Saracen Markets Review: Regulated or Scam Alert?

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

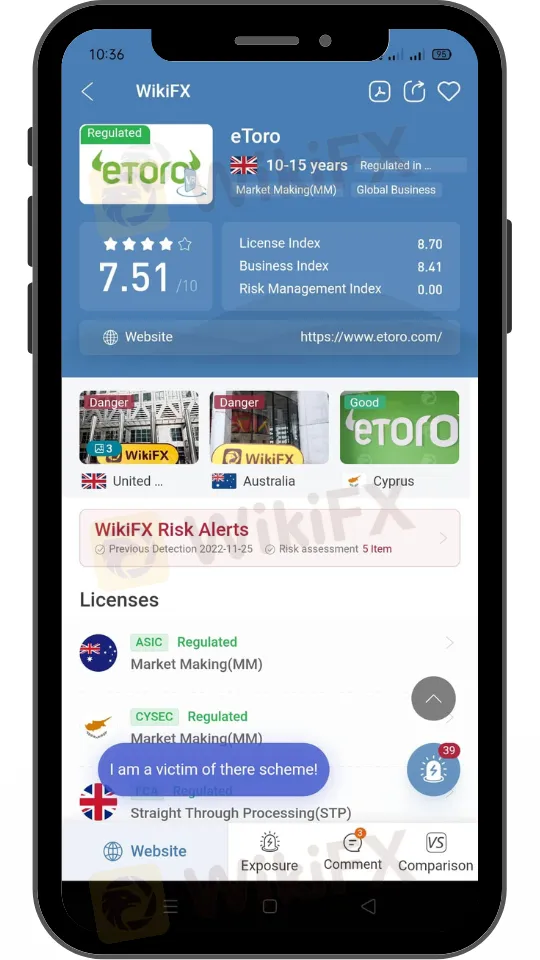

Abstract:The online broker eToro has issued an update regarding the Android app issues that have plagued customers for several days.

eToro, an online broker, has issued an update about the Android app issues that have been plaguing customers for many days.

The broker recently issued an advice stating that they were having troubles with their Android app. They also said that the problem might impact IOS users running versions less than 487.0.1.

The broker claims it has launched a patch and that traders will be able to view all pages and charts once they upgrade the app to the newest version.

The following is an announcement made by eToro:

“ANDROID APP ISSUE RESOLVED”

We have good news: we have fixed the problem that Android app users were facing.

You will be able to view the asset pages as well as the charts after you have upgraded the app to the newest version.

Please keep in mind that the latest version may take a few hours to appear in all app stores.

We appreciated your patience while we worked to address the problem.

The eToroTeam.

eToro founded in 2007, eToro immediately rose to the forefront of the financial industry by pioneering the technique of social trading, commonly known as copy trading. Users of eToro may not only initiate and liquidate positions in assets such as currencies, equities, cryptocurrencies, and ETFs, but they can also mirror other members' transactions by automatically imitating them. Aside from its user-friendly design, eToro is useful because it enables users to communicate with other traders, investigate their profiles and techniques, debate markets, and imitate their ideas.

You can check out more of eToro here: https://www.wikifx.com/en/dealer/0001283907.html

Stay tuned for more Forex Broker news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Saracen Markets claims “regulated,” but serious red flags suggest scam risk—see what to verify before depositing. Read our Saracen Markets review and scam alert now.

FXRoad exposure review: withdrawal red flags, offshore status, and safety risks explained. Learn what to watch for and how to protect your funds—read now.

When people who invest ask, "Is Arena Capitals safe or a scam?" the proof shows we need to be very careful. This broker works without proper rules from top financial authorities, gets very low safety scores from independent financial watchdogs, and many users have serious complaints about them. The information available to everyone suggests that giving your capital to this company could lead to losing it all. This analysis doesn't guess - it looks at these important warning signs. We will look at real facts, study actual user reviews that show big problems with taking out funds, and give a clear answer based on evidence about whether Arena Capitals can be trusted. This article gives you the facts you need to make a smart choice and keep your funds safe from an unregulated, high-risk business.

When traders are choosing a brokerage, the most important questions are always about safety and whether the company is legitimate. When it comes to Arena Capitals, the verdict is clear and immediate based on extensive public data and regulatory checks. This company operates without oversight from any top-tier financial authority, putting it firmly in the high-risk category. Our analysis shows a consistent pattern of warning signs that potential investors must consider. The key findings are clear: verification platforms mark Arena Capitals with a "No Regulation" status, its company registration is in an offshore location known for its lack of financial oversight, and a growing number of user reports detail significant problems, especially with withdrawing funds. This article provides a complete, evidence-based breakdown of these facts to help you make an informed decision and protect your capital. The conclusion is that Arena Capitals presents a high potential risk to investors.