简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FBS Broker Review: The Anatomy of a High-Fidelity Money Trap

Abstract:With over 171 complaints in a single quarter, FBS operates more like a sophisticated financial vacuum than a broker, systematically wiping accounts through predatory price manipulation and withdrawal blockades. Your capital isn't just at risk; it's being harvested by a firm that hides behind dual regulation while the Malaysian SC blacklists their operations.

Dont let the “AA” trade environment rank or the glossy ASIC and CySEC stamps fool you. Beyond the marketing veneer lies a graveyard of retail accounts. Our investigative audit into the FBS review cycle reveals a disturbing pattern: this is a broker that welcomes losers and liquidates winners. If you aren't losing your money through “standard” market volatility, FBS's internal systems—from “Balance Fixed” operations to ghost candles—will ensure your balance finds its way to $0.00.

FBS Regulation Audit: The Shield for the Shadows

On paper, FBS presents a formidable regulatory front. They maintain licenses with top-tier authorities like ASIC and CySEC. However, a localized audit reveals a massive crack in the armor. While they leverage their Tradestone Ltd and Intelligent Financial Markets Pty Ltd registrations to gain credibility, the Malaysian Securities Commission (SC) has officially placed them on the Investor Alert List for unauthorized capital market activities.

| Regulator | License Type | Status |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | Market Making (MM) | Regulated (331/17) |

| Australia Securities & Investments Commission (ASIC) | Market Making (MM) | Regulated (426359) |

| Securities Commission Malaysia (SCM) | Unauthorized Activity | DANGER / ALERT LIST |

The data proves that Forex regulation is often used as a marketing tool rather than a client protection mechanism. Being “regulated” doesn't stop a broker from manipulating its own price feed to trigger Stop Losses that the global market never touched.

The Execution Scandal: When Profits Become “Errors”

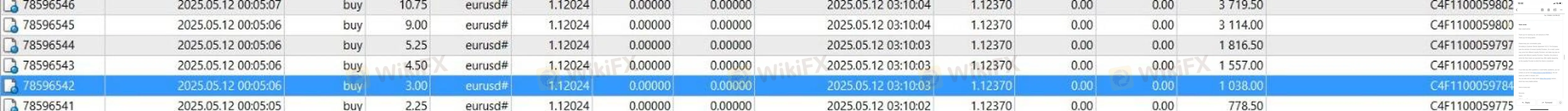

Investigative data from over 69 specific cases shows that FBS specializes in “execution anomalies.” One German trader reported a $30,000 discrepancy when FBS executed a EURUSD gap at 1.1240 while the real market price was 1.1202. When confronted, FBS hid behind the classic “different Liquidity Providers” lie.

It gets worse. For those who manage to navigate the treacherous Forex waters and actually turn a profit, the “Balance Fixed” operation awaits. Multiple traders, particularly from India and Turkey, reported thousands of dollars in profits being arbitrarily removed from their accounts after high-impact news events like the CPI announcement. FBS doesn't just provide a platform; they act as a counter-party that cannot afford for you to win.

The Login and Liquidation Nightmare

While the brokers self-developed app claims “perfect” offline stability, users tell a different story. Before you even reach the login screen to check your balance, your trades might already be ghosted. We have documented cases where FBS manually set “Take Profit” levels on profitable trades (like Facebook/Meta stock) to prevent users from realizing gains, while simultaneously “forgetting” to apply the same logic to losing trades.

The login portal often becomes a one-way street. Deposits are processed with lightning speed, often within minutes via USDT or local banks. However, the moment a withdrawal is requested, the “KyC/AML” trap is sprung. Traders have been asked for a ridiculous 14+ different types of documents, including video selfies.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Currency Calculator