WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

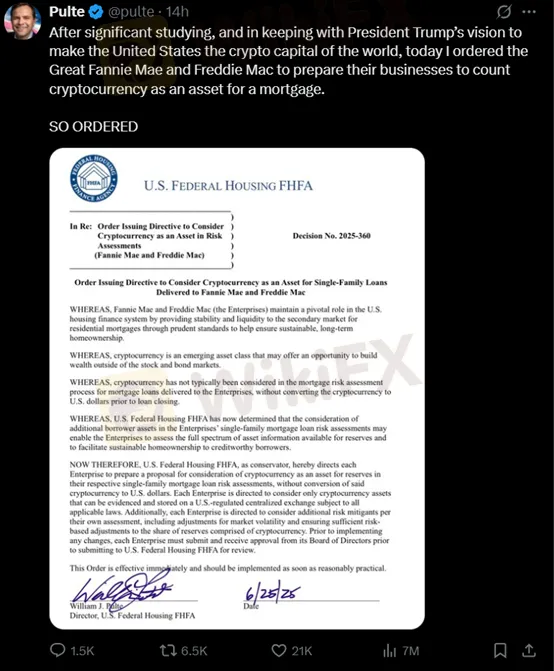

Abstract:The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The U.S. Federal Housing Finance Agency (FHFA) has issued a directive to mortgage giants Fannie Mae and Freddie Mac to begin evaluating cryptocurrency holdings as part of mortgage risk assessment criteria.

The move marks a potential turning point for crypto adoption in the U.S. housing market and reflects the federal governments evolving stance on digital assets.

A Boost for Crypto-Holding Borrowers

The directive, announced Wednesday by FHFA Director William Pulte via social media, signals an effort to make mortgage financing more accessible for homebuyers who hold digital assets.

“After extensive research and in line with President Trump‘s vision to make America the ’crypto capital of the world, I have directed Fannie Mae and Freddie Mac to prepare for the inclusion of cryptocurrency holdings as recognized assets in mortgage applications,” Pulte posted.

While some smaller lenders in the U.S. have previously accepted crypto as collateral, this is the first time a federal housing authority has formally acknowledged digital assets in mortgage underwriting standards.

The FHFA's move comes at a time when mortgage application volumes remain sluggish, weighed down by high interest rates and affordability challenges. By expanding the definition of eligible assets, the agency is not only increasing accessibility but also potentially stimulating loan activity in a stagnating housing market.

Analysts note that this change could unlock lending opportunities for a growing segment of digitally native borrowers who may not hold significant traditional assets but possess meaningful crypto wealth.

Unanswered Questions Remain

However, the directive stopped short of specifying which cryptocurrencies will be eligible for consideration. This lack of clarity raises questions around volatility, valuation methods, and regulatory consistency, particularly as crypto markets remain highly fluid and decentralized.

Industry experts stress the importance of clear guidelines to prevent abuse and ensure that lenders can accurately assess risk.

“This is a bold step, but the details will matter. Without standardized rules on acceptable coins, pricing models, and custody requirements, implementation will be complex,” said a senior analyst at a Washington-based financial policy think tank.

Aligning with the Trump Administration's Crypto Agenda

The FHFA‘s move aligns closely with the Trump administration’s broader agenda to promote cryptocurrency adoption across financial sectors. Since returning to the political spotlight, former President Trump has repeatedly voiced support for blockchain innovation and digital finance infrastructure in the U.S.

The decision also hints at a larger regulatory shift, where federal agencies may begin integrating crypto considerations into other forms of financial oversight and risk modeling.

Conclusion

By instructing Fannie Mae and Freddie Mac to prepare for crypto asset integration, the FHFA is signaling a historic shift in U.S. housing finance policy. While challenges around implementation, regulation, and market volatility remain, the move opens new doors for crypto-savvy homebuyers and brings the U.S. one step closer to mainstreaming digital assets.

As the details unfold, all eyes will be on how the mortgage industry responds — and whether the FHFAs bold step will usher in a new era of crypto-backed home ownership.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.