简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

BDSWISS Review 2026: Comprehensive Safety Assessment

Abstract:BDSWISS holds a low safety score of 3.48 with a heavy volume of user complaints regarding withdrawal failures and account access. While regulated offshore by the Seychelles FSA, the broker faces significant scrutiny due to regulatory warnings and reported liquidity risks.

Executive Summary

In this in-depth review, we analyze the key metrics defining BDSWISS to determine if it remains a viable option for traders in the current financial landscape. The broker was established in 2018 and has since expanded its reach across regions like the UAE, Brazil, and Europe. However, despite its years of operation, our review process highlights critical warning signs regarding its safety profile.

As a broker entity operating within the global markets, BDSWISS currently holds a WikiFX score of 3.48, which is considered low and indicative of potential risk. While the firm lists headquarters in the Seychelles, its historical timeline reveals friction with tighter regulatory bodies. Notably, the German regulator BaFin issued a warning against the company in 2022 regarding unauthorized business activities. This initial audit suggests that while the platform offers modern tools, the underlying safety nets may be insufficient for conservative investors.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under. A license serves as the primary firewall between a trader's capital and broker malpractice.

Regulatory Breakdown:

- Seychelles FSA (Offshore): BDSWISS is regulated by the Financial Services Authority regarding its Seychelles entity (License SD047). While valid, this is an offshore license. Offshore regulation generally implies looser capital requirements and less stringent client fund segregation compared to Tier-1 authorities like the FCA or ASIC.

- Regulatory Warnings: The broker has faced scrutiny, including a specific disclosure from BaFin (Germany) in 2022, citing a lack of authorization to conduct banking business.

- Unverified Claims: The broker's connection to CySEC (Cyprus) is currently flagged as “Unverified” or having an abnormal status in our data, suggesting traders should not rely on European-level protection for accounts held under the offshore entity.

This mixed regulatory profile significantly raises the risk level for prospective clients.

2. Forex Trading Conditions

For traders focusing on Forex instruments, the broker offers competitive technical specifications, though these must be weighed against the safety risks mentioned above. The platform supports high leverage, a common feature among offshore entities.

- Leverage Capabilities: The broker offers leverage up to 1:500. While this allows for significant market exposure with smaller capital, it also amplifies the risk of rapid liquidation.

- Spreads and Costs: Does Forex pricing compete with top-tier providers? Our data shows the “Prime” account offers spreads from 0.3 pips, whereas the “Standard” account starts at 1.5 pips. While the Prime tier is competitive, the Standard costs are higher than the industry average.

- Asset Variety: Traders can access CFDs on indices, commodities, and cryptocurrencies alongside currency pairs, providing ample diversification opportunities.

