Profil perusahaan

| Bell PotterRingkasan Ulasan | |

| Terdaftar Pada | Lebih dari 20 tahun |

| Negara/Daerah Terdaftar | Australia |

| Regulasi | Teregulasi |

| Instrumen Pasar | Saham, Derivatif, Dana & Pendapatan Tetap, dan Lainnya |

| Platform Perdagangan | Klien Bell Potter |

| Dukungan Pelanggan | 1300 023 557 |

| Twitter, Facebook, LinkedIn, YouTube | |

Informasi Bell Potter

Bell Potter adalah perusahaan pialang saham dan konsultan keuangan layanan penuh terkemuka di Australia, dimiliki oleh Bell Financial Group (BFG.ASX). Perusahaan ini melayani investor perorangan, korporat, dan institusi, menawarkan layanan seperti pialang saham Australia/internasional, pendapatan tetap, perencanaan superannuation, pembiayaan korporat (misalnya, IPO, penggabungan, dan akuisisi), dan analisis riset. Perusahaan ini mendukung investasi klien melalui jaringan globalnya.

Pro dan Kontra

| Pro | Kontra |

| Teregulasi | Ambang batas layanan tidak jelas |

| Cakupan layanan penuh | Transparansi biaya rata-rata |

| Cakupan pasar internasional terbatas |

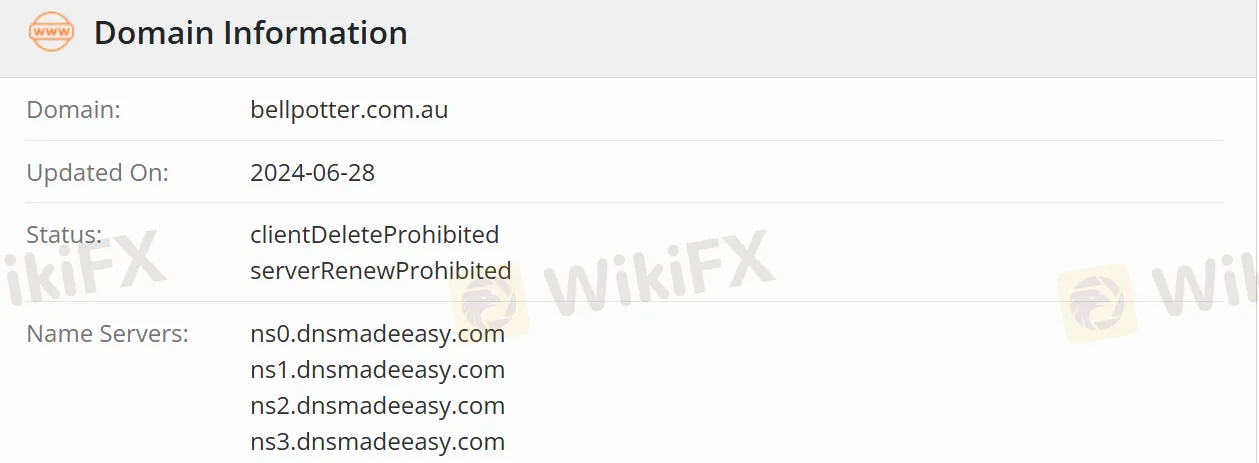

Apakah Bell Potter Legal?

Bell Potter adalah pemegang Lisensi Layanan Keuangan Australia (AFSL), dimiliki oleh perusahaan terdaftar Bell Financial Group, dan diatur oleh Australian Securities and Investments Commission (ASIC), dengan nomor lisensi 000243480.

