Simulated Trading Competition Experience Sharing

Champion Strategy Revealed: Get a Head Start on Winning

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Your strategy, your broker's model, and the market's current condition all determine how you should approach this powerful setting. What is deviation in forex is not an enemy to be feared or a setting to be ignored. It's a critical risk management tool that requires thought, practice, and adaptation. By understanding what deviation is and how to use it wisely, you move from being a passenger to the market's whims to being a pilot in control of your trade execution. This mastery is a defining step on the path to consistent and confident trading.

In forex trading, deviation is a setting that tells your broker the biggest price difference you're okay with between the price you see when you click to trade and the actual price you get. Think of it like telling someone shopping for you that you want to pay “around $50” for something, giving them a few extra dollars to work with if the exact price isn't available. This setting helps traders deal with a common market issue called slippage.

If you don't control deviation, your trades might get rejected when markets move fast, or even worse, you might get filled at prices that ruin your trading plan right away. Learning how to use deviation isn't just a small technical detail - it's a basic skill you need to make trades accurately, avoid surprise losses, and handle the market's natural ups and downs. Understanding this tool is what separates traders who are in control from those who just hope for the best.

At its core, deviation is a safety setting you control in your trading platform, usually measured in “pips” or “points.” When you place a market order to buy or sell, you're asking your broker to make that trade at the best price available right now. But in the split seconds it takes for your order to travel from your computer to the broker's servers and then to the market, that price can change. The deviation setting tells your broker what to do when this happens.

Let's look at two clear examples for a buy order on EUR/USD:

You see EUR/USD at 1.0850 and click “Buy.” While your order is being processed, the market moves, and the best available price is now 1.0852. Since you didn't set any acceptable deviation, the platform sees this as a price mismatch and rejects your order, often showing a “requote” message. You miss the trade completely.

You click “Buy” on EUR/USD at 1.0850 again, but this time you've set a maximum deviation of 3 pips (or 30 points on a 5-digit broker). The market moves to 1.0852 before your order goes through. Since the 2-pip difference is within your 3-pip limit, the trade goes through successfully at the new price of 1.0852. Your order gets filled, and you're in the trade.

You can set this up directly in the order window of platforms like MetaTrader 4 and MetaTrader 5, giving you direct control over how much price movement you'll accept for each trade.

Traders often mix up “deviation” and “slippage,” but they're actually two different things. Getting confused about this can lead to misunderstanding how trade execution really works. The difference is important: one is something you control, and the other is something that happens in the market.

Think of it like setting a thermostat. Deviation is like setting your thermostat to keep the temperature at 70°F, with a tolerance of plus or minus 2 degrees. Slippage is the actual temperature change that happens - maybe the room only gets to 71°F. Since the 1-degree change is within your 2-degree tolerance, the system keeps working. If the temperature suddenly jumped to 75°F, it would go beyond your setting, and the system would shut off.

In trading, your deviation setting tells the broker exactly how much slippage you're willing to accept. If the market's actual slippage is less than or equal to your deviation setting, the trade goes through. If it's more, the order gets rejected.

| Feature | Deviation | Slippage |

| Nature | A setting you choose and control. | Something that happens in the market. |

| Control | You set it before placing an order. | It happens while your order is being filled. |

| Function | To set the maximum acceptable price change. | The actual price change that occurs. |

| Example | “Only execute this trade if the price doesn't move more than 2 pips.” | “The trade was executed 1.5 pips away from the price I wanted.” |

Slippage isn't a mistake or your broker trying to cheat you - it's a normal part of how the forex market works. The forex market is decentralized and operates over-the-counter, which means prices are constantly changing. Understanding why slippage happens is the first step to managing it well. Three main factors cause it.

During major economic news releases, central bank announcements, or big world events, market volatility shoots up. Prices can change hundreds or even thousands of times per second. Events like the US Non-Farm Payrolls (NFP) report or a Federal Reserve interest rate decision can cause prices to “gap” or jump dozens of pips instantly. In this kind of environment, the price you see when you click is almost guaranteed to be different by the time your order gets filled. This fast-moving price action is the biggest cause of slippage.

