Abstract:Trive Regulation explained. Trive Broker is licensed in Australia, Malta, South Africa, UK, and BVI for secure global trading.

Trive is a multi-jurisdictional CFD and investment broker operating under the umbrella of Trive Financial Holding, with a regulatory footprint that spans Australia, Malta, South Africa, the British Virgin Islands, and an unverified license entry in the UK. This review examines Trive Regulation in detail, evaluates Trive Brokers trading conditions and platforms, and weighs its strengths and weaknesses against competing brokers.

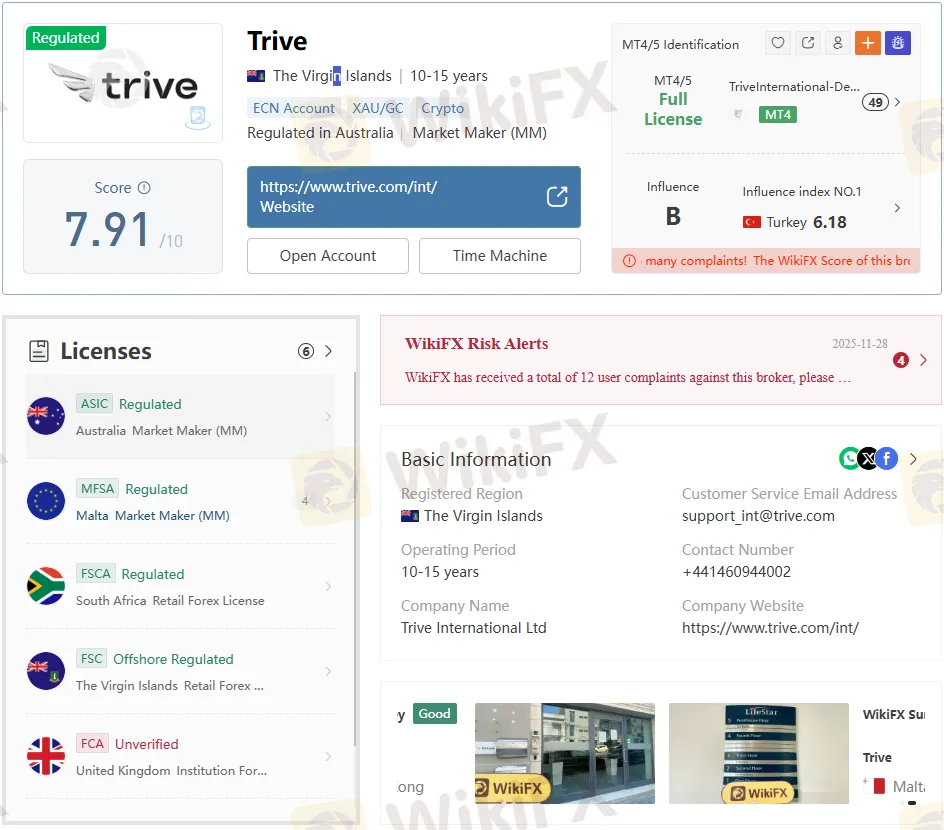

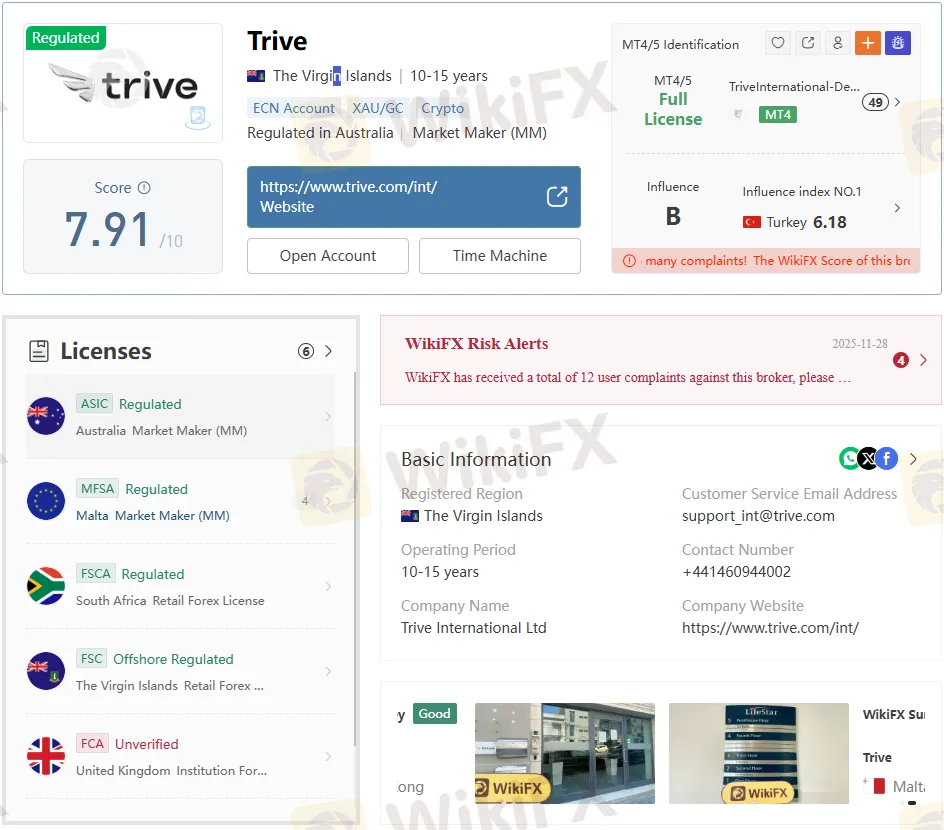

Trive Regulation and Licenses

Trive Regulation is built around a cluster of regulated entities that hold licenses in several major and emerging markets. The groups structure is fragmented by jurisdiction, so traders should match their client entity to the specific regulator and license number.

Key licenses currently disclosed include:

- Australia: TRIVE FINANCIAL SERVICES AUSTRALIA under ASIC, license no. 424122, Market Maker (MM) authorization, effective since 2012-07-24.

- Malta: TRIVE FINANCIAL SERVICES EUROPE LTD under MFSA, license no. C 60473, Market Maker (MM), effective since 2013-06-12, with authorization to serve clients in Germany, Italy, and Spain.

