简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

4T Review 2026: Is this Forex Broker Legit or a Scam?

Abstract:4T presents a conflicting profile, holding a top-tier UK FCA license yet carrying a low WikiFX score of 3.53 due to serious complaints regarding profit deletion and 'bonus abuse.' While the broker offers MT4 and MT5 platforms, the high deposit requirements for raw spreads and reported issues with withdrawals suggest traders should proceed with significant caution.

Executive Summary: 4T is a broker that confuses many analysts. On paper, they hold a prestigious UK license, but their low WikiFX Score of 3.53 reveals a different story driven by client dissatisfaction. With complaints about deleted profits and high barriers to entry for better account types, this broker carries risks you need to understand.

The Big Picture: Why the Low Score?

Finding a safe broker in the vast Forex market can feel like navigating a minefield. You see a flashy website, promises of wealth, and sleek apps, but what is happening behind the scenes? In this review, we are looking at 4T, a company established in 2015 that has managed to survive for a decade but struggles to maintain a high trust score on WikiFX.

Currently, 4T holds a score of 3.53/10. In the world of WikiFX, a score below 4.0 usually signals that a broker has regulatory holes or a poor track record with customer service. While they aren't a confirmed “black-platform,” they sit in a grey area where you arguably need to be more careful than usual. Before you deposit your hard-earned savings, let's break down exactly why their score is lagging despite their long history.

Question 1: Regulation & Safety: Is my money safe?

Safety in trading comes down to one word: regulation. Without it, a broker is just a website asking for your bank details. 4T actually has a complicated setup because they operate under two very different licenses.

1. The Strong License:

They are regulated by the Financial Conduct Authority (FCA) in the United Kingdom (License No. 624225). This is a big deal. The FCA is a “Tier-1” regulator, essentially the gold standard in the financial world.

2. The Offshore License:

They also hold a license with the Seychelles Financial Services Authority (FSA) (License No. SD058).

Why does this difference matter to you?

If you are a UK resident onboarded under the FCA license, your funds are likely protected by “Segregated Accounts.” This means the broker cannot use your money to pay their electricity bills or debts; it sits in a separate trust. However, if you are an international trader, you will likely be onboarded under the Seychelles entity. Offshore regulators like the Seychelles FSA are much more relaxed. They don't enforce the same strict insurance policies or capital requirements as the UK.

The Risk: If you register from outside the UK, you might not have the safety net you think you have. Always check which entity governs your specific account before funding.

Question 2: Are the trading fees and accounts fair?

When we look at the cost of trading, 4T makes it surprisingly difficult for the average trader to get the best deal. They offer three account types: Standard, Raw, and VIP.

The High Barrier to Entry

The “Standard” account requires a minimum deposit of $500. In today's market, where most top-tier brokers allow you to start with $1 or $100, asking for $500 just to get in the door is steep.

It gets worse if you want competitive spreads. To access the “Raw” account (which usually offers spreads close to 0.0 pips), you must deposit $10,000. For the VIP account, it's $25,000.

Why is this a problem?

In Forex trading, the “spread” is the cost you pay on every trade. A “Raw” account usually means you pay a small commission but get market-direct pricing. Most competitors offer Raw/ECN accounts for deposits as low as $200. By gating low costs behind a $10,000 wall, 4T is effectively forcing smaller traders to stay on the more expensive “Standard” account. This eats into your potential profits significantly over time.

Question 3: What are real traders complaining about?

This is where the WikiFX score usually takes the biggest hit. We analyzed the complaints in the `casesText` database, and the results are concerning.

