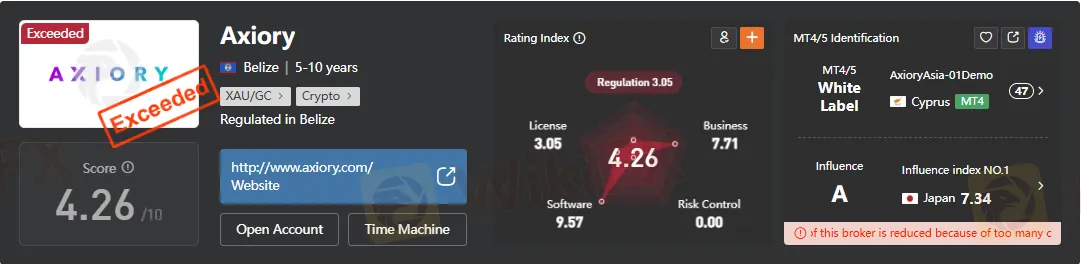

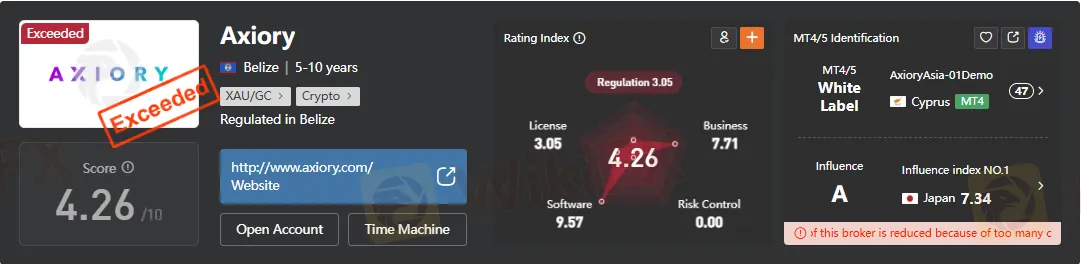

Abstract:Axiory is a Belize-registered forex and CFD broker with a current regulation status "Exceeded". With multi‑platform access and high leverage; here’s what matters before opening an account.

Introduction

Axiory is a forex and CFD broker registered in Belize that offers trading on MT4, MT5, cTrader, and its MyAxiory app, combining high leverage with multiple account types and a broad instrument list to attract beginners and active traders alike. Its offshore authorization via Belizes Financial Services Commission and generous leverage up to 1:2000 are central to the proposition, but they also require careful risk and due diligence considerations from prospective clients.

Axiory Global Ltd was founded in 2012 and is registered in Belize under the oversight of the International Financial Services Commission, with a listed license reference IFSC/60/255/TS/15 current status of “Exceeded” for financial services activities. The broker provides access to forex, metals, energies, indices, stock CFDs, exchange‑listed stocks, and ETFs, positioning itself as a multi‑asset venue complemented by demo access and low minimum deposits. Offices and contact points include a Belize registration address and a representative office in Dubai, supported by phone, email, live chat, and a knowledge base FAQ.

Regulation

Axiory‘s regulatory home is Belize, an offshore jurisdiction whose FSC license requirements are generally lighter than those of top‑tier regulators in the US, UK, EU, or Australia, which can impact recourse and investor protections available to clients. The documentation highlights the licensed entity as AXIORY GLOBAL LTD with the stated IFSC number and Belize jurisdiction, which is consistent with its branding and public disclosures. Field verification notes show the firm’s public address and business status checks in Belize, adding visibility into physical presence, though not substituting for top‑tier oversight.

