Abstract:Is Capital.com truly safe in 2025? Explore its global licenses, on-site verifications, user complaints, pros & cons, and key risks in one objective review.

In the increasingly competitive forex and CFD trading market, selecting a reliable broker is like navigating through fog to find a lighthouse. Capital.com, a veteran platform established in 2016, has attracted countless traders with its over 3,000 trading instruments and global regulatory endorsements. However, in the 2025 market environment, security and transparency have become the primary concerns for investors. This article, through WikiFX's in-depth analysis, peels back the veil on Capital.com: from rigorous evaluation of official licenses to real user feedback on trading experiences, we'll explore it all to help you determine if this broker is worth entrusting your funds.

Capital.com's Regulatory Shield: Multi-Country Licenses for Protection, or Hidden Risks?

Regulation is the “moat” of forex brokers, directly determining fund security. Capital.com is registered in Cyprus with headquarters in the Bahamas, holding licenses in multiple top financial centers worldwide. According to WikiFX's latest data (updated as of November 6, 2025), the broker holds the following official regulations:

- Australian Securities and Investments Commission (ASIC): License No. 513393, Market Maker (MM) mode, ensuring client fund segregation.

- Cyprus Securities and Exchange Commission (CySEC): License No. 319/17, also MM mode, compliant with EU MiFID II standards.

- UK Financial Conduct Authority (FCA): License No. 793714, Straight-Through Processing (STP) mode, emphasizing execution transparency.

- Securities and Commodities Authority (SCA), UAE: License No. 20200000176, retail forex license, optimized for the Middle East market.

- Securities Commission of The Bahamas (SCB): License No. SIA-F245, retail forex license, suitable for offshore trading.

These licenses span five continents, demonstrating Capital.com's global compliance efforts. However, WikiFX's risk alert (Risk Manage 6) also notes that the broker has had retail forex licenses revoked in Seychelles and Belarus, categorizing it under “high potential risk” and “offshore regulation.” This means that while core markets are protected by top-tier oversight, investors should be cautious of potential volatility in offshore accounts.

In the first half of 2025, Capital.com's trading volume surged to $1.5 trillion, a 42.5% year-over-year increase, particularly leading in the Middle East and North Africa (MENA) region. This is thanks to its low entry deposit threshold ($10/€/£ minimum) and 24/7 multilingual support, but it has also triggered more complaints—which we'll detail later.

