简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Start Trading with XM: Account Types, Demo Account, and Withdrawal

Abstract:XM is a Forex and CFD broker registered in Belize and regulated by several internationally renowned financial authorities, including ASIC, CySEC, DFSA, and FSC (Offshore). It offers 1,400+ tradable instruments, including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices via the MT4, MT5 and the XM App.

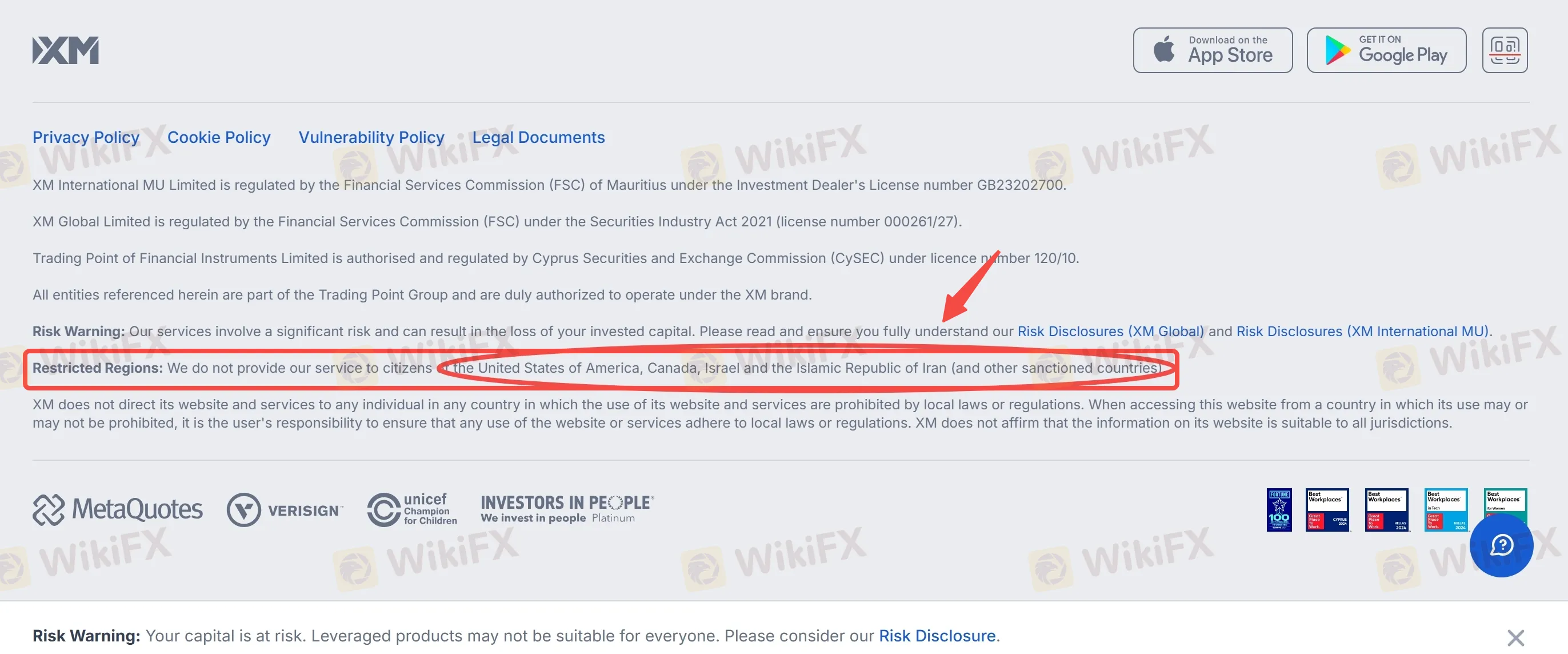

Note: XM does not provide services to citizens of the United States of America, Canada, Israel and the Islamic Republic of Iran (and other sanctioned countries).

XM Review at a Glance

| XM at a Glance |

| Founded | 2009 |

| Registered | Belize |

| Regulation | ASIC, CySEC, FSC (Offshore), DFSA |

| Security of Funds | Account segregation, negative balance protection, two-step authentication, investor protection schemes |

| Trading Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energy, thematic indices |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Account Type | Standard, Ultra Low, Shares |

| Account Minimum | $5 |

| Maximum Leverage | 1:1000 |

| Spread | From 0.8 pips |

| Trading Platforms | MT4/MT5, XM App |

| Copy Trading | ✅ |

| Deposit & Withdrawal Fee | ❌ (except on withdrawals via bank wires below $200 or equivalent) |

| Inactivity Fee | 10 USD monthly |

| Bonus | 20% deposit bonus up to $2,000 |

XM is a Forex and CFD broker registered in Belize and regulated by several internationally renowned financial authorities, including ASIC, CySEC, DFSA, and FSC (Offshore). It offers 1,400+ tradable instruments, including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices via the MT4, MT5 and the XM App.

Is XM Safe and Legit?

