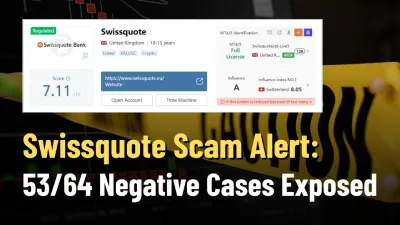

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

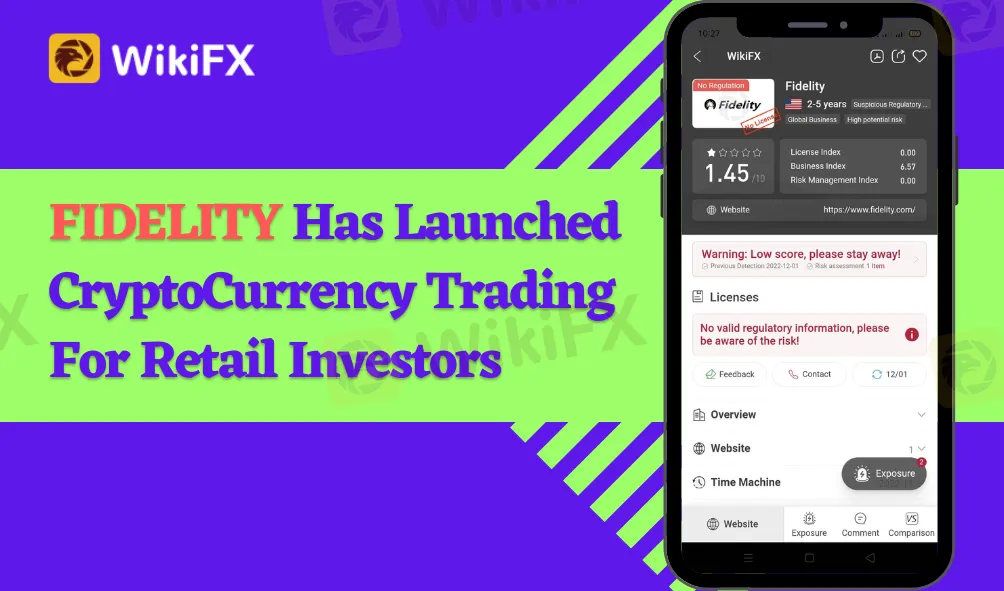

Abstract:Fidelity, one of the world's major financial services companies, has begun to provide consumers with bitcoin trading accounts.

This follows their earlier disclosure of a wait list earlier this month. According to The Block, select users, presumably those on the queue, got an email outlining the release with the message “The wait is gone.”

Fidelity has been involved in the bitcoin sector for some time, beginning mining bitcoin in 2014, according to the company website. In addition, in December 2021, it will offer a spot bitcoin ETF in Canada.

The financial services behemoth's involvement in bitcoin has not gone unnoticed, with US lawmakers questioning its provision of a 401k plan that enables customers to allocate to bitcoin.

The same group of senators recently revived the same concern, stating in their newest letter, “Fidelity Investments has decided to go beyond conventional finance and plunge into the very unstable and more dangerous digital asset sector.”

Despite these cautions, Fidelity looks to be jumping into bitcoin wholeheartedly, as interest in bitcoin within the conventional banking industry grows. It should be emphasized that the move comes at a very intriguing moment, considering recent events surrounding the collapse of FTX and the increased focus on volatility in the sector.

With the industry image so shaky, the acts of behemoths like Fidelity will almost surely have repercussions for bitcoin legislation in the future.

Aside from FTX, senators claim that cryptocurrency investments have only developed as a dangerous and speculative bet, and they are afraid that Fidelity would assume similar risks with millions of Americans' retirement assets.

Fidelity is the biggest retirement plan provider in the United States, with more than $10 trillion in assets under management, and its move was considered a crucial driver for making cryptocurrency even more popular. The cryptocurrency option is now accessible to the 23,000 employers that use Fidelity to manage their 401(k) retirement funds.

You may check out more of Fidelity news here: https://www.wikifx.com/en/dealer/5871434190.html

Always remember to check the true identity of a broker before investing. Being regulated online trading broker must be known to public to be considered as trustworthy broker.

Stay tuned for more Online Trading news.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.