Abstract:Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and questionable practices that should concern any retail trader. This exposure article reviews recent complaints to help readers recognize red flags before committing their funds to this broker.

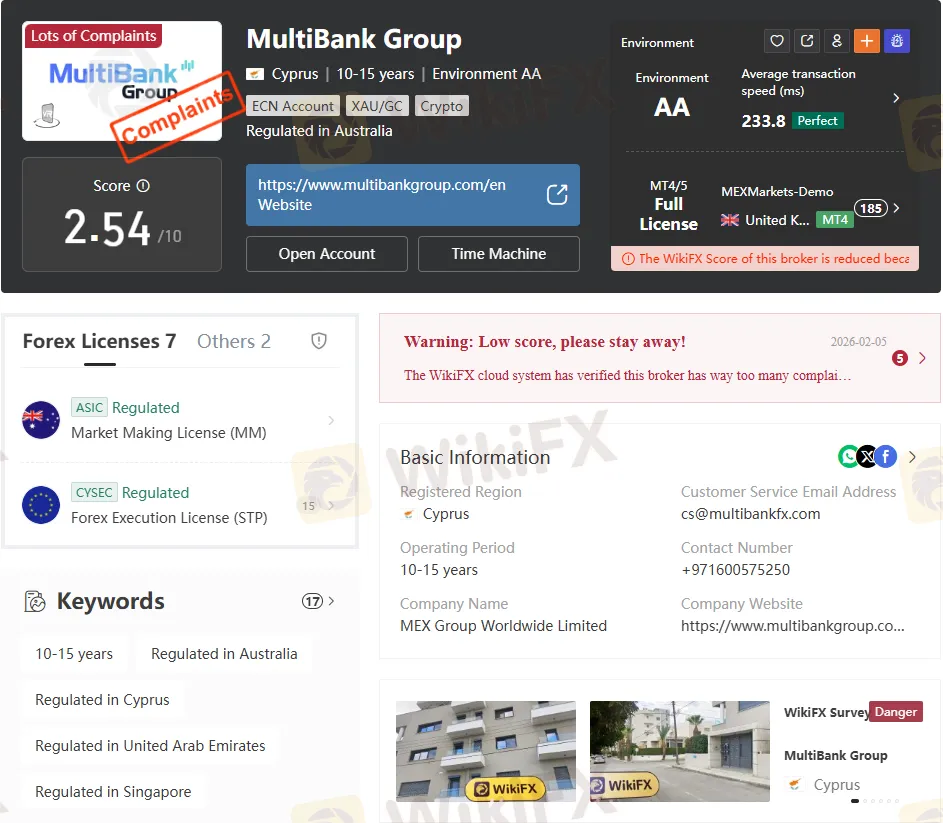

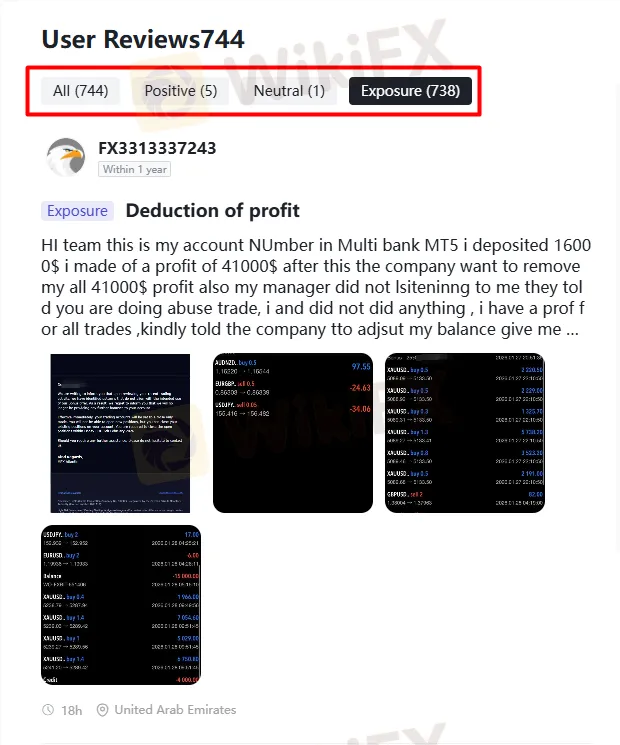

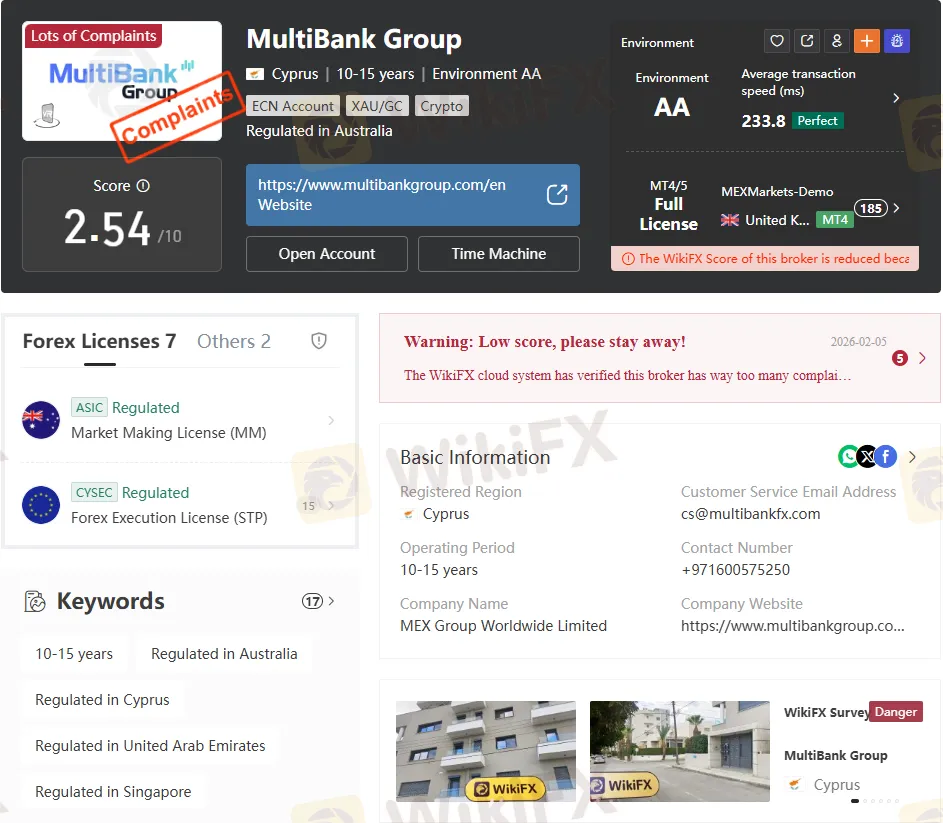

Overview: 738 Exposure Cases Out of 744

According to recent statistics, Multibank Group has accumulated 744 total customer reports, of which 738 are classified as exposure or negative scam-related cases. Such an overwhelming ratio of complaints to total reviews casts serious doubt on the brokers reliability and its marketing image as a trusted global Forex provider. For traders in Vietnam, the United Arab Emirates, and Italy, this pattern should serve as a strong warning sign of a Forex scam before opening or funding an account.

Regulators such as the FSC appear in Multibank Groups promotional materials, with one entity operating under license number SIBA/L/14/1068 in the British Virgin Islands. However, traders should understand that offshore licenses often offer weaker protection and slower dispute resolution than those issued by top-tier regulators in the EU or the UAE. When hundreds of Multibank complaints accumulate alongside limited regulatory recourse, the risk–reward balance tilts sharply against the retail client.

Case 1: Unauthorized Trades and FSC License Concerns

In the first case from Vietnam, a new client deposited funds into a fresh Multibank FX account while markets were closed and found a large open gold position when trading resumed. The trade volume allegedly exceeded the account balance, causing immediate, severe losses and wiping out the initial capital. When the client contacted their account manager, they were told their computer had been hacked, and Multibank Group refused to take responsibility despite server logs showing a different IP address and Internet provider.