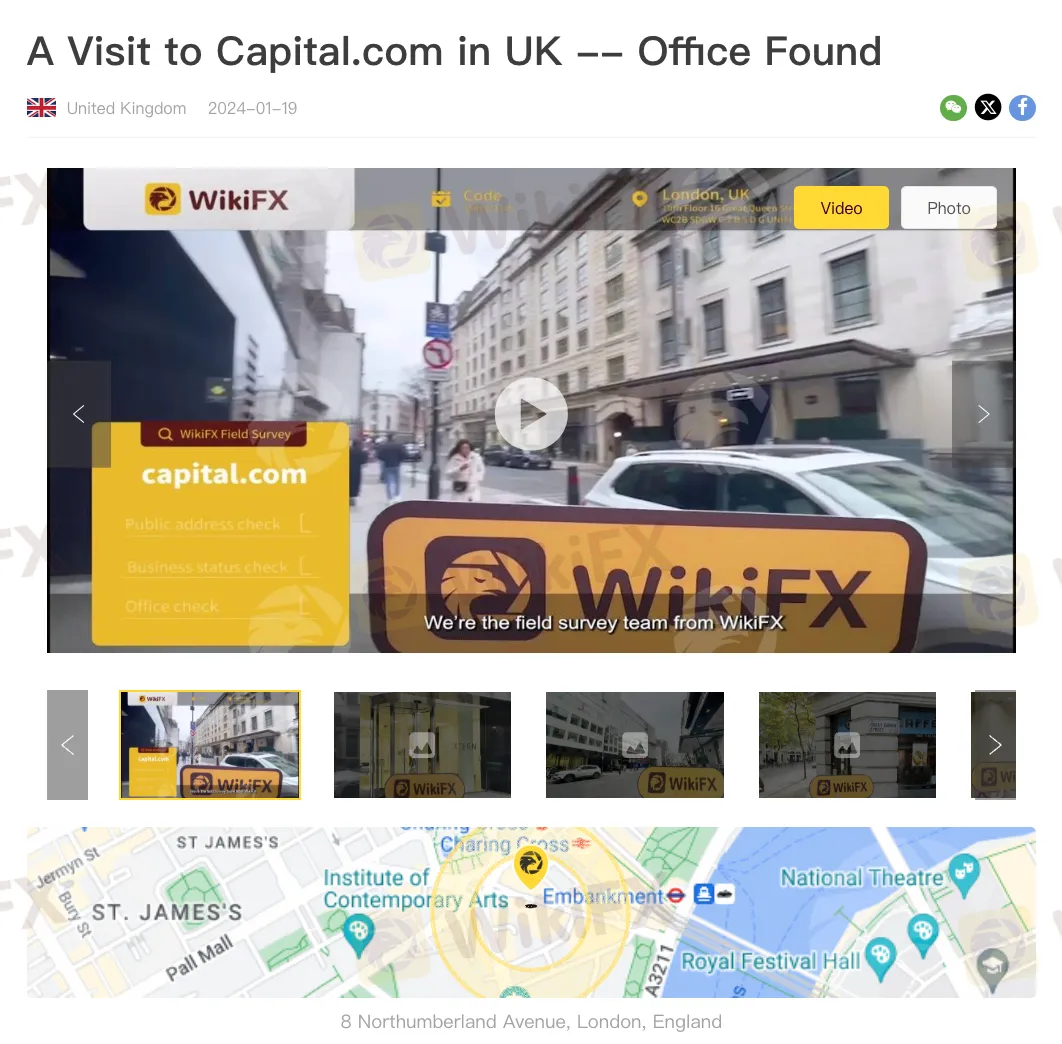

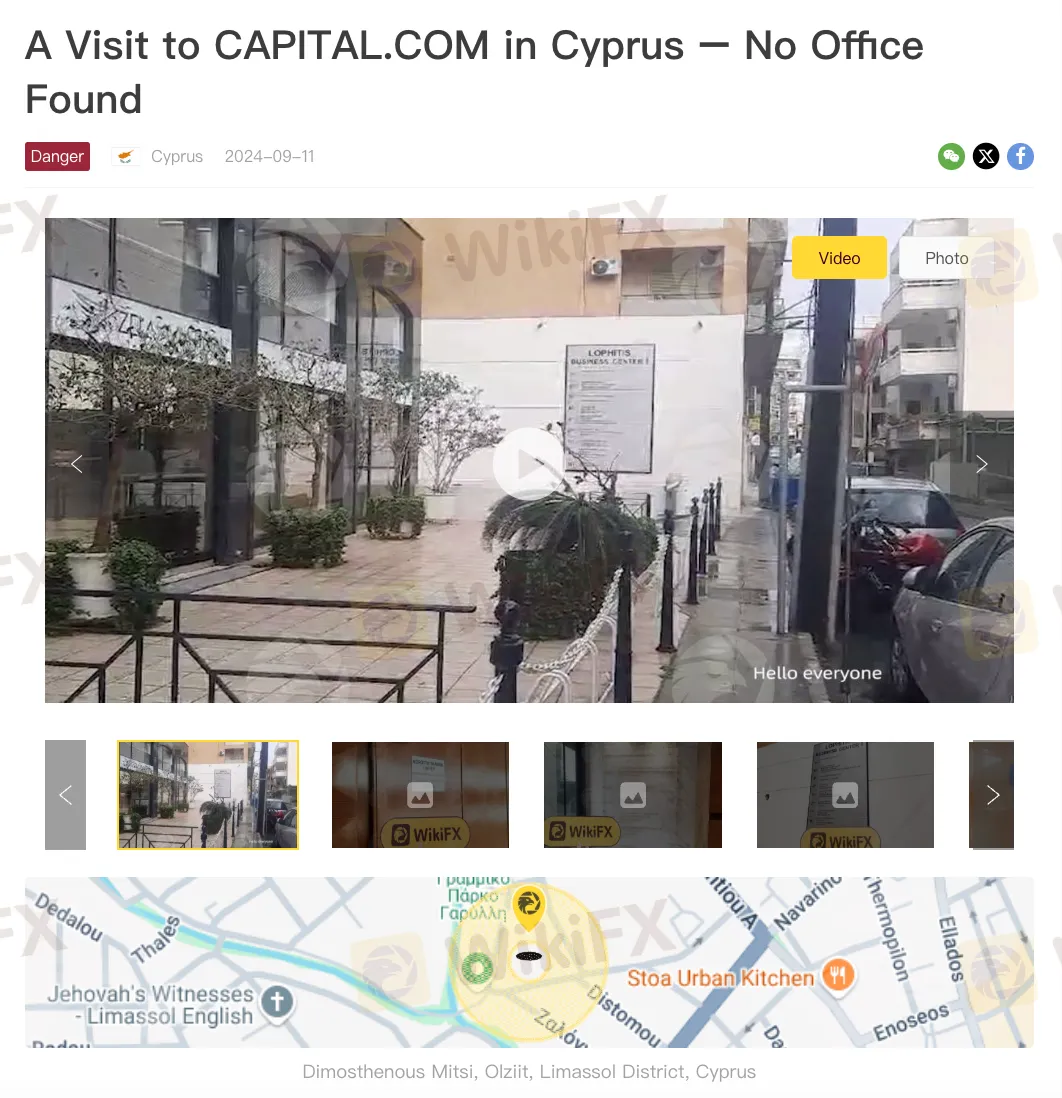

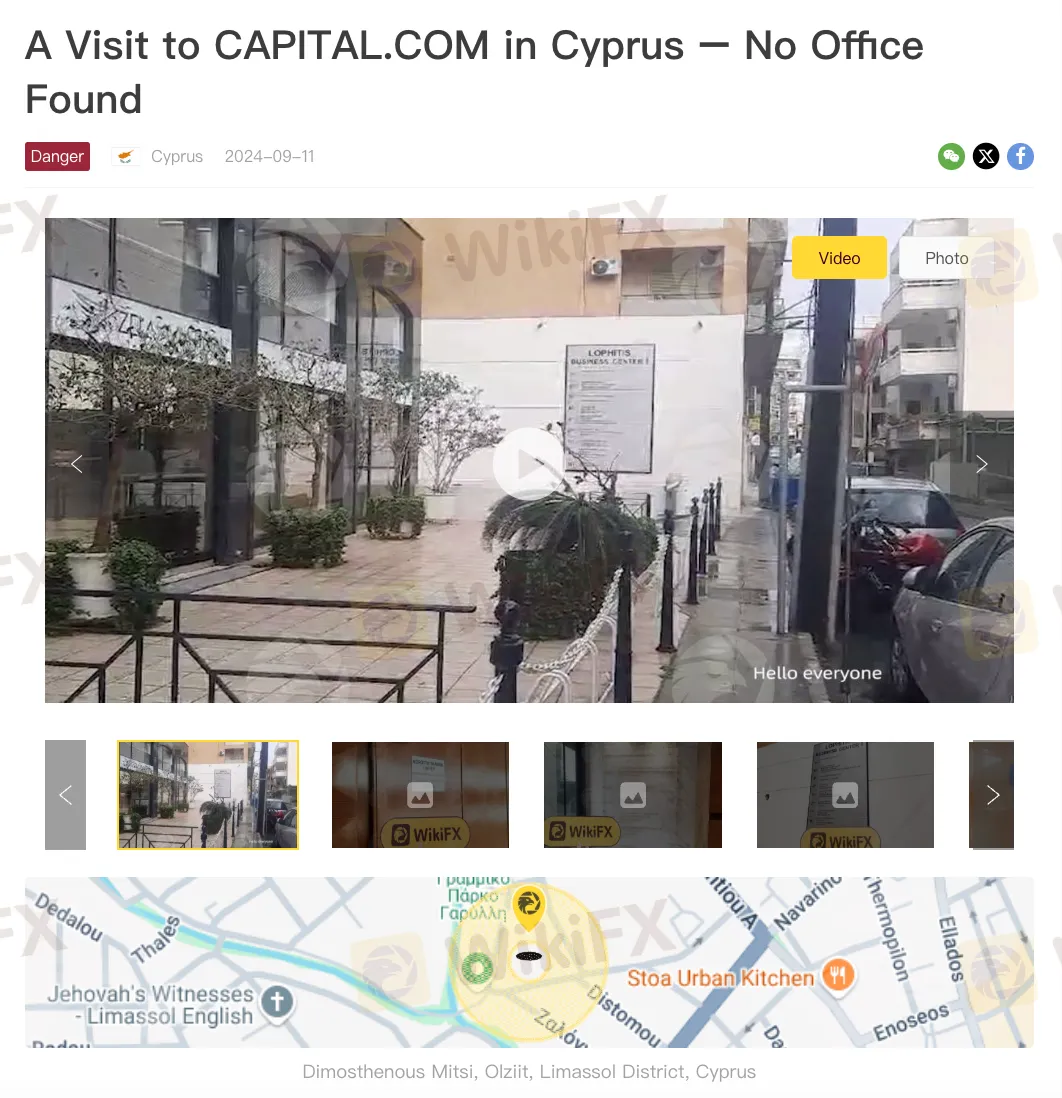

On-Site Address Verification: WikiFX Validates Capital.com's Global Footprint

To further enhance transparency, WikiFX conducts independent on-site verification services for brokers' physical addresses. These surveys are performed by professional investigators, including on-site photography, interviews, and directory checks, to confirm whether the company maintains a genuine physical office at its regulatory registered address. This helps investors identify risks like “shell companies” or false advertising. For Capital.com, WikiFX has surveyed multiple key addresses, with the following latest report summaries:

