower range of its Bollinger Bands, signaling that bearish pressure remains active but is beginning to stabilize. Parabolic SAR readings now appear below the candles, suggesting that near-term upside bias has taken hold. RSI (14) is currently around 53, indicating a neutral-to-slightly bullish recovery phase after previously dipping closer to oversold territory. Force Index (13) has returned to slightly positive territory, reflecting early signs of buying interest returning after the recent sell-off. Overall, momentum shows weakening bearish control, but no strong bullish confirmation has formed yet.

Today, several key economic events from various European countries are scheduled. These releases will likely influence EURUSD price movement and may significantly increase market volatility during those periods. With price positioned inside a reactive short-term zone, any surprise from macroeconomic data could quickly trigger either a bearish continuation toward lower demand areas or a sharp bullish rebound toward upper resistance.

Market Observation & Strategy Advice

1. Current Position: EURUSD is currently trading around 1.1641, consolidating after a steady decline from the 1.1681 rejection zone. Price remains highly reactive inside the mid-term bearish channel.

2. Resistance Zone: Immediate resistance is located at 1.1681, which acts as a strong supply zone. A clean breakout and sustained close above this level would signal a potential short-term trend reversal toward 1.1705–1.1730.

3. Support Zone: Nearest support is seen at 1.1616, aligning with the lower channel boundary and recent demand reaction. Deeper support rests at 1.1591, which represents a stronger historical demand zone.

4. Indicators: RSI is stabilizing near the mid-level, suggesting fading bearish momentum. Force Index has turned slightly positive, indicating early buyer participation. Parabolic SAR still supports the bearish bias until price clearly breaks above the current resistance structure.

5. Trading Strategy Suggestions:

Range Sell Strategy: Look for bearish rejection signals near 1.1662–1.1671 for short-term sell setups targeting 1.1616 with tight risk control.

Support Rebound Strategy: If strong bullish rejection appears near 1.1616, short-term bounce trades toward 1.1645–1.1665 can be considered.

News Volatility Strategy: During European economic releases, wait for post-news candle confirmation before entering to avoid false breakouts and whipsaw movement.

Market Performance:

Forex Last Price % Change

USD/JPY 155.88 −0.02%

GBP/USD 1.3325 +0.02%

Today's Key Economic Calendar:

UK: BRC Retail Sales Monitor YoY

AU: NAB Business Confidence

AU: RBA Interest Rate Decision

AU: RBA Press Conference

DE: Balance of Trade

DE: Exports MoM

UK: BOE Gov Bailey Speech

US: ADP Employment Change Weekly

US: JOLTsJob Openings

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

octa

D prime

AVATRADE

FXCM

EBC

Exness

octa

D prime

AVATRADE

FXCM

EBC

Exness

WikiFX Trader

octa

D prime

AVATRADE

FXCM

EBC

Exness

octa

D prime

AVATRADE

FXCM

EBC

Exness

Rate Calc