The client reports that after requesting server trading logs and escalating the matter to thecompanyss CEO, all communication stopped. Emails went unanswered, and no compensation or investigation result was provided, leaving the trader without recourse for the loss. This case is particularly alarming because the broker holds an FSC license (SIBA/L/14/1068). Yet, the client still has not been able to obtain accountability or a transparent audit of the disputed order.

Cases 2, 6, 7: Blocked Withdrawals and Ignored Requests

Multiple recent cases from Vietnam describe a consistent pattern of blocked withdrawals and unresponsive support. In Case 2, traders describe how losses are deducted instantly, while profitable accounts face repeated withdrawal rejections, account and IB withdrawal locks, and unanswered emails. The account-opening process is described as fast and smooth, but once clients attempt to withdraw profits or even their initial capital, the process stalls or is silently ignored, leading victims to label Multibank a scam.

Cases 6 and 7 echo the same pattern of blocked withdrawals, even for straightforward requests. One user reports depositing 750 USD, making no trades after reading negative reviews, and still being unable to retrieve the initial deposit despite repeated emails and promises from an account manager who allegedly demanded that a bad review be removed before assisting. Another client states that they deposited but never traded, requested a refund in early October, and was encouraged to delete prior negative feedback in exchange for help, yet still received no refund or clear explanation.

These cases illustrate a serious risk of Multibank fraud. Once funds are in the system, clients may face conditions or informal demands unrelated to trading, such as being required to withdraw complaints before receiving their money. For retail traders in the UAE, Italy, and Vietnam, this should be a decisive warning sign that withdrawals can be weaponized as leverage by the broker.

