Abstract:Forex Trade Copiers are a way of instantly replicating the experienced traders trades, thus helping the newcomers to hone their skills. This handout discusses how Forex Trade Copiers works, the steps to follow an expert trader, and the advantages and disadvantages of this approach. It emphasizes the fact that one needs to be careful while selecting the right trading platform, with recommended platforms mentioned including Forex Copier, Axi Copy Trading App, and AvaTrade.

Forex Trade Copiers are a way of instantly replicating the experienced traders trades, thus helping the newcomers to hone their skills. This handout discusses how Forex Trade Copiers works, the steps to follow an expert trader, and the advantages and disadvantages of this approach. It emphasizes the fact that one needs to be careful while selecting the right trading platform, with recommended platforms mentioned including Forex Copier, Axi Copy Trading App, and AvaTrade.

How Forex Trade Copiers Work?

Forex trade copiers function as intermediaries between experienced traders (signal providers) and investors (followers). Essentially, they replicate the trading actions of successful traders onto the accounts of their followers in real time. When a signal provider opens, closes, or modifies a position, the copier automatically executes identical trades on the followers account, adjusted for account size and leverage. This allows investors to benefit from the expertise of experienced traders without the need for constant market analysis or trade execution.

The process typically involves these steps:

- Master Account: A trader, often referred to as the “signal provider,” operates a master account where trading decisions are made.

- Trade Execution: When the signal provider opens, closes, or modifies a position, the trade copier software captures this information.

- Follower Accounts: The software then transmits the trade data to connected follower accounts, where the same actions are executed simultaneously or with a specified delay.

- Configuration: Traders can customize the copying process by adjusting parameters such as lot size, leverage, and trade filtering.1

Who will benefit from Forex trade copiers?

- Novice Forex traders: Forex copy trading is a great starting point for those new to the market. By shadowing experienced traders, beginners can develop a feel for market dynamics and build a solid trading foundation.

- Advanced traders: Even seasoned investors can benefit from copy trading as well. Diversifying your portfolio by following multiple trading strategies offers a chance to test new approaches without risking your core capital.

- Forex copy trading platform providers: Building successful copy trading platforms requires a deep understanding of the technology involved. This knowledge is crucial for seamlessly connecting signal providers with followers, and also ensuring a smooth trading experience.

Steps to Copy Forex Trading Experts

- Set up: You have to select a trusted copy trading platform or broker who offers copy trading. Open an account with the chosen platform and complete the necessary verification process. Make sure there is enough cash being funded in your account for copying trades.

- Choose Your Expert: Use the tools provided by the platforms to search for expert traders. Consider factors such as history of trade performance, risk management measures put in place, and style of trading when choosing.

- Connect: Connect your account with that of the expert you choose. The majority of these platforms give room for adjusting percentages of your accounts that are allocated towards copying the trade patterns employed by experts.

- Manage Your Trades: The platform will execute trades from your profile but you can set parameters such as stop-loss levels and profit-taking prices so that you control your risks. Besides, other risk tools from the same provider should also be considered.

- Monitor & Adjust: At regular intervals view how well the trader you follow is doing as well as all other assets that make up your entire portfolio just in case adjustment has to be made or another expert trader is required since past performance does not guarantee future results.

Advantages and Disadvantages of Forex Trade Copiers

Forex Trade Copier has attracted significant attention from investors worldwide. It offers both a quick start for beginners and new perspectives for experienced traders. However, with great opportunities come great risks. This section delves into the advantages and disadvantages of forex copy trading to help you make more informed investment decisions.

Advantages

- Time-Saving: Imagine spending hours constantly placing and adjusting trades. With copy trading, you can streamline this process, freeing up time or focus on other business ventures. Trading with Forex Trade Copiers is like having a personal trading assistant.

- ExcellentLearning Opportunity: Think of Forex Trade Copier as a seasoned mentor. If you observe how successful traders make decisions, you will learn valuable strategies and risk management techniques, just like getting a front-row seat to a masterclass in trading.

- Transparency: Many platforms provide detailed performance reports, similar to a trader's report card. You can see who's winning and who's losing. It's like having a leaderboard for traders, helping you identify top performers to follow. Real-time updates can keep you informed about market movements.

