Abstract:Finding a well-regulated broker offering MetaTrader 4 (MT4) in the U.S. isn’t easy—strict oversight from the CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association) maintains trader safety and market integrity.

Finding a well-regulated broker offering MetaTrader 4 (MT4) in the U.S. isnt easy—strict oversight from the CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association) maintains trader safety and market integrity.

Here are standout MT4-compatible brokers that U.S. traders can trust in 2025:

Top U.S.-Regulated MT4 Brokers

OANDA (US)

- Fully regulated by the CFTC and NFA.

- Offers user-friendly tools, robust research, and seamless MT4 integration.

- Recognized across multiple lists as one of the best MT4 brokers for U.S. traders.

OANDA is a well-known online forex broker that has been operating for over two decades. It is headquartered in New York City and is regulated in multiple jurisdictions, including the US, UK, Canada, Australia, Japan, and Singapore. With a reputation for transparency and reliability, OANDA offers CFD trading on forex, indices, cryptos, commodities, and bonds on TradingView, Oanda mobile, Oanda web, and MT4 platforms.

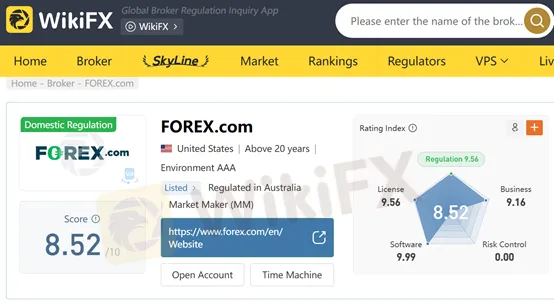

FOREX.com

- Operated by StoneX; regulated by CFTC/NFA.

- Offers powerful MT4 capabilities, a wide range of currency pairs, and strong analytical tools.

- Frequently rated among the best U.S. forex brokers overall.

Forex.com is a major player in forex trading, providing various options including forex, indices, stocks, cryptos, gold, oil & commodities, and bullion. Their platforms, like the popular MetaTrader 4 and MetaTrader 5, are available worldwide to meet different trader preferences. Backed by robust regulation and a strong focus on security, Forex.com is a favored choice for professionals looking for an all-encompassing trading experience. Now, let's delve deeper to verify if Forex.com lives up to its reputation.

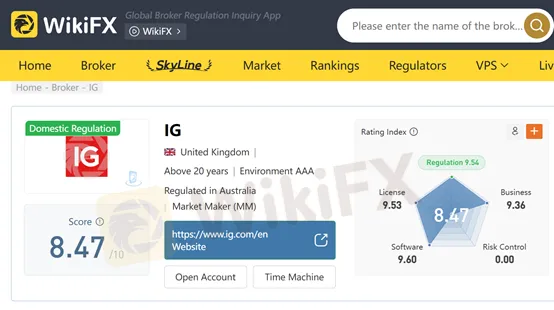

IG US

- U.S. division of global broker IG; regulated by CFTC/NFA.

- Excellent educational resources, tight spreads, and strong MT4 performance.

- Frequently rated top in MT4 usability in the U.S.

IG is a UK-registered company and regulated by multiple international financial bodies, including the ASIC, FCA, FSA, FMA, MAS, and DFSA. It offers access to a 17,000+ markets, including forex, indices, shares, commodities, and cryptocurrencies. The company provides multiple trading platforms, including L2 dealer, ProRealTime, MT4, and TradingView.

What Makes These Brokers Stand Out

- Regulatory Safety: All are compliant with CFTC and NFA, ensuring strict standards and protection for U.S. clients

- Platform Competence: MT4 is the core offering, supported with strong functionality, fast execution, and advanced tools.

- Flexible Access: Many offer low or no minimum deposits, along with demo accounts for practice trading.

- Features & Support: Educational materials, robust research, and responsive customer support enhance the trading experience, especially for new traders.

How to Choose Your MT4 Broker

- Ensure Regulation – Always confirm the broker is registered with CFTC and NFA.

- Compare Costs – Review spreads, commissions, and non-trading fees like withdrawals and inactivity.

- Check Platform Experience – Open a demo to test execution speed and MT4 features.

- Assess Support & Education – Beginners will benefit from brokers that provide tutorials, webinars, and real-time customer assistance.

- Understand Account Details – Look at minimum deposit requirements, available instruments, leverage caps, and account types.