简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TRADEVIEW MARKETS Review: The Anatomy of a High-Stakes Capital Heist

Abstract:TRADEVIEW MARKETS is effectively a digital slaughterhouse where user funds are siphoned under the guise of 'negative balance recovery' and accounts are deleted once profit is made. With 15 major complaints and a dismal WikiFX score of 2.42, this broker is a financial hazard operating under the thinnest veil of offshore legitimacy.

If you think your capital is safe behind a polished website and an MT5 terminal, the data on TRADEVIEW MARKETS will serve as a cold, expensive wake-up call. Behind the 'Influence Rank B' façade lies a broker currently drowning in allegations of systematic theft, account deletions, and coercive legal silencing. This isn't just a case of bad service; it is a calculated operation where the moment you show a profit, you become a target.

With a WikiFX score of 2.42, TRADEVIEW MARKETS has moved from being a questionable offshore entity to a full-blown red alert. The data reveals that in just the last few months, 15 separate investors have come forward with horror stories of wiped balances and deleted trading histories.

TRADEVIEW MARKETS Regulation Audit: The Offshore Shield

The broker relies on its Cayman Islands registration to provide an image of stability, but a closer look at its Forex regulation status reveals a much darker reality. While they hold a CIMA license, European authorities have already smelled the rot.

| Regulator | License Type | Status |

|---|---|---|

| Cayman Islands (CIMA) | Offshore Regulatory | Regulated (License 585163) |

| Spain (CNMV) | Investment Services | Unlicensed / Warning Issued |

The Spanish CNMV explicitly warned as early as 2017 that Tradeview Ltd was not authorized to provide investment services. This is a classic “Regulatory Arbitrage” play: using an offshore license to fleece investors globally while ignoring the warnings of major financial hubs.

