Profil perusahaan

| Tasman FX Ringkasan Ulasan | |

| Dibentuk | 2009-03-05 |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | Teregulasi |

| Layanan | Produk FX, Remitansi Masuk, Manajemen Risiko, Pesanan Pasar, dan Pembayaran Global |

| Dukungan Pelanggan | Sydney: (02) 8011 1846Melbourne: (03) 9111 0310Brisbane: (07) 3733 1913Perth: (08) 9468 2705Adelaide: (08) 7111 0807 |

| (02) 9098 8217 | |

| Facebook, LinkedIn, Instagram, Twitter | |

| The Commons, Level 1, 285a Crown St, Surry Hills, NSW 2010, Australia | |

Tasman FX Informasi

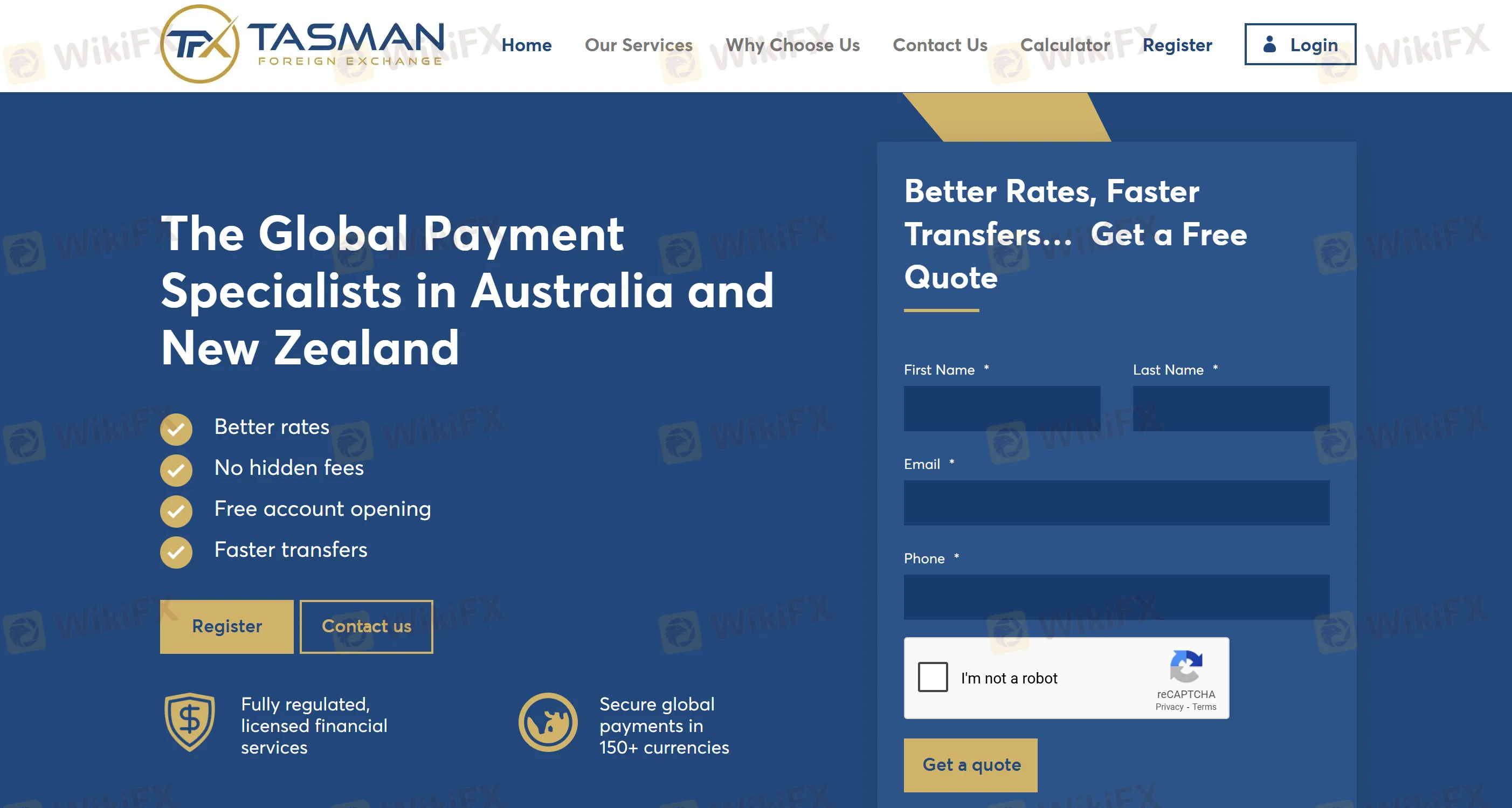

Didirikan pada tahun 2009, Tasman FX adalah penyedia layanan pertukaran valuta asing berlisensi terkemuka di Australia dan Selandia Baru. Tasman FX menawarkan solusi dana lintas batas bagi individu dan bisnis, mendukung pembayaran yang aman dalam lebih dari 150 mata uang di lebih dari 50 negara dan wilayah di seluruh dunia.

Pro dan Kontra

| Pro | Kontra |

| Teregulasi | Lingkup layanan terbatas (difokuskan pada pasar Australia dan Selandia Baru) |

| Berbagai layanan | Jenis produk tunggal |

| Pembayaran global dalam 150+ mata uang | Kurangnya layanan leverage |

Apakah Tasman FX Legal?

Ya. Tasman FX memiliki Lisensi Layanan Keuangan Australia (AFSL) dan secara legal terdaftar dan diatur di Selandia Baru. Nomor lisensi ASIC-nya adalah 000337970.

Layanan Apa yang Disediakan oleh Tasman FX?

Tasman FX menyediakan produk pertukaran valuta asing seperti perdagangan valuta asing spot dan Kontrak Pertukaran Forward (FEC). Investor dapat memilih berbagai metode transfer dana, termasuk transfer telegrafis, ACH, dan SEPA, yang mencakup lebih dari 50 mata uang.

Jenis Akun

Tasman FX menawarkan akun individu dan akun korporat, dengan pembukaan akun gratis. Ini mendukung layanan seperti remitansi lintas batas, konversi valuta asing, dan solusi manajemen risiko yang disesuaikan.

小芯

Taiwan

Platform ini memungkinkan Anda membuka akun dan berinvestasi langsung secara gratis. Sangat cocok untuk pemula. Lebih penting lagi, biaya penanganannya rendah dan kecepatan penarikannya cepat. Sikap pelayanan sangat baik.

Baik

FX3660481217

Hong Kong

Saya memasuki platform ini dengan gentar. Setelah menggunakannya beberapa saat, saya menemukan bahwa ini adalah platform yang sangat bagus. Saya memperoleh penghasilan tambahan di sini dan akan terus menggunakannya.

Baik

FX1349771962

Selandia Baru

Menurut saya, proses pendaftaran akun gratis dengan Tasman FX sangat memakan waktu dan membosankan. Selain itu, waktu respons layanan pelanggan sangat lambat, sehingga sulit mendapatkan jawaban atas pertanyaan penting. Secara keseluruhan, saya memiliki pengalaman buruk dengan perusahaan ini dan tidak akan mempertimbangkan untuk menggunakan layanan mereka di masa mendatang.

ulasan netral

FX1299232315

Australia

Saya telah menjadi klien TASMAN selama bertahun-tahun dan harus saya katakan, mereka adalah yang terbaik dalam bisnis ini. Layanan pelanggan tidak ada duanya; platform mereka membuat investasi menjadi sangat sederhana!

Baik