3. User Feedback & Complaints

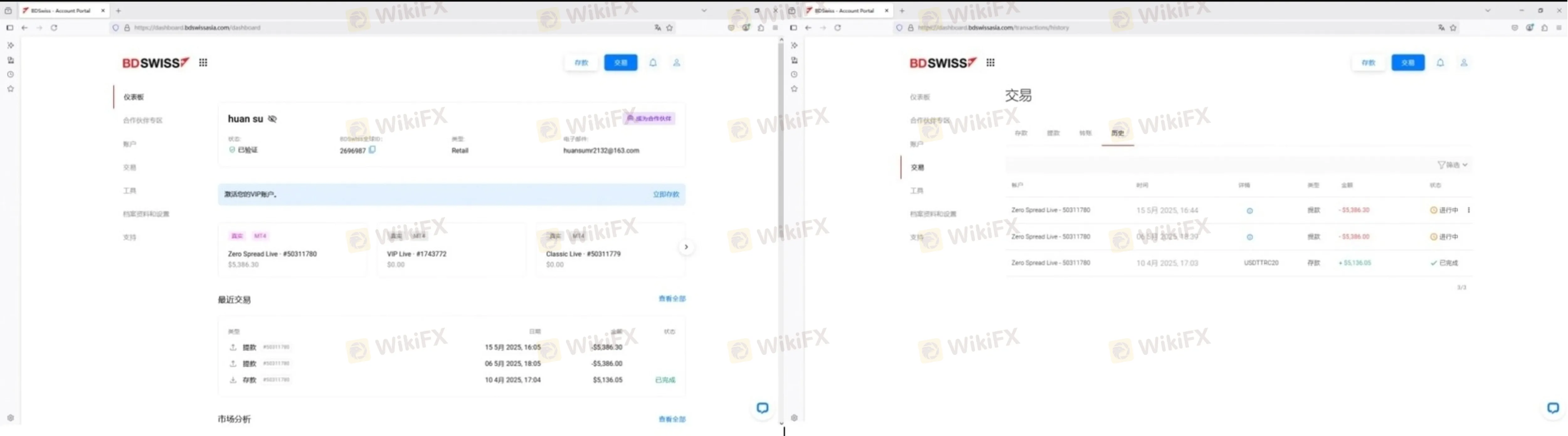

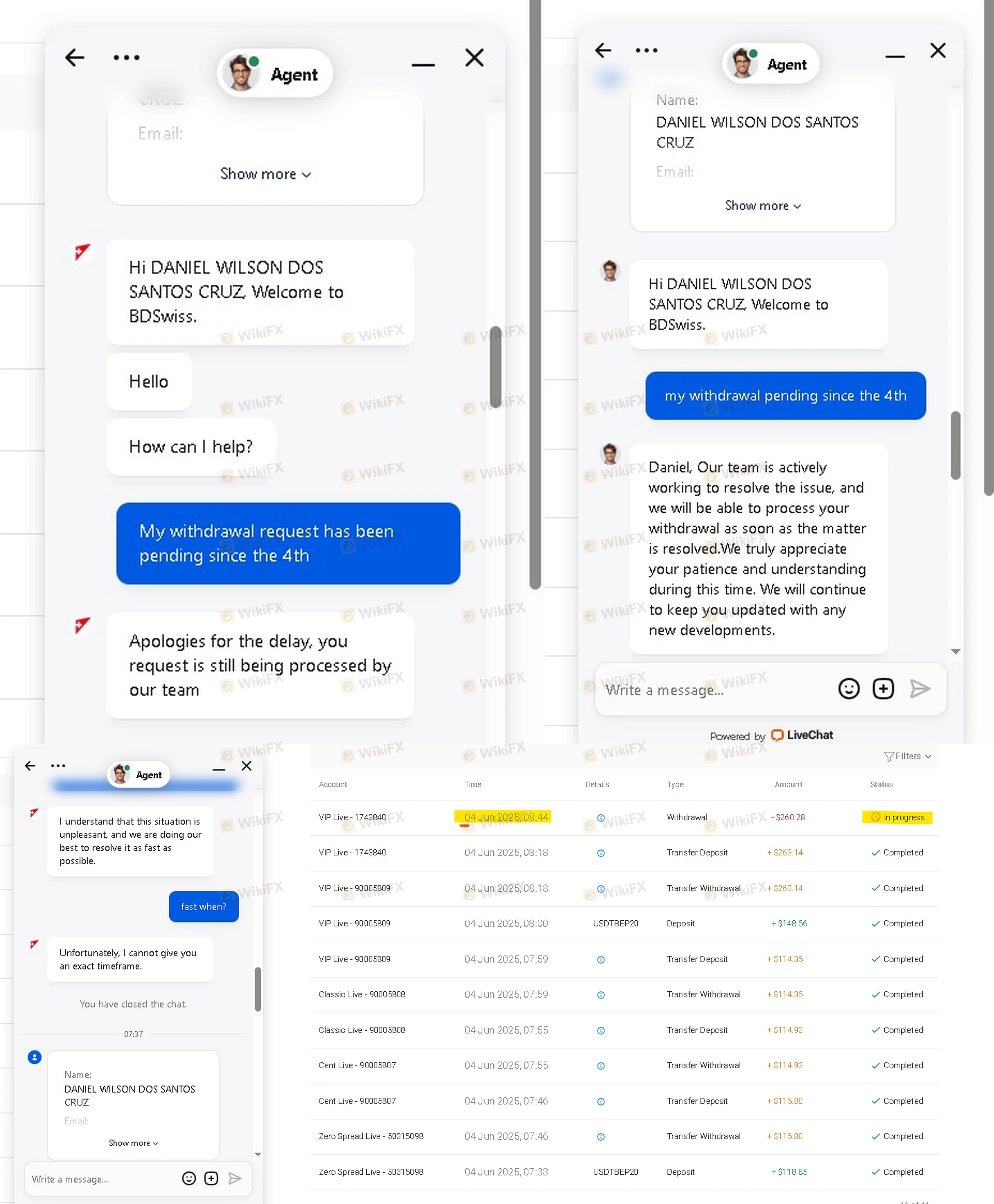

A detailed analysis of user feedback reveals alarming patterns. Over the last few months, the volume of complaints has surged, with severe allegations regarding fund retention.

Common Complaint Patterns:

- Withdrawal Blockages: Numerous users report an inability to withdraw funds. For example, a user from India reported in August 2025, “Withdrawal is pending since Sep-2024... I am not able to login my account.”

Another case from Brazil (June 2025) stated, “They do not allow capital to be withdrawn... strict slippage.”

- Account Lockouts: Several reports mention sudden account closures. A trader from China noted, “Unable to withdraw... suddenly my account was closed by them, and the remaining funds were cleared to zero.”

- Issues with Login: Users have reported difficulties with their login stability during critical dispute periods. One complaint explicitly mentioned, “I am not able to login my account and the customer is always away.”

These narratives suggest systemic liquidity or operational issues rather than isolated technical glitches.

4. Software & Access

BDSWISS utilizes the industry-standard MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These are robust tools favored for their charting capabilities and automated trading support (EAs).

Security and Access:

To access the platform, traders must complete the login security steps. However, our technical review notes a deficiency in modern security features: the system lacks two-factor authentication (2FA) or biometric verification for the login process. In an era where cybersecurity is paramount, the absence of these layers on the client portal is a disadvantage.

Despite the software itself receiving a “Perfect” rating for functionality and customization, the user experience is heavily compromised by the backend financial issues reported in the complaints section.

Final Verdict

BDSWISS presents a dichotomy: it offers a functional trading environment with high leverage and popular software, but it is plagued by severe safety red flags. The combination of offshore regulation , historical warnings from Tier-1 regulators like BaFin, and a torrent of user complaints regarding unpaid withdrawals makes this a high-risk entity.

Pros:

- Access to MT4 and MT5.

- High leverage up to 1:500.

Cons:

- Low Score (3.48): Indicative of poor reliability.

- Withdrawal Failures: Validated complaints of funds being withheld for months.

- Regulatory Weakness: Primarily dependent on offshore oversight.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App to ensure you are avoiding clones and staying informed about the broker's liquidity status. We strongly advise extreme caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

Currency Calculator