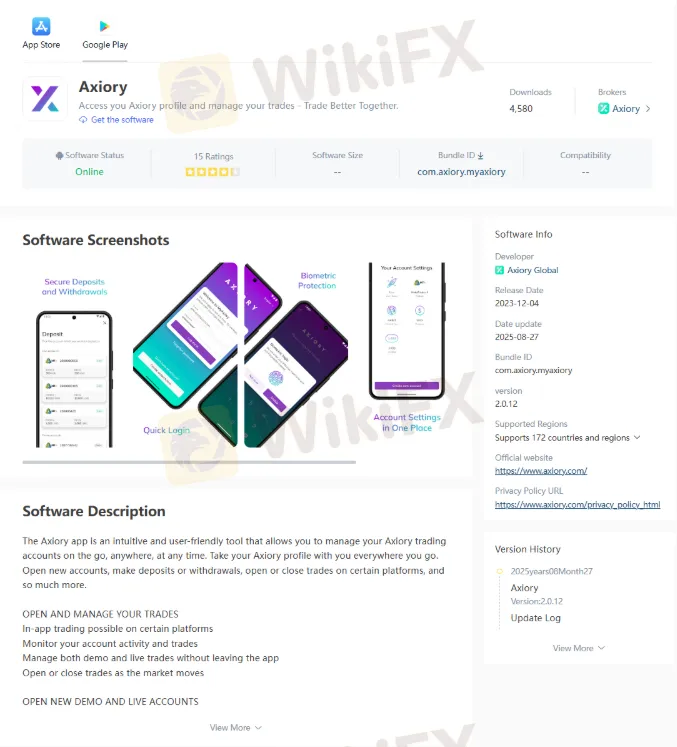

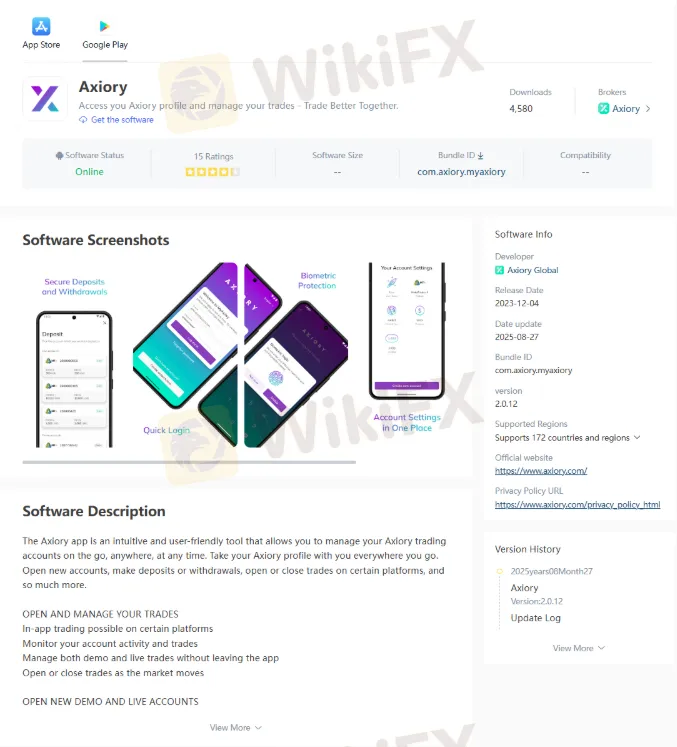

Platforms, Tools, and Execution

Axiory supports MetaTrader 4, MetaTrader 5, cTrader, and its proprietary MyAxiory mobile app, enabling desktop, web, and on‑the‑go trading flows. The listed platforms include advanced charting, multiple order types, and support for EAs, with cTrader emphasized for speed and depth‑of‑market, and MT4/MT5 noted for a large indicators library and detachable charts. The MyAxiory app lets clients open accounts, fund, withdraw, and in some cases place trades, with recent version updates and availability on major app stores.

Accounts, Costs, and Leverage

Axiory offers five live account profiles—Nano, Standard, Max, Tera, and Alpha—each with a minimum deposit indicated as low as 10 USD and varying spreads, commission policies, and platform eligibility. Indicative pricing data in the file cite average EUR/USD spreads starting around 0.3 pips on certain accounts with commission, moving higher for spread‑only accounts, alongside leverage up to 1:2000 on specific profiles. Negative balance protection, hedging permissions, and stock‑CFD commission schedules are mentioned, with demos available and configured to replicate live market conditions without expiry limits.