The “Negative Balance” Scam and Coerced Silencing

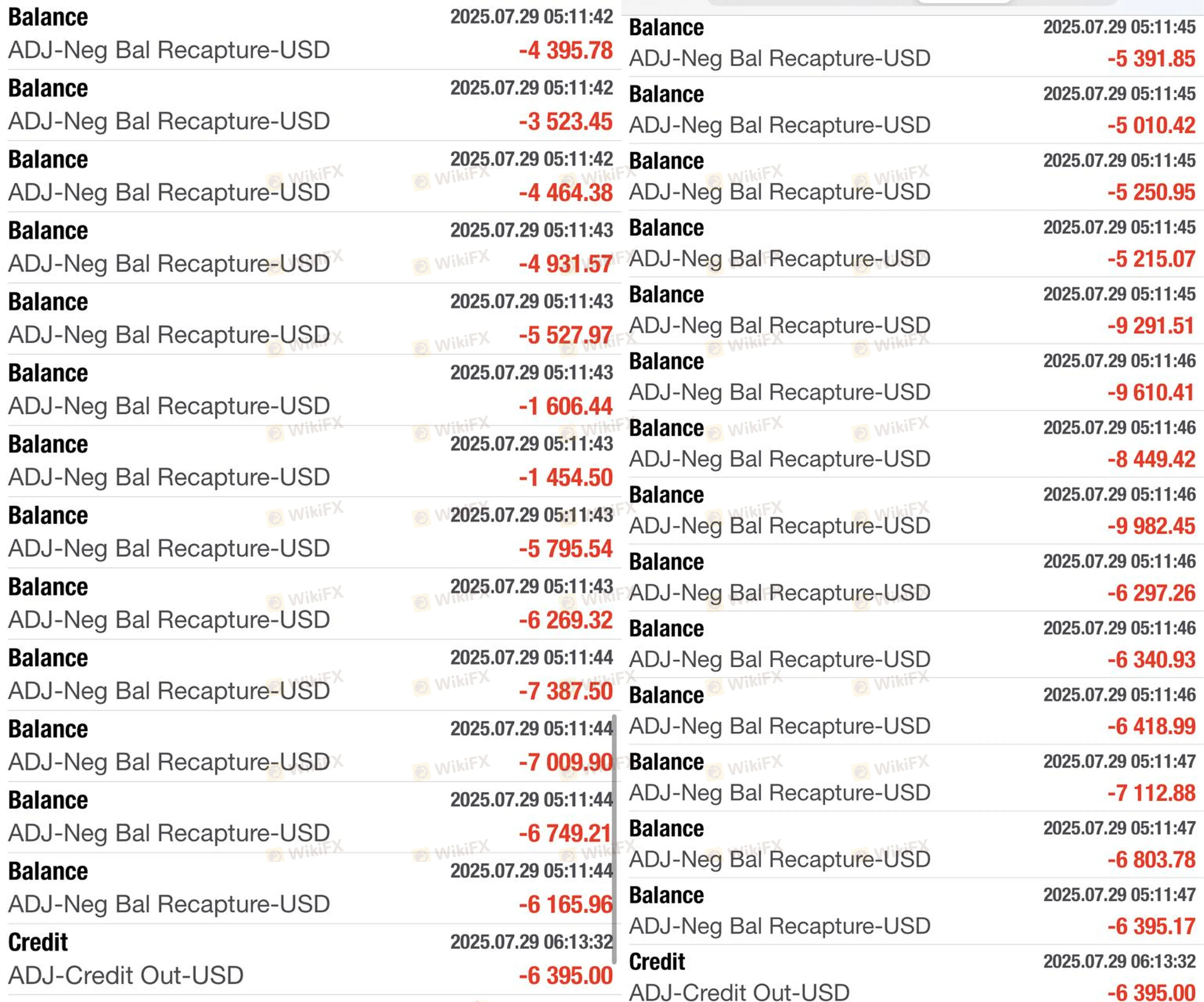

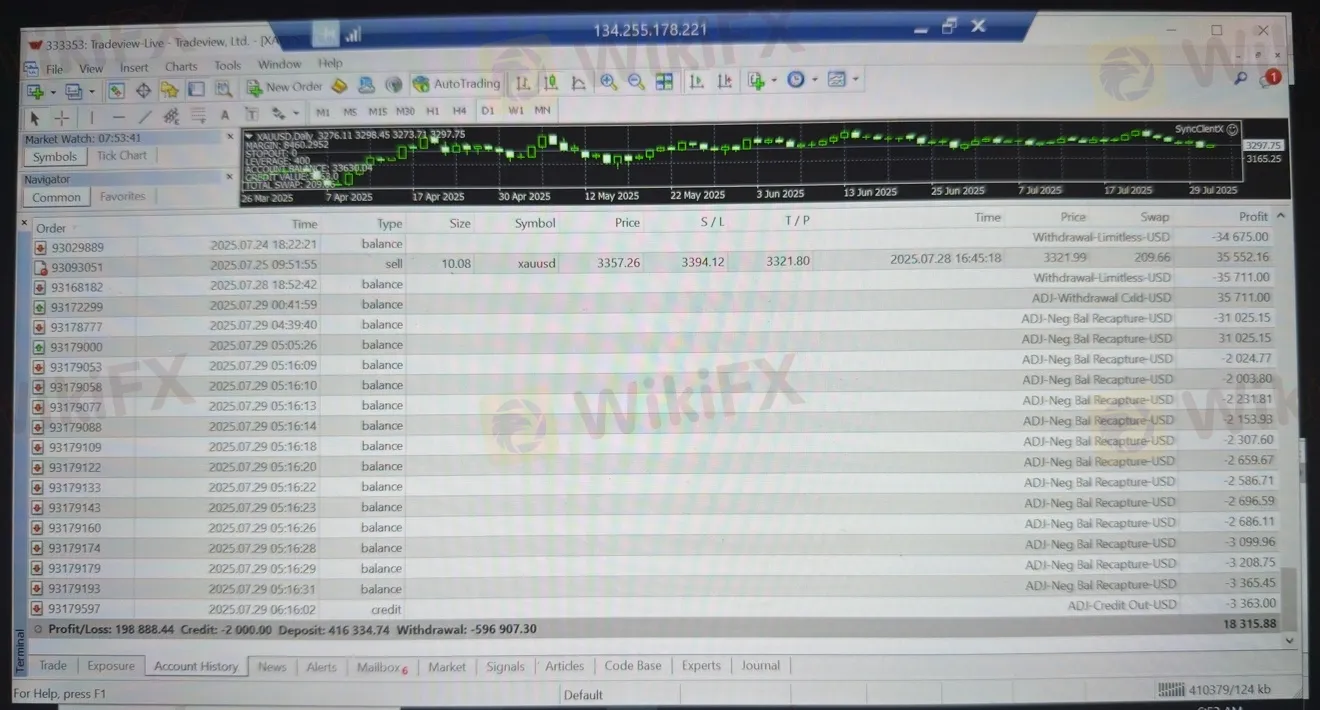

The most disturbing pattern emerging from the TRADEVIEW MARKETS review involves a “Negative Balance” trap. Multiple traders from Nigeria, the UAE, and the USA report that the broker arbitrarily deducted tens of thousands of dollars from their accounts—in some cases up to $166,000—claiming it was to recover “old debts” that were never previously disclosed.

Even more predatory is the exit strategy. Victims report that to access any remaining funds, TRADEVIEW MARKETS forced them to sign legal waivers under duress, promising not to post negative reviews or pursue legal action. This is the hallmark of a predatory Forex broker—using your own frozen capital as a ransom for your silence.

Deleted Evidence: The WhatsApp Trap

If you are looking for the TRADEVIEW MARKETS login page, you should first look at the shattered experiences of traders in Malaysia and Hong Kong. Clients were lured into WhatsApp groups where they were encouraged to deposit hundreds of thousands in USDT.

As soon as these accounts turned a profit, the reality set in:

1. Account Deletion: Users found their login credentials invalidated overnight.

2. Data Scrubbing: Entire trading histories were wiped, leaving victims with no evidence of their positions.

3. Ghosting: Once the funds (totaling over $380,000 in single cases) were stolen, the “account managers” blocked the victims on all platforms.

A Systemic Failure of Trust

The TRADEVIEW MARKETS registration year of 2020 should have been the start of a reputable firm, but instead, it has become a platform where slippage is heavy and price moves are “suspicious.” Whether it is the $62,000 “administrative deduction” for a US client or the $227,197 stolen from a Nigerian trader with five accounts, the message is consistent: your money is only yours until you try to withdraw it.

Risk Warning

The Forex market is volatile enough without having to fight your own broker. TRADEVIEW MARKETS currently exhibits every known red flag of a “Pig Butchering” or “Boiler Room” operation, including the use of unregulated communication channels (WhatsApp) and the forced signing of non-disclosure agreements to release held funds.

Investing here is not trading; it is a donation to a firm that has already been flagged by Spanish regulators and dozens of defrauded clients. Stay away.

Disclaimer: This report is based on current WikiFX data and verified user complaints. Financial markets involve high risks, especially when dealing with low-rated offshore brokers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Currency Calculator