简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

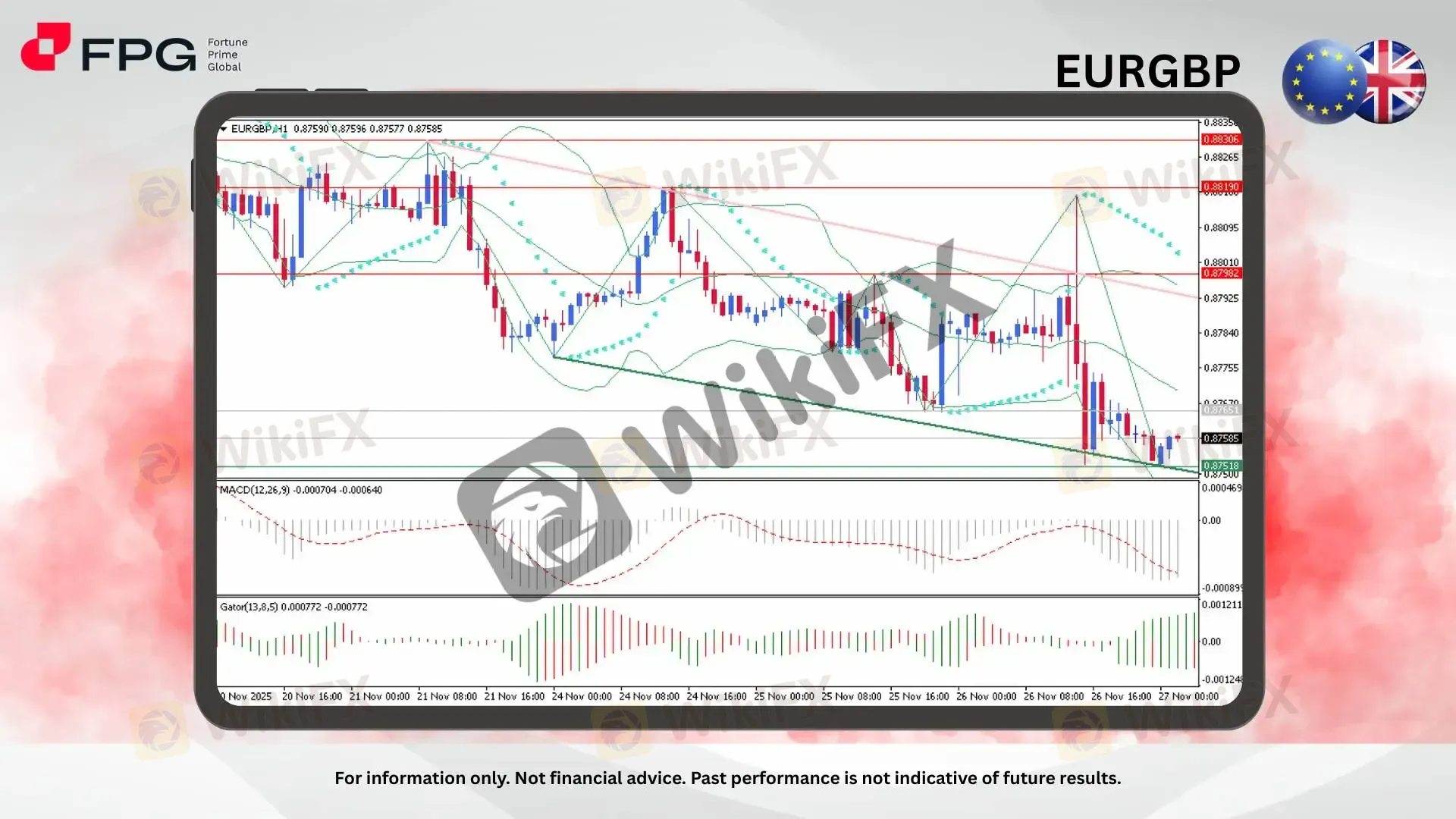

FPG EURGBP Market Report November 27, 2025

Sommario:EURGBP is currently trading around 0.8758, maintaining a bearish tone within a well-defined descending channel. Market structure shows consistent lower highs and lower lows, reflecting sustained selle

EURGBP is currently trading around 0.8758, maintaining a bearish tone within a well-defined descending channel. Market structure shows consistent lower highs and lower lows, reflecting sustained seller dominance. The price is hovering near a crucial demand zone at 0.8751, indicating a possible short-term reaction but still under strong downside pressure.

From a structural perspective, price action remains capped below the mid-Bollinger Band, confirming the absence of bullish strength. Parabolic SAR dots continue to position above price action, signaling persistent bearish momentum. Price has repeatedly tested the lower boundary of the descending channel, where mild buying pressure emerges but lacks conviction. The recent candles are small-bodied, suggesting hesitation but without any clear reversal signal for now.

Momentum indicators reinforce the bearish outlook. MACD histogram stays below zero, with the signal line trending sideways, showing consistent bearish bias but with weakening sell momentum. The Gator Oscillator indicates a potential buildup before a directional breakout. This contraction signals that a strong move could occur once price decisively breaks either above 0.8798 or below 0.8751.

Market Observation & Strategy Advice

1. Current Position: EURGBP trades around 0.8758, sitting at the lower boundary of a descending channel and testing a key support area with weakened bearish momentum.

2. Resistance Zone: Primary resistance sits at 0.8798, a previous supply rejection area. A break above may expose the upper channel line near 0.8819.

3. Support Zone: Immediate support lies at 0.8751, forming a structural base and channel support. A break below here could accelerate bearish continuation toward 0.8735.

4. Indicators: MACD remains below the zero line, keeping bearish momentum intact despite contraction. Gator Oscillator signaling potential price compression before a breakout. Parabolic SAR continues to plot above price, confirming bearish bias with no valid reversal signal yet.

5. Trading Strategy Suggestions:

Sell Continuation Setup: Sell stop below 0.8751 targeting 0.8735 and 0.8718, with stop-loss above 0.8763.

Rebound Pullback Play: Buy limit at 0.8752–0.8754 targeting 0.8785 and 0.8798, stop-loss below 0.8745.

Breakout Retest Strategy: If price breaks and sustains above 0.8798, look for buy setups toward 0.8819, with protective stops below 0.8787.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1602 +0.07%

USD/JPY 156.07 −0.24%

Today's Key Economic Calendar:

EU: ECB President Lagarde Speech

JP: BoJ Noguchi Speech

DE: GfK Consumer Confidence

EU: Economic Sentiment

EU: ECB Monetary Policy Meeting Accounts

CA: Current Account

Risk Disclaimer: This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FXTM

JustMarkets

STARTRADER

octa

IC Markets Global

GTCFX

FXTM

JustMarkets

STARTRADER

octa

IC Markets Global

GTCFX

WikiFX Trader

FXTM

JustMarkets

STARTRADER

octa

IC Markets Global

GTCFX

FXTM

JustMarkets

STARTRADER

octa

IC Markets Global

GTCFX

Rate Calc