- South Africa: TRIVE SOUTH AFRICA (PTY) LTD under FSCA, license no. 27231, Retail Forex License, effective since 2007-08-15.

- British Virgin Islands: Trive International Ltd. under the BVI Financial Services Commission, license no. SIBA/L/14/1066, categorized as offshore regulated with a Retail Forex License.

In the United Kingdom, Trive Financial Services UK Limited appears with an Institutional Forex License (no. 501320) under the FCA, but its status is flagged as “Unverified” with an expiration date of 2024-06-14, which requires additional independent confirmation by traders. This mixed picture means Trive Regulation includes both top-tier oversight (ASIC, MFSA, FSCA) and an offshore BVI layer, a structure common among multi-entity CFD groups.

Trive Broker Corporate Background

Trive Broker sits within Trive Financial Holding, a Netherlands-based financial group offering investment, credit, banking, wealth management, and insurance services on a global scale. The holding company controls subsidiaries across the United States, Europe, Africa, the Middle East, Indonesia, Australia, and Southeast Asia, and holds licenses from regulators including FINRA, ASIC, MFSA, CMB (Türkiye), BAPPEBTI (Indonesia), FSCA (South Africa), and FSC in both Mauritius and the British Virgin Islands, along with a MiCAR VASP license in Czechia.

