Abstract:A 77-year-old man in Kuala Terengganu lost more than RM100,000 to a foreign currency exchange (forex) investment scam that began with a Facebook friend request.

A 77-year-old man in Kuala Terengganu lost more than RM100,000 to a foreign currency exchange (forex) investment scam that began with a Facebook friend request.

According to Kuala Terengganu police chief ACP Azli Mohd Noor, the victim was introduced to the scheme on 28 May by the sister of a woman he had befriended on Facebook. Trusting the connection, he agreed to join the purported investment programme.

In the first week, he deposited RM3,000 into what he believed was his forex account. The fraudsters provided a fake receipt as proof of the deposit and later sent a screenshot via WhatsApp showing supposed profits. Encouraged by these apparent gains, he committed an additional RM69,000 to the scheme.

When the victim attempted to withdraw his profits, he was told he needed to make another payment of RM35,844. The perpetrators claimed this was required because his earnings involved “elements of money laundering” and had to be cleared before withdrawal. Realising he had been deceived, the man lodged a police report. The case is now under investigation under Section 420 of the Penal Code, which covers cheating and dishonestly inducing delivery of property.

The growing vulnerability of older adults to sophisticated online investment scams remains a serious concern in Malaysia. Many retirees have accumulated substantial savings or pension funds, making them appealing targets for fraudsters who promise high returns through bogus investments such as fake bonds, cryptocurrency schemes, or unrealistic trading opportunities.

In addition to financial means, older investors often face a knowledge gap in navigating online threats. While younger generations have grown up with the internet and are generally more familiar with digital red flags, many older individuals may lack the experience to identify counterfeit websites, phishing messages, or fraudulent trading platforms. Even regular internet users in this age group can be caught off guard by well-designed but deceptive interfaces.

