简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Abstract:FIBOGROUP broker currently holds an offshore license from the British Virgin Islands but carries a low WikiFX score of 3.57 due to a high volume of investor complaints. Recent user reports highlight critical risks involving severe price slippage, unreflected deposits, and the inability to execute withdrawals.

FIBOGROUP presents itself as an experienced broker, established in 2010 and offering services on the popular MT4 and MT5 platforms. However, despite its long history, the FIBOGROUP broker profile shows significant warning signs. With a low WikiFX score and offshore regulation, investors must evaluate if the high leverage offered is worth the safety risks.

Key Takeaways

- Low Safety Score:FIBOGROUP holds a WikiFX score of 3.57/10, indicating a “High Risk” environment based on regulatory standards and user feedback.

- Offshore Regulation: The broker is regulated by the BVI FSC (British Virgin Islands), which offers less capital protection than top-tier regulators like the FCA or ASIC.

- Complaint Surge: WikiFX records show 17 complaints in just 3 months, focusing on withdrawal failures and price manipulation.

- Extreme Leverage: Offers up to 1:5000 leverage, which magnifies both potential profits and the risk of rapid account liquidation.

FIBOGROUP Broker Summary

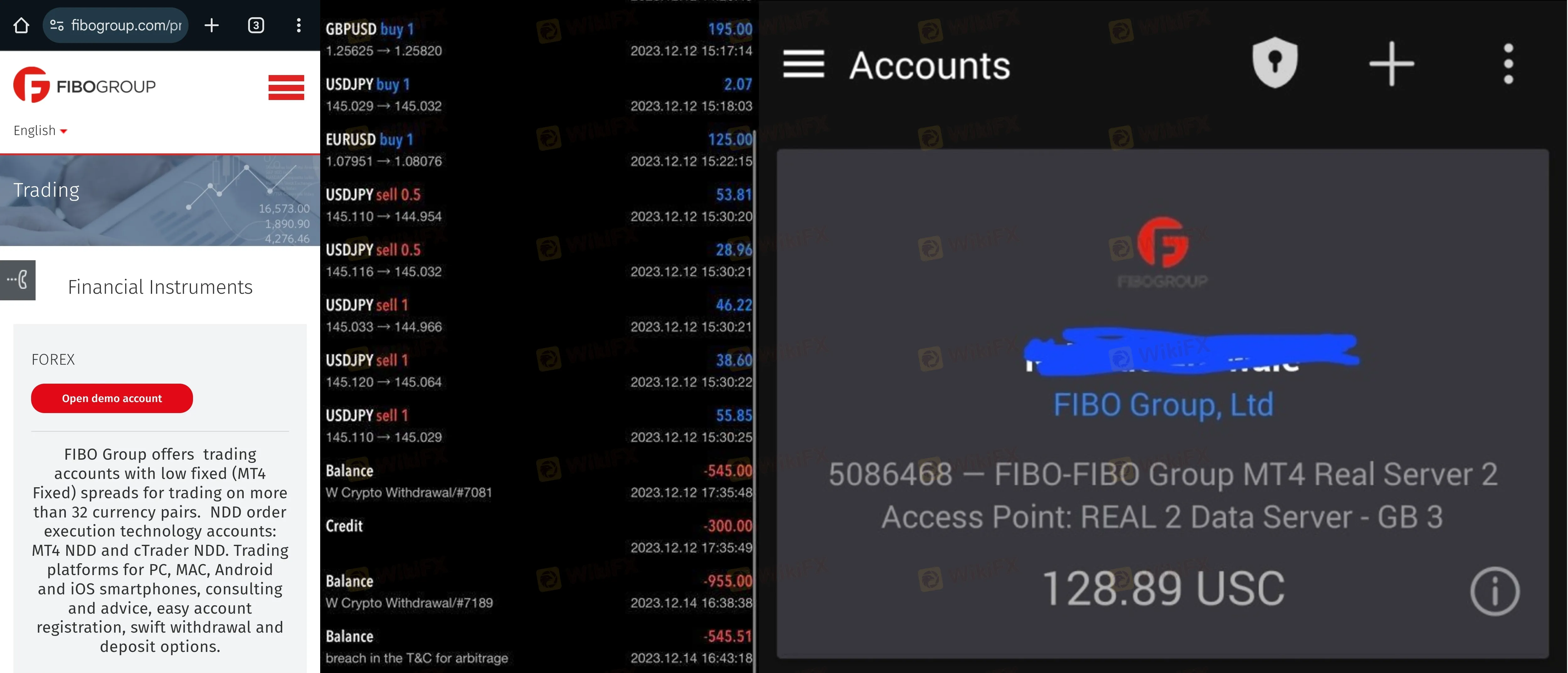

When analyzing the FIBOGROUP broker ecosystem, we see a company that provides extensive digital trading tools but lacks strong trust indicators. The broker supports MT4, MT5, and cTrader, and allows trading in Forex and Metals. However, the trading environment is rated as “C” (Mediocre) by WikiFX influence standards.