Yes. XM is a legit brokerage with top-tier regulations, including the Australia Securities & Investment Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission (FSC) in Belize, and the Dubai Financial Services Authority (DFSA).

You can verify XM's regulatory status and explore more details on WikiFX.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License No. |

| ASIC | Regulated | TRADING.COM MARKETS PTY LTD | Market Making (MM) | 000443670 |

| CySEC | Regulated | Trading Point of Financial Instruments Ltd | Market Making (MM) | 120/10 |

| FSC | Offshore Regulated | XM Global Limited | Retail Forex License | 000261/397 |

| DFSA | Regulated | Trading Point MENA Limited | Retail Forex License | F003484 |

Your funds are kept in segregated accounts with well-established, highly reputable Banking Institutions. Besides, negative balance protection and two-step authentication are available. XM also offers investor protection schemes -- FSCS (up to £85,000) for UK clients under XM UK (regulated by FCA).

XM Account

Demo Account

XM offers demo accounts, which provide a risk-free way of testing your trading strategies in a simulated environment using virtual funds.

You can use your XM Demo account for as long as you like, but, if it remains inactive for over 60 days, it will be closed automatically. Even if this happens, you can open a new Demo account anytime. You can also have up to 5 active Demo accounts anytime.

| XM Demo Account Feature | |

| Trading Platform | MT4/5 |

| Account Opening Fee | $0 |

| Default Balance | $5,000,000 |

| Account Duration | Unlimited |

| Number of Demo Accounts | 5 |

Although a demo account includes all the same features and functionality as a real account, keep in mind that trading in a simulated environment is different to trading under real market conditions, mainly because of the psychology involved. Remember this when evaluating your performance on your demo account.

Account Types

Apart from free demo accounts, XM also offers three real account types, Standard, Ultra Low, and Shares, which provide you with access to live markets, where you trade using your funds.

The accepted currencies include USD, EUR, JPY, GBP, AUD, CHF, and ZAR.

Most brokers offer the Standard account, and so does XM. XM Standard account requires a minimum deposit amount of just $5, which is very friendly for beginners.

However, if you are a beginner, we recommend the XM Ultra Low account, which is equipped with more competitive trading conditions than the Standard account. For example, the EUR/USD spread starts from 1.6 pips on the Standard account, while starts from 0.8 pips on the Ultra Low account. Besides, the Ultra Low account can enjoy swap-free trading while the Standard account can't.

XM also offers a Shares account, which is specially for share traders. But demo trading is not available for this account type and you have to pay an unspecified commission.

You can view the table below to quickly understand the similarities and differences between the three account types.

| XM Real Account Comparison | |||

| Account Type | Standard | Ultra Low | Shares |

| Best for | All traders | Beginners | Traders who specialize in shares trading |

| Trading Markets | Forex, precious metals, equity indices, thematic indices, turbo stocks, commodities, energy | Shares | |

| Base Currencies | USD, EUR, JPY, GBP, AUD, CHF, ZAR | ||

| Minimum Deposit | $5 | $10,000 | |

| Maximum Leverage | 1000:1 | 1:1 | |

| Stop out Level | 20% | 0% | |

| Spread (Gold) | From 3.7 pips | From 1.6 pips | / |

| Spread (USD/JPY) | From 2 pips | From 0.9 pips | / |

| Spread (EUR/USD) | From 1.6 pips | From 0.8 pips | / |

| Commission | ❌ | ❌ | ✅ |

| Micro Account | ✅ | ✅ | ❌ |

| Swap Free | ❌ | ✅ | ✅ |

| Demo Trading | ✅ | ✅ | ❌ |

| Bonus | ✅ | ❌ | ❌ |

You can have up to 10 active trading accounts, and 1 Shares account, open simultaneously.

If your account has no activity – including trading, deposits, withdrawals, internal transfers, opening additional accounts, and registration activity for more than 90 days, your account will be dormant.

Once an account becomes dormant, any remaining bonuses, promotional credits, or XMPs associated with it will be automatically removed. All dormant accounts are charged a monthly fee of 10 USD, or the full amount of your available balance in cases where it is below 10 USD. If your available balance is zero, no fees will be charged.

For further reading, you can directly visit https://www.xm.com/help-center/trading-accounts/are-all-instruments-swap-free-for-ultra-low-account-holders

How do I Open an XM Account? (Step by Step)

Opening an XM account is simple, just follow the steps below:

Step 1: Visit XM's website.

Step 2: Fill in the required information.

Step 3: Check your email.

Step 4: Enter into your Members Area.

Step 5: Set up your trading account.

Step 6: Create a password.

To be specific,

Step 1: Go to XM's website and click on the 'Get Started' button or the 'Get Your Welcome Bonus' button.

Step 2: Fill in the required information, including your country of residence and email address. Set a password. If you have a Partner Code, you can enter it. Tick that 'I consent to receiving marketing communications and to the use of my data for marketing optimization and ad personalization purposes. My consent may be withdrawn at any time.' Then click the 'Register' button.

Step 3: Check your email.

Click the 'Verify Email' button.