The investment arm Trive Investment B.V. provides multi-asset investment services, while Trive Credit B.V. focuses on AI-driven digital lending in Europe and Australia. Trive Bank, licensed by the Central Bank of Hungary (Magyar Nemzeti Bank), delivers digital banking products, and Trive Portföy plus associated Turkish entities handle asset management and brokerage under CMB oversight. This broader ecosystem positions Trive Broker as part of a diversified financial conglomerate rather than a standalone CFD start-up, which strengthens the credibility of Trive Regulation.

Domain and Office Transparency

The documentation lists https://trive.com as the primary website for the Malta-based entity, alongside www.trivepro.co.uk for the UK-facing company Trive Financial Services UK Limited. Field survey material from WikiFX indicates an on-site office visit in Malta at “Floors, The Penthouse, Testaferrata Street, Ta‘ Xbiex, Malta,” where Trive’s premises were located and photographed.

Additional corporate addresses include Level 26, 1–7 Bligh Street, Sydney NSW 2000, for the ASIC-licensed Australian entity and Level39, One Canada Square, London E14, for the UK company. This level of disclosed address and domain detail is stronger than many offshore-only CFD brokers, although traders should always cross-check that their account-opening documents match the correct local entity.

Trading Instruments and Market Coverage

Trive Broker offers a broad range of CFD instruments, including forex, commodities, indices, and stocks, with leverage profiles that differ by asset class. The document highlights forex majors such as EURUSD, GBPUSD, USDJPY, and cross pairs like EURGBP, as well as commodities like XAUUSD and XAGUSD, oil benchmarks such as BRENT spot and BRENT futures, and equity indices including AEX25 and AUS200.

The table of trading instruments shows:

- EURUSD: minimum spread 1.2 pips, margin 0.20, leverage up to 1:500.

- GBPUSD: minimum spread 1.6 pips, margin 0.20, leverage up to 1:500.

- USDJPY: minimum spread 2.3 pips, margin 0.20, leverage up to 1:500.

- BRENT Spot: minimum spread 0.4, margin 0.005, leverage 1:200.

- XAUUSD: minimum spread 1.7, margin 0.20, leverage 1:500.

This product set aligns with mainstream multi-asset CFD offerings and allows Trive Broker to compete directly with brokers such as Pepperstone or XM that also combine forex, indices, metals, energies, and stocks under one roof.

Account Types and Trading Conditions

Trive Broker structures its retail offering into five primary trading account types: Standard, VIP, ECN Zero, Pro Leverage, and Cent. All accounts feature varying spreads, leverage levels, commission structures, stop-out thresholds, and minimum/maximum position sizes.

The structure allows budget-conscious traders to start on Standard or Cent, while high-volume or tighter-spread traders can migrate to VIP or ECN Zero once capital thresholds are met. The Pro Leverage account with up to 1:2000 leverage sharply exceeds the more conservative caps imposed by ESMA or ASIC on retail clients, suggesting that this profile is offered via offshore or non-EU entities and should be approached cautiously.

Fees, Spreads, and Swaps

On the surface, Trive Brokers fee model is straightforward: commission-free pricing for Standard, VIP, Pro Leverage, and Cent accounts, with spreads from 1.2 pips or tighter, and an ECN Zero account that charges a 10 USD per-lot commission and offers raw spreads from 0.0 pips. Swap-free trading is available on all account types except the Cent account, which explicitly lists “No Swap Free.”

In practical terms, the Standard and VIP spreads on majors are competitive but not necessarily the lowest in the market, whereas ECN Zero with 0.0-pip spreads plus commission pushes Trive Broker closer to the pricing models of IC Markets or Tickmill. However, the extremely high leverage on the Pro Leverage account, coupled with a 50% stop-out level, significantly elevates margin risk compared with heavily regulated EU or UK brokers that typically operate at 1:30 or lower for retail clients.