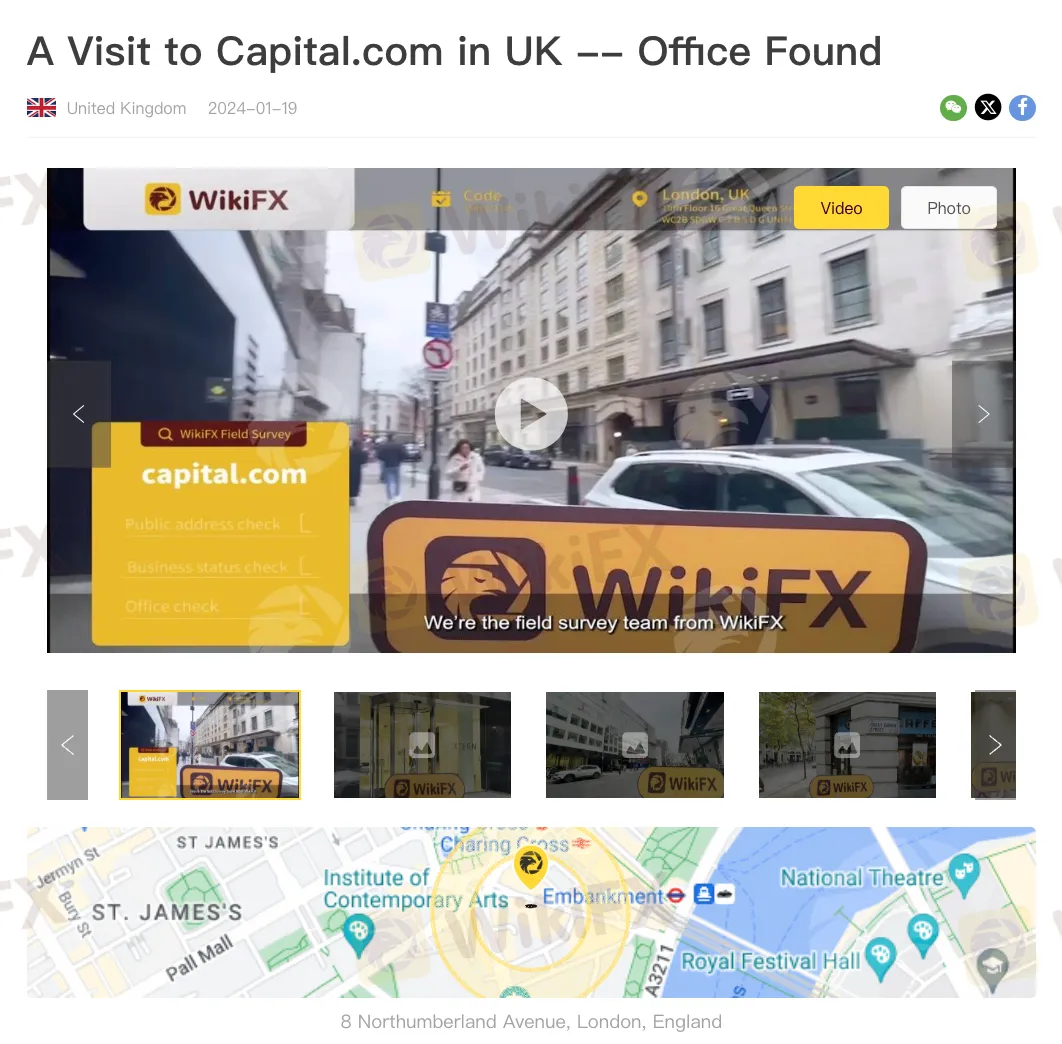

- London Office, UK (FCA-Regulated): Address: 10th Floor, 16 Great Queen Street, London, WC2B 5DG, United Kingdom. Result: Office confirmed to exist. The building features a modern exterior, with the lobby directory clearly listing Capital.com on the 10th floor; front desk reception confirmed ongoing operations, though internal access was restricted for security reasons. Survey photos show the building entrance, directory, and reception area, overall verifying as “office found,” enhancing credibility in the EU market.!London Office Survey PhotoFigure 3: WikiFX London survey screenshot, displaying Capital.com logo in the building directory, confirming physical presence.

- Limassol Office, Cyprus (CySEC-Regulated): Address: No. 237 of 28 October Avenue, Lophitis Business Centre II, 6th Floor, CY 3035 Limassol, Cyprus. Result: Office not found. Despite the building's prime Golden Coast location, the 6th floor shows no Capital.com signage, logo, or company traces; lobby directory and interviews yielded no records. Survey photos only depict the building exterior and an empty floor entrance, raising concerns—this may indicate the address is for registration only, not active operations, posing a potential “virtual office” risk.!Cyprus Office Survey PhotoFigure 4: WikiFX Cyprus survey screenshot, empty floor entrance highlighting the “office not found” warning.