Step 4: Now you can see your Members Area, as the screenshot below shows. Click the 'My Accounts' in the left-hand navigation.

Then click the 'Open Additional Account' on the right. Choose the account type you want to open, real account investor account, or custom demo account.

Here, we select the 'Custom Demo Account' as an example. We always advise beginners to start with a risk-free demo account.

Step 5: Select your demo account type, demo Standard or demo Ultra Low Standard. Choose the leverage ratio (1:1 - 1:1000), base currency (USD, EUR, JPY, GBP, AUD, CHF, ZAR), and investment amount (10,000 - 5,000,000). Then click the 'Continue' button.

Step 6: Create a password for your trading account. Then click the 'Complete button.

Your demo account is ready!

XM Deposit & Withdraw

XM supports deposits and withdrawals via credit and debit cards, bank transfers, e-wallets, etc. Once you open your XM account, simply visit the 'Funding' section in the Members Area to view all the payment methods available.

The minimum deposit/withdrawal amount is $5.

XM charges no fees on all deposits or most withdrawals except on bank wires below $200 or equivalent.

All deposits are automatically converted into the base currency of your trading account, so, you can deposit money in any currency you like. However, Exchange rates may be applied. This may be done by XM or the payment processor. For example, when it comes to credit or debit card transactions, these are handled by the processor and are out of XM's hands. The rates XM uses are quoted by currency exchangers and can be seen in the Members Area.

Withdrawal requests are processed instantly by XM's Artificial Intelligence Back Office System, based on algorithmic parameters. Youll receive your money immediately, or on the same day your request is executed. Withdrawals via bank wire, credit or debit card usually take 2-5 business days to reach your account.

For further reading, you can directly visit https://www.xm.com/help-center/deposits-withdrawals/is-the-money-i-deposit-with-xm-safe

Compare XM to Similar Brokers

We compared XM's key points (regulation, product offering, demo account, account minimum, maximum leverage, trading platform, copy/social trading, promotion, and suitable traders) with three similar brokers, Exness, HFM, and FXTM. See a more detailed comparison of XM alternatives below:

| Logo |  |  |  |  |

| Broker | XM | Exness | HFM | FXTM |

| Regulation | ASIC, CySEC, FSC (Offshore), DFSA | CySEC, FCA, FSCA, FSA (Offshore) | CySEC, FCA, DFSA, FSA (Offshore) | FCA, FSC (Offshore) |

| Segregated Account | ✅ | ✅ | ✅ | ✅ |

| Negative Balance Protection | ✅ | ✅ | ✅ | - |

| Demo Account | ✅($5,000,000 virtual funds) | ✅($10,000 virtual funds) | ✅ | ✅ |

| Islamic Account | ✅ | - | ✅ | - |

| Account Minimum | $5 | $10 | $0⭐ | $/€/£200 |

| Maximum Leverage | 1:1000 | 1:Unlimited⭐ | 1:2000 | 1:3000 |

| Average Trading Cost (EUR/USD) | 0.8 pips | 0.6 pips⭐ | 1.2 pips | 1.5 pips |

| MetaTrader 4 (MT4) | ✅ | ✅ | ✅ | ✅ |

| MetaTrader 5 (MT5) | ✅ | ✅ | ✅ | ✅ |

| cTrader | ❌ | ❌ | ❌ | ❌ |

| TradingView | ❌ | ❌ | ❌ | ❌ |

| Proprietary Platform | XM App | Exness Terminal, Exness Trade app | HFM Trading App | Mobile trading |

| Copy/Social Trading | ✅ | ✅ | ✅ | ❌ |

| Promotion | ✅ | ❌ | ✅ | ❌ |

| Best for | Beginners | Beginners | Beginners | Experienced traders |

FAQs

Is XM a trusted broker?

Yes. XM is a trusted broker with a good reputation and many top-tier regulations.

Does XM offer demo accounts?

Yes. You can find detailed information in the 'Demo Account' section.

Which XM account is best for beginners?

The Ultra Low account is best for beginners for its low minimum deposit and low trading fees.

What is the minimum deposit for an XM account?

Just $5 for the Standard and Ultra Low accounts, while up to $10,000 for the Shares account.

Can I withdraw a bonus on the XM platform?

No, all bonuses XM offers are for trading purposes only, and cant be withdrawn. They are offered to help you open larger positions and maintain them.

Profits earned using the bonuses, however, can be withdrawn at any time. Do keep in mind though, that withdrawing funds will lead to a proportional removal of your trading bonus.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Gold Defends $5,000 Level as Geopolitical Tension Disrupts Risk Appetite

'Takaichi Trade' Propels Nikkei to 57,000; Yuan Surges to Multi-Year High

GLOBAL GOLD & CURRENCY CORPORATION Review (2026): Serious User Problems and Warnings

GLOBAL GOLD & CURRENCY CORPORATION Legitimacy Check

Accountant Loses RM460,888 to PFOU Syndicate’s UVKXE App Crypto Scheme

Currency Calculator