Disadvantages

- Additional Costs: Having a Forex Trade Copier is like paying a monthly fee to access a trading signal service. While these signals are profitable, the subscription cost can eat into your returns. Therefore, it is crucial to weigh the potential profits against the ongoing expense.

- Difficulty in Trader Selection: Choosing the right trader to copy is similar to picking a winning racehorse. There are many factors to consider, such as the track record, trading style, and the minimum amount. For instance, if a trader typically uses high leverage and you prefer a more conservative approach, then this trade is not the best fit.

- Exposure to Expert Mistakes: Even the most experienced traders make errors. So if you blindly copy the trades, you risk losing money when they're wrong. It's like following a financial guru who suddenly makes a bad investment. The impact can be substantial.

Choosing the Right Forex Trade Copier

Selecting a good Forex Trade Copier is very important. A well-chosen platform with skilled traders and reliable performance, can significantly enhance user's copy trading experience. A subpar copier, on the other hand, leads to potential financial losses. By taking these factors into account, you can increase your chances of finding a reliable and effective copy-trading solution.

Recommended Right Forex Trade Copiers

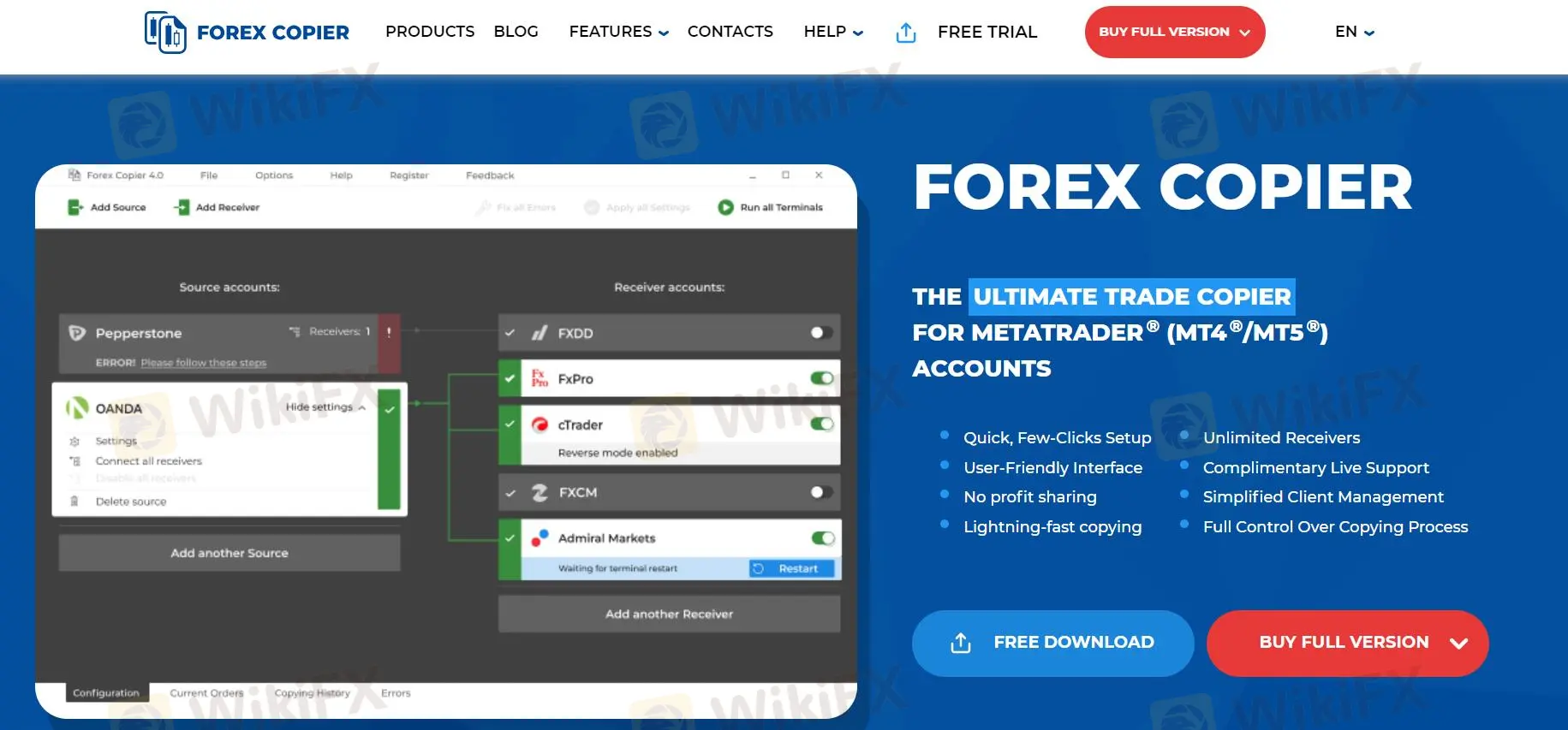

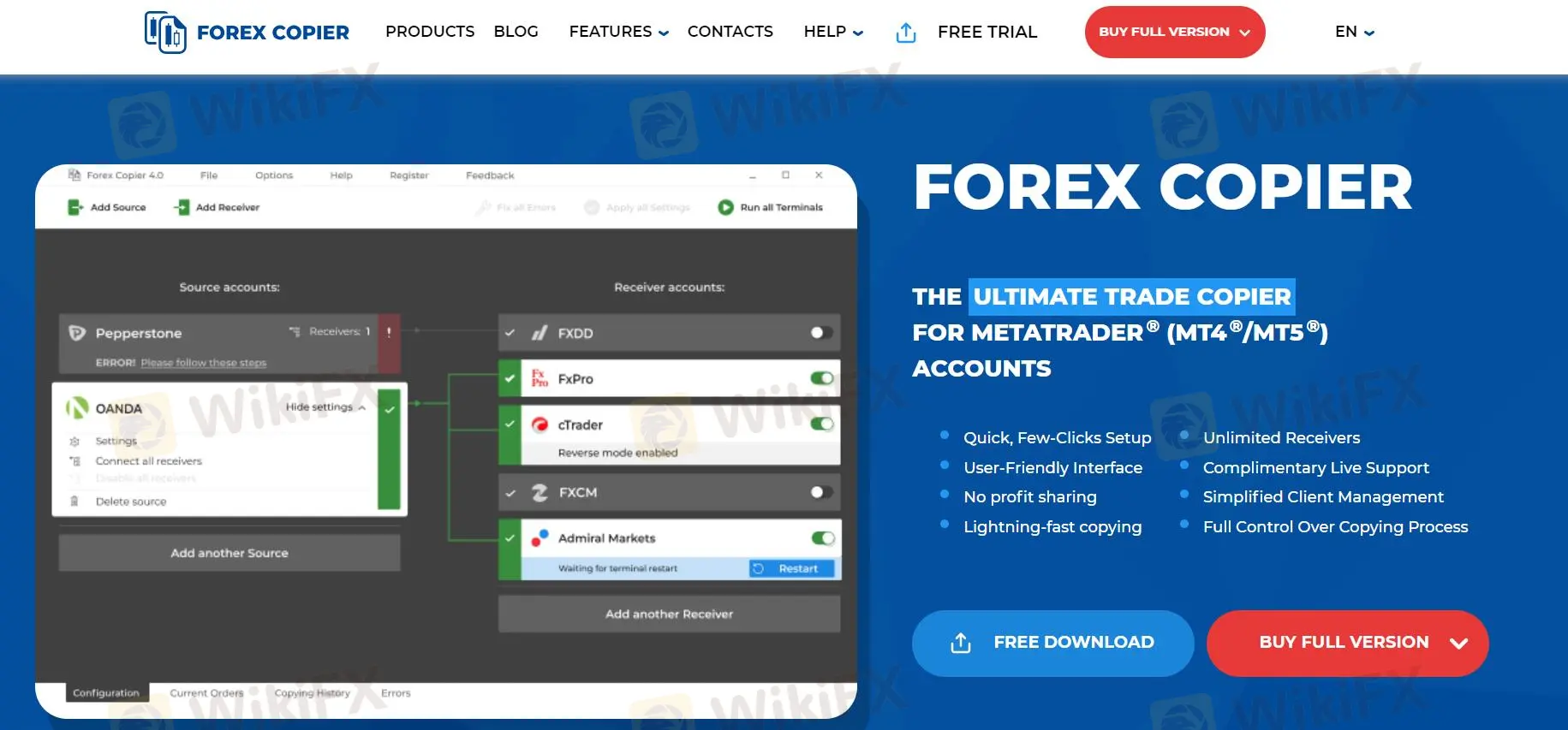

- Forex Copier:

