简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Accounts and Currency Pairs in the Forex Market

Sommario:Introduction : The forex and CFD (Contracts for Difference) market relies heavily on the broker you choose, because the type of account a company offers and the currency pairs available directly affec

Introduction :

The forex and CFD (Contracts for Difference) market relies heavily on the broker you choose, because the type of account a company offers and the currency pairs available directly affect trading costs, risks, and flexibility. As a trader or researcher, it is important to clearly understand the types of accounts and what trading pairs or instruments are available so you can choose what suits your capital, strategy, and risk tolerance.

Trading accounts are different types of accounts offered by brokerage firms to enable traders to enter financial markets. These accounts differ in deposit requirements, fees, execution methods, and available options. Their purpose is to meet the needs of various traders, whether beginners or professionals.

Types of Accounts at INZO :

INZO offers multi‑asset accounts, meaning accounts that allow traders to trade forex pairs and possibly other assets such as metals or CFDs.

· Live Account: INZO provides a real account for trading with real funds on forex pairs or other instruments. This is suitable for those entering the market seriously.

· Demo Account: INZO offers a demo account to test the platform and trading strategies with zero risk. This is especially useful for beginners.

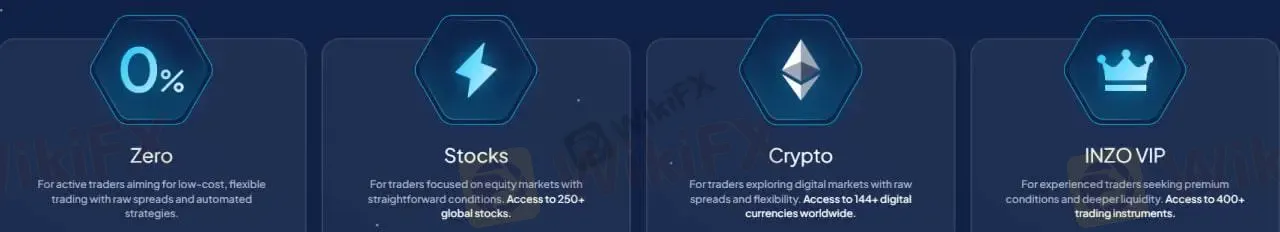

Types of Live Accounts :

· Standard: Spread starting from 0.8 pips, suitable for beginners.

· Zero Standard: Spread starting from 0.0, suitable for traders who prefer low spread.

· Zero: Spread 0.0, designed for traders with larger capital.

· INZO VIP: Zero spread, tailored for large accounts.

· Stocks: Spread starting from 5 pips, designed for trading global stocks.

· Crypto: Raw spread, for trading cryptocurrencies.

Types of Currency Pairs Available :

• Major Pairs

These pairs include the USD paired with major global currencies, such as:

EUR/USD - USD/JPY - GBP/USD - USD/CHF - AUD/USD - USD/CAD

Features: High liquidity, low spreads, and more stable price movements, ideal for beginners.

• Minor (Cross) Pairs

Pairs that do not include USD, such as:

EUR/GBP - EUR/JPY - GBP/JPY

Features: Lower liquidity than majors, wider spreads, and higher volatility.

• Exotic Pairs

Pairs with a major currency and a currency from an emerging market, such as:

USD/TRY - USD/ZAR

Features: High volatility, lower liquidity, higher spreads, and strong sensitivity to economic and political news, making them higher risk.

Why Trading Accounts Differ Between Brokers :

Trading accounts differ across brokers because each one targets specific types of traders and structures its services accordingly. Some focus on low‑cost accounts to attract small‑cap traders, while others offer premium accounts with higher fees but better liquidity and more precise execution suitable for professionals. Accounts also vary depending on the brokers technology, liquidity providers, execution speed, and pricing models (fixed spread, variable spread, zero spread + commission).

This variety allows each trader to choose the account that matches their strategy, experience, and risk level.

Choosing the Right Account at INZO :

Choosing the right INZO account depends on several factors. Beginners usually prefer accounts with moderate spread and no commission, like the Standard Account, as it provides stable trading experience at low cost.

Traders relying on scalping or fast execution may choose Zero Standard or Zero accounts since they offer spreads close to zero and faster execution.

Large‑capital traders may find INZO VIP more suitable due to its premium conditions and lower fees.

A trader should always consider their capital size, trading style, and trade frequency to choose an account that balances cost, flexibility, and risk.

Conclusion:

Understanding account types and available trading pairs at a broker like INZO is essential before entering the forex or CFD markets. Accounts differ in execution methods, liquidity, and asset options, from demo and live accounts to multi‑asset accounts or STP models. Likewise, currency pairs vary from highly liquid major pairs with low spreads, to more volatile minor pairs, and exotic pairs with higher risk and lower liquidity.

Choosing the right account and currency pair depends on capital size, trading strategy, and risk tolerance, not on marketing slogans or promotional offers.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Exness

D prime

GTCFX

EC markets

octa

TMGM

Exness

D prime

GTCFX

EC markets

octa

TMGM

WikiFX Trader

Exness

D prime

GTCFX

EC markets

octa

TMGM

Exness

D prime

GTCFX

EC markets

octa

TMGM

Rate Calc