简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

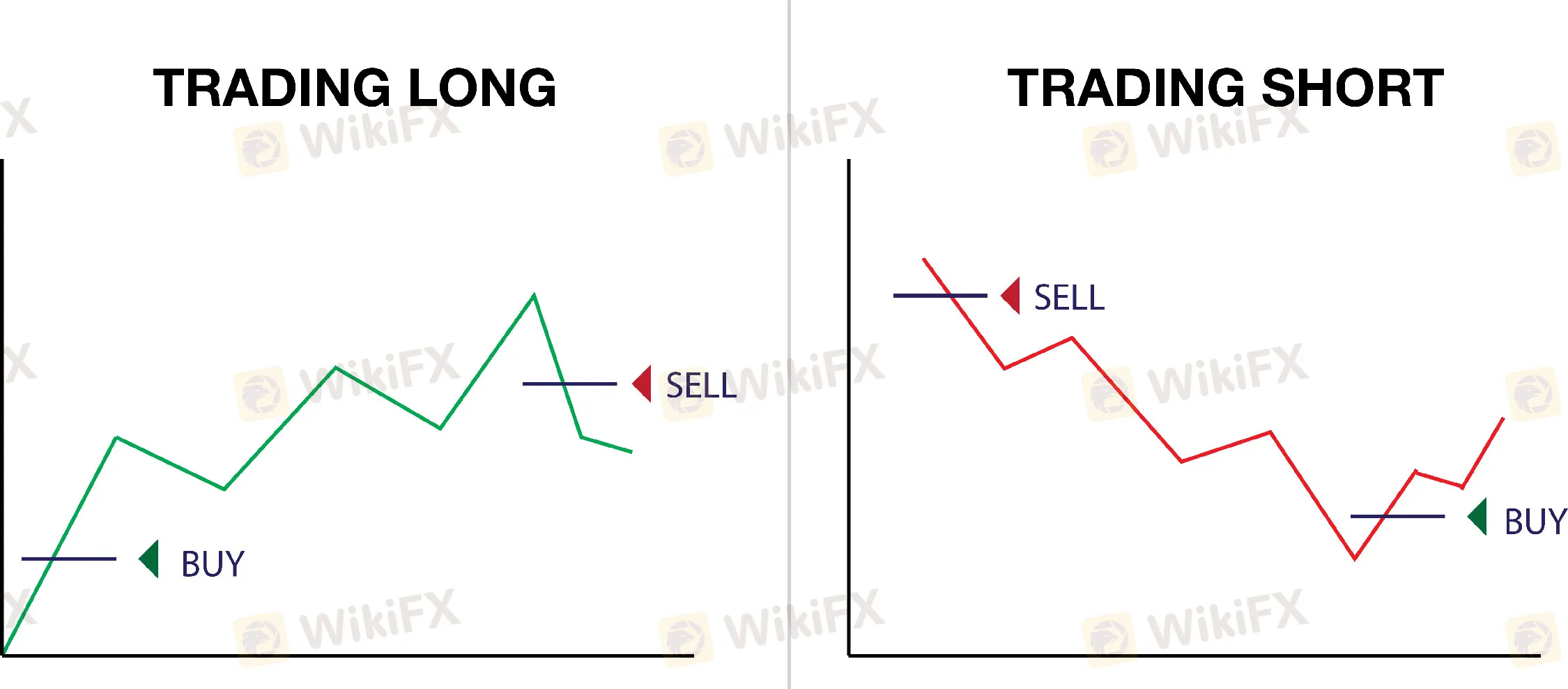

Long & Short Trading Explained for Beginners

Abstract:Want to master the market and profit whether prices rise or fall? Long and short trading are the ultimate tools every trader needs! Whether you’re a complete beginner or looking to refine your strategy, this guide breaks down how to buy low/sell high (long) and sell high/buy low (short) with clarity.

What you will learn:

✅What long and short trades mean?

✅Key differences in risk, execution, and strategy

✅When to use each approach (bullish vs. bearish)?

✅Step-by-step guides to executing trades + critical mistakes to avoid

By the end, youll grasp how to align your trades with market trends and protect your capital.

What is a Long Trading?