Apa yang Dapat Saya Perdagangkan di Bell Potter?

| Instrumen Perdagangan | Jenis/Deskripsi Spesifik |

| Saham | Saham Australia (terdaftar di ASX), Saham internasional |

| Derivatif | WaranFutures (memerlukan bimbingan dari spesialis derivatif berakreditasi) |

| Dana dan Pendapatan Tetap | LICs, ETF, Produk pendapatan tetap (obligasi, sekuritas hibrida), Produk superannuation |

| Lainnya | Perdagangan Forex, Gearing, dan mFunds |

Jenis Akun

Menurut situs web resmi, Bell Potter menawarkan jenis akun berikut:

Akun Investasi Personal: Cocok untuk investor perorangan, mendukung perdagangan saham Australia, saham internasional, ETF, dll., dan dapat dipasangkan dengan layanan perencanaan superannuation.

Akun Korporat: Disesuaikan untuk klien korporat, menyediakan layanan seperti IPO, pembiayaan ekuitas, dan konsultasi penggabungan & akuisisi, memerlukan aplikasi yang disesuaikan.

Akun Institusi: Dirancang untuk perusahaan dana dan lembaga manajemen aset, menawarkan eksekusi perdagangan, koordinasi riset, dan layanan Akses Korporat.

Akun Layanan Perantara: Dirancang khusus untuk perencana keuangan, memungkinkan perdagangan berbasis klien atas nama klien, bersama dengan dukungan riset dan seminar yang disesuaikan.

Platform Perdagangan

Investor dapat mengakses portal Akses Klien Bell Potter melalui web untuk melihat informasi real-time seperti penilaian portofolio. Selain itu, integrasi platform pihak ketiga mendukung penyelesaian elektronik melalui sistem CHESS, memungkinkan manajemen bersatu dari kepemilikan dengan aset yang diperdagangkan di ASX lainnya.

Deposit dan Penarikan

Deposit didukung melalui transfer bank (rekening AUD dan mata uang asing). Penarikan dikembalikan ke rekening bank terikat melalui rute asli, dan aplikasi perlu diajukan melalui backend akun. Transaksi AUD biasanya tiba dalam 1-2 hari kerja, sementara transfer internasional dapat diperpanjang hingga 3-5 hari kerja.

Mata uang utama adalah AUD, dan transaksi internasional memerlukan konversi ke mata uang lokal (biaya konversi valuta asing berlaku).

dd4516

Kamboja

Perangkat lunak perdagangan SoonTrade5 sangat nyaman

Baik

HxIn

Siprus

Perusahaan yang baik dan pelayanan yang baik. Pengalaman trading saya bagus. Setoran tidak memakan waktu sama sekali, tetapi penarikan membutuhkan waktu terlalu lama bagi saya.

Baik

阳谷电缆

Kolombia

Saya sangat menyukai platform MT4 yang disediakan oleh bellpotter. Masuk akal bahwa MT4 sangat populer karena kaya akan fitur dan mudah digunakan.

Baik

FX1024642656

Hong Kong

Bell Potter tampaknya dapat dipercaya, tetapi saya belum memutuskan apakah akan berinvestasi dengan mereka. Modal awal yang minim cukup menarik bagi saya. Hanya berinvestasi 5 dolar, maka saya dapat memiliki kesempatan untuk menghasilkan uang. Hal lain yang menarik bagi saya adalah bahwa broker tersebut mendukung pembayaran PayPal, sementara sebagian besar broker lainnya, setidaknya menurut saya, sangat sedikit dari mereka yang menawarkan. Namun...saya juga membaca dari situs web mereka bahwa penarikan biasanya memerlukan waktu 7 hari untuk muncul di akun saya, jadi saya ragu..yeah..saya juga perlu s

Baik

...61405

Hong Kong

SSSSO MUDAH UNTUK MEMULAI! SAYA HANYA MEMBUKA AKUN SAYA DENGAN 5 DOLAR! SELAMAT UNTUK SAYA GUYS!

Baik

你好99363

Hong Kong

Perlu saya katakan, broker ini meminta modal awal yang kecil, yang merupakan bagian yang bagus. Namun, Anda juga harus memperhatikan bahwa biaya tidak aktif adalah biaya yang harus Anda bayar. Menurut saya, mungkin Anda dapat mempertimbangkan perusahaan ini untuk membantu Anda membuat beberapa keputusan keuangan.

Baik