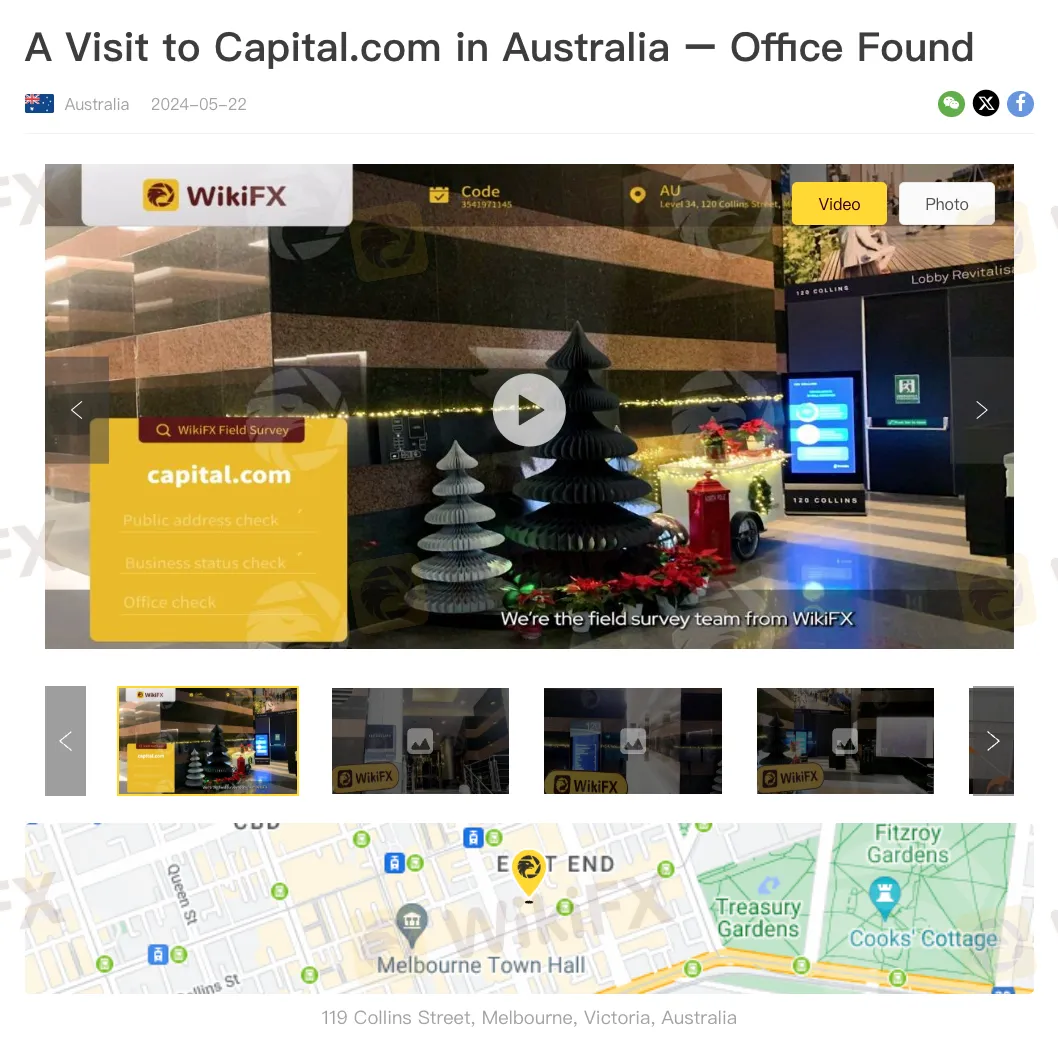

- Melbourne Office, Australia (ASIC-Regulated): Address: Level 34, 120 Collins Street, Melbourne VIC 3000, Australia. Result: Office confirmed to exist. The address is in a modern commercial high-rise with convenient access; lobby directory lists Capital.com details, and front desk verified the company's presence, though elevator access required a keycard, preventing internal observation. Survey photos include building exterior, directory, and evidence, overall verifying as “office found,” supporting its physical operations in the Asia-Pacific region.!Melbourne Office Survey PhotoFigure 5: WikiFX Melbourne survey screenshot, lobby directory highlighting Capital.com entry, confirming real footprint.

These survey results show that Capital.com has physical presence in core regulatory areas (like the UK and Australia), but the absence in Cyprus may reflect common issues with EU offshore registrations. Investors should prioritize verifying address authenticity under local regulations when selecting.

