Abstract:When a trusted financial regulator like the FCA (Financial Conduct Authority) warns people about a broker, it should not be ignored. These warnings usually come after serious issues are found, such as fraud, unlicensed activity, or investor complaints. It’s important to check the warning signs. This helps protect your money and avoid unnecessary risk. Here are 5 major red flags about DeltaFX.

When a trusted financial regulator like the FCA (Financial Conduct Authority) warns people about a broker, it should not be ignored. These warnings usually come after serious issues are found, such as fraud, unlicensed activity, or investor complaints. Its important to check the warning signs. This helps protect your money and avoid unnecessary risk. Here are 5 major red flags about DeltaFX.

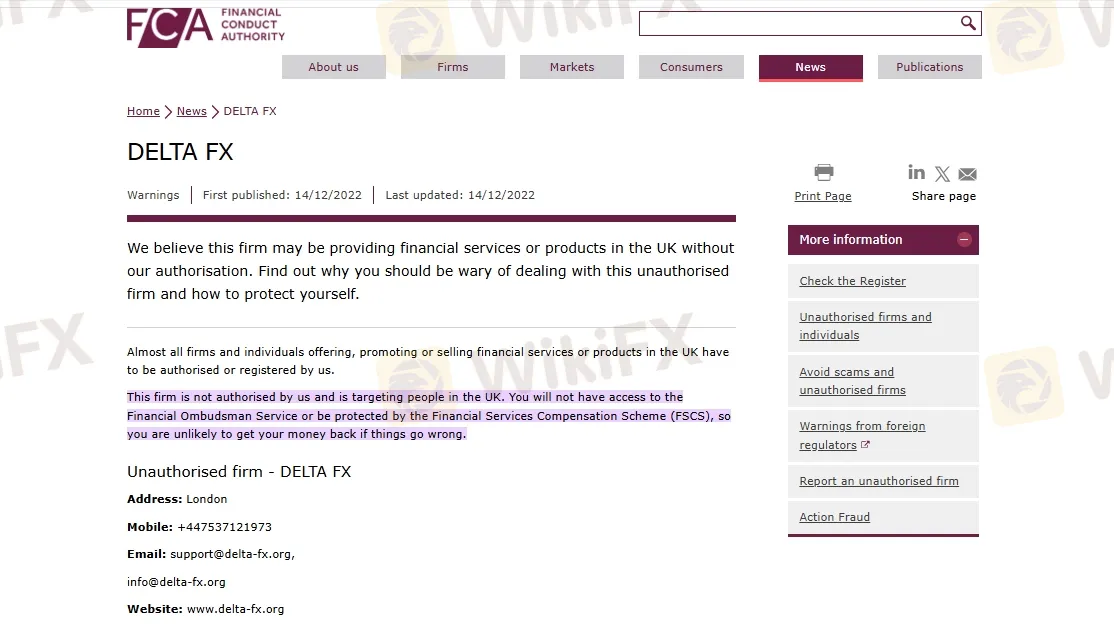

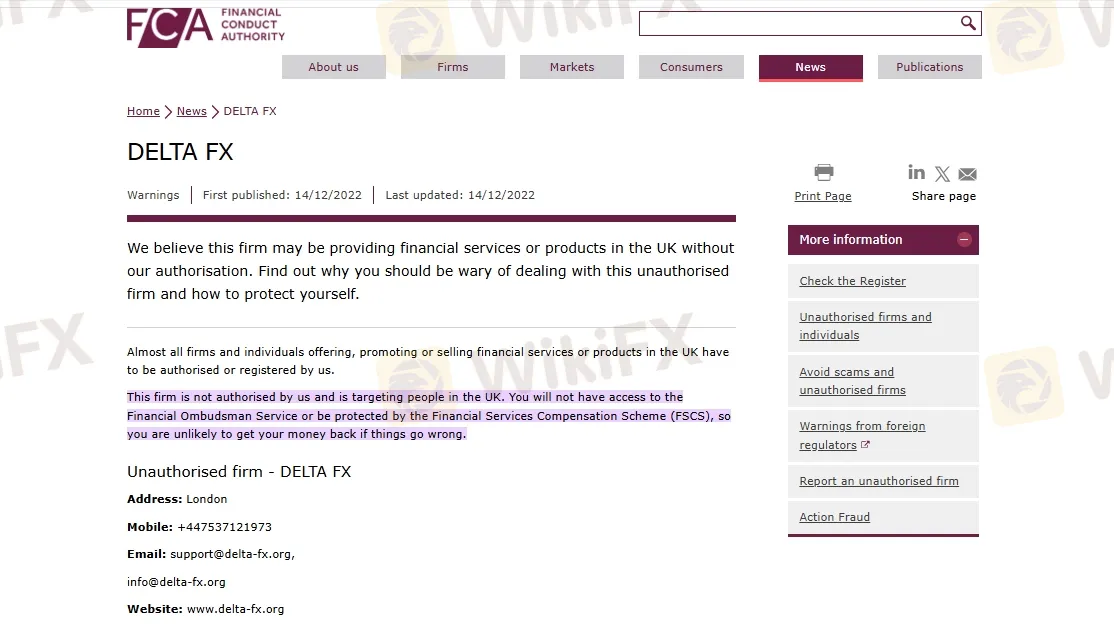

1. FCA Warning

In 2022, the FCA, which is the UK‘s top financial watchdog, issued an official warning against DeltaFX. This means the broker was offering financial services without proper authorization. When a broker operates without a license from a trusted authority, it’s a huge red flag. It means there's no official body watching over their actions to keep investors safe.