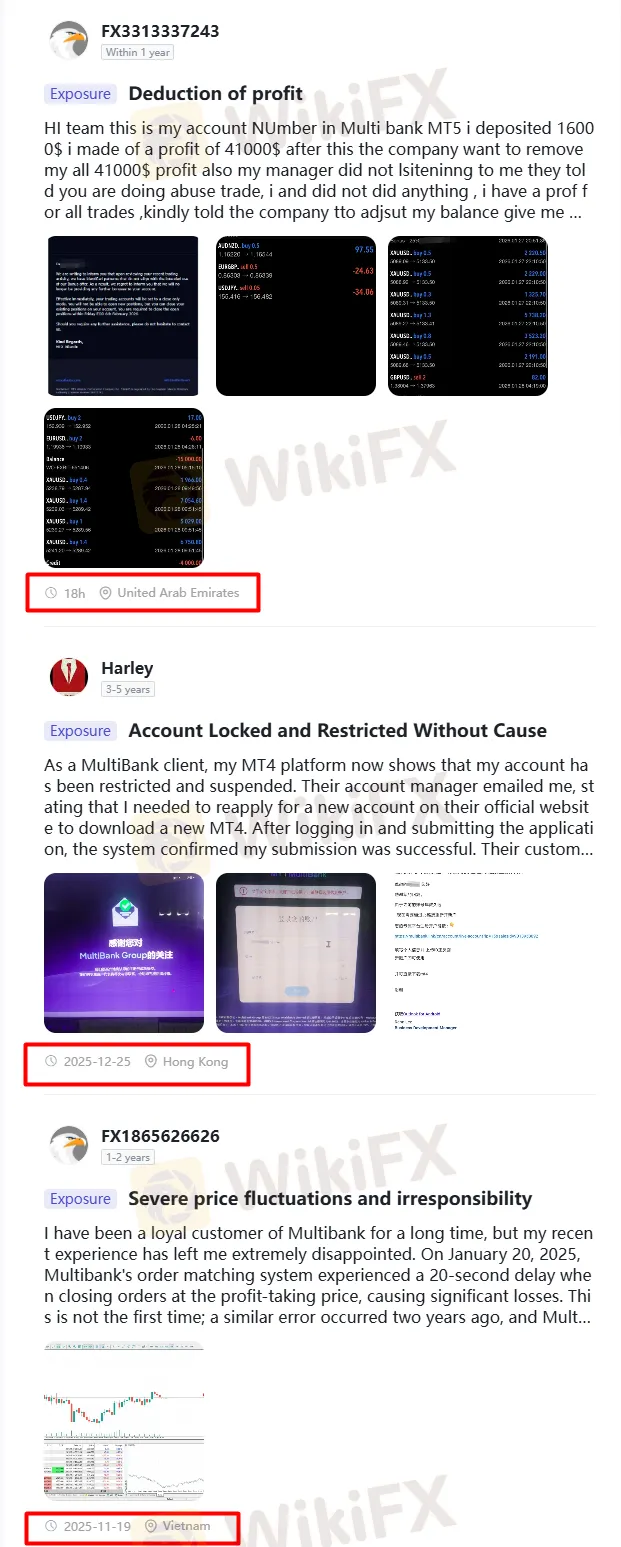

Cases 3, 4, 5, 8: Confiscated Profits and Bonus Abuse Accusations

Several reports describe Multibank Group confiscating profits or voiding trades under obscure rules or in response to accusations of “bonus abuse.” In Case 3, a trader recounts that the platform invalidated all orders closed within 15 minutes by invoking a rule requiring trades to be held for at least 900 seconds, thereby canceling profits and leaving only losses. The client believes this rule was selectively enforced only when their profits became “too large,” a hallmark of many Forex scam alerts worldwide.

Case 4 focuses on bonus-related accusations that appear to change once clients become profitable. According to the report, Multibank Group heavily promoted bonuses to attract investors. Later, it was alleged that winning clients abused those same bonuses, even when they used only a fraction of the advertised leverage. The trader alleges that losing clients were ignored, while profitable accounts were targeted with shifting explanations until their funds were misappropriated, and even account histories were deleted to erase evidence.

In Case 5, a long-time user claims that withdrawal records showed profits as “paid,” yet no money actually arrived in their bank or e-wallet. The profits were described as virtual numbers that could vanish if the client continued trading, and every attempt to withdraw real funds failed, leading the trader to call Multibank Group a blatant scam hiding behind a once-respected brand. Case 8 adds that after six years of working with the broker, a client had a confirmed 20% bonus revoked and was suddenly accused of gambling simply for closing positions daily and trading profitably, despite using the same strategy for years.

Case 9: Questionable Relationship Management Practices

Case 9 highlights the role of Multibank‘s relationship managers (RMs), especially for VIP clients investing 1,000 USD or more. The reviewer from Vietnam says the RM’s apparent objective was to push for larger deposits and more aggressive trades, which ultimately wiped out their 2,000 USD investment. Each time the client invested, they were encouraged to add more funds, with comments that 1,000 USD was “too little,” creating psychological pressure rather than risk-aware guidance.

From an investor protection standpoint, this behavior contradicts the expected duty of care for regulated financial service providers. Instead of individualized risk management and transparent advice, the client describes a pattern of high-pressure sales tactics that prioritized the broker‘s potential commissions over the customer’s capital preservation. For traders in the UAE and Italy who might be attracted by polished marketing and claims of VIP support, this case demonstrates how relationship management can be misused to facilitate a Multibank scam rather than genuine service.

Case 10: Execution Delays and Platform Reliability

Case 10 involves a long-term customer who cites serious order execution issues on 20 January 2025. The client reports a 20‑second delay when closing positions at the take‑profit level, resulting in significant slippage and losses, even though similar trades are executed instantly on other accounts and competitors platforms. While isolated technical glitches can occur in any trading system, the reviewer notes that a similar error two years earlier led to a refund. In contrast, this time, Multibank Group allegedly refused to accept responsibility.

The head of the dealing desk reportedly described the delay as “normal,” contradicting the firms own advertising of millisecond execution speeds. After two weeks of silence from support and management, the trader decided to leave the platform and considered the incident a serious breach of fair execution standards. For experienced Forex traders, consistent and transparent execution is a core trust factor, and any pattern of unexplained delays, combined with a denial of responsibility, should be treated as a strong Multibank fraud warning.