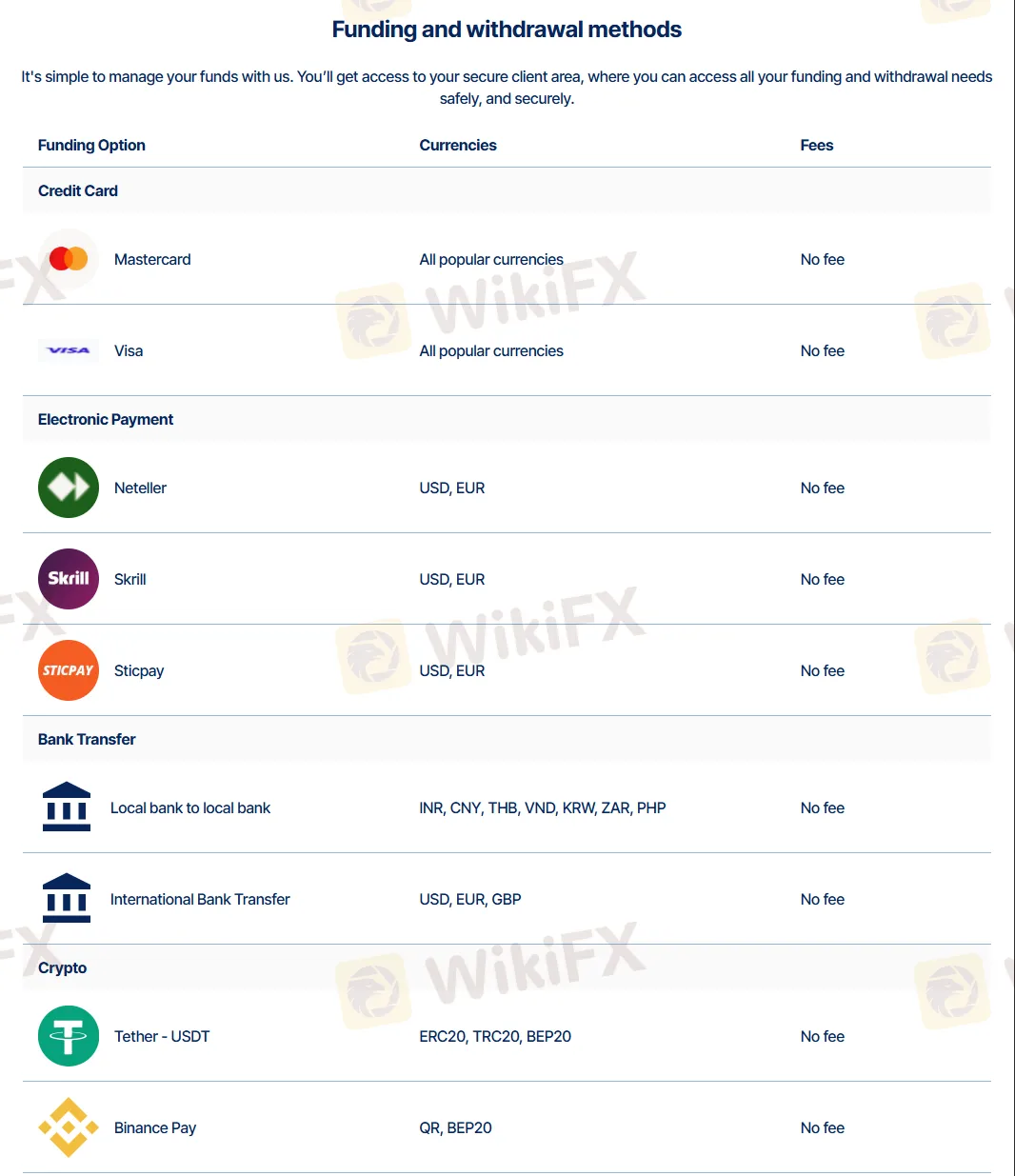

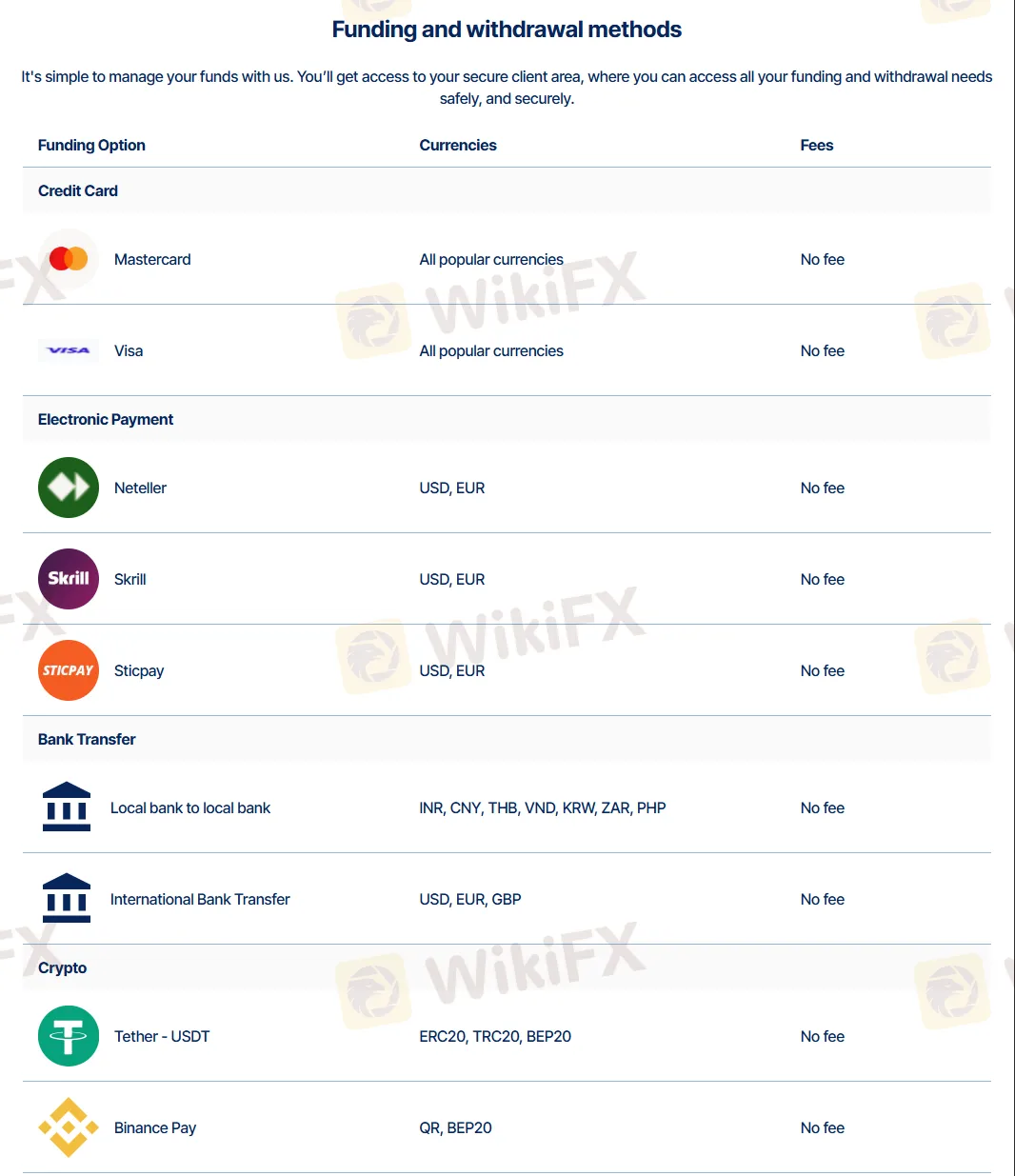

Funding, Withdrawals, and Payments

Trive Broker supports multiple funding and withdrawal methods, focusing on fee-free processing across cards, e-wallets, bank transfers, and crypto. The funding schedule in the document lists the following:

- Credit Cards: Mastercard and Visa in “all popular currencies,” with no deposit fee.

