简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is CICC Broker Safe? CICC Regulation Check & In-Depth Review

Abstract:Before investing, every trader should verify whether a broker is safe and trustworthy, as regulatory oversight is a crucial factor when committing capital. This article reviews the key aspects of broker CICC and examines CICC regulation to help readers gain a clearer understanding of the broker and make well-informed investment decisions.

Before investing, every trader should verify whether a broker is safe and trustworthy, as regulatory oversight is a crucial factor when committing capital. This article reviews the key aspects of broker CICC and examines CICC regulation to help readers gain a clearer understanding of the broker and make well-informed investment decisions.

Overview of CICC Broker

China International Capital Corporation (CICC) is a prominent global investment bank and financial services institution headquartered in Beijing, China. Established in 1995, CICC has grown to become one of the largest and most influential investment banks in China, with a strong international footprint. As a leading CICC broker, the firm provides a wide spectrum of financial services to individual, corporate, and institutional clients, positioning itself as a key participant in both domestic and international capital markets.

Know about CICC Regulation

CICC regulation plays a crucial role in establishing the firm‘s credibility and trustworthiness. CICC operates under strict regulatory oversight across multiple jurisdictions. Notably, its Hong Kong operations are regulated by the Securities and Futures Commission (SFC), a well-respected regulatory authority known for enforcing high standards of market integrity, transparency, and investor protection. This regulatory supervision requires broker CICC to comply with stringent rules, including segregation of client funds, robust risk management frameworks, and comprehensive reporting obligations. Such regulatory compliance enhances confidence among investors and reinforces CICC’s reputation as a legitimate and professionally governed financial institution.

Market Instruments & Financial Services

CICC broker offers an extensive range of market instruments and financial solutions. These include equity financing, debt and structured finance, fixed income securities, commodities, foreign exchange, derivatives, and futures products. In addition, CICC provides research, sales, and trading services designed to support informed investment decisions. The firm also offers wealth management services for high-net-worth individuals, comprehensive asset management products, and private equity investments in innovative companies across various global industries, enabling clients to diversify their portfolios effectively.

Account Types and Trading Features

Broker CICC provides multiple account types to meet the diverse needs of its clients. Individual accounts are tailored for personal investors seeking access to capital markets, while corporate accounts support businesses requiring financing and advisory services. Institutional accounts are designed for large entities such as pension funds, insurance companies, and asset managers, offering customized investment strategies and solutions. CICC also provides advanced trading features, including margin trading, short selling, and stop-loss orders, allowing clients to manage risk and enhance trading efficiency within a professional framework.

Trading Platforms

The trading infrastructure offered by CICC broker is designed to deliver a seamless and efficient trading experience. Clients benefit from access to real-time market data, advanced charting tools, technical analysis capabilities, and reliable order execution systems. The platform is structured to meet the needs of experienced and professional traders, ensuring stability and performance during volatile market conditions.

Deposit & Withdrawal

CICC broker supports secure deposit and withdrawal methods, primarily through bank and wire transfers, ensuring compliance with regulatory and anti-money-laundering requirements. The firm maintains a transparent pricing structure, offering competitive spreads and clearly disclosed commissions. While leverage is available through margin trading, CICC emphasizes responsible use, as higher leverage can amplify both gains and losses.

Customer Support & Global Presence

CICC broker maintains an extensive global network, with over 200 securities business offices in China and additional branches and subsidiaries in key financial centers worldwide. This wide presence enables broker CICC to provide effective customer support through in-person assistance, as well as phone and email communication. The firms commitment to accessibility and professional service further strengthens its standing among global investors.

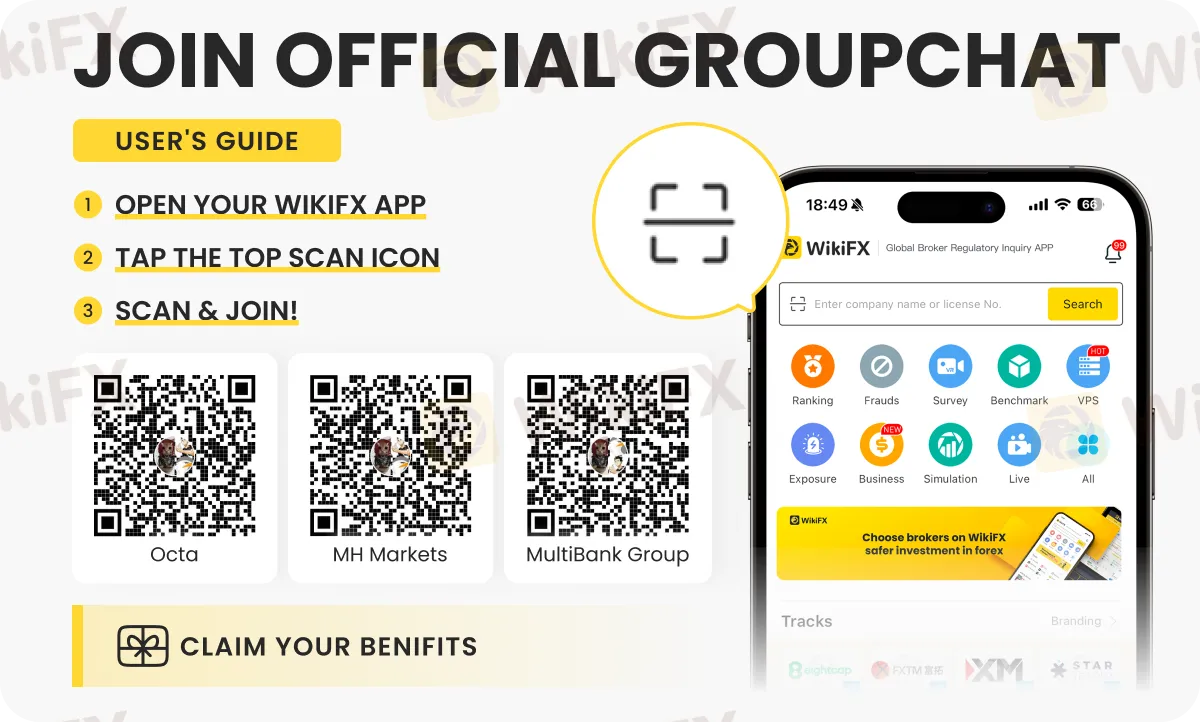

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Telegram Investment Scam Wiped Out RM91,000 in Days

SPEC TRADING Review 2026: Is this Forex Broker Legit or a Scam?

Gold Smashes $5,100 Barrier: Dalio Warns of 'Capital Wars'

Fiscal Policy Monitor: Authorities Tighten Tax Compliance Framework

AMBER MARKETS Review 2026 — Is AMBER MARKETS Broker Safe for Forex Trading?

Who are the “Police” Watching Your Forex Broker? (FCA, ASIC, NFA Explained)

Dollar Index Hits Four-Year Low as 'Fed Whisperer' Signals Rate Pause

PayPal Re-enters Inbound Nigerian Market via Paga Partnership

German Capital Flows Heavy into China, Defying Trade War Risks

FIBOGROUP Review: Safety, Regulation & Forex Trading Details

Currency Calculator