Funding, Withdrawals, and Access

Supported deposit methods include cards, bank transfer, major e‑wallets, and ThunderX Pay, with processing timeframes ranging from instant to several business days depending on rail and region. Withdrawal options broadly mirror deposits, with instant to multi‑day timelines and provider fees potentially applied to certain e‑wallets or transfers as disclosed. The broker notes multilingual support, regional availability across many countries, and explicit restrictions for several jurisdictions where accounts are not offered.

Pros and Cons

Axiorys strengths are breadth of instruments, multiple platforms, flexible accounts, low entry deposits, Islamic account availability, and a polished mobile experience that centralizes account management. The primary drawbacks are offshore regulation under Belize FSC, absence of continuous 24/7 live support, and a list of country restrictions that exclude applicants in several African and Asian markets. High maximum leverage increases potential returns but also magnifies drawdown risks—appropriate sizing, risk controls, and strategy testing on the unlimited‑term demo are prudent first steps.

Firsthand Checks and User‑level Experience

On‑the‑ground office verification in Belize supports that the brand maintains a public presence at the stated locations, which aligns with expectations for a broker of its tenure. Hands‑on platform comparisons consistently show MT4/MT5 compatibility for automated strategies and cTraders appeal to speed‑sensitive traders seeking depth‑of‑market and granular order control. Practical account setup flow, funding paths, and app‑based account orchestration indicate that operational onboarding can be completed quickly when documents are in order and regional rails are supported.

Due‑diligence Checklist

Before funding, confirm account type details—spreads, commissions per lot or per instrument, and leverage ceilings—against current disclosures to ensure cost alignment with strategy. Validate the exact regulatory status and license references on the regulators site for the most current standing; licensing numbers and entities should match the account agreement. Test execution, slippage behavior, and margin performance in a risk‑free demo environment mirroring planned position sizes to calibrate expectations.

Who Axiory Suits—and Wo Should Pass

Axiory is a pragmatic fit for traders who value multi‑platform choice, low starting deposits, and the latitude of higher leverage for systematic or discretionary strategies. Long‑only equity CFD dabblers and short‑term FX participants benefit from the range of instruments and platform tools if comfortable with an offshore regulatory framework. Traders who require top‑tier regulatory protection, segregated safeguarding under major regimes, and extensive investor compensation schemes should consider brokers under stronger jurisdictions.

Customer Support and Learning Curve

Support channels include email, phone, live chat, and a structured FAQ, with self‑help sections covering common onboarding and platform questions. The firm references education and research initiatives, alongside demo accounts intended to mirror live environments, aiding newer traders in progressing safely. The absence of round‑the‑clock support coverage may matter to weekend strategists or those trading outside primary desk hours.

Funding Speed and Costs in Practice

Most cards and e‑wallet deposits are listed as near‑instant, while bank transfers can take 3–10 business days; some alternative rails require short confirmation windows. Withdrawal timelines vary similarly—e‑wallets tend to process faster than bank transfers, and fees may accrue depending on the method and provider. Mapping funding and withdrawal routes to personal banking infrastructure can materially improve overall trading logistics and reduce turnaround friction.

Risk Management Realities with 1:2000

Leverage up to 1:2000 can transform small balance accounts into high‑beta profiles where micro‑errors can cascade, so strict position sizing and stop discipline are critical. Negative balance protection helps cap downside, but it does not eliminate the risks of rapid losses during gaps or illiquid conditions when stops may not fill at expected levels. Demo‑led optimization, followed by incremental size increases on live accounts, provides a practical buffer against early over‑exposure.

Geographic Availability and Restrictions

Axiory indicates service to a broad set of countries, while explicitly restricting accounts from multiple jurisdictions across Africa, the Middle East, and Asia. Prospective clients should confirm eligibility during onboarding, as restrictions can change with local regulations or internal risk policies. Where service is unavailable, attempts to register may be denied at KYC, so planning for alternatives under local rules is advisable.

Conclusion

Axiory pairs accessible platforms and low entry costs with a wide asset menu and high leverage, making it a compelling offshore option for strategy‑driven traders. However, the Belize FSC authorization is not equivalent to top‑tier regulation, so capital allocation decisions should be sized with that governance context in mind. For many, a thorough demo phase, cost verification, and conservative leverage use are the right prerequisites before funding a live account.