JPMorgan CFO Sounds Alarm on Risky Stablecoin Yields

JPMorgan CFO warns high-return stablecoins could endanger financial stability as global regulators move toward tighter digital asset rules.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Uncover the truth about RIF-Capital, an unregulated broker scam manipulating trades and denying withdrawals. Protect your investments by choosing regulated brokers.

The attraction of rapid profits in the always-growing field of online trading may sometimes trap gullible investors in the hands of dishonest brokers. A concerning instance involving RIF-Capital, a trading platform with a documented track record of unethical behavior, has come to light, highlighting the perils associated with conducting business with unlicensed financial institutions.

Traders have reported many concerning events involving RIF-Capital, which bills itself as a registered and reliable broker on its website, https://rif-capital.com/index. In the latest instance, a trader was subjected to serious trading manipulation and blatant extortion. The trader had the dread of every investor after trading for a few weeks, earning some profits, and then choosing to stop: the broker erased the winnings and denied access to the deposit. RIF-Capital sternly told the trader that the original investment was unavailable in addition to the earnings being lost when the withdrawal was requested.

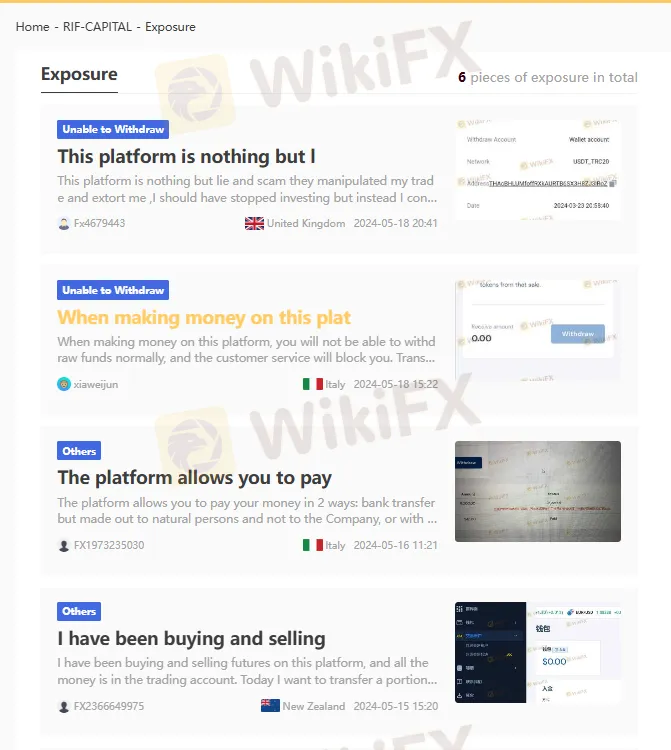

There have been more incidents like this one. An obvious warning sign in forex trading scams, the inability to withdraw money has been the subject of several complaints filed with financial supervision organizations such as WikiFX. Such actions highlight the need to check a broker's regulatory standing before investing.

For some reason, dealing with a licensed broker is essential. First of all, capital adequacy regulations and other stringent financial criteria that authorized brokers must follow assist in guaranteeing their solvency and safeguarding traders' money. Their frequent audits, open operations, and the requirement to keep client money in separate accounts all contribute to the creation of a safer trading environment.

Additionally, merchants who conduct business with a regulated organization are more likely to obtain redress in the event of disputes or anomalies. Unregulated brokers lack the extra degree of protection that regulatory authorities give by their ability to step in, arbitrate, and, if needed, discipline the broker.

The RIF-Capital case drives home the risks that are present in the unregulated areas of the financial markets. It emphasizes the significance of conducting in-depth research and choosing brokers who are subject to reputable organizations' regulations. Your money should be your priority as an investor, and selecting a registered broker is a crucial first step in preventing fraud and manipulation of your assets.

You may access more of RIF-Capital reported cases here:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

JPMorgan CFO warns high-return stablecoins could endanger financial stability as global regulators move toward tighter digital asset rules.

A 39-year-old lecturer in Kuantan has been defrauded of RM493,600 in a sophisticated online investment scam

Do you have to constantly witness trade delays on the EO Broker trading platform? Have you encountered cases of unfair trade executions where you have recorded heavy losses? Are inconsistent spreads eating into your trading gains? Is the EO Broker withdrawal process too slow? Is the customer support team incompetent in resolving all these trading queries? You are not alone! Many traders have vehemently opposed the broker’s tactics on review platforms. We have highlighted different EO Broker reviews in this article. Read on!

Achiever FX has been receiving flak for numerous reasons, including slow-paced trade execution, lack of transparency, and, importantly, alleged attempts to defraud traders. With its customer support team not able to resolve these issues, traders have allegedly been left alone! They have rightly reviewed the Saint Lucia-based forex broker negatively online. In this Achiever FX review article, we have explored complaints against the forex broker. Keep reading to know the same.