Abstract:When evaluating financial service providers, trust, regulation, and transparency are key. In this review, we examine Pictet — a well-known Swiss financial institution — and assess whether it is legitimate or a scam, highlight its core services, and compare it with other brokers in the market.

When evaluating financial service providers, trust, regulation, and transparency are key. In this review, we examine Pictet — a well-known Swiss financial institution — and assess whether it is legitimate or a scam, highlight its core services, and compare it with other brokers in the market.

What Is Pictet? Company Overview

Pictet is a Swiss investment firm and private bank established in 1805, with a long history of wealth management and asset services. It operates globally with offices in Europe, Asia, the Americas, and the Middle East. https://www.wikifx.com/en/survey/8794408d6e.html

The companys core offerings include:

- Wealth Management – tailored private banking and wealth planning services.

- Asset Management – institutional and private investment solutions across equities, bonds, multi-asset, and thematic strategies.

- Alternative Investments – private equity, real estate, hedge funds, and private debt strategies.

- Asset Services – custody, fund administration, and related support services.

Pictet is structured as a partnership, meaning it is privately owned by its managing partners rather than external shareholders, which the firm says allows for long-term focus rather than short-term profit pressures.

Pictet vs Online Retail Brokers

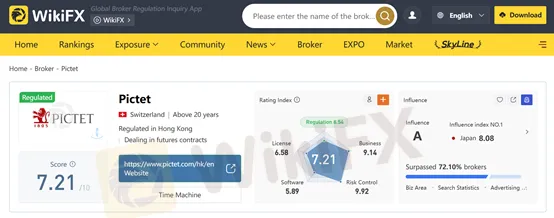

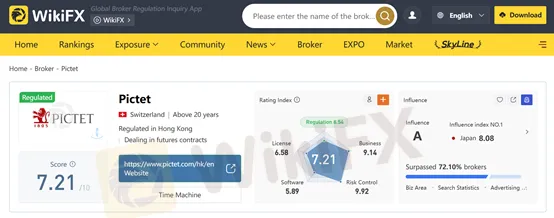

Regulation & Legitimacy: Is Pictet a Scam?

Short answer: No — Pictet itself is not a scam.

Pictet is a legitimate and regulated financial institution:

Regulation & Licensing

- Swiss Regulation: The parent entity, Banque Pictet & Cie SA, is regulated under Swiss laws and supervised by the Swiss Financial Market Supervisory Authority (FINMA).

- Hong Kong Regulation: The Hong Kong branch of Pictet (Banque Pictet & Cie SA, Hong Kong Branch) is registered with the Securities and Futures Commission (SFC) and licensed to carry out regulated activities, including securities dealing and asset management.

This level of oversight from established regulators like FINMA and the SFC indicates that Pictet operates under strict compliance standards, with requirements for capital adequacy, governance, and client asset protection.

Scam Warnings to Be Aware Of

There have been scam operations impersonating Pictet (e.g., “Pictet Private Wealth Management” clone firms), which are unauthorized and should not be trusted. These scams often lack regulation, office addresses, or legitimate contact information.

Key takeaway:

The genuine Pictet Group is credible and regulated.

Be cautious of fake firms using the Pictet name without proper licensing.

Pictet Services Explained

1️. Wealth Management

Pictets wealth management division focuses on high-net-worth individuals and families, offering tailored strategies for wealth preservation, growth, and succession planning. They emphasize bespoke solutions over product-led sales.

2️. Asset Management

The firm provides diversified investment solutions for institutional and private investors, from traditional equities and bonds to complex multi-asset portfolios.

3️. Alternative Investments

Pictet has a dedicated alternative investment platform that includes private equity, real estate investment, hedge funds, and private debt strategies.

4️. Asset Services

Through its asset servicing arm, the group supports fund administration, custody, and related services across global markets.