The most concerning aspect is the discrepancy between its years of operation (since 2010) and its low reputation score. Usually, a broker of this age would secure top-tier licenses to build trust. FIBOGROUP has remained offshore, which limits the legal recourse available to international clients if disputes arise.

FIBOGROUP Regulation: Is the License Safe?

Regulation is the primary safety net for any Forex trader. FIBOGROUP regulation relies entirely on an offshore framework. While they do hold a valid license, offshore jurisdictions often have looser rules regarding client fund segregation and compensation schemes compared to restricted zones like the UK or Australia.

| Regulator | License Type | Status | Regulatory Strength |

|---|---|---|---|

| Virgin Islands FSC | Retail Forex License | Regulated (Offshore) | Moderate/Low |

Why does this matter?

The BVI FSC (British Virgin Islands Financial Services Commission) is a legitimate regulatory body. However, it is considered a Tier 2 or Tier 3 authority. This means that while FIBOGROUP is legal, it does not offer the heavy rigorous oversight found in stricter jurisdictions. In the event of bankruptcy, recovering funds from an offshore entity can be extremely difficult for African and global investors.

User Reviews: FIBOGROUP Withdrawal & Slippage Complaints

A review of recent user activity reveals a troubling pattern of operational failures. FIBOGROUP users have reported serious issues that go beyond clear technical glitches, suggesting potential unfair practices.