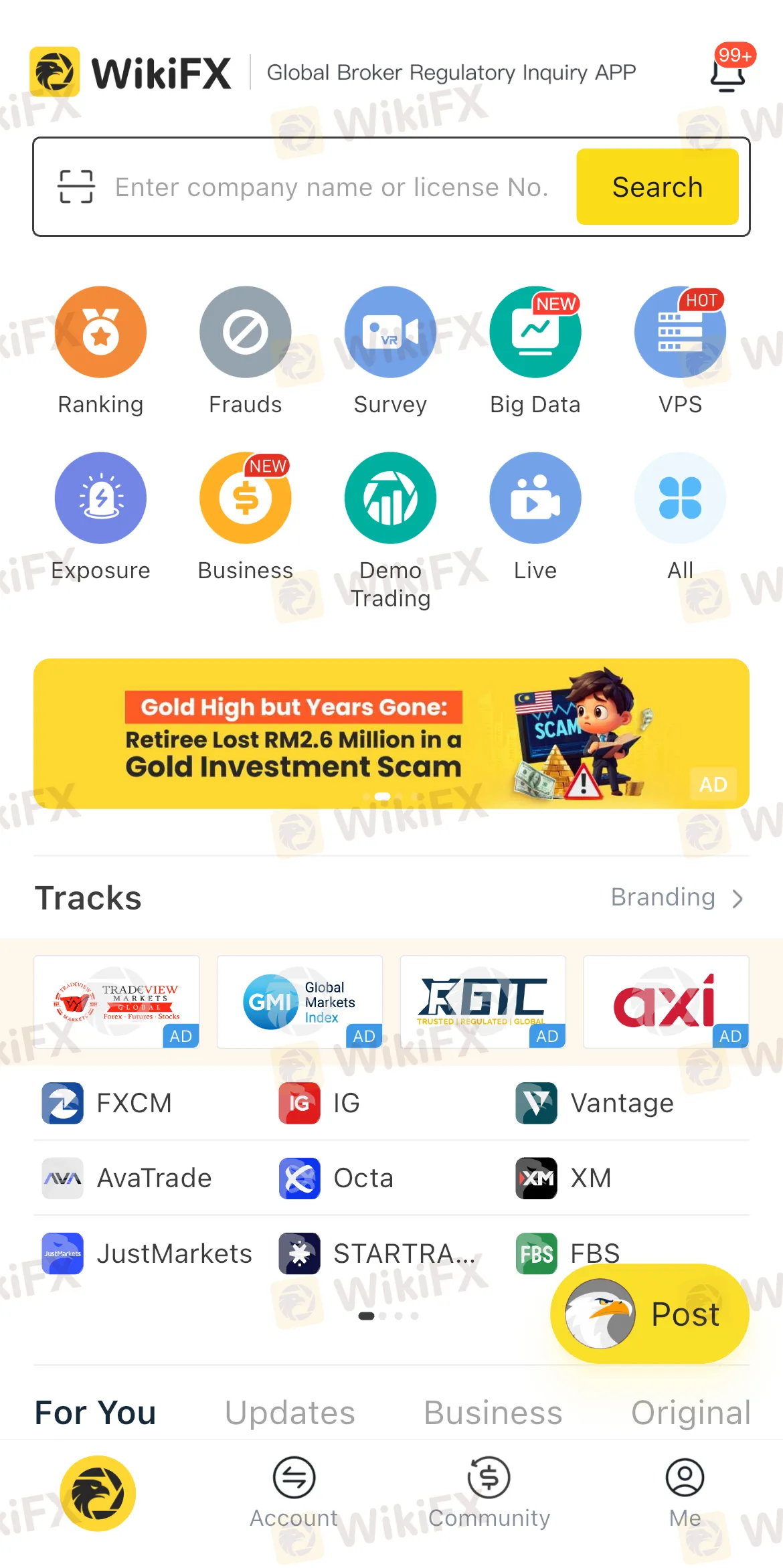

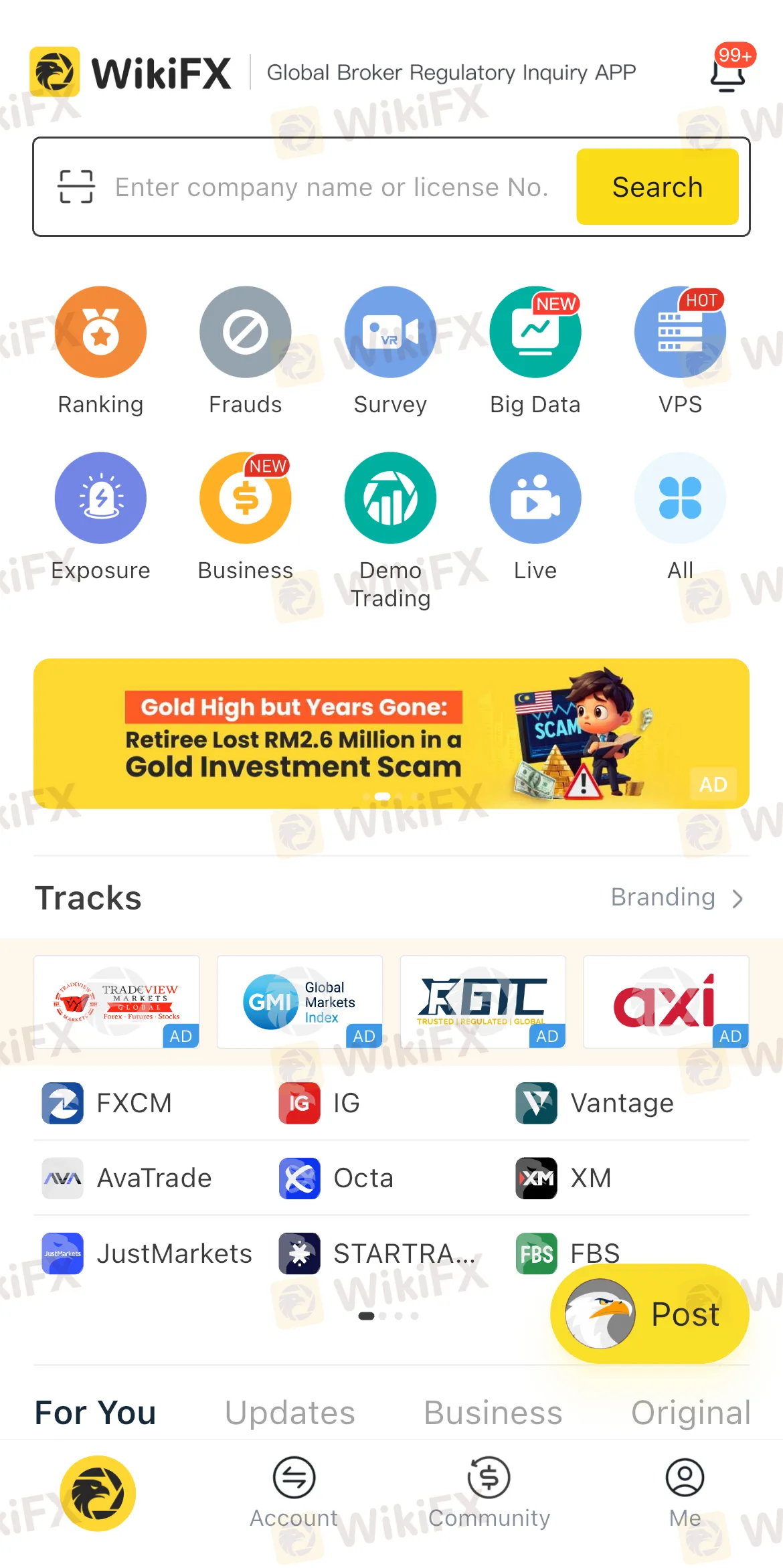

Industry experts stress the importance of verifying the legitimacy of brokers and financial platforms before investing. One tool available to the public is WikiFX, a platform offering a database of global broker profiles, regulatory status updates, and user reviews. The applications risk ratings and alerts flag unlicensed or suspicious entities, enabling investors to recognise warning signs before parting with their money.

By conducting a quick background check on a broker through services like WikiFX, individuals can avoid falling into the traps of unregulated schemes. This simple step can help safeguard savings that may have taken decades to build. The application is available for free on both the App Store and Google Play. There is nothing to lose and everything to gain with this free app!