简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Bold Prime Exposed: The Unlicensed Broker on Malaysia’s Investor Alert List

Abstract:Bold Prime, scoring just 2.35/10 on WikiFX and flagged by Malaysia’s SC for unlicensed trading, faces mounting complaints and warnings over extreme risk and false regulatory claims.

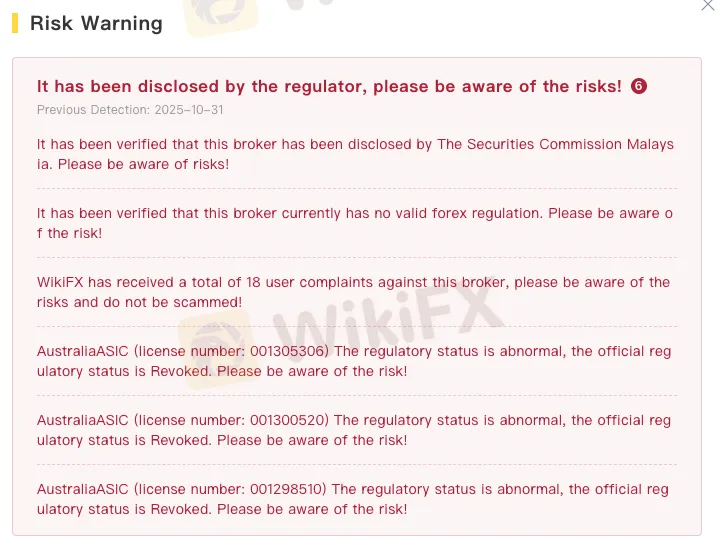

In an industry where image often overshadows integrity, Bold Prime has rapidly attracted attention and concern from traders across Malaysia. Despite its sleek branding and promises of high-speed execution and leverage of up to 1:2,000, a closer examination reveals serious warning signs. According to data compiled by WikiFX, the global broker regulatory query platform, Bold Prime has earned a WikiScore of only 2.35 out of 10, reflecting deep regulatory and operational risks. Adding to the unease, the Securities Commission Malaysia (SC) has placed Bold Prime on its Investor Alert List for operating without a valid licence. For Malaysian investors, these developments raise an urgent question: is Bold Prime a legitimate trading opportunity or a financial trap in disguise?

WikiFX Score and Overall Risk Assessment

According to WikiFXs broker-rating system, Bold Prime carries a WikiScore of just 2.35 out of 10.

This is an exceptionally low score, reflecting multiple risk factors including lack of credible regulation, numerous complaints, and a regulatory warning for Malaysian clients. In short, Bold Prime is evaluated by WikiFX as a high-potential risk broker.

When a broker scores so poorly, the implication for investors is simple: this is not a broker that meets trusted standards, and funds placed with it carry heightened risk of loss or non-recovery.

See WikiFXs full review on Bold Prime here: https://www.wikifx.com/en/dealer/1568170713.html

Licence Status and Regulatory Concerns

Bold Prime presents itself as an international broker, offering CFD and Forex services in multiple jurisdictions. WikiFX notes that Bold Prime has claimed regulation by the Australian Securities & Investments Commission (ASIC), citing licence numbers 001305306, 001300520, and 001298510.

However, WikiFX found that each of these licence numbers has been revoked. In other words, the claims of valid regulation under these ASIC numbers are false or misleading.

Bold Primes profile on WikiFX explicitly flags Bold Prime under “No Regulation” despite earlier claims.

In short: there is no credible, verifiable, valid regulatory licence backing Bold Primes operations. WikiFX labels the regulatory licence status as “Suspicious Regulatory License”, “Appointed Representative (AR) Revoked” and “High potential risk”.