A long trade (or “going long”) is when you buy an asset (e.g., a stock, currency pair, or commodity) with the expectation that its price will rise over time. You profit by selling the asset later at a higher price than you paid.

e.g.

- You buy 100 shares of Company X at $50 per share (total cost = $5,000).

- If the price rises to $70, you sell them for $7,000.

- Profit = $7,000 - $5,000 = $2,000.

What is Short Trading?

A short trade (or “going short”) is when you sell an asset you dont own (borrowed from a broker) with the expectation that its price will fall. You profit by buying the asset back later at a lower price and returning it to the lender.

e.g.

- You borrow 100 shares of Company Y from a broker and sell them at $100 per share (total = $10,000).

- If the price drops to $80, you buy back the shares for $8,000 and return them to the broker.

- Profit = $10,000 - $8,000 = $2,000.

Long vs. Short: Key Differences

Understanding whether to go long (buy) or short (sell) is fundamental to trading. Below is a comparison table of the differences between long trades and short trades:

| Long Trade | Short Trade | |

| Goal | Profit from rising prices | Profit from falling prices |

| Market View | Bullish (price will rise) | Bearish (prices will fall) |

| Risk | Limited (price can't go below 0) | Unlimited (price can soar) |

| Leverage Use | Common in forex/stocks | Requires margin (borrowed funds) |

| Common Tools | Buy orders, stop-loss below | Sell orders, stop-loss above |

| Time Horizon | Flexible (minutes to years) | Typically short-term |

| Complexity | Beginner-friendly | Advanced (margin, borrowing) |

Key Takeaways:

- Long trades are safer for beginners.

- Short trades require strict risk management (e.g., stop-losses) due to unlimited downside.

- Always practice with a demo account first.

How to Execute Long/Short Trades?

Executing long (buy) and short (sell) trades involves different steps and risks. Heres a clear breakdown:

Executing a Long Trade (Buying)

Step 1: Choose a Trading Platform

Open an account with a broker (e.g., MetaTrader4/5, TradingView, or platforms like eToro).

Step 2: Analyze the Market

Use technical analysis (e.g., support/resistance levels, RSI, moving averages) or fundamental analysis (e.g., earnings reports, news) to identify bullish opportunities.

Step 3: Enter the Trade

Click “Buy” or “Go Long” on your platform. e.g., Buy 100 shares of Stock X at $50/share.

Step 4: Set Risk Management Tools

Place a stop-loss order (e.g., sell if price drops to $48). Set a take-profit order (e.g., sell at $55).

Step 5: Monitor and Close

Wait for the price to rise, then manually close the trade or let orders execute automatically.

Executing a Short Trade (Selling)

Step 1: Ensure You Have a Margin Account

Shorting requires borrowing assets, so you need a margin account (e.g., with Interactive Brokers (IB), Robinhood, or FXCM).

Step 2: Analyze the Market

Look for bearish signals (e.g., overvalued stocks, negative news, or downtrends).

Step 3: Borrow and Sell the Asset

Click “Sell” or “Go Short” on your platform. e.g., Borrow 100 shares of Stock Y and sell them at $100/share.

Step 4: Set Risk Management Tools

Place a stop-loss order (e.g., buy back if price rises to $105). Set a take-profit order (e.g., buy back at $90).

Step 5: Buy Back and Return the Asset

When the price drops, buy back the shares and return them to the lender. Profit = (Sell Price - Buy Price) × Quantity.

When to go Long or Short?

Go Long (Buy)

- Uptrend: Price breaks resistance or stays above key moving averages (e.g., 200-day MA).

- Positive catalysts: Earnings beats, new products, or sector growth (e.g., AI boosting tech stocks).

- Undervalued: Low P/E ratio or oversold RSI (<30).

e.g. Buy Tesla if its price breaks a resistance level after a positive product launch.

Go Short (Sell)

- Downtrend: Price falls below support or under key moving averages.

- Negative catalysts: Poor earnings, scandals, or recessions (e.g., oil drops due to oversupply).

- Overvalued: High P/E ratio or overbought RSI (>70).

e.g. Short a stock if it plunges after a fraud accusation.

