Capital.com Expands into Kenya with Local Licence

Capital.com secures a Kenyan CMA licence and appoints Samwel Kiraka as CEO, marking a major step in its Africa expansion strategy.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:eToro, an online trading platform, has collaborated with TradingView, a provider of charting and analysis tools, to introduce a significant upgrade to its platform, which includes new investment visuals. The charts provide precise technical analysis, twice as many analysis tools, over 100 indications, and 50+ drawing tools, enabling traders to plan their trades more effectively. Buyers can also see how an asset's worth varies over time, from one minute to four hours, using the graphs. The new utility aims to help sellers make better decisions by providing more precise information.

The online trader eToro has worked with TradingView, a supplier of graphing and analytical tools, to bring a major update to its platform, including new investment graphics. The plots offer exact technical analysis, twice as many analysis tools, over 100 signs, and 50+ sketching tools, allowing traders to better plan their deals. The plots also enable buyers to see how an asset's price changes over time, from one minute to four hours. By giving more exact information, the updated tool hopes to help dealers make better-informed choices.

The new investment plots have an easy-to-use user layout and a toolbar that enables dealers to quickly access all of the research tools. Furthermore, the graphics have been tailored for mobile devices, allowing users to traverse the site more easily. This enhancement has removed the hassle of having to go through multiple stages to view the desired display, making it more approachable to dealers.

The second part of the update will add even more features to eToro's displays, such as the option to trade straight from them. This feature enables dealers to perform transactions swiftly and simply without having to move between various parts of the website.

Furthermore, the update will give dealers more analysis instruments, providing them with more choices for fundamental analysis. The arrangement function will enable users to view previously made charts, providing greater clarity for the study at hand. Finally, a nighttime option will be introduced to the app to make trading in low-light circumstances easy on the eyes.

Finally, eToro's collaboration with TradingView has resulted in a major update to its platform, with the introduction of new investment displays that provide users with more exact information. A simple user layout, mobile-friendly graphics, and a readily available toolbar are all part of the update. The upgrade's second part will include even more features, such as the ability to trade straight from the charts, more analytical tools, and a layout feature. The update is intended to make dealing more approachable and simple for dealers, resulting in better-informed choices.

eToro is a social trading platform and multi-asset exchange firm that provides a variety of financial goods and services such as equities, currency, coins, and more. Since its inception in 2007, the site has evolved to become one of the most famous online exchanges in the world, with over 20 million active customers worldwide.

One of the reasons eToro has grown in popularity is its novel trading strategy. The website is intended to be user-friendly, with a basic and clear layout that allows even inexperienced dealers to explore. eToro also has a social trading function that enables users to watch and replicate the deals of other traders on the site, allowing them to learn from more experienced traders while also possibly profiting.

Install the WikiFX App on your smartphone to stay updated on the latest news.

Download link: https://www.wikifx.com/en/download.html?source=fma3

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Capital.com secures a Kenyan CMA licence and appoints Samwel Kiraka as CEO, marking a major step in its Africa expansion strategy.

Nearly 400 investors have urged the Labuan FSA to take stricter measures against a company accused of running an illegal forex trading scheme, which has reportedly caused losses exceeding RM104 million.

LMS Forex Broker Review 2026 – Regulation, Risks & WikiFX Score 1.49/10. Is LMS a safe forex broker? Read our in-depth LMS broker review covering regulation, trading conditions, risks, comparison with regulated brokers, FAQ, and why WikiFX gives LMS a low score of 1.49/10.

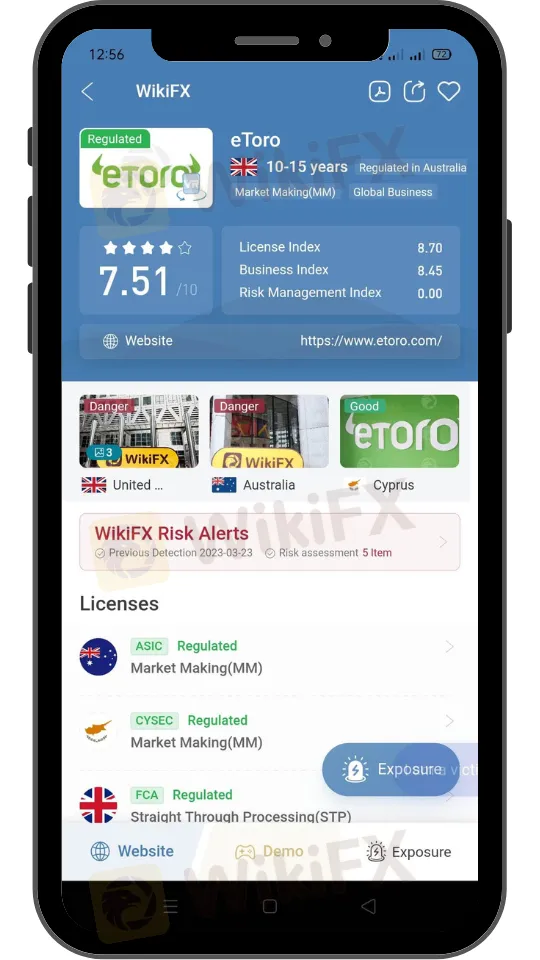

eToro is regulated by ASIC, FCA, CySEC, MAS & ADGM, though some users report withdrawal delays and offshore risks.