Impact on Malaysia

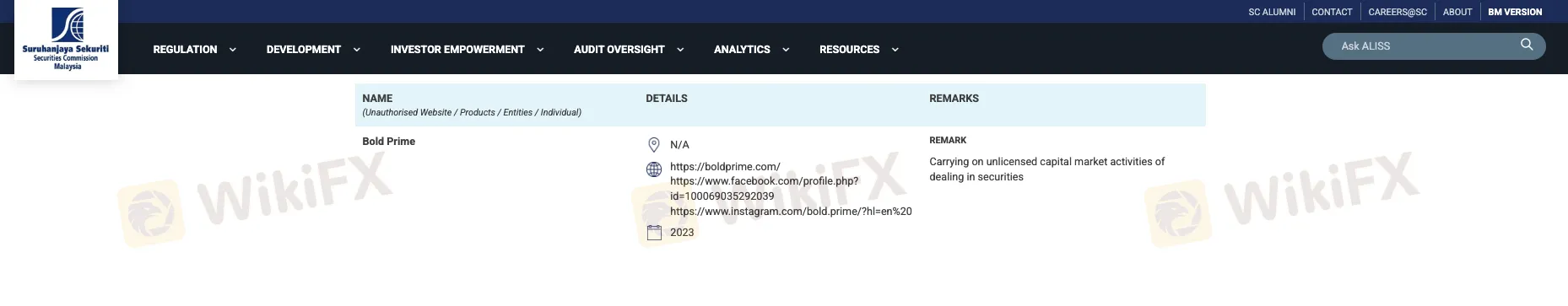

Most importantly for Malaysian traders, the Securities Commission Malaysia (SC) has explicitly added Bold Prime to its Investor Alert List for carrying on unlicensed capital market activities, notably dealing in securities or derivatives without proper authorisation.

This means that Bold Prime is unlicensed and unauthorised to offer trading services in Malaysia, and Malaysian clients have no protection under the SC regulatory regime.

To emphasise: even if Bold Prime holds licences elsewhere (which it does not, in any credible sense), Malaysian clients cannot rely on any local regulatory assurance. The SCs warning is unequivocal: dealing with such entities means you trade at your own risk.

Complaints and User Feedback

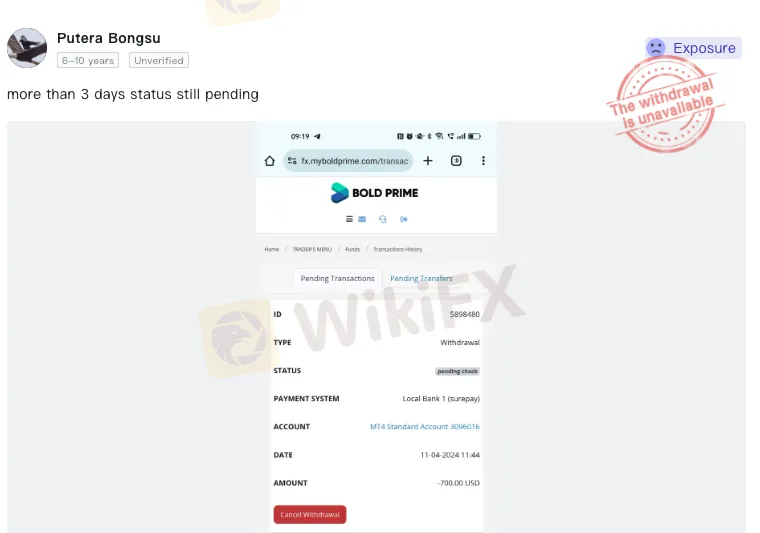

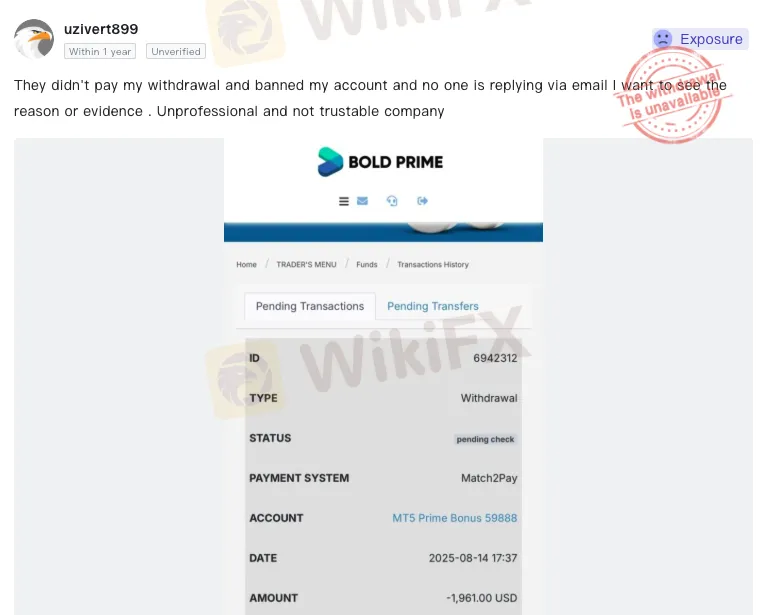

A major cause of the poor WikiScore is the volume of client complaints lodged on WikiFX and other forums. On the dealer profile page, there are multiple “Exposure” entries from Malaysian (and international) clients complaining about withdrawal problems, account freezes, blocked access, and alleged non-payment of profits.

