Abstract:Regulatory warnings have exposed the unlicensed platform Eighttoro, which imitated well-known brands. Learn about the risks of fake brokers and how to protect your funds.

Choosing a trading platform can already be difficult for investors. That confusion is exactly what scammers behind a platform called eighttoro appear to have exploited—by deliberately blending the names and visual cues of two well-known brokers into a single, misleading brand.

Despite how it may sound, eighttoro has no connection to either Eightcap or eToro. It is an unauthorised platform that has drawn regulatory attention for attempting to pass itself off as something it is not.

A Name Designed to Mislead

The name “eighttoro” is not accidental. It closely resembles a combination of Eightcap and eToro, both established brokers with global recognition. The platforms branding reportedly echoed elements associated with eToro, increasing the likelihood that unsuspecting users might assume legitimacy based on familiarity alone.

This type of brand imitation is a common tactic in online financial fraud. By borrowing trust built by regulated companies, clone platforms attempt to lower investors guard before any verification takes place.

Regulatory Warning and Website Takedown

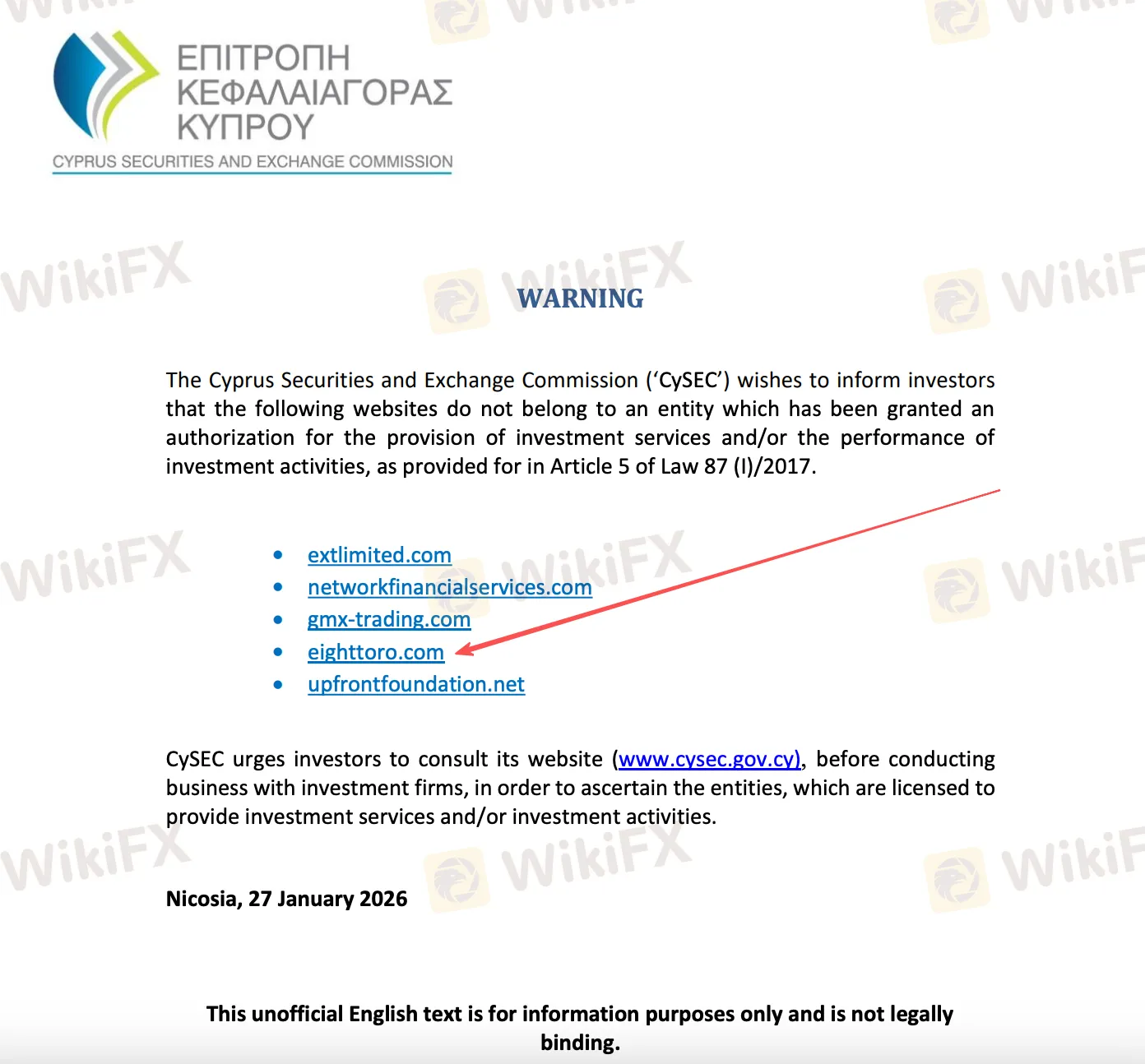

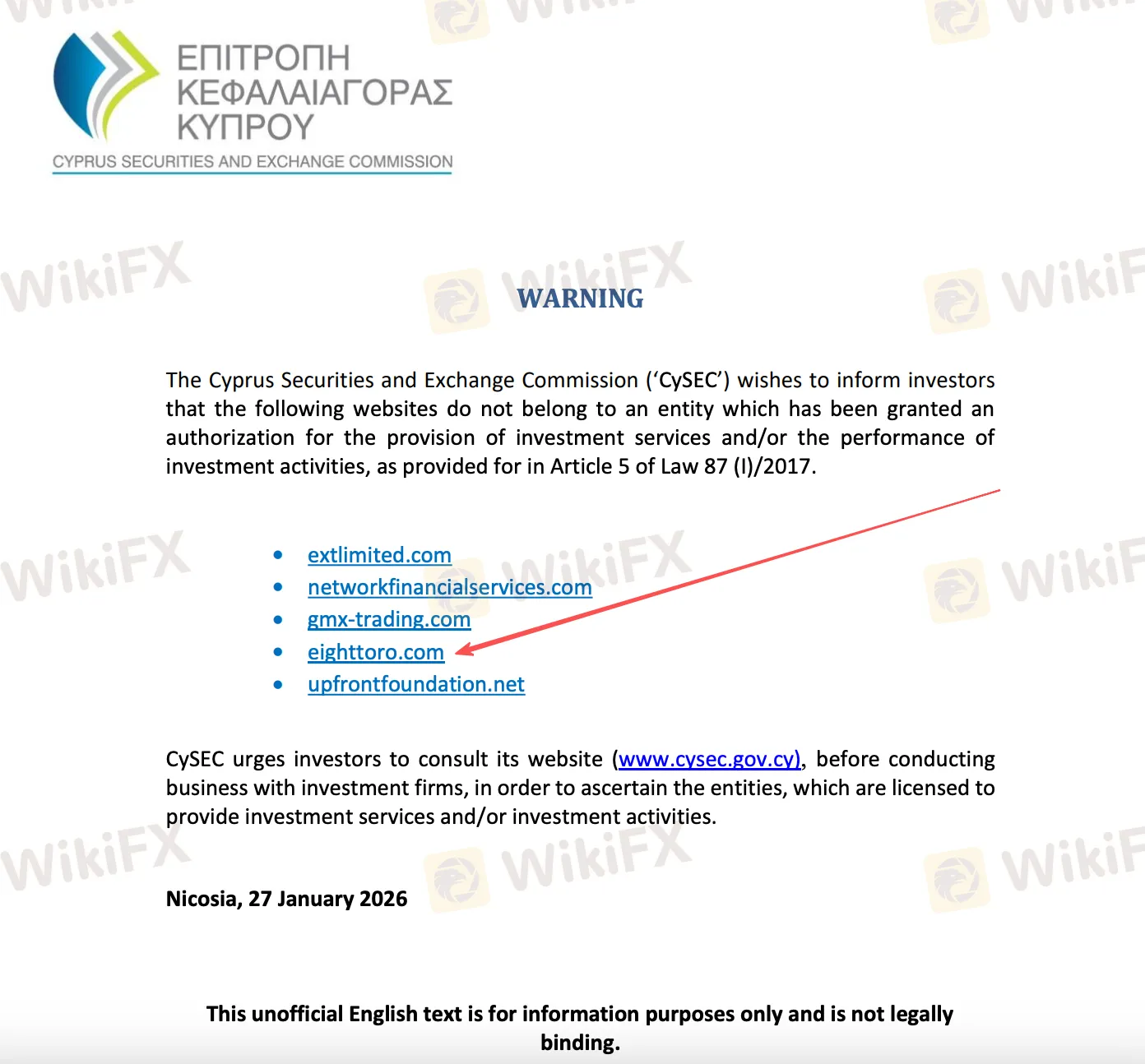

Cyprus financial regulator has issued a public warning against eighttoro, confirming that the platform is not authorised to offer investment services. The warning grouped eighttoro alongside several other unauthorised websites targeting retail traders.

Shortly after regulatory attention, the platforms website became inaccessible. However, archived versions of the site suggest it previously operated in Russian, indicating a targeted approach toward specific language communities rather than a truly global operation.

Inflated Claims and False Scale