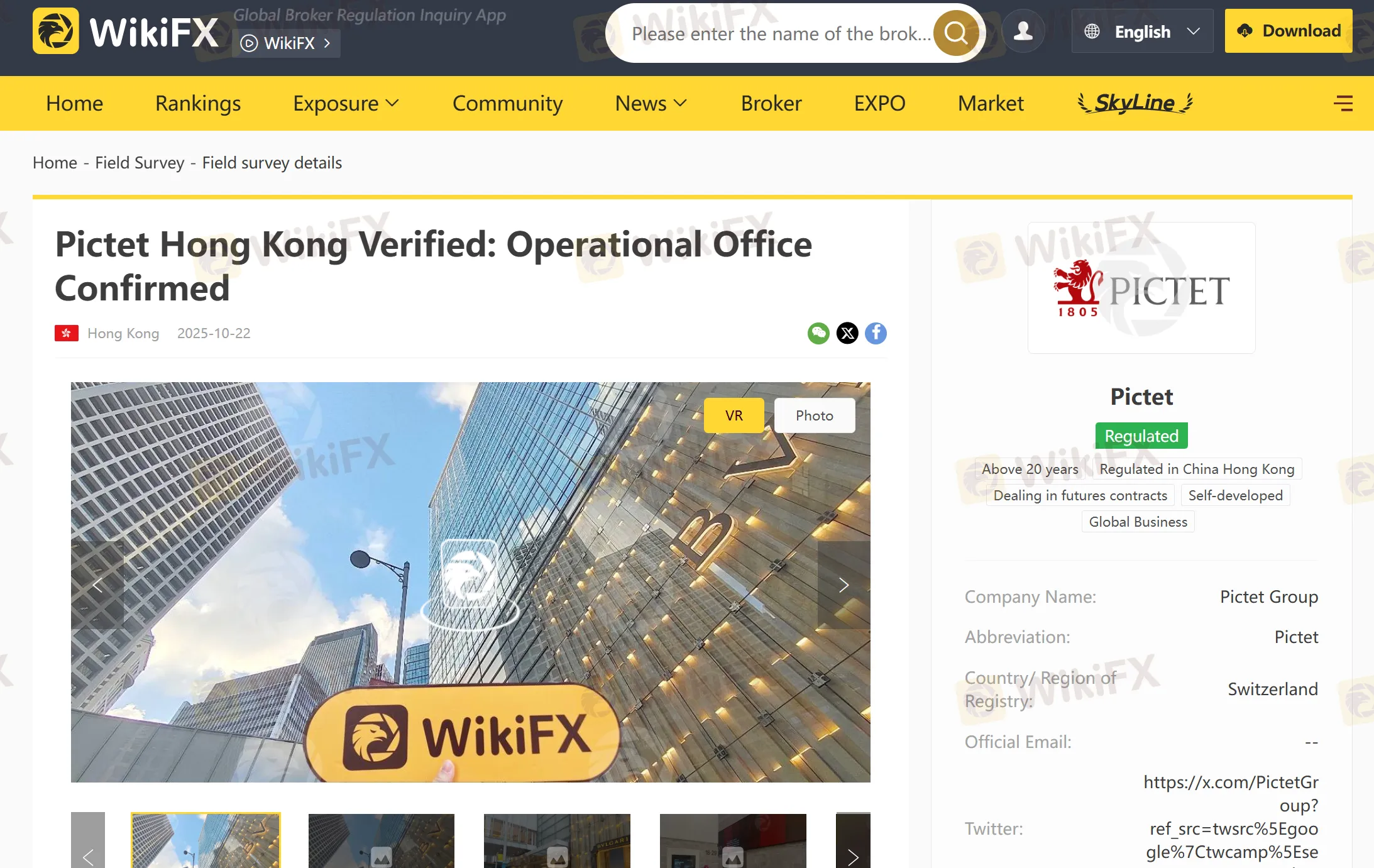

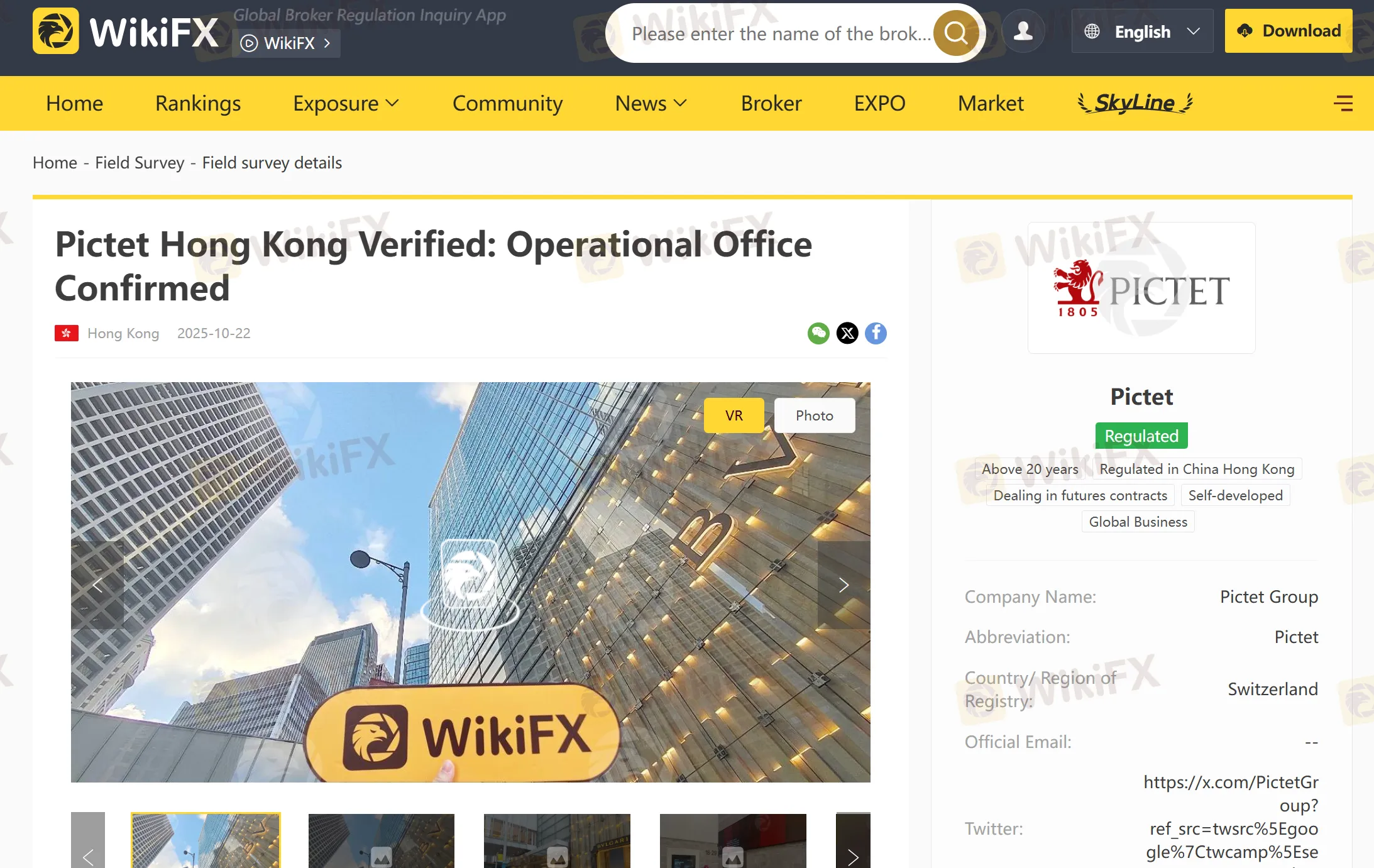

Field Survey

WikiFX has sent a investigation team to make an on-site survey. The on-site inspection team visited the forex broker Pictet in Hong Kong, China as planned. According to public information, its office address is 8-9/F, Chater House, 8 Connaught Road Central, Central, Hong Kong. The company name and other information were visible at the location, confirming the existence of a genuine business premises.

Pros & Cons of Pictet

Conclusion: Legit or Fraud?

Pictet is Legitimate:

- Regulated by major authorities like FINMA and the Hong Kong SFC.

- Over two centuries of institutional presence and client trust.

- Offers high-end wealth and asset management, not typical “brokerage” trading services.

Not Suitable for Everyone:

- Not an everyday trading broker.

- High-level services mean fees are often significant.

Avoid Scam Clones:

- There are unauthorized entities misusing the Pictet name — always verify licenses and regulatory status.