Abstract:CMC Markets Australia reports a 34% revenue surge. Simultaneously, the company's high-net-worth clients are facing a serious tax-related phishing threat.

London-listed brokerage CMC Markets (LSE: CMCX) has reported a record-breaking performance in its Australian stockbroking division. However, this period of financial success coincides with a heightened security risk, as cyber security firms issue warnings about a targeted phishing campaign aiming at the platform's high-net-worth clients.

Australian Business Records Stellar Growth

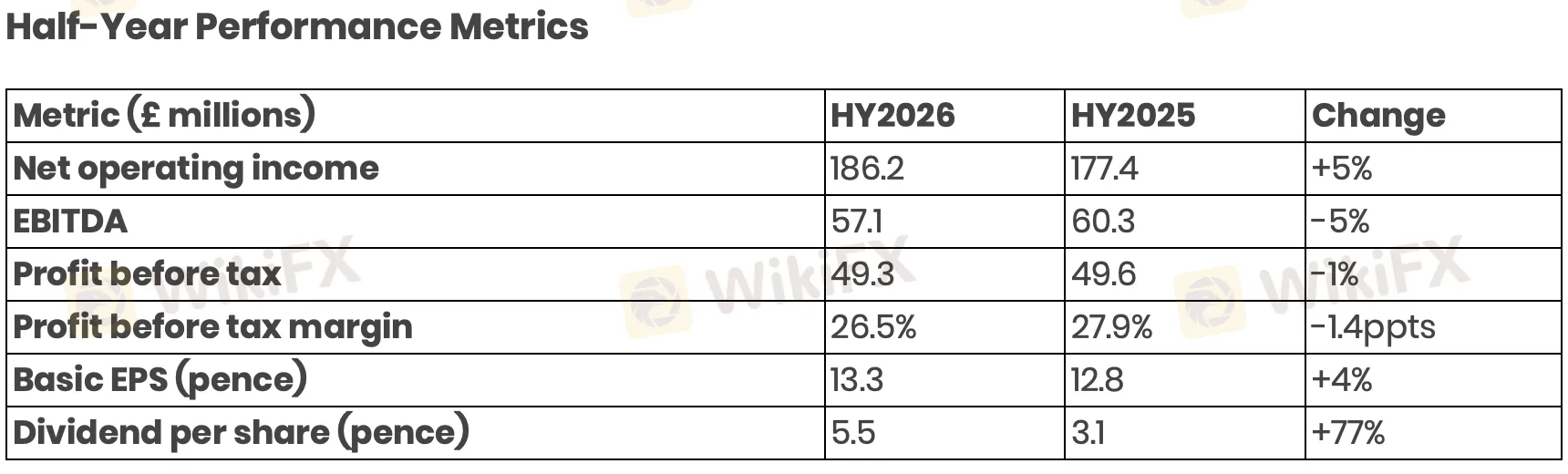

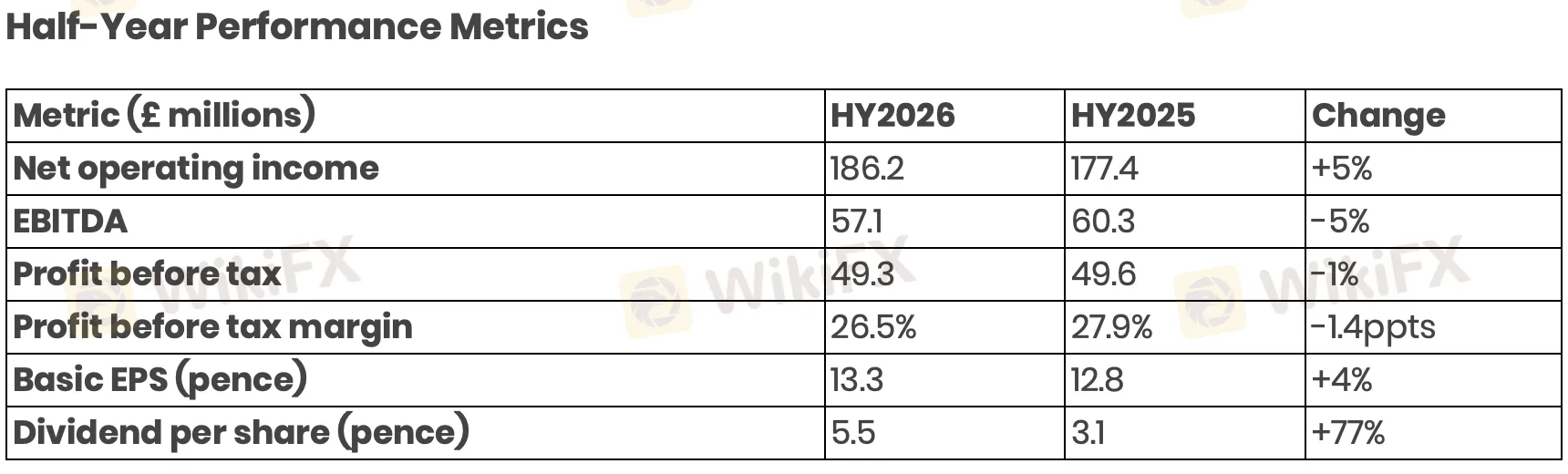

According to CMC Markets latest financial data for the first half of the FY2026, the company recorded a net operating income of £186.2 million, marking a 5% year-on-year increase. The Australian market was the primary catalyst for this result.

The Australian stockbroking unit delivered a record half-year performance, with net operating income climbing 34% to A$65.9 million. Assets under Administration in the region also increased by 14% to approximately A$91 billion. This robust growth has positioned CMC as Australias second-largest stockbroker by revenue.

Furthermore, CMC Markets‘ extended white-label partnership with Westpac Banking Corporation, Australia’s second-largest bank, is expected to fuel future growth, with projections suggesting a 40% increase in the Australian customer base and a roughly 45% uplift in domestic trading volumes following the integration period.

