WikiFX Spring Festival Message | Grounded in Transparency, Walking with Trust

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:In this article, we will conduct a comprehensive examination of Tradehall, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Tradehall, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Established in 2020 and based in Australia, TradeHall began with the launch of its founders' inaugural online trading service under the trademark TradeHall.

Tradehall offers a diverse range of over 500 tradable assets, encompassing currency pairs, global indices, equities, cryptocurrencies, commodities, and ETFs. Additionally, Tradehall provides clients with a variety of financial services, including personal finance, wealth management, brokerage white labeling, fintech products, and various other financial offerings.

Upon initial observation, Tradehall's official website may seem to have a simple and user-friendly design; however, closer examination reveals a lack of critical information, suggesting a lack of full transparency and candour from this broker.

It is important to note that Tradehall does not currently offer its services to residents of the United States, Germany, the Peoples Republic of China (including Hong Kong SAR), North Korea, Japan, and certain other regions.

Types of Accounts:

The official website of Tradehall lacks a detailed breakdown of the offered account types, as well as their corresponding spreads and charges; instead, there is only a “create live account” button located at the top corner of the website.

Deposits and Withdrawals:

No information about the deposit and withdrawal methods offered is found on Tradehalls official website.

This omission could indicate a lack of transparency because these details are essential for potential clients to make informed decisions about using the platform. Deposit and withdrawal methods are crucial aspects of any trading platform, directly impacting users' ability to fund their accounts and access their funds. Without clear information on these methods, clients may be left in the dark about how they can deposit funds into their accounts or withdraw their profits. This lack of transparency can lead to confusion, frustration, and ultimately erode trust in the platform and its services.

Trading Platforms:

Tradehall provides traders with the MetaTrader 5 (MT5) platform, renowned for its versatility and advanced features. MT5 offers a user-friendly interface and supports trading across various asset classes, catering to both novice and experienced traders. The platform is available in different versions, including the Web Version, Desktop Platform, and Apps, offering flexibility to traders.

Research and Education:

Tradehall's official website does not offer information on research and educational resources.

Customer Service:

At the bottom of Tradehall's official website, it is indicated that clients can reach the broker's customer support team via email using the addresses asia@tradehall.co and support@tradehall.co. Additionally, clients have the option to contact the Asia office directly by phone at +603 48169431. The physical address of Tradehall's Asia office is A-19-2, Tower A, Vertical Business Suite, Bangsar South, No. 8 Jalan Kerinchi, 59200 KL, Malaysia, and Level 33, Australia Square, 264 George Street, Sydney NSW 2000, Australia. It's worth noting that Tradehall does not offer a live chat service.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Tradehall a WikiScore of 1.45 out of 10.

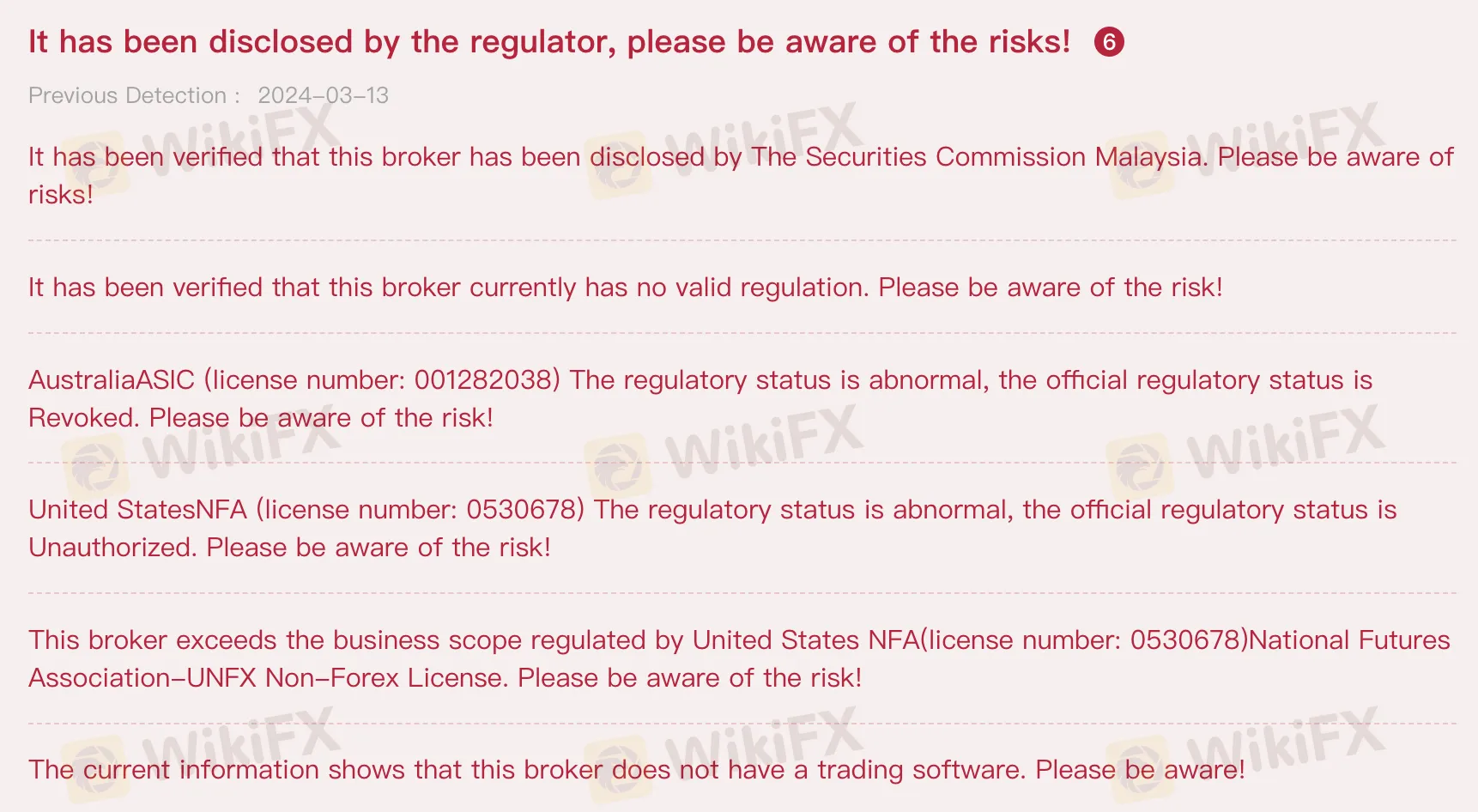

Despite Tradehall's claims of being a highly regulated and award-winning broker, a thorough examination by WikiFX has revealed that the broker lacks legitimate licenses. Specifically, Tradehall's ASIC license (license number 001282038) has been revoked. Additionally, due to the nature of Tradehall's business exceeding the regulated business scope of the United States NFA, its United States NFA license (license number: 001282038) is unauthorized.

Moreover, Tradehall is listed as an unauthorized entity on Malaysias Security Commission investor alert list.

This low WikiScore signifies that Tradehall is deemed a highly risky broker within the forex trading industry. The assessment is based on the broker's notable deficiencies, including a lack of transparency in providing information on its official website and its status as an unregulated entity operating without a valid license. These factors collectively contribute to WikiFX's verdict of caution regarding Tradehall as a broker. Therefore, WikiFX urges our users to opt for a broker with a higher WikiScore for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

As the Lunar New Year approaches, renewal is in the air. It is a moment to bid farewell to the old, welcome the new, and reflect while moving forward.

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.