The “Bonus Abuse” Trap

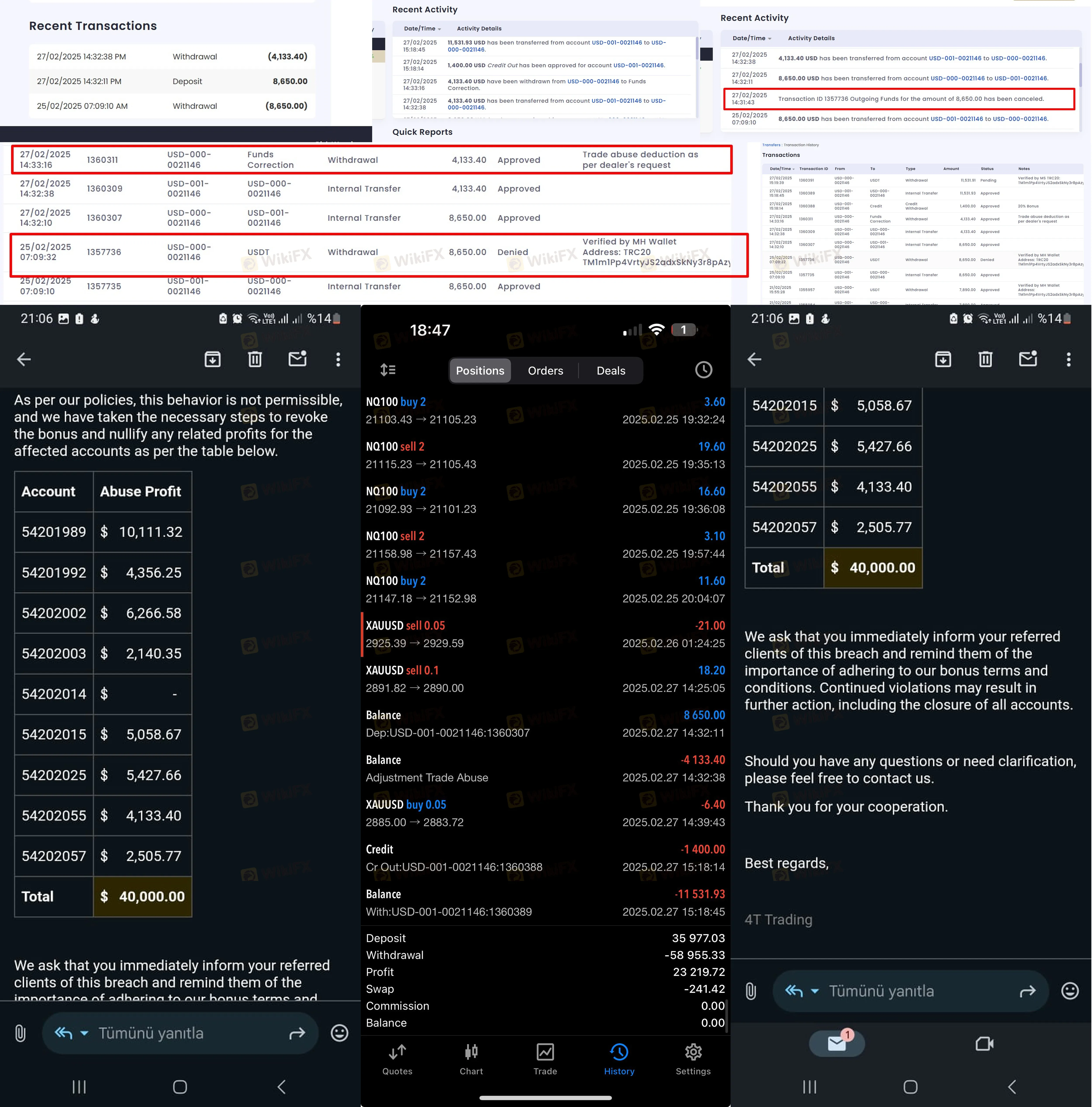

A trader from Montenegro reported a severe issue where $4,133 was deleted from their account. After making profits, the broker delayed the withdrawal and eventually wiped the money, citing “bonus abuse.”

Educational Pro-Tip: Brokers often offer “deposit bonuses” (free money to trade with). However, the terms and conditions often contain vague clauses that allow them to cancel all your profits if they decide your trading style was “abusive.” Essentially, if you win too much using their bonus, they might just take it back.

Pressure and Allegations

Another user from the UAE mentioned that after losing their initial investment, 4T representatives pressured them to deposit more money to “recover losses.” This is a classic hallmark of aggressive sales tactics, not a professional financial service.

There is also a very detailed complaint from a trader in China alleging a complex connection between 4T's operations and a previous scam involving a diverse Ponzi scheme. While we cannot verify the criminal allegations, the volume and detail of such complaints contribute to the low trust score.

Question 4: What software will I use?

The good news is that 4T provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the industry standards used by millions. If you already know how to trade, you will feel right at home with the charting tools and automated trading (EA) capabilities.

However, they also offer a proprietary app called “4T Trader.” While proprietary apps can be user-friendly, our data highlights a specific security concern: the software lacks two-step verification and biometric authentication.

Security Warning:

In 2026, cybersecurity is everything. When you access your trading account, the login process is your first line of defense. The lack of two-factor authentication (2FA) means that if a hacker guesses your password, they can drain your account immediately. Almost all modern banking apps require a fingerprint or face scan. The fact that 4T's app misses this standard feature is a “red flag” for your account security. Always ensure you have a strong, unique password if you choose to use their systems.

Final Verdict: Should I open an account?

We do not recommend opening an account with 4T at this time.

While the UK FCA license provides a veneer of legitimacy, the high deposit requirements ($10,000 for competitive spreads) and the serious complaints regarding deleted profits make this a risky choice for retail traders. There are simply too many other brokers with higher scores, lower entry costs, and cleaner track records.

Status changes daily. Before depositing, check the WikiFX App for the latest real-time certificate and to read new reviews from other traders.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Renewable Grid Integration: Economics and Technology

Gold Rally Validated as Miners Forecast Doubled Earnings

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

South Africa's Reform Agenda Gains Traction, Business Sentiment Improves

4T Review 2026: Is this Forex Broker Legit or a Scam?

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

Currency Calculator