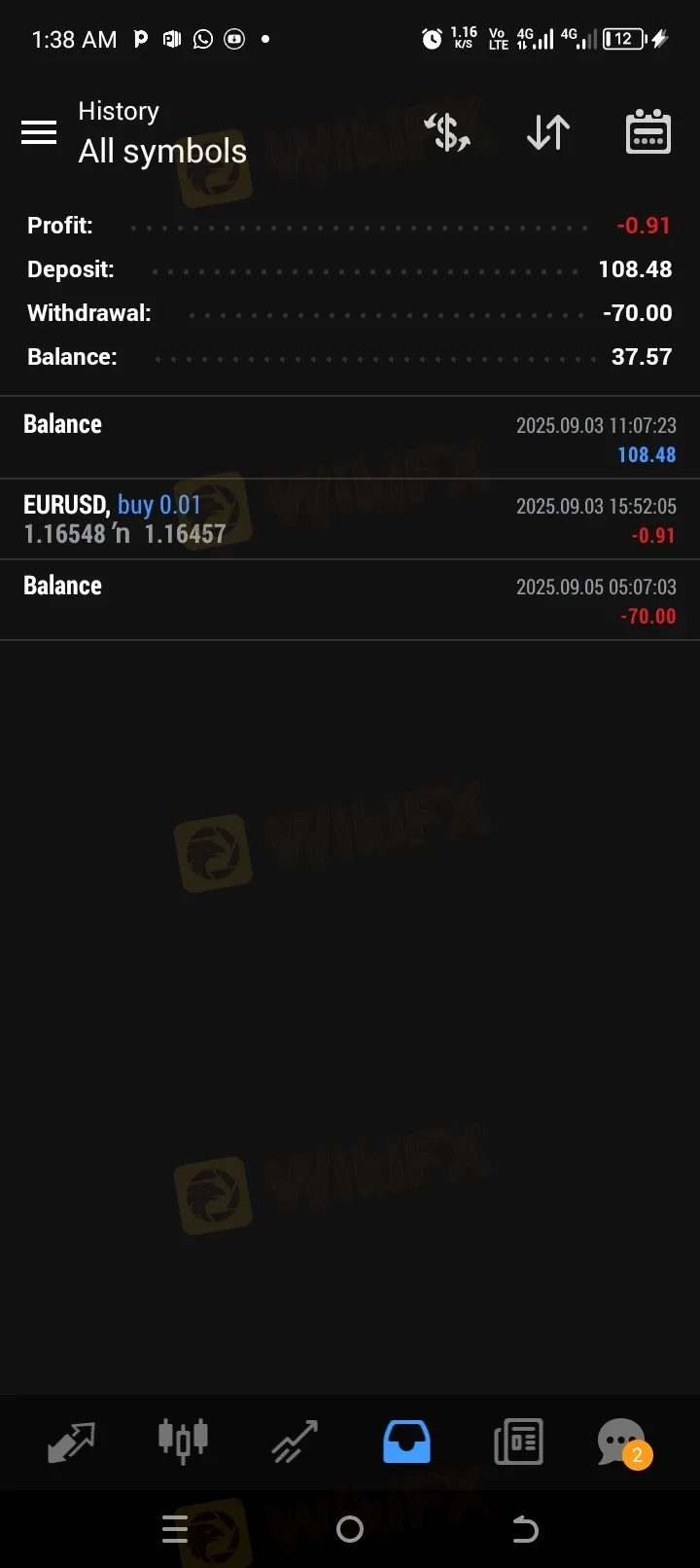

1. Withdrawal and Deposit Failures

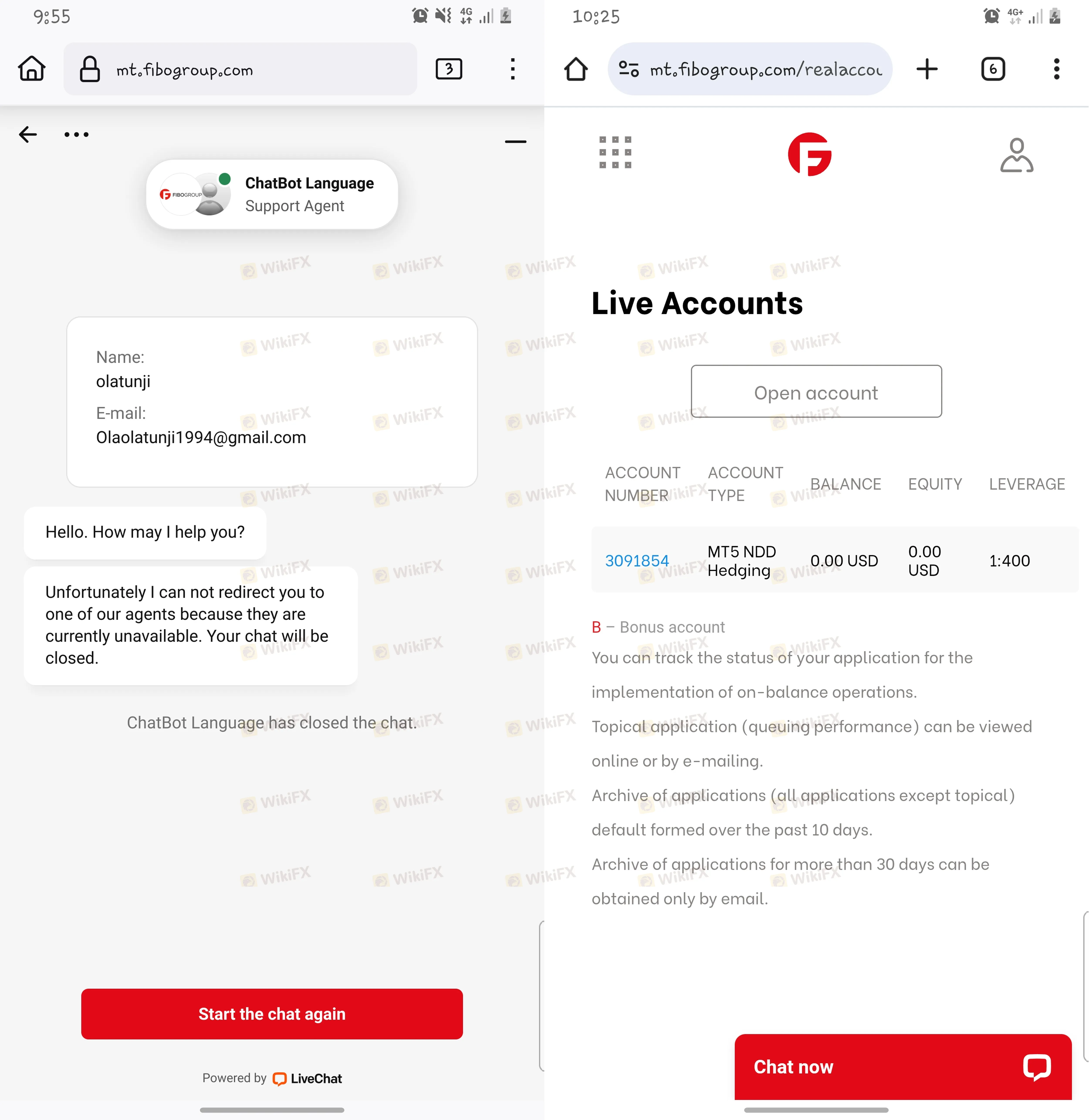

Accessing funds is the most critical part of trading. Recent case logs indicate that investors face barriers when trying to move their money.

- Missing Withdrawal Buttons: One user reported that the specific “withdrawal button” was missing from the website interface, making it impossible to request a payout (Case 9).

- Unreflected Deposits: Reports exist of traders depositing funds that never appear in their trading accounts. In one instance, a user opened multiple accounts, yet the deposits failed to reflect each time (Case 1).