Before going offline, eighttoro claimed to provide access to thousands of trading instruments across forex, equities, cryptocurrencies, and other asset classes. It also promoted figures such as hundreds of thousands of users worldwide—numbers that would rival or exceed many long-established brokers.

Such exaggerated claims are a recurring pattern among fraudulent platforms. Large user counts and expansive product offerings are often used to create a false sense of scale and credibility, especially when no regulatory filings or independent verification exist.

Brand Impersonation Is No Longer Isolated

The case of eighttoro reflects a broader trend rather than an isolated incident. Financial institutions have become the most frequently impersonated sector online, with typosquatted domains and clone websites forming a large share of scam-related internet traffic.

Industry leaders have openly acknowledged that fake websites and impersonation accounts are now being discovered and taken down on a near-daily basis. Regulators, meanwhile, continue to issue warnings about fraudulent use of official names, logos, and even staff identities.

Despite enforcement efforts, regulators themselves admit that scammers adapt quickly. As soon as one domain is blocked, another may appear under a slightly different name or structure.

A Reminder for Investors

Cases like eighttoro underline an important reality: a familiar or well-designed brand name does not guarantee legitimacy. Before engaging with any trading platform, investors should take the time to verify regulatory status, corporate background, and operational history through reliable, independent sources.

Using broker information platforms such as WikiFX can help investors quickly check licensing records, risk warnings, and exposure reports linked to a platform. In an environment where fraudulent websites increasingly imitate legitimate firms with high precision, conducting basic verification in advance remains one of the most effective ways to reduce unnecessary risk.