简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scammed Twice: How a RM1,500 Loss Escalated to RM1.2 Million

Abstract:What began as an effort to recover RM1,500 lost to an online scam ended in a devastating financial collapse of RM1.2 million.

A Malaysian womans attempt to recover a small sum lost to an online scam ended in a devastating financial collapse, exposing a dangerous new layer of fraud targeting victims who are already vulnerable.

The woman initially lost RM1,500 in an online scam. Determined to recover the money, she later approached a firm that presented itself as an “anti-scam” law firm. What followed was not justice or recovery, but the largest financial loss of her life. By the end of the ordeal, she had lost approximately RM1.2 million.

The case was revealed by the MCA Public Services and Complaints Department, which has seen a surge in similar reports. According to the department, fake law firms are actively advertising online, promising recovery rates of up to 90 or 95 per cent. These claims are carefully designed to appeal to victims who are desperate, anxious and eager to reverse their losses.

After making initial payments, victims are gradually asked to pay more under various reasons, including legal fees, processing charges and cross-border costs. Each request appears plausible on its own. Over time, however, these payments accumulate and can wipe out entire life savings. In many cases, victims only realise they have been scammed again when the firm becomes unresponsive.

Authorities have stressed that this is not an isolated case. Another reported victim lost RM390,000 in an earlier scam and then paid an additional RM33,000 to a fake law firm in the hope of recovering his funds. Like many others, he did not receive a single ringgit back. To date, none of the victims who have approached the MCA department have successfully recovered any money through such firms.

The damage goes far beyond finances. Victims often suffer severe emotional distress, shame and anxiety. Some resort to borrowing from informal moneylenders, believing they can recover their losses quickly. Instead, they fall into deeper debt, creating a cycle that destroys livelihoods and families. In extreme cases, the consequences are life-altering.

Legal professionals have also sounded the alarm. Senior lawyers have pointed out that legal advertising in Malaysia is strictly regulated, and many of these so-called law firms appear to operate outside the law. Promises of near-guaranteed recovery are widely regarded as misleading and unethical. These advertisements often target specific communities and rely heavily on social media platforms.

Further suspicion arises from firms claiming to be “cross-border” or international while conducting transactions entirely in Malaysian ringgit. Such inconsistencies raise serious doubts about their legitimacy and suggest that victims are being deliberately misled.

Public reaction has been strong. While some Malaysians have called for investigations to be handled carefully, many believe the warning signs are already clear. There is growing pressure on regulators and the Bar Council to act swiftly to protect the public and preserve trust in the legal profession.

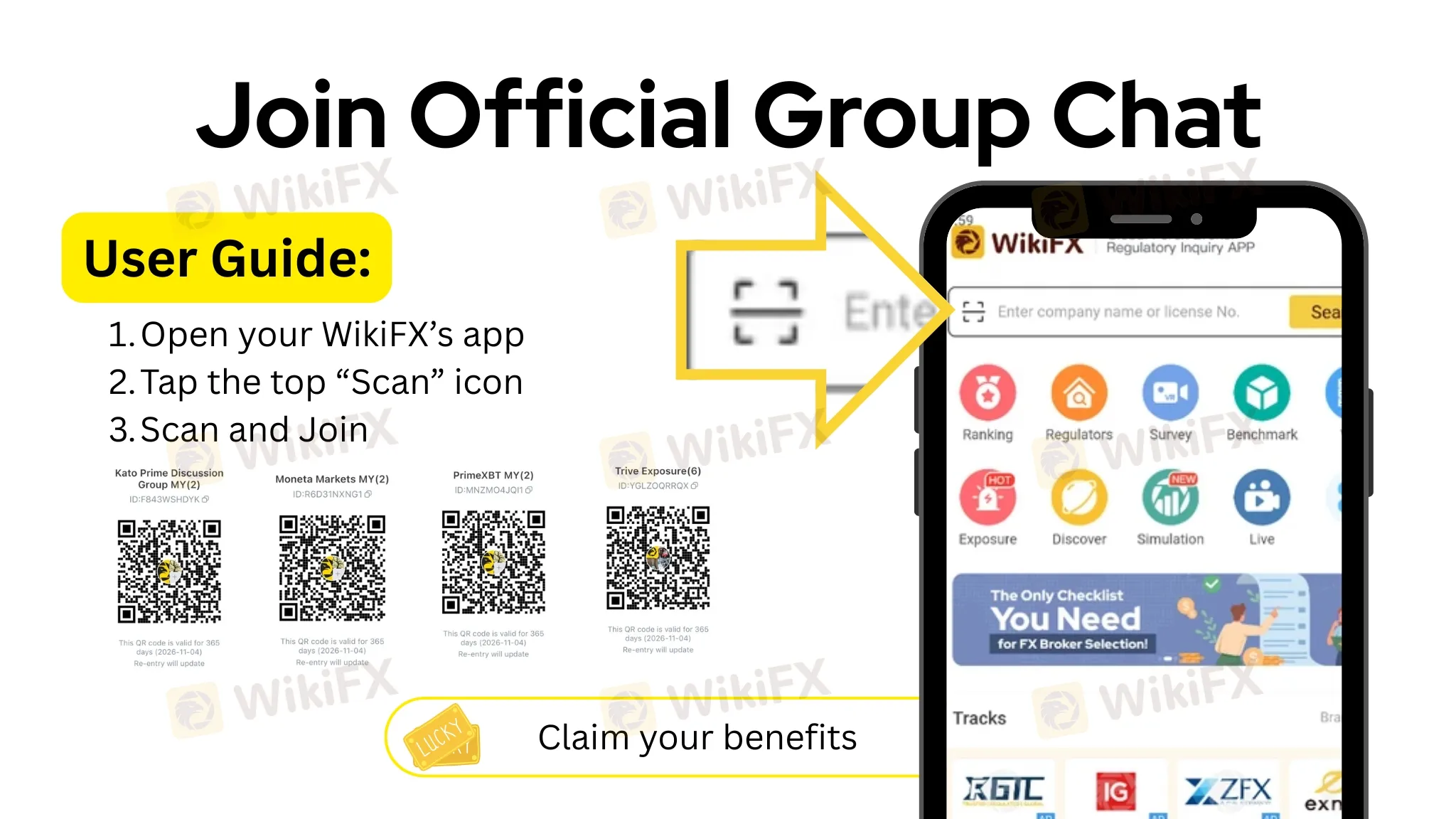

As incidents like this become increasingly common, tools such as WikiFX can play a vital role in helping individuals verify the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, enabling users to make informed decisions before committing to any financial investment. Its risk ratings and alerts for unlicensed or suspicious entities help investors easily spot red flags and avoid potential scams. By using tools like WikiFX to research a broker's background, individuals can safeguard their hard-earned savings and reduce the risk of falling victim to fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

BitPania Review 2026: Is this Broker Safe?

Kudotrade Review 2026: Is this Forex Broker Legit or a Scam?

ALPEX TRADING Review 2025: Is This Forex Broker Safe?

MONAXA Review: Safety, Regulation & Forex Trading Details

SOOLIKE Review 2026: Is this Forex Broker Legit or a Scam?

Macron's India Trip Exposes EU Tech Overreach And Policy Failures

Five key takeaways from the Supreme Court's landmark decision against Trump's tariffs

FXORO Review 2026: Is this Forex Broker Legit or a Scam?

Binomo Review: Safety, Regulation & Forex Trading Details

VenturyFX Review 2025: Is This Forex Broker Safe?

Currency Calculator