简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

U.S. Government Reopens — Key Data to Watch This Week

Abstract:Continuing our liquidity monitoring from last week, the Federal Reserves balance-sheet dynamics show that short-term liquidity stress has begun to ease. The U.S. Treasury General Account (TGA) decline

Continuing our liquidity monitoring from last week, the Federal Reserves balance-sheet dynamics show that short-term liquidity stress has begun to ease. The U.S. Treasury General Account (TGA) declined from the US$1 trillion level on October 30 to roughly US$900 billion. This suggests reduced liquidity withdrawal by the U.S. Treasury going forward.

Although December marks corporate tax season, our assessment indicates a low probability of liquidity disruptions. This supports the view that the equity market will follow its typical Q4 seasonal uptrend cycle.

(Chart 1: U.S. Treasury General Account Balance; Source: MacroMicro)Market Volatility Hinges on This Weeks U.S. Macro Data

Risk assets recently broke below their 50-day moving average — a key technical “life line” — triggering CTA-driven systematic selling and amplifying volatility. If this weeks macro releases act as catalysts for further downside pressure, single-day swings above 3% could become the new normal.

The market‘s primary focus remains on end-demand conditions. Although Tuesday’s (25th) retail sales release covers the month of September, the data will still help investors assess consumption momentum.

Our alternative data tracking, including the ISM Purchasing Managers Index, suggests improving conditions in both services and manufacturing. The key indicator to watch is whether new orders continue to rebound, signaling a recovery in demand. Based on these trends, we remain constructively optimistic toward the upcoming data.

Fed Cut Expectations for December Fall to 69.4%

According to market-implied pricing, the probability of a December rate cut has slipped to 69.4%. Importantly, the hesitation is not due to economic resilience, but rather the lack of hard data during the government shutdown.

Many investors worry that the Fed may choose to stay on hold if it lacks sufficient economic evidence. In such a case, if the labor market later softens more than expected, concerns about a drift into disinflation or even deflation risk would likely intensify.

(Chart 2: Probability of a December Fed Rate Cut; Source: CME FedWatch Tool)Monitoring Supreme Court Developments on Retaliatory Tariffs

Bloomberg reports that the White House is preparing a “Plan B” in case the Supreme Court rules against the legality of the government's retaliatory tariffs. The exact timing of the ruling remains uncertain.

Currently, the U.S. effective import tariff rate stands at 14.4%, with roughly half imposed under the International Emergency Economic Powers Act (IEEPA).

If the Supreme Court overturns the Trump-era retaliatory tariffs, the ruling would be marginally positive for markets (via corporate tax rebates), but would simultaneously introduce additional uncertainty for companies and policymakers.

Gold Market Outlook — Upside Still Limited

Despite ongoing macro noise and elevated uncertainty, we remain highly constructive on risk assets over the medium term. Under this backdrop, gold continues to struggle for upside catalysts, and we maintain our view that the probability favors a consolidation-to-downtrend scenario.

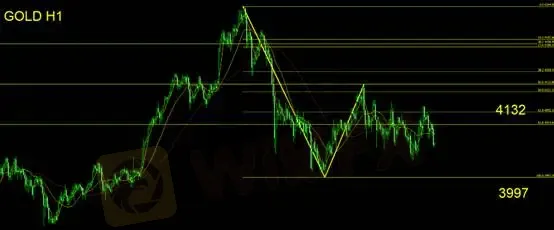

Gold Technical Analysis

On the daily chart, gold has consolidated sideways for six sessions with no decisive trend breakout. Overall momentum remains weak and tilted downward.

Key support sits at 3997–4000; a breakdown below this zone would confirm that the recent consolidation range is merely a mid-range pause within a broader bearish structure, opening the door for further declines.

Given golds fragile high-level consolidation and the risk of macro-data-triggered mispricing selloffs, investors should guard against sharp irrational downturns driven by volatility surges. Remaining on the sidelines or favoring short positions is advisable.

Stop-loss: US$30

Support: 3997

Resistance: 4132

Risk Disclaimer

The above views, analyses, research, prices, and other information are provided solely as general market commentary and do not represent the position of this platform. All readers should manage their own risk and exercise caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

CFTC Polymarket Approval Signals U.S. Relaunch 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

Voices of the Golden Insight Award Jury | Kazuaki Takabatake, CCO of Titan FX

Currency Calculator