简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Jan 26, 2026

Abstract:Weekly Outlook: Hard Assets, Soft Dollars, and Central Bank StandoffsThe financial landscape enters the final week of January 2026 in the midst of a historic regime shift. While equity markets continu

Weekly Outlook: Hard Assets, Soft Dollars, and Central Bank Standoffs

The financial landscape enters the final week of January 2026 in the midst of a historic "regime shift." While equity markets continue to flirt with record highs, the real narrative has shifted toward a massive structural breakout in precious metals and a high-stakes cat-and-mouse game between global currency traders and the Bank of Japan.

Last week was a tale of two halves. Major global equity markets faced early-week pressure from Trumps “Greenland Threat,” but these fears quickly eased as the threat was removed. Consequently, the global market—particularly the currency market—saw a sharp spike in volatility following the BoJ meeting in the later session.

The BoJ Pivot: Yen Surges Strongly

On Friday, January 23, the BoJ opted for a "Hawkish Hold," keeping its policy rate at 0.75%. While the hold was expected, the banks updated projections were decidedly aggressive:

· Inflation Upgrade: The BoJ significantly lifted its "core-core" inflation path, now expected to remain above the 2% target through 2027.

· Growth Revisions: GDP forecasts for fiscal 2026 were revised upward to the 0.9%–1.0% range.

Despite the hawkish outlook, the Yen initially softened until a late-session surge sparked intense speculation of direct intervention. This was fueled by comments from BoJ Governor Ueda that shifted from "steady-hawkish" to what the market interpreted as "warning-hawkish."

USDJPY, H4 Chart

After briefly spiking above 159.00 following the BoJ announcement, USD/JPY plummeted nearly 400 pips to the 155.00 range in the later US session. This signals that the market is now taking the intervention threat and the BoJs potential actions more seriously.

Fed Preview: The January Standoff

The Federal Open Market Committee (FOMC) meets tomorrow, January 27–28. While a "hold" at the 3.50%–3.75% range is nearly 100% priced in, the market is bracing for a "Hawkish Hold" from Chairman Powell.

Recent PCE and economic data suggest the Fed lacks the "clear evidence" needed for rate cuts. However, the impact on the Dollar is increasingly driven by political pressure and broader currency debasement.

Adding to the tension, Donald Trump recently directed his focus toward Powell: f there isn't a rate cut on Wednesday, it‘s a stab in the back of this country’s economy.

USD Index, Daily Chart

For the US Dollar Index, sell-off pressure remains as we covered last week. Key support now lies at 96.80. The outlook for the Dollar remains to the downside, especially as the index has broken below the 98.00 psychological floor (which now serves as major resistance between 97.50–97.80).

Precious Metals: The $5,000 and $100 "Super-Breakout"

We are witnessing a historic structural repricing of the metals complex. This morning, Monday, January 26, the psychological ceilings finally gave way.

· Gold has officially surpassed the $5,000 milestone, acting as a macro risk hedge amid a broad move of fiat currency debasement and investor "Fear of Missing Out" (FOMO).

· Silver has performed even more aggressively, surging past the $100 mark. With supply deficits deepening and its essential role in the AI/Defense sectors, the $100 breakout signals that Silver is entering a new, higher-level trend.

Gold Technical Outlook

XAUUSD, H4 Chart

With current momentum, the path of least resistance for Gold remains upward as the sky is clear above.

For now, key resistance targets the $5,100 and $5,200 levels next. On the downside, $5,000 has turned from a ceiling into a floor, while $4,800 remains the major support that validates the overall long-term uptrend.

Silver Technical Outlook

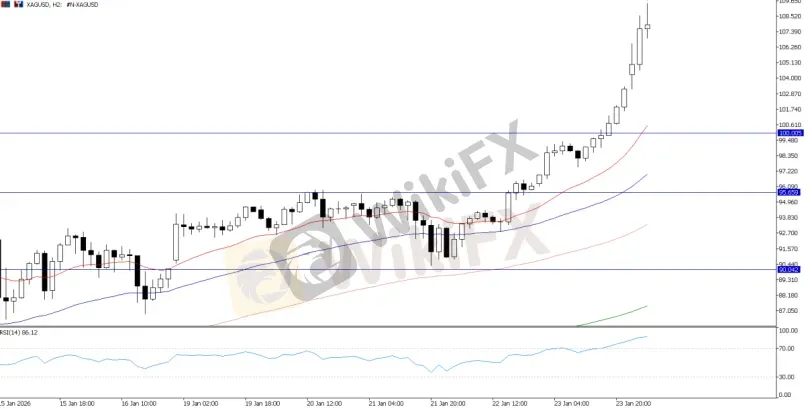

XAGUSD, H2 Chart

Similarly for Silver, after breaking $100, the upside is clear. $110 remains the next major objective.

Outlook: For Gold and Silver, the outlook is clear: you cannot short against this momentum. Focus remains on the upside; however, remain cautious of short-term pullbacks driven by profit-taking volatility. Aggressive day traders should remain biased to the upside, while swing traders should stay cautious regarding potential pullbacks.

Oil Price Outlook: Geopolitics vs. The Surplus

Energy markets are currently caught in a tug-of-war between a structural oversupply and a resurgent geopolitical risk premium. While the IEA still projects a massive surplus for 2026, the deployment of additional U.S. naval assets to the Middle East has put a "fear floor" under prices. This means the bearish bias on supply is strong, but the bullish risk from Iran/Middle East tensions dominates price action.

Currently, WTI is expected to trade within a choppy $58–$61 range until a clear directional trigger emerges from the FOMC or Middle East headlines.

USOIL, H4 Chart

The upside outlook remains intact for USOIL, but traders should be cautious of recent choppiness due to a lack of a clear directional catalyst.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is ICM Brokers Legit? Checking Its Legitimacy and Scam Risks

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Currency Calculator