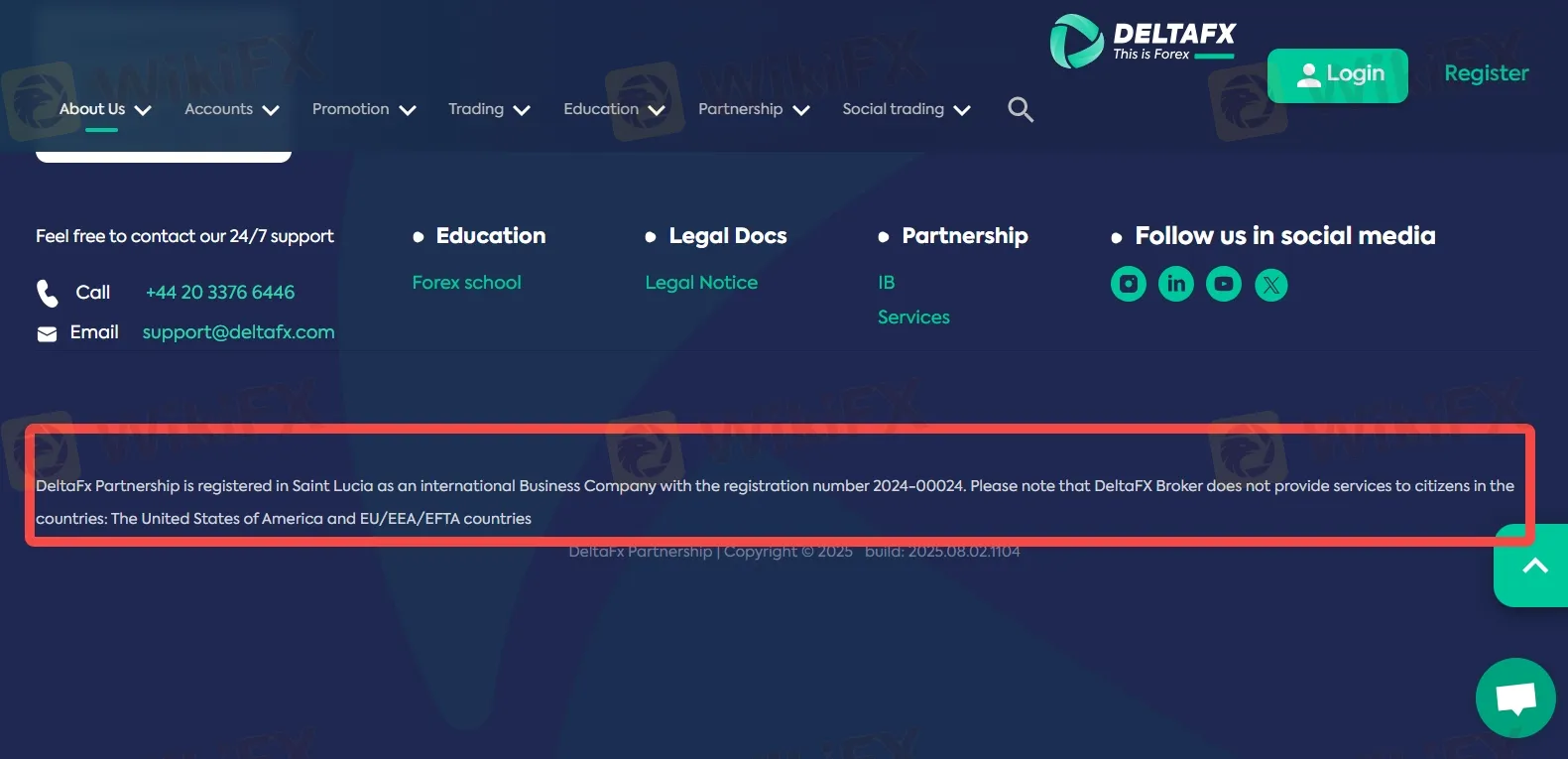

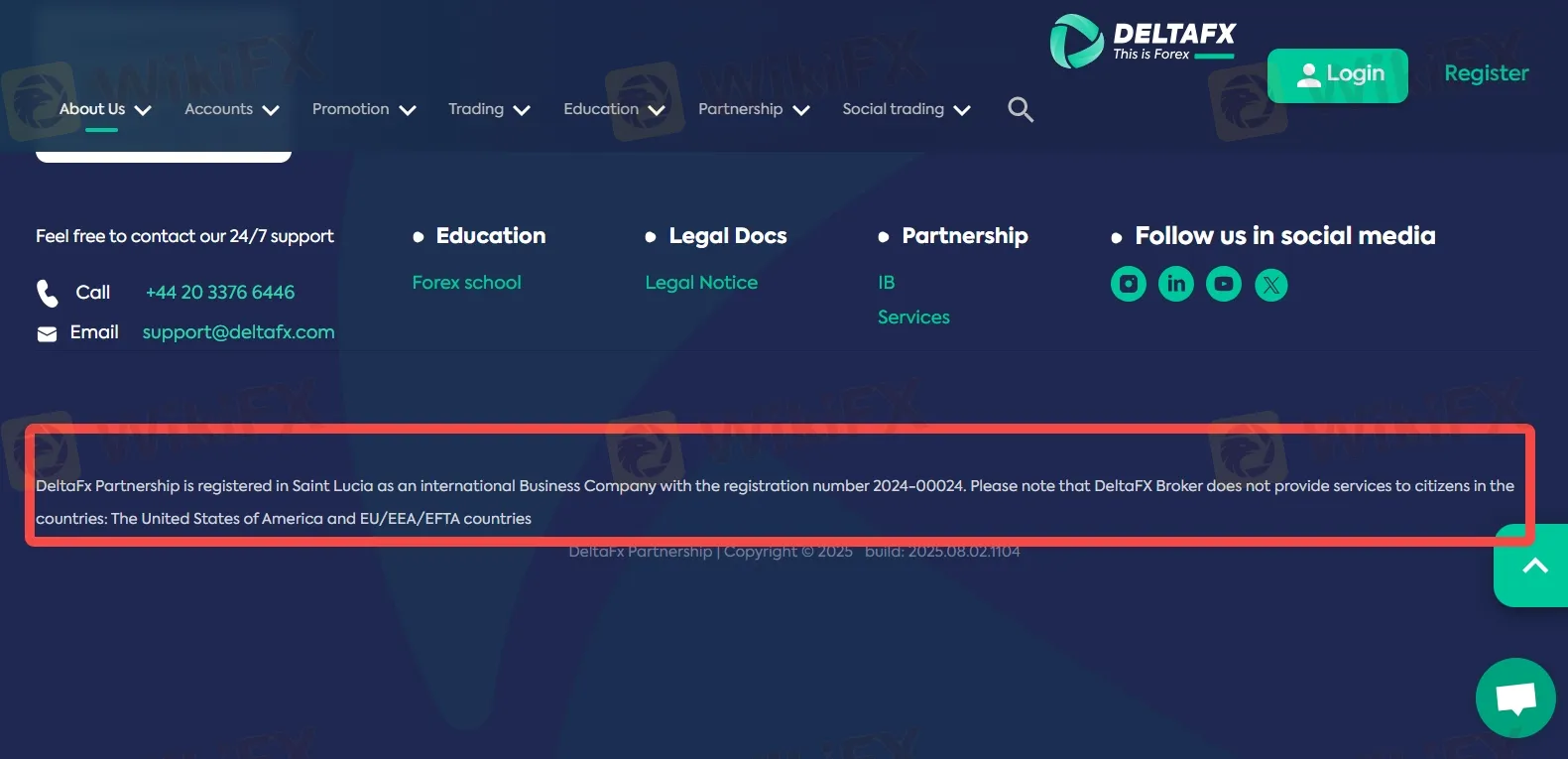

2. Weak Regulation – Offshore Registration

DeltaFX is registered in Saint Lucia, a small offshore location known for its loose regulations. Many scam brokers choose these places to avoid following strict financial rules. This kind of