Abstract:As regulation matures, brokers are entering crypto at scale. IG Group and Capital.com signal a broader shift toward compliant digital asset trading.

Over the past two years, cryptocurrency has quietly shifted from a side offering to a strategic priority for several major retail brokerage firms. What once appeared as cautious experimentation is now turning into full-scale expansion, with brokers investing in exchanges, securing crypto-specific licences, and preparing to offer spot digital assets alongside traditional products.

Two recent developments involving IG Group and Capital.com illustrate how this transition is accelerating across regulated markets.

IG Group Prepares a Dedicated Crypto Offering

IG Group has confirmed plans to launch a dedicated crypto proposition for clients in Singapore, Australia, and the UAE in the second half of 2026. The move follows the completion of its acquisition of Independent Reserve, a regulated cryptocurrency exchange based in Australia.

The deal, valued at an initial enterprise price of AU$178 million, closed after receiving regulatory approval in Singapore. As part of the transaction, IG onboarded Independent Reserves management team and staff, who retained a minority ownership stake. The acquisition gives IG direct access to established crypto infrastructure, custody capabilities, and a platform with more than 129,000 funded accounts and AU$1.7 billion in client assets.

IG‘s interest in crypto did not emerge overnight. The broker began offering limited digital asset exposure through a partnership with Uphold and later became the first UK-listed brokerage to secure registration under the FCA’s crypto regime. Financial disclosures show that even early-stage spot crypto trading generated measurable revenue, reinforcing managements view that regulated crypto demand is no longer niche.

For IG, the strategy appears clear: integrate crypto into its core offering while maintaining the regulatory standards expected of a publicly listed broker.