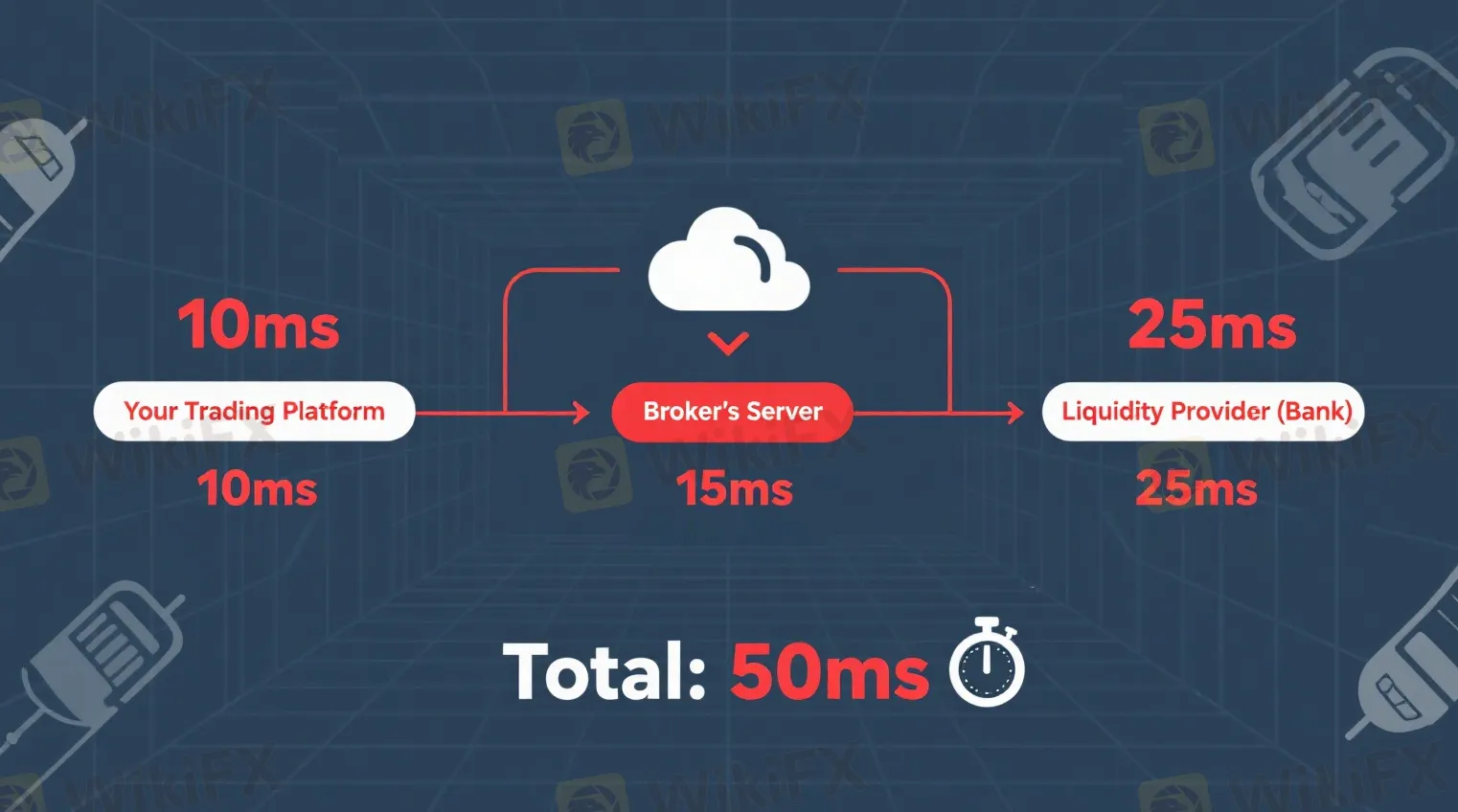

Your trade order doesn't travel instantly. It goes from your trading platform, across the internet to your broker's server, and then from the broker's server to the liquidity provider (a big bank or financial institution) that will fill your order. While this process only takes milliseconds, it's not zero time. This delay is called latency. In a calm market, a few milliseconds don't matter. But during volatile periods, a 50-millisecond delay is plenty of time for the market price to change significantly, causing slippage. How far you are from your broker's servers can also add to this delay.

Liquidity means how many buyers and sellers are available at any given price level. High liquidity means lots of people are willing to trade large amounts with small bid-ask spreads. Low liquidity is the opposite. This often happens when trading less common currency pairs, during quiet trading hours (like the end of the New York session), or around major bank holidays. When liquidity is low, there might not be enough trading volume available at your requested price. The system then has to look for the next available price to fill your order, which could be several pips away. This forces the execution price to “slip” to find enough volume.

The word “slippage” sounds negative, and most traders think it always works against them. This is a common mistake that can be costly. Slippage is simply a price difference, and that difference can help you just as much as it can hurt you. Understanding this gives you a more balanced and accurate view of trade execution.

