简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

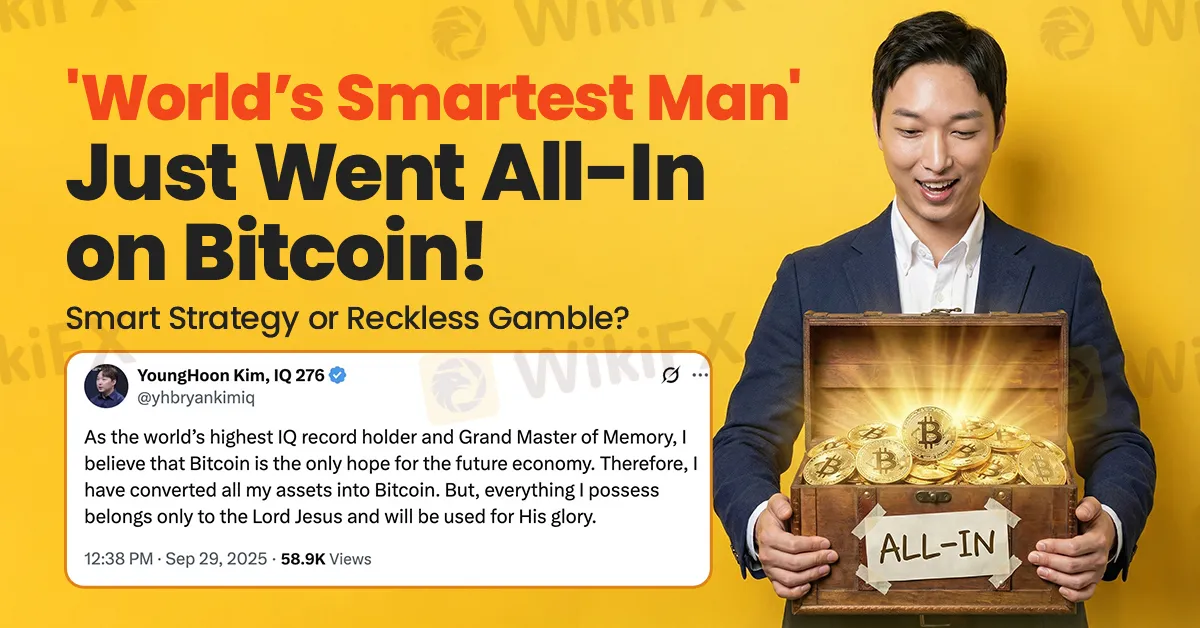

‘World’s Smartest Man’ Just Went All-In on Bitcoin: Smart Move or Reckless Gamble?

Abstract:A self-proclaimed South Korean “genius” sparked global debate after announcing that he went all-in on Bitcoin.

A self-proclaimed South Korean intellectual who claims to possess an IQ of 276 has once again captured global attention after announcing that he has committed all his assets to Bitcoin. The move has sparked widespread debate among traders, analysts and cryptocurrency observers, many of whom are questioning whether the decision reflects exceptional foresight or extraordinary recklessness.

YoungHoon Kim, who often refers to himself as “the worlds greatest genius,” posted on X (formerly Twitter) in late September that he had converted his entire portfolio into Bitcoin. He stated that he viewed the cryptocurrency as “the only hope for the future of the global economy,” a remark that spread rapidly across investor communities and ignited intense discussion about his motives and credibility.

A Controversial Figure With a Highly Disputed IQ

Kim is no stranger to the spotlight within trading circles. His claim of having an IQ of 276, that is far beyond the measurable range of most standard assessments, has drawn both fascination and scepticism. He has described himself as a “Grand Master of Memory” and has associated his name with groups such as the GIGA Society and the United Sigma Intelligence Association (USIA).

However, intelligence experts have long emphasised that mainstream IQ testing becomes increasingly unreliable beyond the 160–200 range. International media, including VICE, have noted the absence of verifiable evidence supporting Kims assertion. As a result, his alleged intellectual status remains one of the most hotly debated aspects of his public persona.

The All-In Bitcoin Declaration

Kim‘s post on 25 September announced that he had moved all his financial resources into Bitcoin. He had previously claimed that the cryptocurrency could expand by a factor of 100 within ten years and eventually become the world’s most important asset. His latest declaration, therefore, reinforced his long-standing, highly optimistic outlook.

The announcement went viral within hours. Traders questioned whether the decision stemmed from extraordinary confidence, a deep belief in Bitcoins long-term dominance, or simply a dramatic attempt to attract attention. The situation became even more intriguing when the post was quietly deleted shortly afterwards.

The removal fuelled a wave of speculation. Some observers wondered whether he regretted the decision or had been affected by Bitcoins volatility. Others questioned whether authorities had contacted him or whether the post had been intended purely to provoke discussion. Kim himself offered no clarification, leaving the market to debate his motives in the absence of further comment.

A Divided Investor Community

Reactions to Kim‘s announcement have varied sharply. Among committed Bitcoin supporters, some viewed his decision as an extreme but inspiring demonstration of confidence. Within this group, Kim’s belief in Bitcoins long-term value was seen as a reaffirmation of their own convictions.

More cautious voices within the trading community, however, regarded the move as a warning sign. They noted that concentrating all assets into a single, highly volatile instrument represents a level of risk that can rapidly lead to devastating losses. Many argued that Kims disputed IQ claims and lack of verified expertise only heightened concerns about the reliability of his judgment.

For these investors, Kims actions symbolise a broader issue within the cryptocurrency market: the tendency for some participants to treat bold speculation as a substitute for structured financial discipline.

Beyond Intelligence: The Fundamentals of Sound Investment

While the market briefly reacted to the drama surrounding Kims declaration, the incident also revived an important discussion about what truly drives long-term success in trading. Industry professionals repeatedly stress that high intelligence, be it real or perceived, does not guarantee favourable outcomes in financial markets.

Successful investing, they argue, depends on a set of disciplined behaviours: calm analysis, careful assessment of risk, strategic timing and consistent execution. Regardless of ones intellectual capabilities, ignoring these principles frequently leads to disappointment rather than profit.

Kims dramatic gamble may have reignited enthusiasm among some Bitcoin enthusiasts, but the episode also serves as a reminder that markets reward discipline more reliably than bold declarations. In a sector known for its unpredictability, the ability to manage risk remains far more valuable than the pursuit of extraordinary claims.

Disclaimer:

The views expressed in this content are solely those of the author and do not constitute investment advice. This site does not guarantee the accuracy, completeness or timeliness of the information provided and is not responsible for any losses incurred from the use of this material or any related content.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

HFM Review 2026: Is this Forex Broker Legit or a Scam?

ESMA Tightens Derivative Rules: Crypto 'Perpetuals' Face Strict CFD Leverage Caps

INFINOX Analysis Report

Dukascopy Triples MetaTrader 5 Asset Suite to Surpass 400 Instruments

Scope Prime Strengthens Institutional Liquidity Infrastructure with Ultency Integration

NAGA Earnings Signal Industry Stress Amid Low FX Volatility

What Will US-Iran War Affect Stock Market: A Comprehensive Investor's Guide to 2026

Is FINOWIZ Safe or Scam? 2026 Deep Dive into Its Reputation and User Complaints

FX Deep Dive: Dollar King Returns as Energy Shock Splits G10 Currencies

The 25-Day Tipping Point: Energy Markets Stare Down a Hormuz Blockade

Currency Calculator