Trading Products and Platforms: The Allure of 3,000+ Diverse Tools

Capital.com's core strength lies in its vast asset library, covering CFDs, stocks, forex, indices, commodities, cryptocurrencies, and ESG (Environmental, Social, and Governance) products. Specifically:

- Forex: Major, minor, and exotic pairs, with EUR/USD spreads starting from 0.6 pips.

- Indices: Such as US 500, UK 100, Germany 30.

- Commodities: Precious metals (gold, silver), energy (oil, natural gas), and agriculture (wheat, corn).

- Cryptocurrencies: Bitcoin, Ethereum, Ripple, etc.

- Not Supported: Bonds, options, ETFs.

On the platform side, full MT4 support with an average execution speed of 173.33 ms and 2 MT4 servers. Leverage up to 1:300 (for professional traders), no commissions, but floating spreads influenced by market conditions.

For beginners, the platform includes a built-in Learning Hub with articles, videos, and an economic calendar; trading calculators aid in risk simulation.

Accounts and Fees: Low-Threshold Entry, Watch for Hidden Costs

Capital.com's account system is simple and efficient:

- Demo Account: Unlimited duration, virtual funds up to $100,000, ideal for practice.

- Live Account: Minimum deposit $10, supports Islamic accounts (unconfirmed). Leverage 1:300, floating spreads (EUR/USD from 0.6 pips).

Deposit/withdrawal methods are diverse, including Apple Pay, VISA, MasterCard, wire transfer, PCI, Worldpay, RBS, and Trustly. No deposit/withdrawal fees, free currency conversion, but $10 fee for inactive accounts (over 1 year), and overnight fees based on position direction. Compared to the industry average minimum deposit of $100, Capital.com's $10 threshold is more accessible.

Customer Support and Complaint Exposures

24/7 multilingual support is a highlight, via live chat, phone (+44 20 8089 7893), email (support@capital.com), and social media (Facebook, Instagram, etc.). User feedback praises quick, helpful responses, especially for US stocks and forex queries.

However, among 38 user reviews collected by WikiFX, 23 are exposure complaints, focusing on:

- Withdrawal Delays/Rejections: E.g., $6,262 withdrawal unapproved, $18,523.49 MT4 account rejected, €14,000 AMC stock lost due to unauthorized trading.

- Account Restrictions: Crypto deposits requiring SOF proof leading to limits, missing credit card verification blocking withdrawals.

- Others: Spreads over 10 pips in non-volatile markets, illegal closure of profitable positions, unresponsive complaints.

Neutral reviews (4) commend the app's smoothness and fast transfers but gripe about demo account limits and occasional closures. Positive feedback (11) highlights stable trading, low deposit thresholds, and broad tool libraries.

Pros and Cons at a Glance

Pros:

- Multi-country top-tier regulation, reliable fund segregation.

- 3,000+ tools, low spreads (from 0.6 pips), flexible leverage.

- Minimum deposit just $10, efficient 24/7 support.

- Rich educational resources, app downloads over 10 million.

- Confirmed physical offices in core regions, boosting entity credibility.

Cons:

- Some licenses revoked, high risk alerts.

- Frequent withdrawal complaints, common account restrictions.

- Large spread fluctuations, 85.24% loss rate warning.

- Cyprus regulatory address not found in survey, potential virtual office risk.

Conclusion: Capital.com, a Safe Choice or a Risky Bet?

In the 2025 trading wave, Capital.com stands out with its global layout and innovative platforms, especially suitable for Asian and MENA traders seeking diversification and low thresholds (e.g., highest user traffic from Malaysia). However, the “offshore shadow” in regulations, withdrawal pain points, and missing address surveys cannot be ignored. WikiFX recommends: Start with a demo account for testing, prioritize FCA/ASIC accounts, and monitor risk alerts (last check November 6, 2025). Ultimately, investment security comes from your due diligence—is Capital.com tailored for you? Scan the QR code below to join our exclusive WikiFX community group for real-time discussions, expert insights, and shared experiences on brokers like Capital.com!