Phishing Campaign Targets High-Value Credentials

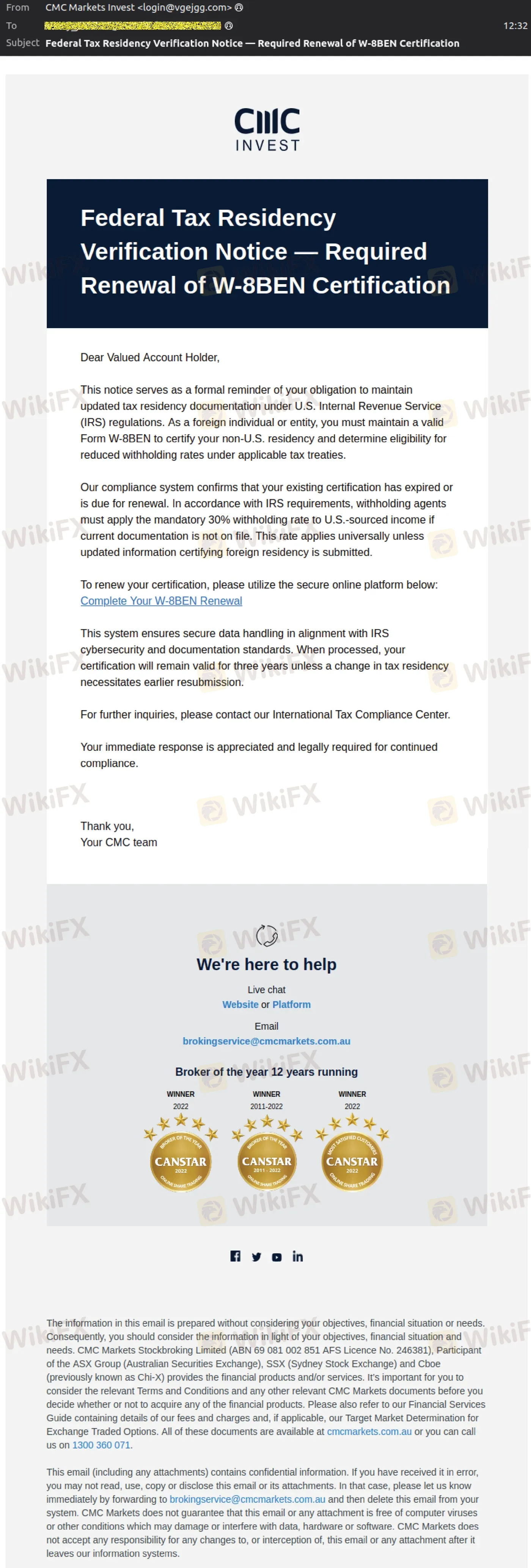

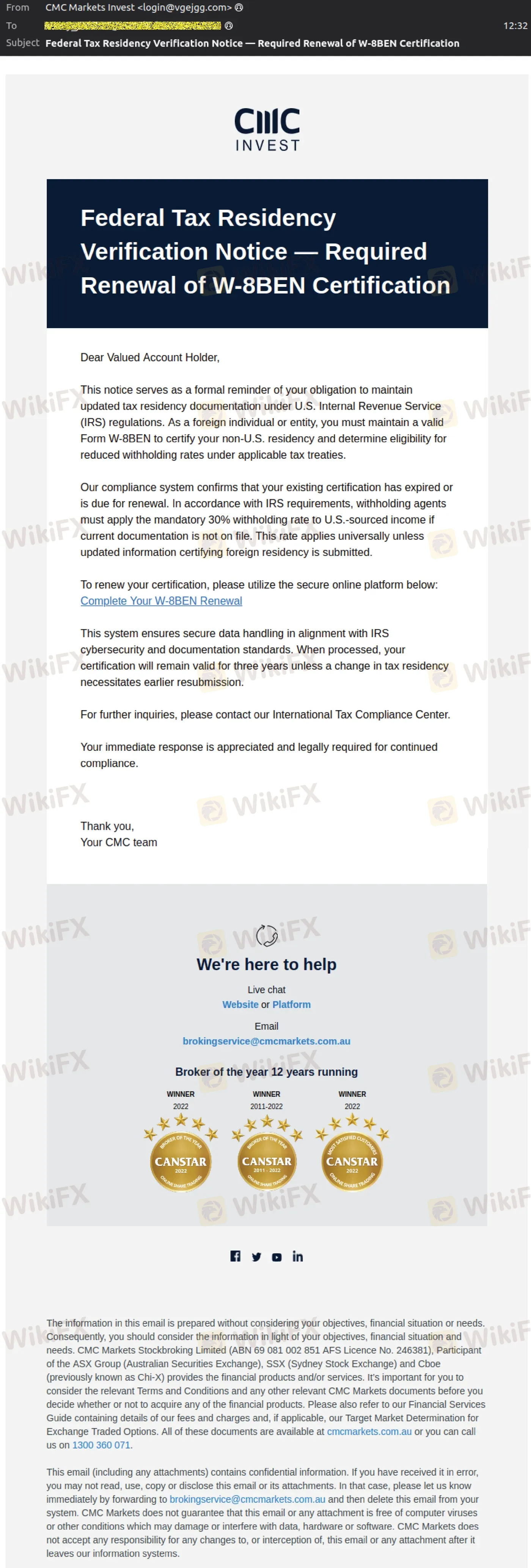

Despite the strong financial results, a significant security concern has emerged. Cyber security firm MailGuard AU detected a sophisticated phishing campaign impersonating both CMC Markets and TD Direct Investing. The operation specifically targets wealthy investors.

These highly convincing emails are designed to steal user login credentials. They often carry the subject line: “Federal Tax Residency Verification Notice — Required Renewal of W-8BEN PMC Certification.”

The fraudulent messages utilize branding consistent with CMC Invest, referencing real financial processes, and include detailed legal disclaimers to appear credible. Users who click the embedded links are directed to fake login portals designed to harvest sensitive account information.

ASIC Intensifies Crackdown on AI-Driven Scams

The specific threat to CMCs clients reflects a wider pattern of online financial fraud noted by the Australian Securities and Investments Commission (ASIC). The regulator has voiced concerns over the proliferation of sophisticated scams, often utilizing AI-driven tools to create more convincing fake websites.

ASIC is actively combating this surge, reporting that it is taking down approximately 130 fraudulent investment websites each week, with more than 10,000 removed to date. The regulator stresses that scammers frequently clone legitimate sites, including ASICs own consumer resource, Moneysmart, to solicit personal data.

Despite these increased enforcement efforts, financial losses remain substantial, with investment scams reaching $945 million in 2024. Investors are urged to exercise extreme caution and verify any requests for tax information or personal data directly through official communication channels.