This is what traders usually worry about and why the deviation setting exists. Negative slippage happens when your trade gets filled at a worse price than you expected.

This happens most often during high-volatility breakouts where the price is moving quickly against your entry direction when your order gets executed.

This is the good side of slippage, where your trade gets filled at a better price than you expected.

Positive slippage can happen in fast markets just like negative slippage can. The possibility of getting positive slippage is often a sign of a fair and honest broker, especially one using an ECN/STP execution model. It shows that they're sending your order to the real market and giving you the best price available when your order gets executed, whether it helps you or them.

Knowing the theory is one thing; actually doing it is another. Fortunately, setting deviation in the world's most popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), is straightforward. This practical skill lets you take direct control over your trade execution.

Follow these simple steps to turn on and set up the deviation setting for your market orders.

1. Open the 'New Order' Window. You can do this by pressing the F9 key, right-clicking on the chart and selecting 'Trading' -> 'New Order', or clicking the 'New Order' button in the toolbar.

2. Find the 'Deviation' Field. In the 'New Order' window, look below the 'Stop Loss' and 'Take Profit' fields. You'll see a checkbox labeled “Enable maximum deviation from quoted price.”

3. Turn on the Feature. Click the checkbox to activate the deviation setting.

4. Enter Your Desired Value. In the input box next to the checkbox, enter your maximum acceptable deviation. It's very important to understand that this value is set in 'points', not 'pips'. For most currency pairs, there are 10 points in 1 pip (for example, a move from 1.08500 to 1.08510 is 1 pip, or 10 points). So, if you want to allow a maximum deviation of 2 pips, you must enter “20” in the box.

There's no single “perfect number” for deviation that works for all traders in all situations. The best setting depends completely on your trading strategy, the market conditions, and how much risk you're comfortable with. Here's a guide to help you decide.

Your experience with deviation and slippage isn't just about the market - it's heavily influenced by your broker's execution model. The way your broker handles your orders determines the type and frequency of slippage you'll experience. Understanding this difference is crucial when choosing a broker that fits your trading style.

A Market Maker, or Dealing Desk broker, is the direct counterparty to your trades. When you buy, they sell to you; when you sell, they buy from you. They create the “market” for their clients. Because they control the pricing, they can often offer “zero slippage” or “guaranteed fills” on market and stop-loss orders.

However, this comes with a significant trade-off: requotes. If you try to execute a trade and the price moves quickly against them, a Market Maker may reject your order and offer you a new, worse price - a requote. Your deviation setting in this model basically tells the dealing desk how much they're allowed to slip the price in their favor while still filling your order without sending a requote. While it can protect against slippage, it can also lead to missed trading opportunities during fast moves.

An ECN (Electronic Communication Network) or STP (Straight Through Processing) broker operates a No Dealing Desk model. They don't take the other side of your trade. Instead, they act as a middleman, passing your order directly to the interbank market, where it interacts with a pool of liquidity providers (banks, hedge funds, and other brokers).

In this transparent environment, slippage is a natural and expected part of execution. Because the broker is just a messenger, they can't guarantee your price. You get the best price available from the liquidity pool at the exact moment of execution. This means you'll experience both negative and positive slippage. Based on our observations, with true ECN brokers, getting positive slippage, especially on limit orders, is a real possibility and a strong sign of a healthy, fair execution environment. Your deviation setting here is a pure instruction: fill the order if the market price is within this range, otherwise, cancel it. There are no requotes, only fills or rejections.

The “better” model depends on what the trader values most.

| Factor | Market Maker (Dealing Desk) | ECN/STP (No Dealing Desk) |

| Execution Method | Broker is the counterparty. | Order passed to interbank market. |

| Slippage Type | Mostly negative slippage or zero slippage. Positive slippage is rare. | Both positive and negative slippage occur naturally. |

| Requotes | Common during high volatility. | Very rare or non-existent. Orders are filled or rejected. |

| Transparency | Prices set by the broker. Potential conflict of interest. | Prices come from the live market. High transparency. |

| Best For... | Beginners who fear slippage and prefer simpler execution rules. | Intermediate to advanced traders who prioritize speed and transparency. |

To make these concepts real, let's walk through a case study. This is a common scenario that shows the important trade-off a trader makes when setting their deviation.

The Setup: A trader, let's call her Anna, is getting ready to trade the GBP/USD pair. It's five minutes before the Bank of England is scheduled to announce its latest interest rate decision. The market is very quiet, with the price staying around 1.2500. Anna expects a hawkish statement, which would be good news for the pound.

