简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

JMC Clone Investment Scam Drains RM1.25 Million from Businessman

Abstract:A single online advertisement was all it took for a Malaysian businessman to lose RM1.25 million!

A single online advertisement was all it took for a Malaysian businessman to lose RM1.25 million in what authorities describe as a highly organised clone investment scam. The case, now under investigation by the Commercial Crime Investigation Department (CCID), underscores the growing sophistication of online fraud and the speed at which victims can be drawn into devastating losses.

The victim, a 50-year-old businessman, encountered the scheme after seeing an investment promotion on Facebook. The advertisement claimed to represent an international investment entity operating under the name JMC, a move investigators believe was designed to mimic a legitimate Hong Kong-based finance and investment firm. The resemblance was convincing enough to disarm initial suspicion.

After responding to the advertisement, the man was added to a WhatsApp group that appeared to be an active investment community. Messages within the group reinforced confidence, with participants discussing trades and sharing apparent success stories. He was later instructed to download an investment application known as TRADEJMC. The app presented detailed trading activity and rapidly rising account balances, giving the impression of genuine market participation.

Over time, the figures shown on the app escalated dramatically. The victims account displayed paper profits reaching as high as RM16.7 million. Convinced by the consistent growth and the apparent professionalism of the platform, he proceeded to invest heavily.

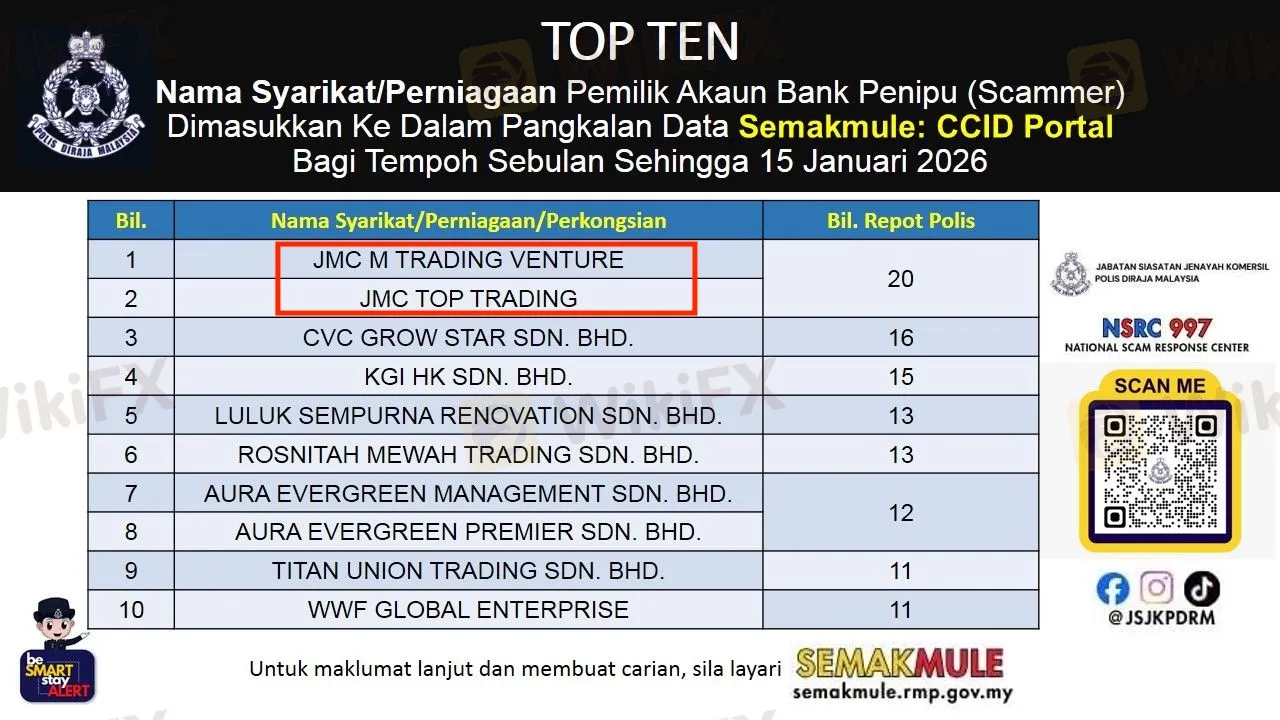

Between October and December 2025, the businessman made 23 separate transfers amounting to RM1.25 million. The funds were deposited into several third-party bank accounts registered under corporate and business names, including JMC M Trading Venture, JMC Top Trading, JCG Entire Trading Sdn Bhd and JMC Flex Solution. The use of registered business accounts gave the operation an added layer of credibility.

The turning point came when the victim attempted to withdraw his profits. He was informed that a withdrawal fee of RM4.5 million was required, allegedly representing 30 per cent of his earnings. The demand triggered alarm. Further checks revealed that the scheme had no connection to the legitimate international firm it claimed to represent. Realising he had been deceived, the victim lodged a police report on 6 January.

According to the CCID, this case is far from isolated. The departments latest update of its Semakmule database shows at least 111 police reports linked to eight suspicious entities. JMC M Trading Venture recorded the highest number of cases, highlighting its central role in reported investment fraud incidents.

Authorities warned that company registration offers no protection against fraud. Registered corporate accounts are increasingly being exploited as mule accounts, allowing scams to operate openly and at scale.

The CCID has urged the public to verify entities and bank accounts through the Semakmule portal before transferring funds. Investors are also advised to treat social media advertisements promising fast and unusually high returns with extreme caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Gold Breaches $5,100 as 'De-Dollarization' and Tariff Wars Crush the Greenback

Market Perception: 'SA Inc' Under Review

Energy Markets: Chevron and NNPCL Add 146,000 b/d to Global Supply

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

APAC Outlook: 'Takaichi Trade' Returns to Tokyo; RBA Hike Bets Propel Aussie Dollar

Dollar Index Falters Near 97.00 as Washington Dysfunction Overshadows Economic Data

Geopolitical Risk Premium Rising: Russia Warns on Arms Treaty as Trump Pushes Ukraine Land Deal

Emerging Markets: West Africa Projected for 4.4% Growth Amid Reforms

Currency Calculator