- E-wallets: Neteller and Skrill in USD and EUR, no funding fee.

- STICPAY: in USD and EUR, no fee.

- Local bank transfers: multiple local currencies, including INR, CNY, THB, VND, KRW, ZAR, and PHP, with no fee.

- International bank transfer: USD, EUR, GBP, no fee.

- Crypto: Tether (USDT) on ERC20, TRC20, and BEP20 networks, plus Binance Pay via QR/BEP20, both listed as fee-free.

This structure compares favorably with many competitors that charge incoming or outgoing fees on at least some methods, though actual bank or blockchain network costs may still apply outside Trive Brokers control.

Platforms: MetaTrader 4 and MetaTrader 5

Trive Broker offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) across desktop, web, and mobile, catering to both beginners and advanced traders who rely on automated strategies. The description emphasizes:

- MT4: user-friendly interface, desktop/web/app access, support for Expert Advisors, advanced technical analysis tools, and intuitive navigation.

- MT5: expanded multi-asset support, improved indicator suite for technical analysis, full Expert Advisor automation, and a “simple and professional trading platform” positioning.

By centering the platform stack on MetaTrader, Trive Broker stays aligned with industry standards rather than pushing proprietary platforms, which can ease migration for traders moving from other brokers such as FP Markets or Exness.

Trive Regulation vs Competitor Oversight

From a regulatory standpoint, Trive Regulation offers stronger coverage than brokers that rely exclusively on offshore jurisdictions but falls short of the uniform top-tier coverage that some EU- and UK-centric providers offer. ASIC and MFSA bring recognized investor protections, while FSCA adds regional legitimacy for African clients; however, the presence of a BVI offshore license and an unverified FCA entry means traders must pay close attention to which entity holds their funds.

By comparison, a broker licensed only in BVI or Seychelles with no ASIC or EU-regulated entities would typically present higher structural risk, but a broker holding active FCA and CySEC licenses might still be perceived as safer for EU/UK retail than a structure that leans on offshore leverage profiles. For clients trading under Trive Brokers EU-regulated entities, leverage limits and product governance should align with stricter regulatory standards, whereas the ultra-high leverage Pro Leverage account clearly mirrors more permissive offshore norms.

Pros and Cons of Trive Broker

Pros

- Multi-jurisdictional Trive Regulation with licenses in Australia, Malta, South Africa, and the BVI under recognized regulatory authorities.

- Diverse account lineup (Standard, VIP, ECN Zero, Pro Leverage, Cent) giving traders a choice of spread, commission, leverage, and lot-size configurations.

- Broad instrument range, including major and minor forex pairs, commodities, indices, and stock CFDs, with leverage up to 1:500 on many instruments.

- Access to MT4 and MT5 across all major devices, including Expert Advisor support for automated strategies.

- Funding via cards, e-wallets, local and international bank transfers, and crypto, all listed as fee-free on the brokers side.

Cons

- Presence of an unverified FCA license entry and an offshore BVI entity may concern traders who prioritize only top-tier regulation.

- Extremely high 1:2000 leverage on the Pro Leverage account significantly increases risk and is typically not available under stricter regulators.

- Cent account does not provide swap-free conditions, which limits flexibility for Islamic or long-term carry traders using that account type.

- Minimum deposit of 2,000 USD for the VIP account may be a barrier for lower-capital traders who want tighter spreads without ECN commissions.

Bottom Line on Trive Regulation

Trive Broker presents a layered regulatory profile anchored by ASIC, MFSA, and FSCA licenses, complemented—but also complicated—by an offshore BVI entity and an unverified FCA record. The mix of competitive account types, MetaTrader platforms, and fee-free funding options makes Trive a legitimate contender in the global CFD space, especially for traders comfortable navigating multi-entity structures and carefully choosing their regulated branch.