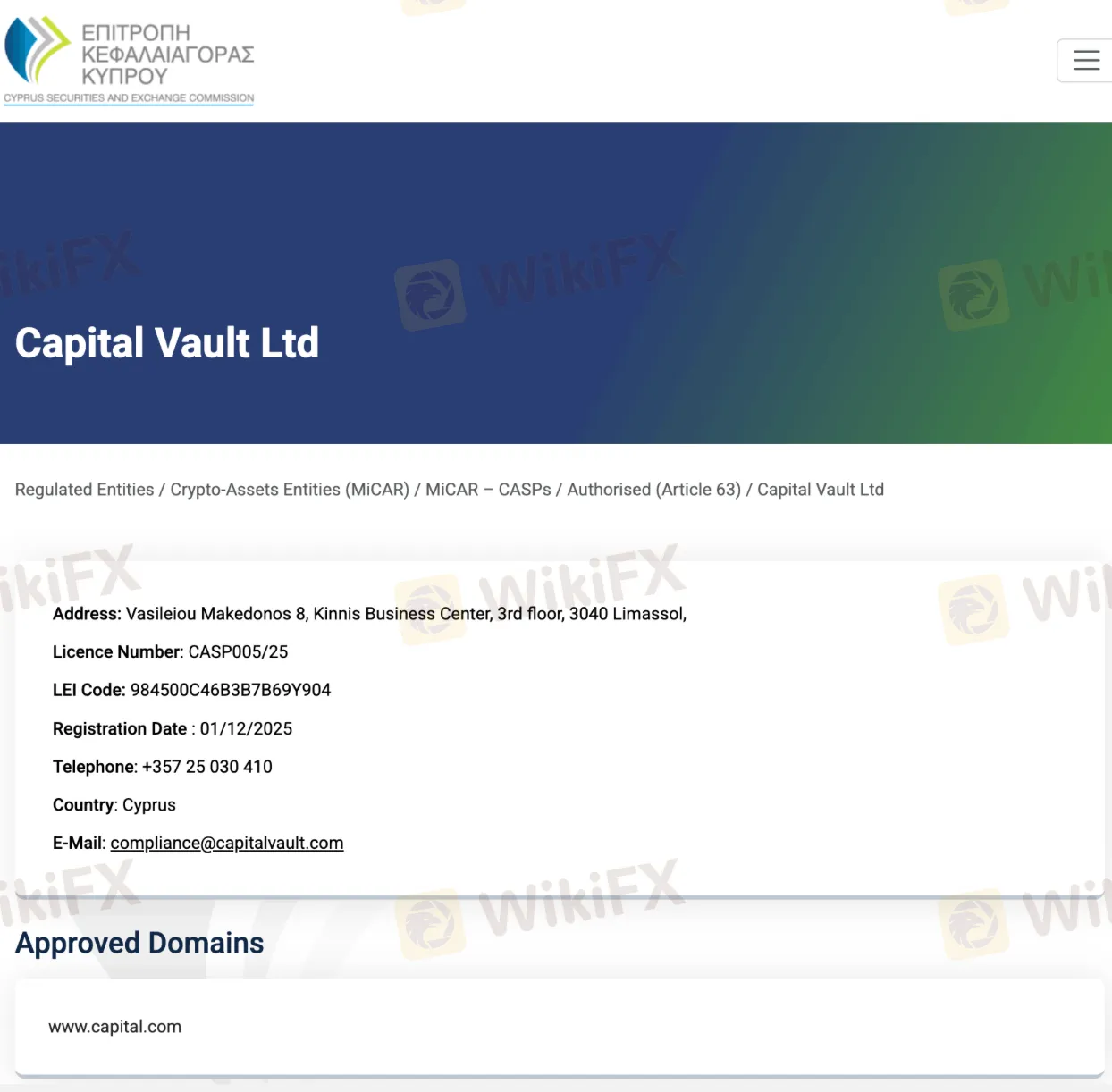

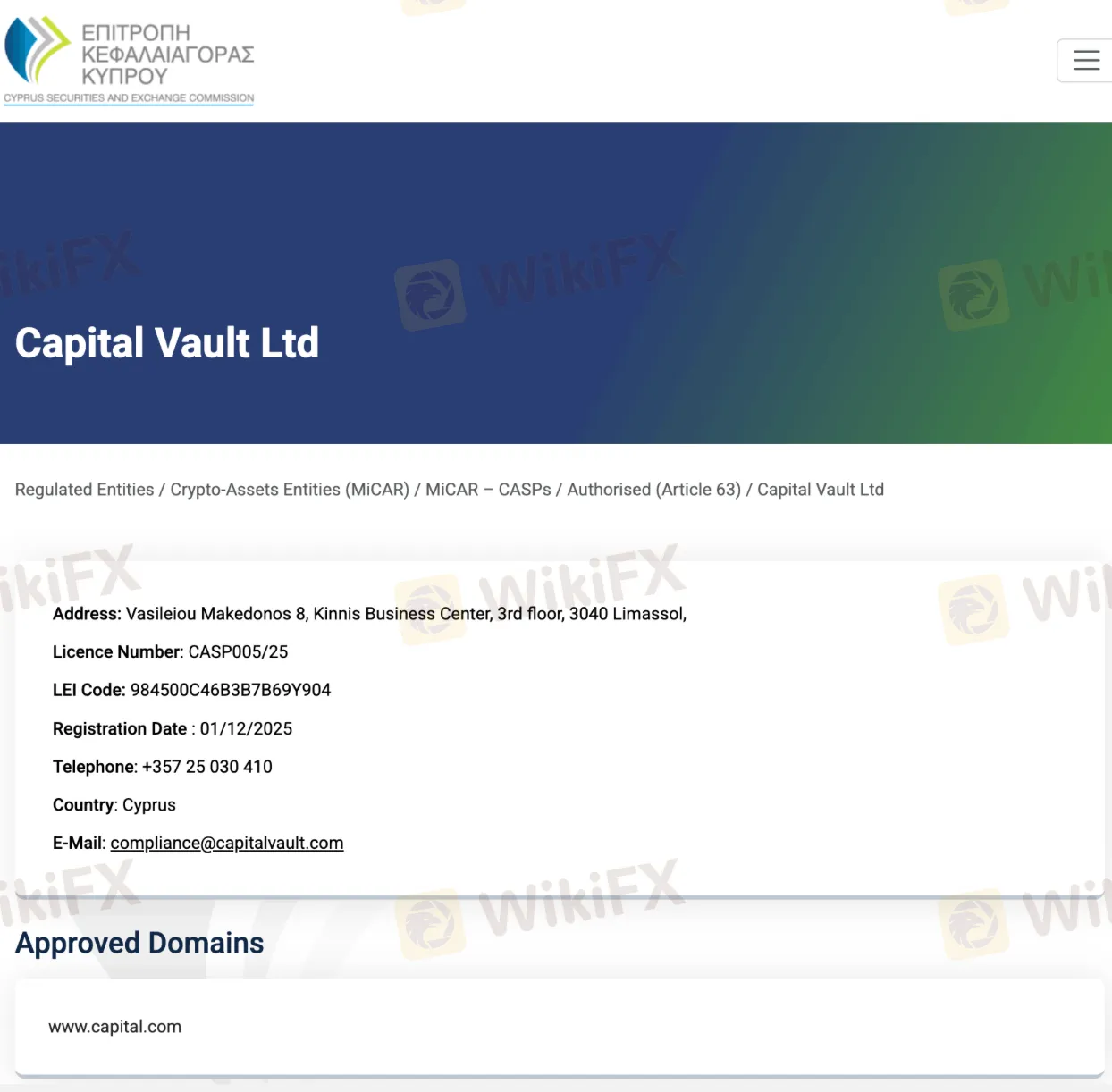

Capital.com Moves Toward Spot Crypto Under MiCA

A similar shift is unfolding at Capital.com. Regulatory records indicate that a related entity, Capital Vault Ltd, secured a Markets in Crypto-Assets (MiCA) licence from Cyprus securities regulator in late 2025. The licence lists Capital.com as an approved operating domain, opening the door for pan-European spot crypto services under the new EU framework.

Although Capital.com has not formally announced a product launch, its recent hiring activity and infrastructure investments suggest that crypto expansion is imminent. The broker has previously offered crypto CFDs in multiple jurisdictions, but a MiCA licence allows it to provide spot crypto products and related services across the European Union.

This regulatory step coincides with Capital.coms broader international expansion. Over the past year, the company has entered new markets, applied for additional licences, and invested heavily in technology and customer service hubs—moves that align with the operational demands of crypto trading at scale.

A Broader Industry Shift

IG and Capital.com are not isolated cases. Across Europe, Asia-Pacific, and the Middle East, brokers are repositioning themselves as multi-asset platforms where crypto sits alongside forex, equities, and derivatives. The motivation is not simply revenue diversification, but long-term relevance.

Retail traders increasingly expect access to digital assets within regulated environments. At the same time, regulators have begun providing clearer frameworks—from MiCA in Europe to licensing regimes in Singapore and Australia—making compliant expansion more feasible.

Still, the transition carries risks. Crypto products introduce new custody, volatility, and operational challenges, and the gap between regulated offerings and unlicensed platforms remains wide. For traders, understanding who is genuinely authorised to offer crypto services—and under which regulatory regime—has become more important than ever.

About WikiFX

As brokers expand into digital assets, independent verification remains a critical safeguard for investors. WikiFX is a global broker information platform that focuses on licence verification, regulatory status checks, risk alerts, and user-reported exposure cases. By aggregating official regulatory data and operational records, WikiFX helps traders assess whether a platforms crypto ambitions are supported by proper authorisation—or whether caution is warranted before engaging.