Risks & Mistakes to Avoid

Trading offers opportunities but comes with significant risks. Here are some common pitfalls and how to avoid them:

#1 Overleveraging: The Silent Killer

Risk: Using excessive leverage (e.g., 100:1) amplifies both gains and losses.

e.g. A 1,000 account with 50:1 leverage→50,000 exposure. A 2% price drop wipes out your entire account.

Fix: Stick to low leverage (e.g., 10:1) and risk ≤2% of your capital per trade.

#2 Ignoring Stop-Loss Orders

Mistake: “Hoping” a losing trade will recover.

Result: Small losses snowball into catastrophic ones.

Fix: Always set a stop-loss (e.g., 1-3% below entry) to cap losses automatically.

#3 Emotional Trading

Risks: FOMO (Fear of Missing Out): Chasing trends without analysis; Revenge Trading: Doubling down after a loss to “win back” money.

Fix: Follow a trading plan and take breaks after losses.

#4 Neglecting Fundamentals

Mistake: Relying solely on charts while ignoring news (e.g., interest rates, earnings reports).

e.g. Going long on stock before a CEO scandal crashes its price.

Fix: Combine technical + fundamental analysis.

#5 Overtrading

Risk: Placing too many trades to “stay active” → higher fees + emotional burnout.

Fix: Focus on quality setups (1-3 trades/day) with clear entry/exit rules.

#6 Not Diversifying

Mistake: Putting all funds into one asset (e.g., only forex or crypto).

Result: A single market crash destroys your portfolio.

Fix: Spread risk across uncorrelated assets (e.g., forex + stocks + commodities).

Trading is a marathon, not a sprint. Avoid these mistakes, and youll already be ahead of 90% of beginners.

Final Takeaways

Remember that long trades let you ride bullish trends with controlled risks, while short trades turn market downturns into opportunities (but demand strict risk management).

Your next steps:

1️⃣ Practice First: Test strategies risk-free with a demo account.

2️⃣ Start Small: Use micro-lots or small positions to build confidence.

3️⃣ Stay Disciplined: Stick to stop-losses and avoid emotional decisions.

Long & Short Trading FAQs

What is long and short in forex trading?

Long is buying a currency pair (e.g., EUR/USD) expecting its price to rise (profit from upward moves).

Short is selling a currency pair expecting its price to fall (profit from downward moves).

Which is riskier: long or short trading?

Short trading carries higher risks: unlimited potential losses (prices can rise infinitely); requires margin/leverage (amplifies losses).

Long trading risks are capped (max loss = initial investment, if no leverage).

Which is better, long or short trading?

There is no absolute “better” – long trading is suitable for bulls and risk averse, short trading is suitable for bears and risk tolerance, and can be flexibly chosen according to market direction and personal strategy.

Can I lose more money than I invest?

Long trades: No (unless using leverage).

Short trades: Yes. Prices can rise indefinitely → Losses exceed initial capital. e.g. Shorting a stock at $50→ It jumps to $200 → You owe $150/share.

What markets can I trade long/short?

- Forex: Easily go long/short any currency pair (e.g., EUR/USD).

- Stocks: Shorting requires a margin account; some stocks are hard to borrow.

- Crypto: Many exchanges allow shorting (e.g., Bitcoin futures).

Can I hold short positions long-term?

Not recommended. Shorting costs fees (e.g., borrowing interest) and risks sudden price spikes.

Can I use both strategies at the same time?

Yes. Advanced traders “hedge” (e.g., long gold + short USD during inflation) while for beginners, focusing on mastering one strategy first is the best choice.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is Purple Trading a Scam? Honest User Reviews Reveal the Truth

Kraken Review: A Tale of Unsolved Withdrawal Issues & Poor Customer Support Service

IG Launches 5% Cashback Offer for New UK Customers

Forex Trading During Pakistan Market Hours: Best Time to Trade

KKR Exposed: Traders Allege Fund Scams, Withdrawal Denials & Regulatory Concerns

Malaysia’s SkyLine Guide Top 25 Brokers Are Out!

EPlanet Broker Review: Detailed Look at Regulation, User Experiences & Reported Complaints

In-Depth Stonefort Securities Commission Fees and Spreads Analysis for 2025

In-Depth Review of MH Markets Regulation and Compliance Profile – What Traders Should Really Know

Trading Suspended at CME Group Today due to Cooling Issue

Currency Calculator