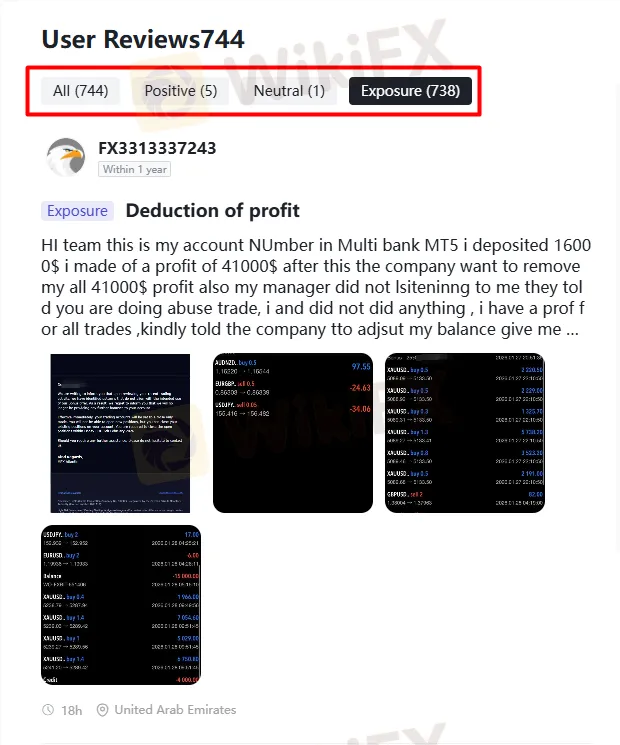

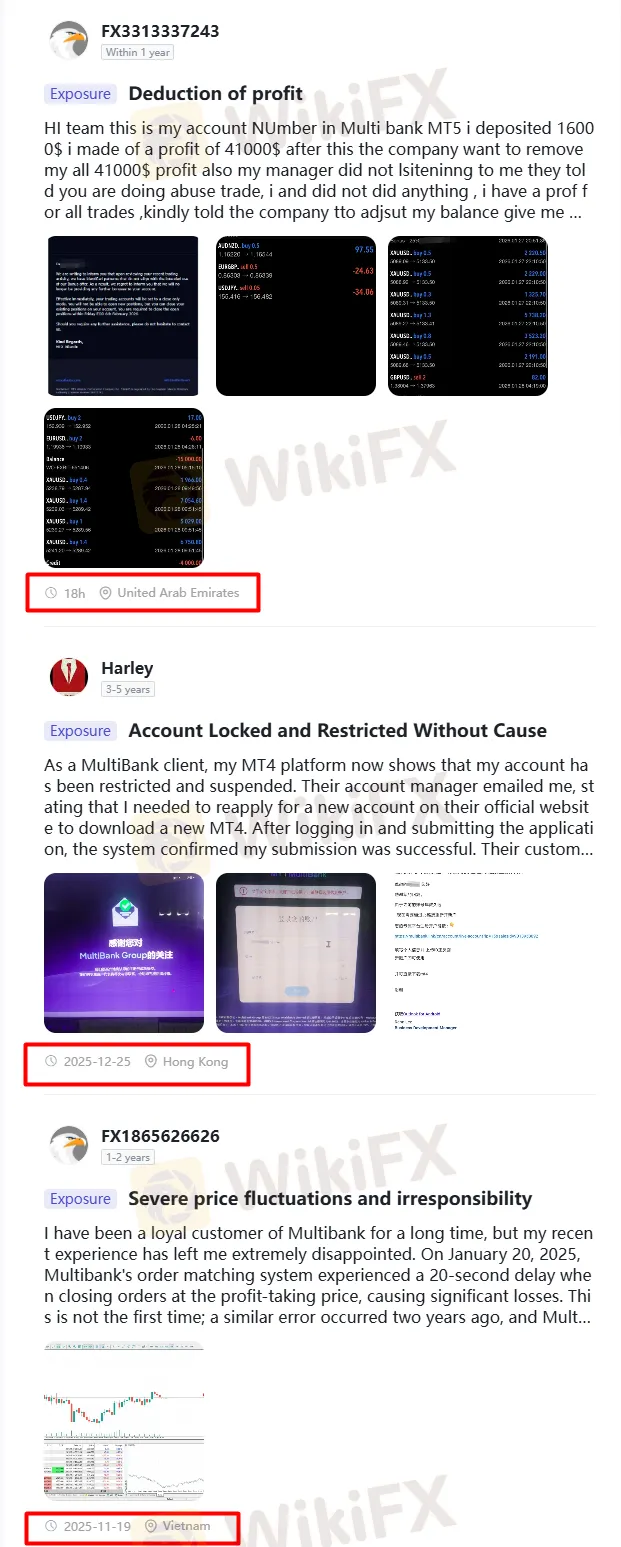

Cases 11 and 12: Account Restrictions and Large Profit Disputes

Case 11, from Hong Kong, describes an abrupt account restriction in which theclientss MT4 login showed the account as suspended and dormant. The trader was instructed to apply for a new account and a new MT4 installation, submit the application, and receive confirmation, but heard nothing afterward. In contrast, the old account and backend access remained blocked. Support staff reportedly cited dormancy and “regulatory scrutiny” without prior notice or specific justification, leaving the client effectively locked out of their own funds and trading history.

Case 12, from the United Arab Emirates, involves a substantial dispute over realized profits. The client deposited 16,000 USD into a Multibank MT5 account, reported making 41,000 USD in profits, and claims that the broker then attempted to remove all profits by accusing them of abusive trading without providing detailed proof. Despite stating they have full trading records and repeatedly contacting their manager, the client says their withdrawal request remains unresolved, fueling concerns that Multibank Group uses vague “abuse” allegations to avoid paying out on large, profitable accounts.

Key Risk Patterns for Traders in the UAE, Italy, and Vietnam

Across these 12 cases, several recurring themes emerge that any potential client should treat as serious red flags. First, blocked withdrawals and endless delays recur, even on accounts that never traded, suggesting systemic issues with allowing clients to reclaim their own capital. Second, confiscated profits, bonus clawbacks, and retroactive accusations of “abuse” or “gambling” surface once traders become consistently profitable, which is a classic pattern in many Forex scam alerts.

Third, unsupported technical explanations—such as unexplained execution delays, arbitrary 15‑minute holding rules, or sudden account restrictions under vague “regulatory scrutiny”—appear in multiple Multibank complaints. When combined with an offshore FSC license structure under SIBA/L/14/1068 and a very high ratio of negative exposure cases, these patterns should prompt cautious traders in the United Arab Emirates, Italy, and Vietnam to reconsider using Multibank Group altogether. In such an environment, risk management is not just about trading strategy; it starts with broker selection and due diligence.