Some representative complaints include:

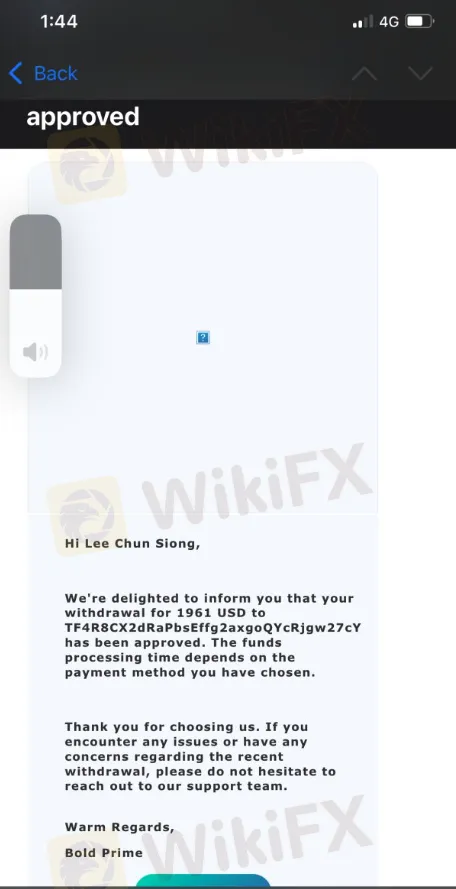

- A Malaysian trader withdrew US$1,966 and claims the account was then blocked and no further withdrawals permitted. However, Bold Prime labelled the withdrawal request as “approved”.

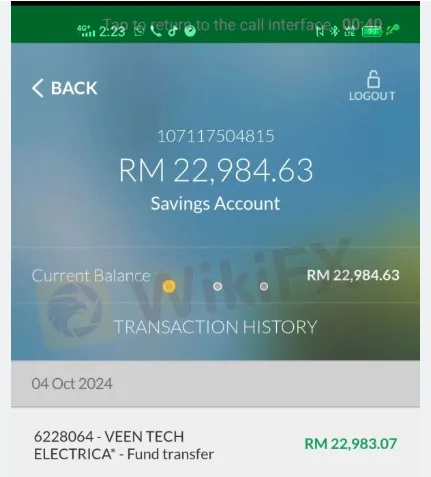

- Another Malaysian client reports a balance of approximately. US$42,640, managed to withdraw only US$5,344 before the account was frozen and login block.

- Many other complaints: withdrawal requests “pending” for weeks, vague reasons given and zero response from Bold Prime's customer service team.

High Leverage: Up to 1:2000

One of the marketing points of Bold Prime is the offering of exceptionally high leverage of up to 1:2,000.

While high leverage may seem attractive (it magnifies profits), it also magnifies losses to an extreme degree. Many reputable regulators impose much lower leverage caps for retail clients, often 1:30, 1:50 or 1:100, and require negative balance protection, among other safeguards.

Bold Primes leverage offering is therefore another red flag: the broker is targeting high-risk behaviour, which tends to favour the broker more than the client, especially in volatile market conditions.

For Malaysian retail traders, such high leverage, offered by an unlicensed broker, is a particularly dangerous combination. Without robust regulation, there may be little or no protection if losses arise or if problems occur with the withdrawal of funds.

Why Malaysian Traders Must Remember This Warning

- Unlicensed in Malaysia – Bold Prime is on the SCs Investor Alert List for unlicensed operations. That means you do not have the protections a licensed local broker would provide.

- No credible regulation anywhere – The claimed licences (ASIC) are revoked or unverifiable. So the regulatory veneer is illusory.

- Multiple client complaints – Numerous withdrawal issues, account freezes, non-payment of profits, from Malaysian clients among others.

- Marketing of high leverage – Up to 1:2000 is offered, which is much higher than standard regulated environments; high leverage plus weak oversight equals risk.

- Poor risk management features – WikiFX notes Bold Prime lacks clearly stated negative balance protection, has restricted deposit/withdrawal methods, and limited transparency overall.

In short, Malaysian traders dealing with Bold Prime do so outside the regulatory safety net. In the event of a dispute, fund loss, or broker default, the avenues for recourse may be extremely limited with cross-border complications, ill-defined legal entities, and no local oversight.

Final recommendation: Join the Bold Prime Users' Community

If you‘ve traded with Bold Prime or are currently using its platform, you don’t have to navigate your experience alone.

We‘re building a community group for Bold Prime users to share verified information, discuss experiences, and stay updated on any new developments affecting the broker’s operations and regulatory status.

Purpose of the group:

Exchange honest feedback about your experiences using Bold Prime

Learn how others handle platform-related issues (e.g. withdrawals, support responses)

Receive updates from independent sources about market or licensing developments

Build a network of traders who prioritise transparency and accountability

How to join:

Simply scan the QR code below to connect with the group.

Participation is voluntary, and the goal is community support and information-sharing only, and not financial advice or legal coordination.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator