简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets: Market Report for Nov 24, 2025

Abstract:Market Opens Week on Sentiment Reversal: December Cut Odds SurgeThe market begins the week with a sharp shift in sentiment, driven by coordinated signals from Federal Reserve officials that sharply in

Market Opens Week on Sentiment Reversal: December Cut Odds Surge

The market begins the week with a sharp shift in sentiment, driven by coordinated signals from Federal Reserve officials that sharply increased the probability of a December rate cut, reversing the recent hawkish trend.

New York Fed President John Williams delivered a strong counter-signal, restoring investor confidence. The market-implied probability for a December rate cut jumped from near 30% to around 70% following Fridays close.

This fundamental pivot triggered a robust recovery in risk sentiment. The Dollars surge stalled, and rate-sensitive assets such as the Nasdaq 100 Index saw renewed buying interest.

The Fed Dovish Tilt

The market is now forced to contend with an intensely divided Fed, where the dovish camp is pushing back strongly against the hawkish rhetoric.

· Williams' Influence: Williams, as a permanent voting member, framed his view by prioritizing the maximum employment goal and arguing that current policy is “modestly restrictive.” His voice is central to rebuilding the policy consensus ahead of the December meeting.

· Structural Debate: The internal fight means the Fed is not on a preset course. The volatility will remain high as policymakers demand “convincing evidence” of sustained disinflation before supporting the rate cut fully.

Data Void Continues - PPI & Retail Sales Focus

With the government shutdown resolved, the markets attention is shifting toward the final pieces of delayed inflation data ahead of the December FOMC meeting in two weeks.

However, the BLS has officially cancelled the release of the October CPI due to incomplete data collection during the shutdown. As a result, the next official inflation update will be the November 2025 CPI—scheduled for December 18—after the December Fed meeting. This leaves markets operating in an information gap.

For now, focus turns to the September PPI, scheduled for release on Tuesday, November 25.

· PPI will be critical as it serves as a leading indicator of consumer inflation, giving the Fed the last crucial inflation gauge before their December meeting.

· A weak PPI reading would support the dovish narrative and reinforce the current 70% probability of a December rate cut.

U.S. Dollar Index: Test of the New Level

Fed comments immediately pressured the U.S. Dollar, with the Dollar Index struggling to sustain gains above 100.

USD Index, H4 Chart

Technically, the near-term bullish bias remains, but momentum is limited near the 100 level, particularly against the 100–100.30 resistance zone.

Key technical factors now include whether the ascending trend channel can hold and whether the index can maintain levels above 100. A solid hold would confirm the bullish trend, while a failure could signal renewed consolidation.

Outlook: The DXY's short-term direction will be determined by the PPI and Retail Sales releases this week.

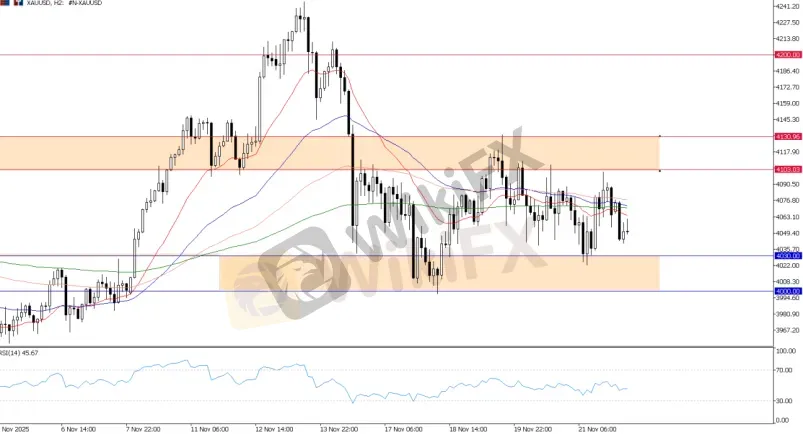

Gold: Policy-Driven Support

Gold‘s appeal, which had been pressured by rising real yields, found immediate support from Williams’ dovish pivot. Recent price action shows a clear consolidation pattern.

XAU/USD, H2 Chart

Gold is likely to remain supported as long as markets price in the increased probability of a December rate cut, now near 70%. Structural pressure from high yields has temporarily eased.

US Equities: Valuation Concerns Remain

The NASDAQ has benefited from restored rate cut expectations, providing a lifeline after a challenging week of selling pressure. However, the indexs technical health remains fragile, and ongoing valuation concerns could continue to weigh on tech-heavy stocks.

UT100, H4 Chart

The NASDAQ finds support at 24,000, which currently acts as a lifeline. Nevertheless, with the index trading below the key 25,000 level, bearish momentum remains present.

Cryptocurrency: Sentiment Remains Fragile

Cryptocurrencies, particularly Bitcoin, continue to exhibit sensitivity to risk sentiment, with the outlook remaining fragile.

BTCUSD, Daily Chart

Bitcoin broke below the key support zone of 90,000–86,000 last week, dipping to a low near 80,600 before rebounding. This indicates that BTC remains vulnerable to current market sentiment.

Weekly Outlook: Market Caught Between Hawkish Uncertainty & Dovish Hopes

Markets are in a delicate balance between renewed dovish expectations and lingering structural risks. Risk assets, including tech and crypto, are likely to remain volatile, with the U.S. Dollar, gold, and equities reacting sharply to any new data or Fed commentary.

· The Dollar remains technically supported but faces immediate resistance near 100–100.30.

· NASDAQ and tech-heavy indices have regained some support due to restored rate-cut expectations, but underlying valuation concerns persist.

· Gold has found near-term support from the dovish Fed tilt, holding above $4,000.

· Bitcoin remains sensitive to risk sentiment, consolidating below 90,000 is likely after last weeks decline.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CFTC Polymarket Approval Signals U.S. Relaunch 2025

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

Australia’s Fraud-Intel Network Exposes $60M in Scams

Malaysia’s SkyLine Guide Top 25 Brokers Are Out!

Currency Calculator