How Traders Can Protect Themselves

Before funding any account, traders should verify a broker‘s licenses directly on the regulator’s website and confirm whether the specific entity they are dealing with is under strong supervision. In the case of Multibank Group, clients should distinguish between offshore registrations and any locally authorized entities in the UAE or EU, as not all companies under the brand offer the same level of protection. It is wise to search for up‑to‑date exposure articles, Multibank complaints, and independent reviews, paying special attention to reports of blocked withdrawals and profit disputes.

Investors should also avoid large initial deposits, test withdrawals with small amounts first, and keep meticulous records of all trades, communications, and account changes. If suspicious behavior arises—such as unexplained position openings, sudden rule changes, or pressure to delete negative reviews in exchange for withdrawals—clients should document everything and immediately contact regulators or consumer protection bodies in their jurisdiction. Sharing experiences on reputable forums and exposure platforms can also help warn others and provide a clearer picture of emerging Multibank scam patterns.

Conclusion

The recent wave of exposure reports—738 negative cases out of 744 total—casts a long shadow over MultibanGroupsps public image as a global, trustworthy broker. The cases summarized above describe blocked withdrawals, confiscated profits, unexplained delays in execution, aggressive sales tactics, and opaque account restrictions affecting traders in Vietnam, Hong Kong, and the United Arab Emirates.

While every complaint should be evaluated on its own merits, the volume and consistency of these Multibank fraud allegations mean that retail traders in the UAE, Italy, and Vietnam should approach this broker with extreme caution. Before sending any money, verify the regulations, test withdrawals, and consider choosing a better‑regulated alternative with a cleaner track record of handling client funds. In the current environment, the safest course of action for most investors is to treat Multibank Group as a high‑risk option and prioritize protecting their capital above all else.