Abstract:The forex broker FXWinning recently announced a statement. In this statement, FXWinning claimed it will stop offering services from June 22, 2023.

The forex broker FXWinning recently announced a statement. In this statement, FXWinning claimed it will stop offering services from June 22, 2023. It is said that the platform was forced to shut down due to its lack of regulatory authorization and the loss of MT4/5 permissions.

In a significant development for investor protection, the scam broker FXWinning has been compelled to shut down its operations. The closure comes as authorities and regulatory bodies intensify their efforts to combat fraudulent practices in the financial industry.

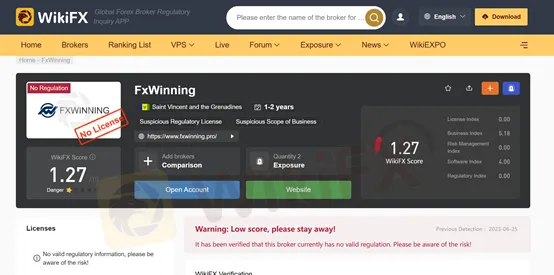

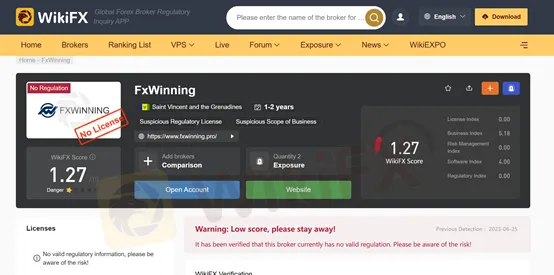

FXWinning on WikiFX

FxWinning is an online forex broker registered in St. Vincent and the Grenadines less than two years ago, and currently under no effective regulation. WikiFX has given this broker a low score of 1.27/10. WikiFX advises you to avoid this broker. It is risky to invest in a broker like FXWinning.

Unveiling the Scam

FXWinning, a previously operating brokerage firm, has come under scrutiny due to multiple reports and complaints from investors regarding suspicious activities and potential fraudulent practices. Authorities, along with concerned regulatory bodies, launched investigations into the operations and business practices of the broker, leading to a string of discoveries that confirmed the existence of fraudulent activities.

In response to the mounting evidence against FXWinning, regulatory authorities stepped up their efforts to protect investors and uphold the integrity of the financial markets. These actions were essential to bring an end to deceptive practices and prevent further harm to unsuspecting individuals. As a result, FXWinning has been forced to shut down.

Implications for Investors

The closure of FXWinning serves as a stern reminder to investors about the importance of due diligence and conducting thorough research before engaging with any brokerage firm. Investors who had accounts with FXWinning may face significant financial losses, as the fraudulent broker may have engaged in activities such as unauthorized withdrawals, misleading investment advice, and manipulation of trading platforms. It is crucial for affected investors to report their grievances to the relevant authorities and seek appropriate legal action to recover their funds, if possible.

The case of FXWinning serves as a cautionary tale, emphasizing the need for investors to remain vigilant and informed. Conducting thorough research, reading reviews, and seeking advice from trusted financial professionals can help identify potential red flags and steer clear of fraudulent brokers. Investor education initiatives should be promoted to enhance awareness of the risks associated with fraudulent schemes and empower investors to make informed decisions.

Importance of Regulatory

The shutdown of FXWinning highlights the crucial role played by regulatory bodies in maintaining the integrity of the financial industry. Through effective monitoring and enforcement of rules and regulations, these bodies strive to protect investors from falling victim to fraudulent schemes. Investors are encouraged to verify the regulatory status of any brokerage firm and ensure they are licensed and authorized by reputable regulatory authorities before entrusting them with their funds.

Conclusion

The closure of scam broker FXWinning is significant in the fight against financial fraud and the protection of investors. The incident serves as a reminder for investors to exercise caution, conduct thorough due diligence, and choose reputable brokers who adhere to regulatory standards. By remaining vigilant and informed, investors can mitigate the risk of falling victim to scams and fraudulent practices, ensuring the safety of their investments. If you invested money in this broker, we advise you to withdraw your money.