registration does not protect traders, especially if there are problems with withdrawals or fraud. A trustworthy broker should be licensed by strong regulators like the FCA (UK), ASIC (Australia), or CySEC (Europe).

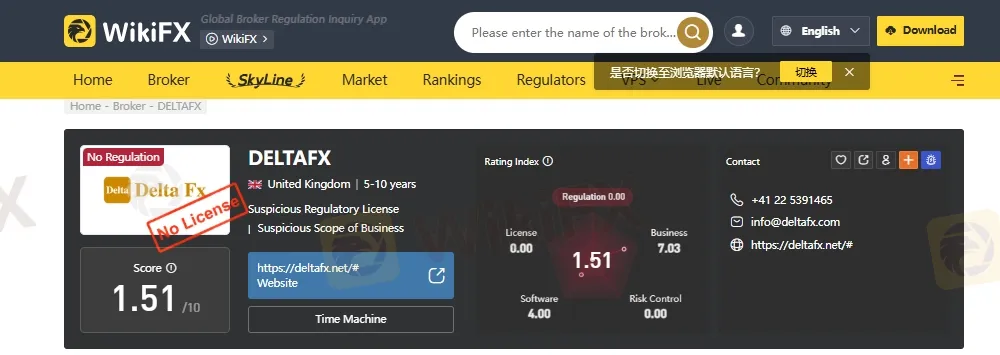

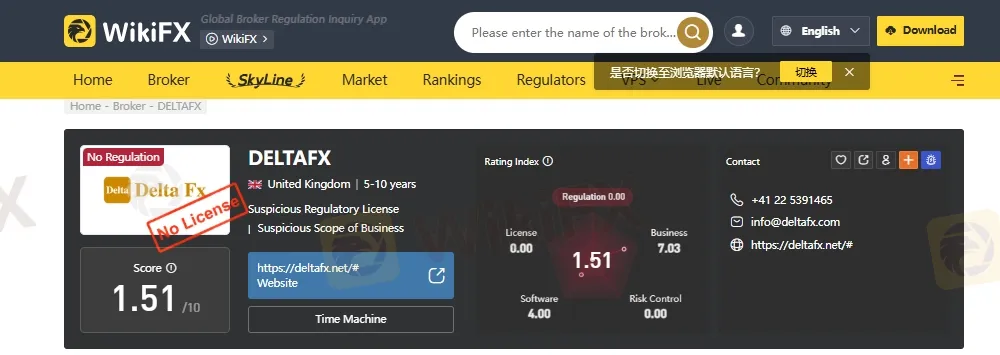

3. Low WikiFX Score

WikiFX, a well-known platform for checking broker reputations, gives DeltaFX a score of just 1.51 out of 10. This is extremely low and clearly shows that the broker has a poor reputation in the trading community. A low score like this often means high risk, bad customer service, and frequent complaints from users.