Engage in the effectiveness of automated Forex Trading through Forex Copier where you can replicate the performances of professional traders. You can copy trades across platforms with ease, whether you use MetaTrader® or cTrader®. You can also increase your profit margins using a set of strong features and a 30-day free trial to see how it works. Newcomers can have discounted rates to start their copy-trading journey.

- Axi Copy Trading App:

Axi Copy Trading App helps you to trade following experienced Forex experts with just a few clicks. Come and copy the trades of successful traderseffortlessly and use their market knowledge to boost your returns. With Axis easy-to-use app, you can easily allow connection of your MT4 account and select the signal providers with clear track records. Take advantage of trading tips from experienced traders while controlling your risks using leverage sizes. Begin your copy trading today with Axi and see the advantages of automated trade.

Comparison of Forex Copier and Axi Copy Trading App

- Platform Type: Forex Copier is a software program, while Axi Copy Trading App is a mobile app.

- Broker Compatibility: Forex Copier offers more flexibility in terms of compatible brokers, while Axi Copy Trading App is primarily designed for Axi accounts.

- Signal Providers: Forex Copier requires users to find signal providers independently, while Axi Copy Trading App provides a built-in selection.

Additional Tips for Successful Copy Trading:

- Diversification: Don't put all your eggs in one basket. Spread your risk by following multiple traders with different styles. For instance, one trader might focus on scalping, while another on long-term trends. This way, if one trader hits a rough patch, your overall portfolio won't be as severely impacted.

- Risk Management: Always use stop-loss orders to limit potential losses on individual trades. Additionally, keep an eye on your overall portfolio risk. Imagine your portfolio as a boat; you wouldn't overload it with heavy cargo. Similarly, don't overexpose your portfolio to any single trader or market. Regularly review your risk levels to ensure they align with your comfort zone.

- Continuous Monitoring: Forex markets are dynamic. Traders' performance can fluctuate, and market conditions change. Regularly assess your copied traders' results and compare them to market benchmarks. If a trader consistently underperforms, it might be time to unfollow them. Stay informed about economic news, geopolitical events, and market sentiment to make informed decisions about your copy trading strategy. Think of it as regularly checking the weather before setting sail

Conclusion

Overall, Forex Trade Copiers provide an enticing unique approach to participating in the Forex Market, especially for newcomers or constantly engaged traders. Nevertheless, bear in mind that, success depends on the choice of a competent platform, reliable experts, and risk management. Adhering to the facts mentioned above and being cautious, one can learn from the experience of other traders and possibly accomplish their targeted objectives in Forex trading. Yet, as a rule, conduct proper research into the particular stock before investing your money into it and use proper approaches to it.

Frequently Asked Questions ( FAQs)

What is a Forex Trade Copier and how does it work?

Forex Trade Copier is a tool, that synchronizes one account (usually an experienced trader) with another account (yours). It works in a way that it brings together accounts and allows traders to emulate the actions of other traders or signal providers without input constantly.

To which category of people can Forex Trade Copiers be of help?

Depending on the needs of the traders, Forex Trade Copiers are of different types. To the newcomers, they act as informative tools when they are allowed to follow the performance and observe the approaches used by experienced traders. Meanwhile, experienced traders can also use Forex Trade Copiers to expand their range of trading strategies.

What should I pay attention to when selecting the Forex Trade Copier?

Picking out a suitable Forex Trade Copier has the following critical factors. You are advised to evaluate the platform's reliability, security measures, and compatibility with your preferred forex broker. Also, you shall also consider the available trading features including performance reports, measures of risk management and any associated costs.

What are the risks involved when using Forex Trade Copier?

The use of Forex Trade Copier has advantages, but they have some general drawbacks. The traders will be exposed to losing their money if poor decisions are made by the expert trader. Also, subscription fees as well as other costs will affect profitability. Additionally, market volatility also has impacts on copied trades, which calls for constant supervision and management of risks.