简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

eToro Review: The $170,000 Trap Hidden in Fine Print

Abstract:Urgent warning for mobile traders: Our investigation confirms complaints of eToro forcibly moving client accounts from top-tier jurisdictions to offshore zones, stripping vital legal protections. With 47 recent complaints and active regulatory lawsuits regarding high-risk client acquisition, immediate caution is advised.

By WikiFX Special Investigator

Our investigation into the eToro broker platform begins with a devastating financial collapse reported by a user in Morocco. This isn't just a story about bad luck in the market; it is a warning about systemic risks embedded in the terms of service.

The trader reported a total loss of $170,000. The primary cause? A forced regulatory migration. The user alleges that eToro moved their account from the protection of Australias ASIC regulation to a Seychelles-based offshore entity. This shift stripped away strict legal protections without the user fully grasping the consequences. When technical failures struck, the user was left exposed.

This eToro review digs into the disconnect between the company's “social trading” marketing and the harsh reality faced by retail clients.

eToro Regulation Status: Protection or Illusion?

While eToro boasts a global presence and multiple licenses, a closer look at the regulatory data reveals dangerous cracks. Holding a license is not enough; a broker must adhere to the laws designed to protect you.

Our audit of the regulatory records exposes severe issues. The Australian Securities and Investments Commission (ASIC) has previously launched legal proceedings against eToro. The regulator alleged that eToro's “screening tests” were insufficient, allowing inexperienced traders to access high-risk products they did not understand. 77% of retail accounts lose money here.

Furthermore, data from the Philippines Securities and Exchange Commission (SEC) indicates that eToro is operating without the necessary license in that region, warning the public against investing.

The Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| UK FCA | Licensed | Regulated |

| Australia ASIC | Licensed | Sued by Regulator / High Risk Disclosure |

| Seychelles FSA | Offshore | High Risk (Low Protection) |

| Philippines SEC | None | Unauthorized / Official Warning Issued |

| Spain CNMV | Warning | Clone Firm Warnings Issued |

This table confirms the danger. While the eToro regulation framework looks robust on paper, the operational reality involves lawsuits and warnings in key markets. The practice of shifting clients to the Seychelles (FSA) jurisdiction allows the Forex broker to operate with higher leverage and lower accountability.

eToro Broker Failures: Withdrawal Blocks and Platform Freezes

The complaints flooding into our center paint a picture of a system that fails when traders need it most. It is not just about losing trades; it is about losing access to your own money.

The “Login” and Access Crisis

Traders in Thailand have reported that the platform freezes at critical moments. These technical glitches act as a de facto eToro login blockade, preventing users from closing positions during market volatility. When the platform hangs, your capital evaporates.

One user from Thailand (Case 3) stated: “The platform freezes... Withdrawal money does not enter. Contact support, they are silent.”

Withdrawal Nightmares

Accessing your funds should be instant. For many eToro clients, it is a battle. A user from Indonesia (Case 4) simply pled, “Please return my money,” after being unable to withdraw. Another Thai user (Case 2) reported that their status was closed without notice for “security reasons,” a common excuse used to freeze funds indefinitely.

Visual Evidence from Victims

Our investigation collected direct evidence from the last three months regarding these anomalies:

> Case 1: The Regulatory Trap

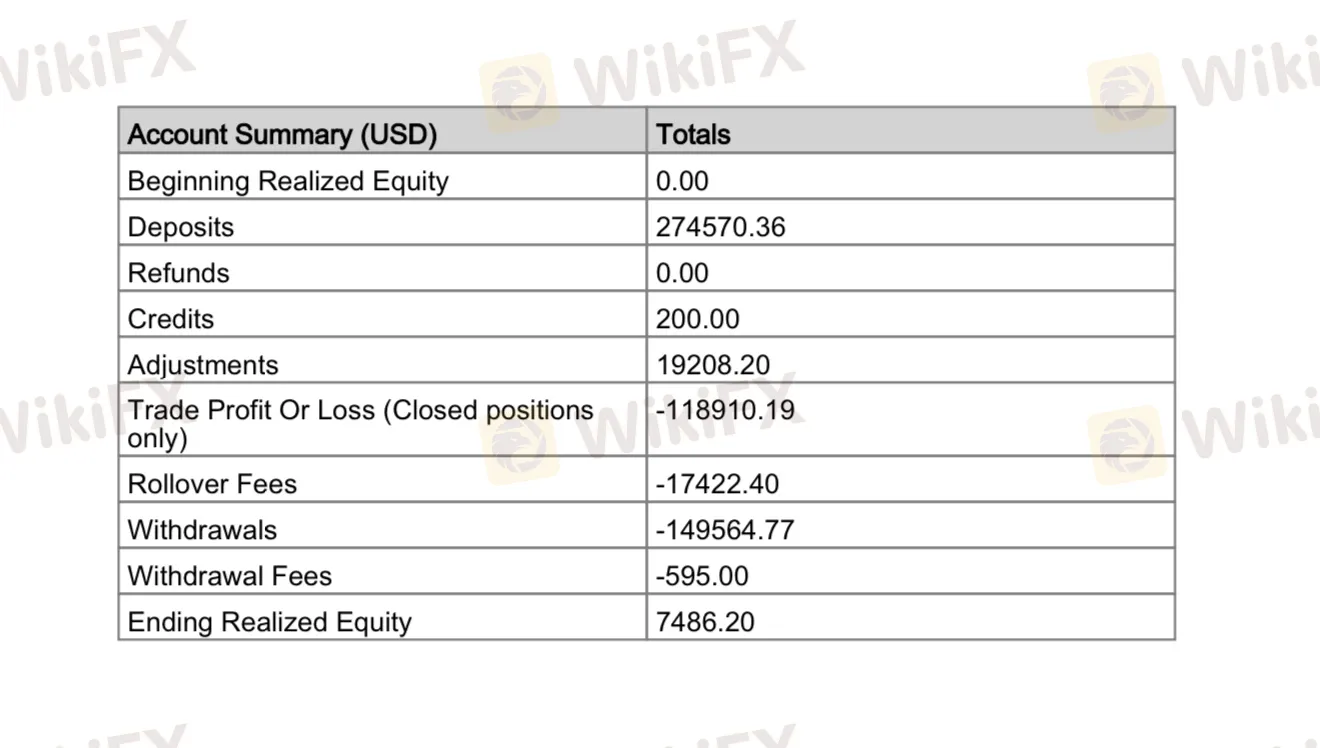

> A user lost $170k after being moved to offshore regulation.

> Case 2: Account Closures

> “Closed status without notice... Support can't help.”

> Case 3: Withdrawal Silence

> “Scam seen... Platform hangs.”

Verdict: Is eToro Safe?

Based on the evidence, we cannot recommend eToro for traders who value the safety of their capital over “gamified” social features. The combination of forced regulatory migration and active lawsuits by major regulators is a massive red flag.

Key Red Flags

- Regulatory Arbitrage: Moving clients from ASIC (High Protection) to Seychelles (Low Protection).

- ASIC Legal Action: Sued for failing to filter out unsuitable clients for high-risk CFD products.

- Withdrawal Barriers: Multiple recent reports of silent support and frozen payments in Asia.

- Unauthorized Operations: Flagged by the Philippines SEC for operating without a license.

The eToro broker model profits when you lose. If you are currently trading here, check your account settings immediately to see which regulation protects you. If it says “Seychelles,” you are swimming with sharks.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Currency Calculator