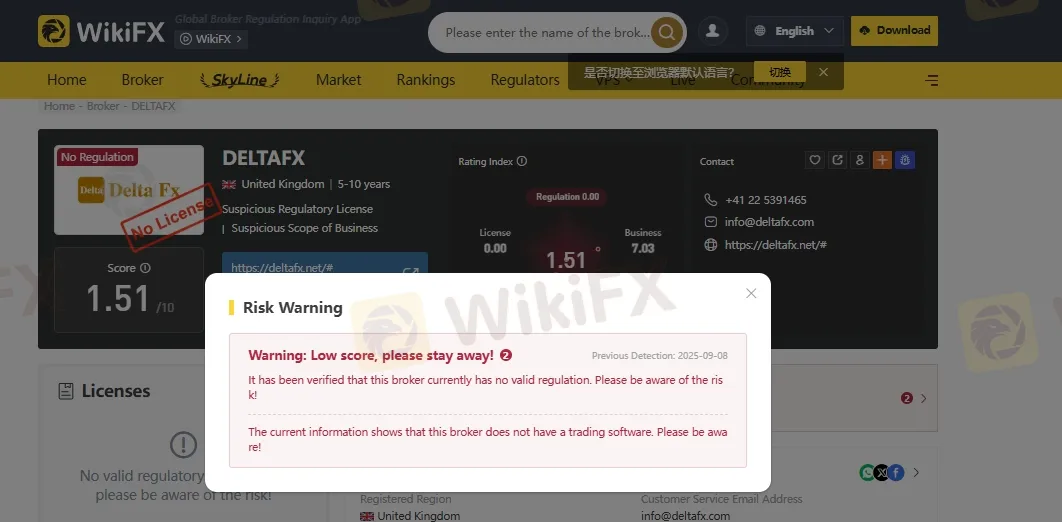

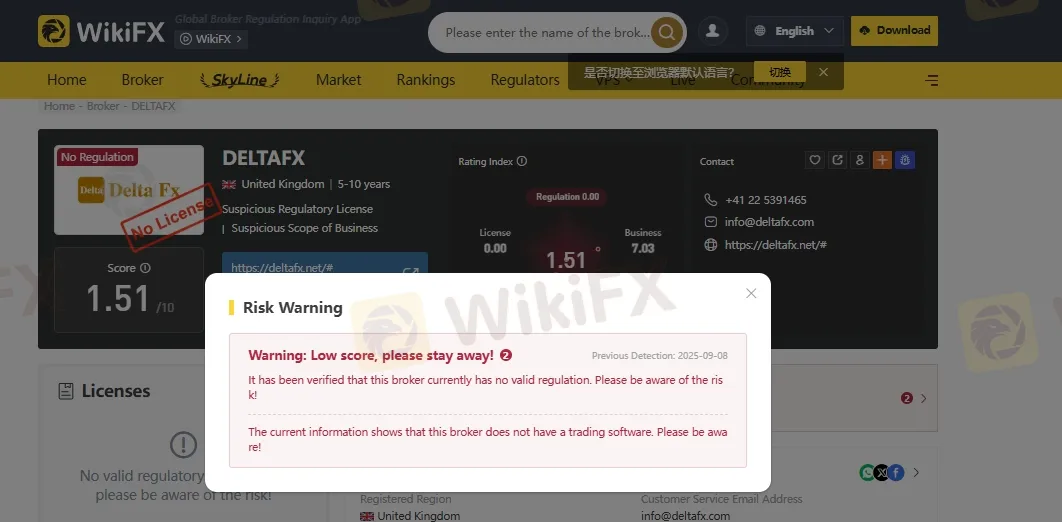

4. WikiFX Warning to Traders

During our investigation, we also found that WikiFX didn‘t just give a low rating — it even displayed a direct warning on the broker’s profile:

“Warning: Low score, please stay away!”

This kind of warning is not common and is used only for brokers that are considered unsafe or dishonest.