The Action: The news breaks, and it's even more hawkish than expected. The price explodes upward. Anna reacts instantly, clicking the “Buy” button at 1.2500. Having been frustrated by slippage before, she had set her maximum deviation to a very tight 2 pips (20 points), wanting a precise entry.

The Outcome: In the fraction of a second between her click and the order reaching the server, the price doesn't just move up a little - it gaps. The first available price is now 1.2515, a full 15 pips higher. Her platform immediately rejects the order. A message appears on the screen: the price has moved too far. The 15-pip actual slippage was way more than her 2-pip maximum deviation setting. Anna watches, unable to move, as the price continues to shoot higher without her. She missed the entire initial, most profitable part of the move.

The Lesson: Anna's thinking afterward was important. On one hand, her deviation setting worked perfectly; it protected her from being filled 15 pips away from her intended entry, which could have been a terrible start. On the other hand, her setting was completely wrong for the event she was trying to trade. It was too precise for the level of volatility. She realized that for a high-impact news release, a wider deviation was necessary. A wider setting might have gotten her an entry, perhaps at 1.2512 or 1.2515. While not her ideal price, it would have put her in a trade that ultimately ran for over 100 pips. The story shows the essential balance between precision and the certainty of execution.

Simply setting your deviation is just the first step. Professional traders use a range of strategies to actively manage execution risk and minimize the negative effects of slippage. Using these techniques can significantly improve your trading results.

Market orders say, “Get me in now at the best price available.” This makes them highly susceptible to slippage. Pending orders, however, work differently. A Buy Limit or Sell Limit order specifically tells the broker to fill you only at your specified price or better. This effectively eliminates the possibility of negative slippage on entry. The trade-off is that if the price touches your level and immediately moves away, your order may not get filled at all. Buy Stop and Sell Stop orders are designed to enter a trade once a certain price is broken and will still be subject to slippage, but they allow you to plan entries around key levels without watching your screen constantly.

The simplest risk management strategy is often the most effective: step aside. Unless you're an experienced news trader with a specific strategy for these events, it's wise to avoid opening new market orders in the five minutes before and after a major, high-impact news release. During these brief windows, spreads can widen dramatically, and slippage can increase by 5-10 times the normal amount. The risk of a terrible fill far outweighs the potential reward for most retail traders.

Latency directly causes slippage. Therefore, reducing latency is a direct solution. When choosing a broker, look into their execution speed and server infrastructure. A top-tier broker will have servers located in major financial data centers like London (LD4) or New York (NY4), right next to the servers of their liquidity providers. This physical closeness drastically reduces latency, leading to faster fills and less potential for slippage.

Before risking real money, always test your strategies and settings on a demo account. Use the demo account to intentionally trade during volatile news events. Try different deviation settings - use a tight one, then a wide one. This risk-free practice will give you valuable experience with how your specific broker handles execution under pressure. It helps you understand their slippage and requote behavior so you're not surprised when real money is on the line.

In the end, understanding what is deviation in forex is about understanding the very nature of trade execution. We've seen that deviation is your direct command to the broker, your primary tool for controlling the market phenomenon of slippage. This slippage is not an error but a natural result of volatility, latency, and liquidity in a fast-moving market. Importantly, it can be positive as well as negative.

Your strategy, your broker's model, and the market's current condition all determine how you should approach this powerful setting. What is deviation in forex is not an enemy to be feared or a setting to be ignored. It's a critical risk management tool that requires thought, practice, and adaptation. By understanding what deviation is and how to use it wisely, you move from being a passenger to the market's whims to being a pilot in control of your trade execution. This mastery is a defining step on the path to consistent and confident trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Champion Strategy Revealed: Get a Head Start on Winning

The formation of the SkyLine Guide 2026 Thailand judge panel has officially begun. This year’s selection brings important upgrades to both the evaluation mechanism and participation approach, further emphasizing the role of local perspectives and authentic investor experiences within the judging framework.

WikiFX Elite Club Focus is a monthly publication created exclusively for members of the WikiFX Elite Club. It spotlights the individuals, ideas, and actions that are genuinely driving the forex industry toward greater transparency, professionalism, and long-term sustainability.

Switched to Galileo FX from other brokers, thinking that you would earn profits, but things went the other way round? Did you continue to face losses despite executing constant optimizations on the trading software? Like did you experience issues concerning executing stop-loss orders? Failed to cash in on the positive market wave because of the broker’s trading bot? You are not alone! Many complaints concerning losses due to trading bot deficiencies have been doing the rounds. In this Galileo FX review article, we have demonstrated these complaints. Take a look!