”New Traders Launch Pad” Initiative

Bravely Share Your First Trade

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:WikiFX Evaluation reveals that ATM Capital LTD only scored 1.92 points. Check the company's unverified license and the risks of Arab investment.

The WikiFX Risk Control System has recently detected high-risk operational activity by ATM Capital Ltd, which is aggressively targeting investors in the Arabic-speaking region. This finding immediately triggers an alarm, urging investors to exercise extreme caution before engaging with this broker.

A comprehensive review and evaluation of ATM Capital Ltd's regulatory standing reveals a significant and deceptive gap between its self-promotion and its actual compliance status.

As evidenced by its own website footer, ATM Capital Ltd claims to operate as a brand name registered in Saint Lucia with a specific registration number.

However, a closer review of its purported regulatory claims reveals serious misappropriation. While the broker may reference regulatory oversight, WikiFX's investigation into its associated Seychelles Financial Services Authority (FSA) license (SD082) confirms a critical mismatch: the license belongs to an entity named Evalanch Ltd, not ATM Capital Ltd. Furthermore, the license status is marked as Unverified.

This lack of verifiable oversight confirms that ATM Capital Ltd does not hold any valid regulatory licensethat would permit it to offer foreign exchange or CFD trading services credibly. Dealing with an entity that lacks valid regulation and a verifiable license exposes investors to an extremely high risk of scam or financial loss.

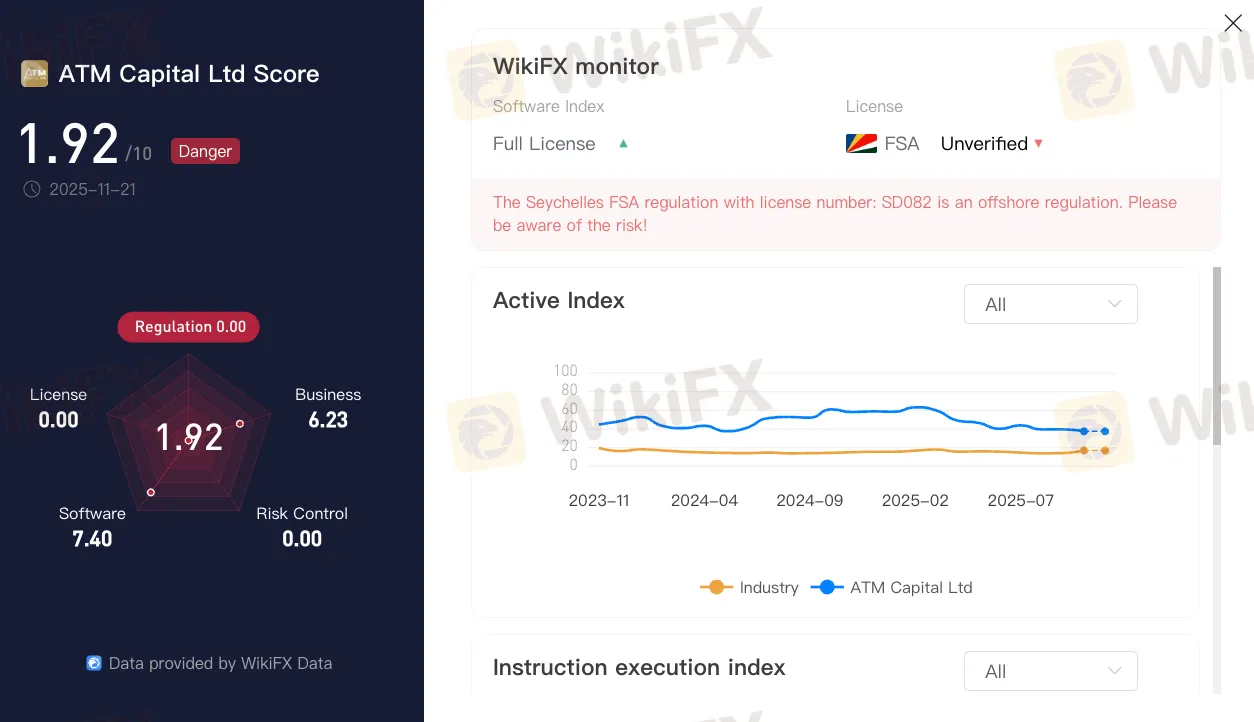

The severe lack of regulatory compliance is starkly reflected in ATM Capital Ltd's extremely low score on the WikiFX evaluation system. As of November 21, 2025, the broker has received a score of just 1.92 out of 10, placing it squarely in the “Danger” category.

Crucially, its Regulation Index is rated 0.00. This zero score directly confirms the unverified nature of the brokers regulatory claims and the inadequacy of its oversight. Furthermore, the Risk Control Index is also 0.00, indicating a total absence of effective measures to protect client funds and mitigate operational risk, validating the urgent need for investors to avoid this platform.

Further scrutiny of ATM Capital Ltds operational footprint indicates multiple red flags related to transparency and market outreach:

The combination of an unverified license claim, the use of irregular promotional domains, a dangerously low WikiFX evaluation, and a Regulation Score of 0.00 places ATM Capital Ltd firmly in the high-risk category.

WikiFX strongly advises all investors, particularly those in the Arab region, to avoid depositing funds with ATM Capital Ltd. The absence of a valid license means there is no regulatory body to oversee its conduct, protect client funds, or mediate disputes. Engaging with an unlicensed broker like ATM Capital Ltd exponentially increases the likelihood of a financial scam or the inability to withdraw capital. Investors should always perform a thorough review and evaluation using the WikiFX platform before entrusting capital to any online trading provider.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Bravely Share Your First Trade

Do you have to constantly witness trade delays on the EO Broker trading platform? Have you encountered cases of unfair trade executions where you have recorded heavy losses? Are inconsistent spreads eating into your trading gains? Is the EO Broker withdrawal process too slow? Is the customer support team incompetent in resolving all these trading queries? You are not alone! Many traders have vehemently opposed the broker’s tactics on review platforms. We have highlighted different EO Broker reviews in this article. Read on!

Achiever FX has been receiving flak for numerous reasons, including slow-paced trade execution, lack of transparency, and, importantly, alleged attempts to defraud traders. With its customer support team not able to resolve these issues, traders have allegedly been left alone! They have rightly reviewed the Saint Lucia-based forex broker negatively online. In this Achiever FX review article, we have explored complaints against the forex broker. Keep reading to know the same.

Alpari艾福瑞's notably low overall rating of 2.52 out of 10 raises immediate red flags for traders seeking a reliable forex broker. While the broker has generated sufficient market presence to accumulate 218 documented reviews, the available data presents an unusually opaque picture of their operational strengths and weaknesses. This lack of clear performance metrics across key service areas makes it challenging to provide specific insights into their trading conditions, platform reliability, or customer service quality. Read on for more information.