Trade Nation Rebrands TD365 in Global Integration Move

Trade Nation completes TD365 integration, unifying its brand and platforms under one global identity to enhance user experience and streamline trading operations.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Philippine Authorities arrest two in a major phishing scam linked to a foreign suspect; crackdown expands as 410 cybercrime offenders caught nationwide.

Philippines — Authorities are ramping up their offensive against cyber-enabled financial crimes. The Philippine National Police Anti-Cybercrime Group (PNP ACG) reported this week the capture of two individuals allegedly involved in a widespread phishing operation targeting mobile phone users across Manila.

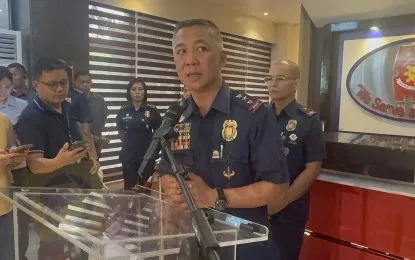

According to Brigadier General Bernard Yang, ACG director, suspects “Ayong” (24) and “Ramil” (39) were arrested in coordinated raids in Mandaluyong and Makati City last Thursday. Intelligence provided by the Philippine Navy led to the swift issuance of a search warrant, enabling the seizure of key evidence, including four international mobile subscriber identity catchers marked with non-English? text.

The suspects, reportedly recruited by an unidentified foreign national, used the devices to collect phone numbers in densely populated commercial centers. They then posed as banks or telecommunications companies, sending fraudulent texts with malicious links to lure victims into providing sensitive information.

Yang explained that while Ayong and Ramil did not personally know each other, both belonged to an organized group orchestrated by the foreign mastermind. The apprehended suspects now face charges for violating Republic Act No. 3846 (Radio Control Law), RA No. 8484 (Access Devices Act), RA No. 11934 (SIM Card Registration Act), and RA No. 10175 (Anti-Cybercrime Act). Telecommunications firms and banks affected by the scam are also preparing separate legal actions.

In a related development, the Philippine National Police, acting on the directive of President Ferdinand R. Marcos Jr., intensified operations against fraudulent car financing schemes and syndicates exploiting loopholes in ownership records.

Acting PNP Chief Lt. Gen. Jose Melencio Nartatez Jr. announced the recovery of three vehicles involved in suspected financial crimes in Central Luzon. Law enforcement in Abucay, Bataan repossessed a Toyota Vios linked to Talon-Casa scam rings, while Pilar police seized a motorcycle found with falsified registration papers. Meanwhile, authorities in Angeles City, Pampanga, impounded a Ford Everest after receiving a failed-to-return complaint.

“These operations send a strong signal that the PNP does not tolerate financial deception or forged documents. We urge the public and financial institutions to thoroughly vet all transactions to protect themselves against fraud,” Nartatez said.

He called for collaboration between banks, lending companies, and the public, emphasizing that Ang laban kontra pandaraya ay hindi lang trabaho ng pulis, ito ay responsibilidad nating lahat? — the fight against fraud is everyones responsibility.

Throughout July to September, PNP-ACG operatives conducted extensive anti-cybercrime sweeps, resulting in 410 arrests. These included 311 apprehensions during sting operations, 97 wanted suspects taken into custody, and the rescue of 26 minors from abuse. Investigators processed 426 digital examinations and executed 338 cyber warrants, yielding 387 formal charges and 240 quick inquests.

Brig. Gen. Yang noted a growing trend in the online sale of hacking apparatus used in phishing scams, as authorities redouble “cyber-patrol” activities to trace sellers and buyers.

“With the increasing availability of such devices online, we have enhanced surveillance and enforcement against sellers to prevent further victimization,” Yang added.

Philippine police continue to forge partnerships, strengthening coordination between the Highway Patrol Group, Anti-Cybercrime Group, and regional offices to stamp out fraud syndicates exploiting both digital and physical vulnerabilities in the countrys financial system.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Trade Nation completes TD365 integration, unifying its brand and platforms under one global identity to enhance user experience and streamline trading operations.

INFINOX secures UAE CMA Category 5 license, expanding its regulated presence in the Middle East with a focus on transparency and strategic growth.

Belgian consumers lost over €23M to crypto and WhatsApp investment scams in late 2025, financial regulator warns amid rising fraud cases.

Hong Kong trader Ng Ka Hei convicted of false trading in listed stocks as SFC intensifies crackdown on market manipulation. Read the full report now.