简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

STMARKET User Reputation: A Deep Look into Real User Complaints and Safety Warning Signs

Abstract:When traders ask, Is STMARKET Safe or Scam they want a straight, fact-based answer before putting their money at risk. Our research gives a clear, though warning, conclusion. While STMARKET does have a license, it has many serious warning signs that make us seriously question whether it can be trusted and if it operates properly. These worries show up in an extremely low overall score of just 3.27 out of 10.

When traders ask, Is STMARKET Safe or Scam they want a straight, fact-based answer before putting their money at risk. Our research gives a clear, though warning, conclusion. While STMARKET does have a license, it has many serious warning signs that make us seriously question whether it can be trusted and if it operates properly. These worries show up in an extremely low overall score of just 3.27 out of 10.

This score comes with official, clear warnings from industry investigators. These warnings should be taken very seriously and serve as a main sign of the broker's risk level. The evidence strongly shows that traders should be extremely careful and think twice about any plans to work with this company.

> “Warning: Low score, please stay away!”

This direct advice, along with a “High potential risk” label, forms the basis of our initial decision: STMARKET is a high-risk broker that shows many signs that don't match up with a safe and reliable trading partner.

Breaking Down The Warning Signs

A broker's claims must be checked against facts that can be verified. For STMARKET, a deep look into its regulatory status, how it operates, and official ratings will reveal Is STMARKET Safe or Scam. These are not small issues but basic warning signs that every potential investor must understand. This section breaks down the main evidence that adds to the broker's high-risk label, moving beyond marketing claims to present a clear picture of how it actually operates. We will examine the issues around its regulation, physical presence, and the clear warnings given by independent survey teams.

Misleading Location Claims

One of the biggest warning signs is the disconnect between where STMARKET is registered and where it is actually regulated and operated. The company name, ST MARKET UK LTD, suggests a UK-based operation, a region known for its strict financial oversight under the Financial Conduct Authority (FCA). However, STMARKET is not regulated by the FCA. These are red flags which cannot be ignore while looking for Is STMARKET Safe or Scam.

Its operations are run by a different company, STMARKET COMPANY LIMITED, which is based in Phnom Penh, Cambodia. This company holds a “Derivatives Trading License” from the Securities and Exchange Regulator of Cambodia (SERC), with license number 00049975.

From an expert view, the level of investor protection offered by the SERC in Cambodia is not the same as that of a top-level regulator like the UK's FCA. Top-level regulators provide strong frameworks for solving disputes, separated client funds, and payment schemes that are often missing or less strict in offshore locations. This location confusion can be a deliberate trick to attract clients with the reputation of a UK connection while operating under a much weaker regulatory system.

The following table clarifies this important difference:

| Aspect | Claimed/Registered | Actual/Operational | What This Means for Traders |

| Region | United Kingdom | Cambodia | Potential for misleading marketing; regulatory protection is based in Cambodia, not the UK. |

| Regulation | (Implied UK Association) | SERC (Cambodia) | Weaker investor protection and dispute resolution mechanisms. |

| Company Entity | ST MARKET UK LTD | STMARKET COMPANY LIMITED | Operations are run by the Cambodian entity, not the UK-registered one. |

A broker's regulatory status is extremely important. Differences between registered and operational locations are a major warning sign. We strongly advise traders to verify every broker's license and operational history on an independent verification platform like WikiFX before proceeding.

No Physical Office

A legitimate financial services company, especially one claiming connection with a major financial center like the UK, should have a real physical office that can be verified. This provides a basic level of accountability and transparency.

Independent field survey teams conducted on-the-ground verification to check Is STMARKET Safe or Scam. STMARKET's UK-registered company. The result was a critical finding: “STMARKET United Kingdom Verified: No Physical Presence Found.” This was not a one-time check; the finding was repeated, leading investigators to assign a clear “Danger” label to the broker based on this survey.

For a trader, this is a deeply worrying piece of information. A company that exists only on paper in its registered country often operates as a shell company. It lacks the substance, accountability, and transparency expected of a firm handling client funds. If a dispute happens, there is no physical office to approach, no local management to hold accountable, and a much reduced chance of getting help.

On-the-ground verification, like checking for a physical office, provides a level of research that is impossible for an individual trader to perform. This is a key value provided by dedicated broker review and verification services that go beyond just checking a license number online.

Negative Score and Warnings

The result of these warning signs is reflected in the broker's overall rating. STMARKET holds a score of just 3.27 out of 10. This is an extremely low score in the brokerage industry, placing it well below what would be considered a reliable or trustworthy partner.

This score is not a random number; it is a combination of data points including regulatory status, license quality, operational history, software verification, and risk management assessment. More importantly, this low score comes with direct and severe warnings from analysts:

• “Warning: Low score, please stay away!”

• “High potential risk”

Furthermore, a specific note highlights issues found during field surveys: “The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!”

When independent evaluators, whose purpose is to assess risk, give such direct and clear warnings, they should be treated with the highest seriousness. These are not suggestions to be careful; they are clear advisories to tell you Is STMARKET Safe or Scam due to the high probability of risk and potential for fraudulent activity.

Looking at User Feedback

While objective data provides the foundation for our analysis, examining STMARKET Complaints and reviews can offer a glimpse into the real-world client experience. However, it is crucial to approach this feedback with a critical and analytical mindset, understanding its limitations. The question we seek to answer Is STMARKET Safe or Scam whether the available user feedback for STMARKET supports or contradicts the significant warning signs we have already identified. For a broker that has been in operation for 5-10 years, a large body of reviews would be expected.

The Available User Reviews

As of early 2025, the public record of user feedback for STMARKET is remarkably thin. Our search has yielded only two reviews, which we present here for a complete picture to tell you Is STMARKET Safe or Scam:

• Review 1: Positive (JohnnyJ, Peru)

• Summary: “Seamless Crypto Trading: Hassle-Free Withdrawals, Web Terminal Ease.”

• Key Points: This user reports a positive experience, specifically mentioning no issues with withdrawals, the availability of crypto trading, and a preference for the broker's web terminal over the standard MT5 platform.

• Review 2: Neutral (Mkioik, Kazakhstan)

• Summary: “Market Swings: Perception vs. Reality in Share Value Changes.”

• Key Points: This user's feedback is not a complaint about the broker's service or integrity. Instead, it expresses confusion about how percentage changes in share values are calculated and reflected in their account balance. This points more towards a need for better user education on market mechanics rather than a fault of the broker.

A Critical Understanding

As experienced industry analysts, we must place this feedback into its proper context. A critical understanding reveals several key problems that immediately raise the question: Is STMARKET Safe or Scam when evaluated beyond surface-level commentary?

First, the sample size is statistically meaningless. Two reviews for a broker with a 5-10 year operational history are completely insufficient to form a credible opinion. Legitimate, large-scale brokers typically accumulate hundreds, if not thousands, of reviews over such a period. The near-total absence of feedback is, in itself, a warning sign. both troubling indicators for anyone asking, Is STMARKET Safe or Scam.

Second, the single positive review, while noting hassle-free withdrawals, is just one person's story. It cannot and does not outweigh the hard, verifiable evidence of weak offshore regulation, the complete lack of a physical office in its claimed location, and the direct “Danger” warnings from investigators. A single positive data point is an outlier when confronted with a mountain of objective negative indicators.

Third, the “neutral” review is not relevant to the question of safety or scams. It is a query about market functionality, not a complaint about fraud, withdrawal problems, or poor service. As such, it provides no meaningful data for evaluating whether Is STMARKET Safe or Scam from a risk-management perspective.

In conclusion, the available user feedback for STMARKET is far too sparse to be a reliable indicator of its reputation. When faced with such a lack of credible social proof, traders must default to the objective, verifiable warning signs. Stories from individual people should never replace thorough research.

A Skeptical Overview

While the operational warning signs are significant and form the basis of our cautionary stance, for the sake of completeness, it is useful to review the trading conditions STMARKET claims to offer. This information is what potential clients see and is designed to be attractive. However, given the previously established risks, this information should be viewed with extreme skepticism. A broker's advertised features are meaningless if the underlying operation is not secure and client funds are at risk.

Accounts, Spreads, Commissions

STMARKET advertises a tiered account structure, which is common in the industry, designed to cater to traders with different capital levels and needs.

| Account Type |

| Standard |

| Premium |

| ECN |

A notable point of caution arises here. While the account types list minimums starting at $50, other documentation from the broker states a first deposit minimum of $500. Such inconsistencies in basic information are unprofessional and can be another indicator of a disorganized or untrustworthy operation. The raw spreads on the ECN account appear competitive, but this is only valuable if the broker is legitimate.

Platform and Market Access

The broker provides access to the industry-standard MetaTrader 5 (MT5) platform, available for PC, web, and mobile devices. A full MT5 license indicates a certain level of technical investment.

The range of tradable instruments covers the main asset classes that most retail traders seek:

• Forex: Over 55 currency pairs.

• Metals: Gold and Silver.

• Energies: Crude Oil, WTI, and Natural Gas.

• Indices: Major global stock indices from Europe, Asia, and America.

• Cryptocurrencies: Includes major coins like Bitcoin and Ethereum.

This offering is fairly standard for a global online broker. However, the availability of these markets is secondary to the primary concern of fund safety.

Deposits, Withdrawals, Fees

STMARKET claims to support a variety of common payment methods for both deposits and withdrawals, including bank transfers, Visa, MasterCard, Skrill, Neteller, and UnionPay. This is a crucial area for any trader.

The broker states that it aims to approve withdrawal requests within 48 hours, with funds expected to arrive in a client's bank account within 2-3 business days, depending on the bank's own processing times. While these timeframes seem reasonable on paper, they are merely claims. The true test of any broker is not how easily it accepts deposits, but how reliably and promptly it processes withdrawals. Given the severe warning signs—offshore regulation, no physical office, and official danger warnings—the risk of experiencing withdrawal delays, excessive fees, or outright refusal is unacceptably high.

Final Verdict and Protection

After a thorough analysis of STMARKET's regulatory framework, operational structure, independent evaluations, and user feedback, we can circle back to the original question Is STMARKET Safe or Scam with a definitive answer. The evidence points overwhelmingly in one direction, and it is crucial for any potential investor to understand the full weight of the findings before proceeding. This final verdict synthesizes the key risks and provides a clear, actionable path for protecting your trading capital.

The Bottom Line

Based on the extensive body of evidence, STMARKET falls squarely into the high-risk category and exhibits multiple characteristics of an unreliable and potentially unsafe operation. Engaging with this broker would be a significant gamble with your capital, not a calculated investment.

The primary reasons for this conclusion can be summarized as follows:

• Weak Regulation: It operates under a Cambodian SERC license, which lacks the robust investor protection of top-tier regulators, despite a misleading association with the UK.

• No Physical Presence: The broker failed a fundamental due diligence check, with investigators confirming it has no physical office in its registered country (UK), a classic trait of a shell company.

• Official “Danger” Rating: Independent survey teams have assigned the broker a “Danger” label and issued explicit warnings to “please stay away” due to its low score and high-risk profile.

• Insufficient Social Proof: With only two reviews on record after 5-10 years of operation, there is no credible body of positive user experience to counteract the severe objective warning signs.

Your Most Important Step

The financial markets are filled with opportunities, but they are also full of risks, many of which can be avoided. The single most important step you can take to protect your capital is to perform thorough research on any broker you consider. Do not rely on a broker's own marketing materials.

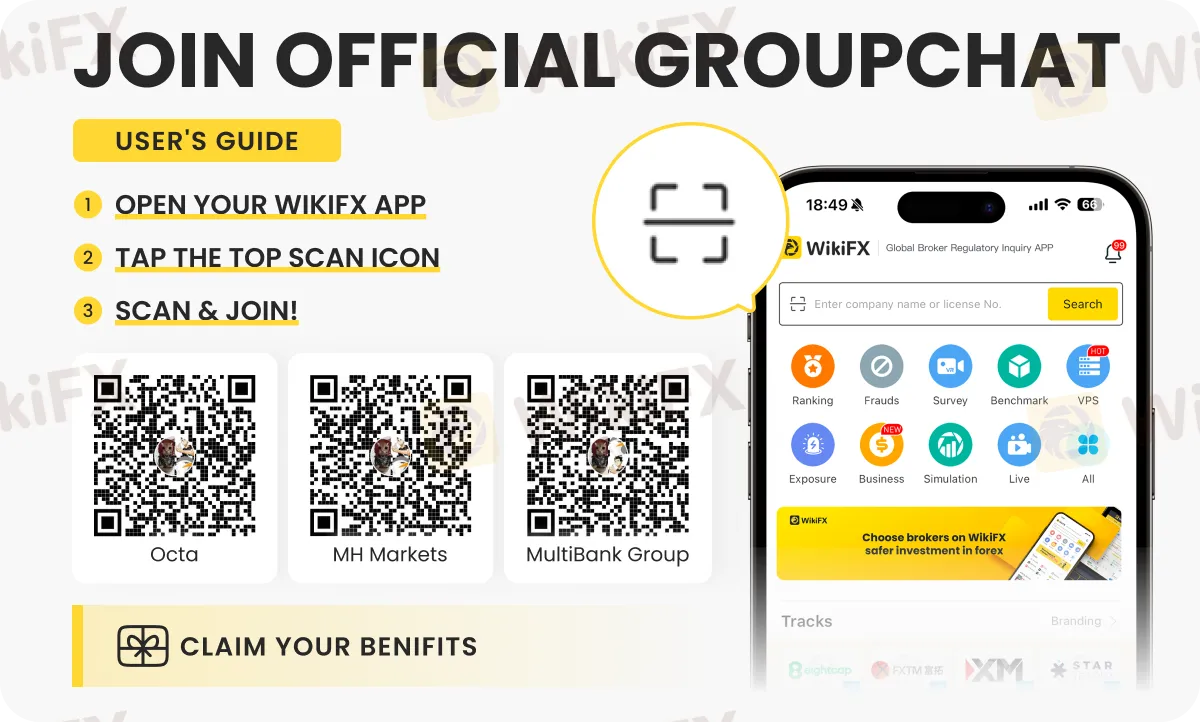

Before you deposit a single dollar, use a comprehensive and independent broker verification platform like WikiFX. These services consolidate regulatory data, conduct field surveys, and collect user reviews on a large scale, giving you a much clearer picture of a broker's true reputation than their own website ever will.

Always check the overall score, read the full regulatory details, and pay close attention to any warnings or negative survey results before making a decision. In the case of STMARKET, the warnings are clear and severe. Your financial safety depends on heeding them. Choosing a well-regulated, transparent, and reputable broker is the first and most critical trade you will ever make.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Kudotrade Review: Safety, Regulation & Forex Trading Details

FXPN Review 2026: Is This Forex Broker Safe?

Naira Rallies to Start February as Government targets Fiscal Consolidation

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Currency Calculator