- Excessive Delays: Other traders mention that the withdrawal process is time-consuming and requires unnecessary information not previously requested (Case 3).

2. Severe Slippage and Price Manipulation

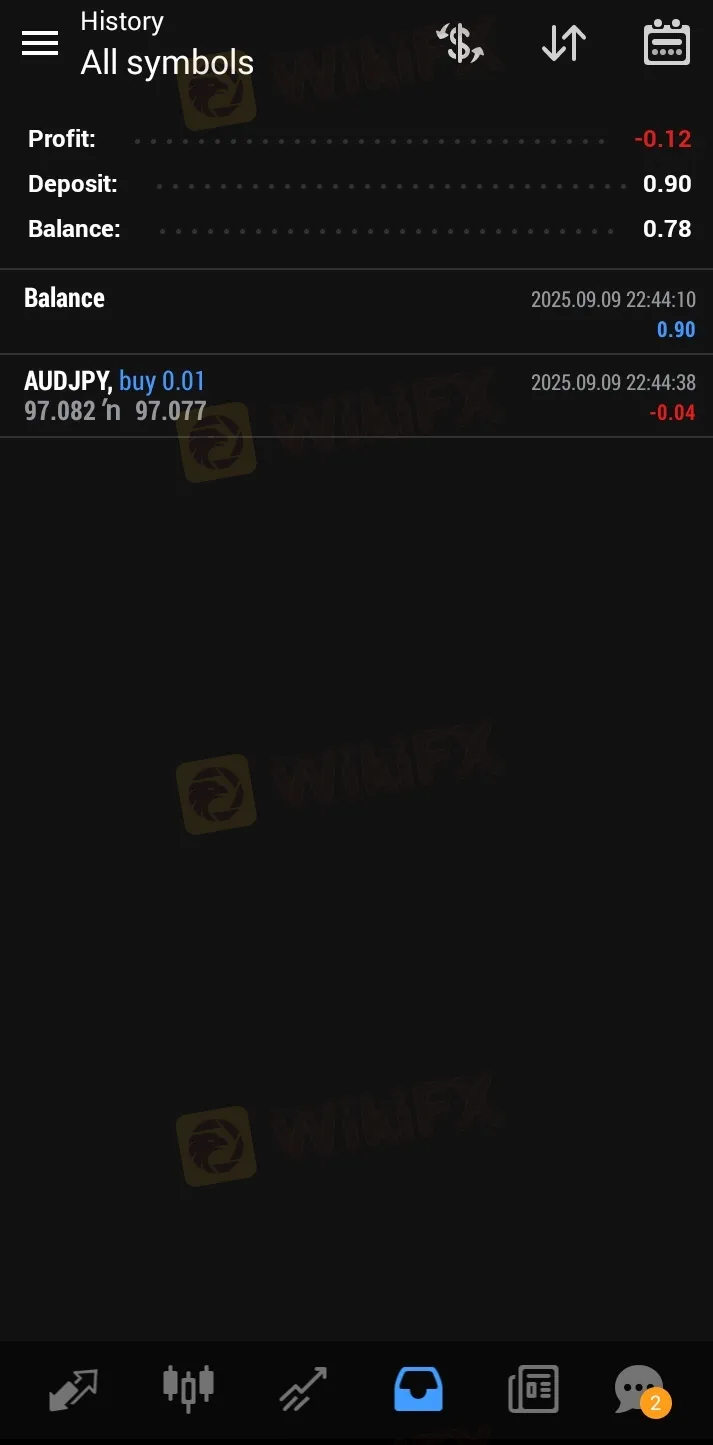

Forex trading requires fair execution, but FIBOGROUP reviews suggest this may be lacking.

- Worse Price Execution: Evidence submitted by users shows trades executing at prices significantly worse than the market rate—sometimes by over 10 pips. One user documented 32 instances of such slippage, resulting in over $400 in losses (Case 5).

- Abnormal Liquidation: A serious complaint detailed an incident where a US Stock position was liquidated maliciously before the market even opened. The user claimed the order was deleted during non-trading hours, leading to heavy losses (Case 4).

> Analyst Note: Slippage can happen in volatile markets, but consistent execution at poor prices during stable periods often indicates a “B-Book” or market maker model working against the client.

Conclusion

Is FIBOGROUP safe for your investment? Based on the FIBOGROUP review data, the risks currently outweigh the benefits.

While the broker offers attractive leverage of 1:5000 and popular platforms like MT4, the combination of offshore regulation, a low safety score of 3.57, and serious accusations of withdrawal blocking creates a dangerous environment for retail traders.

Recommendation: Investors should prioritize brokers with Tier 1 regulation (FCA, ASIC, or cySEC) and a clean track record of withdrawals. Proceed with extreme caution if you choose to trade here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Currency Calculator