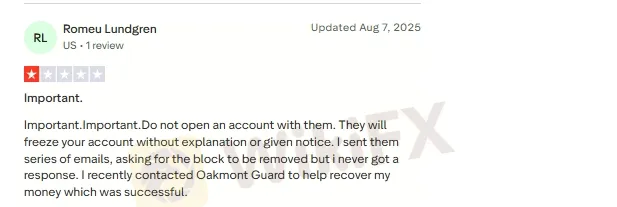

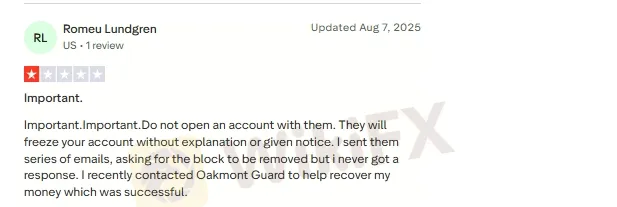

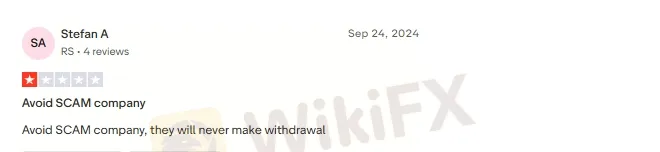

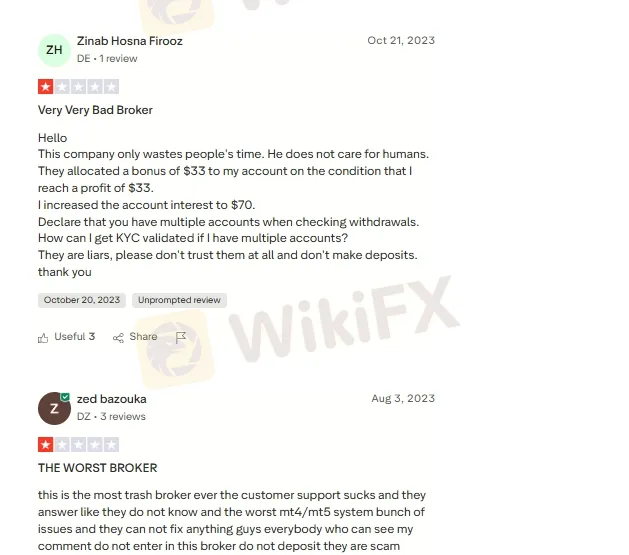

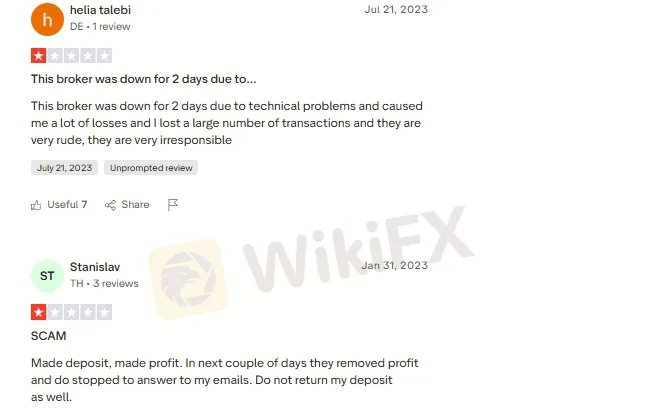

5. Negative Reviews Exposed – Real User Complaints

Many users are calling this broker a scam, warning others to avoid the company at all costs due to serious issues with withdrawals. One trader reported that after making a deposit and earning a profit, the broker removed the profit and stopped responding to emails, even refusing to return the original deposit. Another user said their account was frozen without any explanation or notice, and despite sending multiple emails, they received no response. Some even mentioned that the MT4/MT5 trading platforms are full of issues, and the team seems unable or unwilling to fix them. Overall, traders are urging others to stay away from what they describe as the “worst broker ever.”

Conclusion

With an FCA warning, offshore registration, low scores, and serious user complaints, DeltaFX shows several red flags. If you‘re thinking about trading, it’s safer to choose a broker that is fully regulated, transparent, and trusted by other traders.

Join WikiFX Community

Stay alert and informed with WikiFX- your one-stop destination for everything related to the Forex market. Whether you're looking for the latest market updates, scam alerts, or reliable information about brokers. Join the WikiFX Community today by scanning the QR code at the bottom and stay one step ahead in the world of Forex trading.

Steps to Join

1. Scan the QR code below

2. Download the WikiFX Pro app

3. After installing, tap the Scan icon at the top right corner

4. Scan the code again to complete the process

5. You have joined!