Abstract:XTB is an online forex broker offering a series of financial instruments to its clients across the globe. However, because of recent complaints and a fake address, we want to remind you of the risk when investing in XTB.

About XTB

XTB ranks as the fourth largest stock exchange-listed forex and CFD broker in the world, founded in 2002 and headquartered in London, UK, with offices in over 12 countries, including Poland, Germany, France, and Turkey. XTB provides investors with some popular tradable instruments in the global financial markets, mainly foreign exchange, indices, commodity futures, stock CFDs, CFDs on traded funds, cryptos, etc.

Regulation: Is XTB legit?

XTB is a regulated broker. XTB Limited is authorized and regulated by the Financial Conduct Authority in the UK, with regulatory license number 522157. It also holds a license from CySEC with the number 169/12 and another license from CNMV with the number 3325.

Minimum Deposit

XTB has designed two types of trading accounts, the Standard Account, and the Pro account, as well as the Islamic account. The minimum deposit to start a standard account is US$250, which sounds slightly higher than most brokers' requirements.

Leverage

XTB, as a European-based broker, cannot provide high trading leverage for traders due to EU regulations. Retail traders can use the maximum leverage of up to 1:30 for forex instruments, and 1:5 for stock trading. However, professional traders can apply high leverage of up to 1:500 after the status is confirmed.

Spreads & Commissions

The main spreads for Forex products are 0.1 pips for EUR/USD and 0.2 pips for GBP/USD. Spreads for index products start from 0.7 pips for US2000 and 1.7 pips for UK100. Gold spreads start at 0.41 pips, silver from 0.041 pips, and oil from 0.04 pips.

Trading Platform

XTB offers traders the x Station 5 and x Station Mobile trading platforms. The trading platform allows traders to trade anywhere, anytime, and choose from over 4,000 commodities (including CFDs on Forex, Cryptocurrencies, Indices, Commodities, Stocks, and Exchange Traded Index Funds from all over the world) in an intuitive design that makes it faster and easier for traders to manage their assets. The platform supports web, mobile, and desktop.

Deposit & Withdrawal

XTB offers various deposit and withdrawal methods for users to choose from, some of which may incur additional fees. Bank transfers: welcoming EUR, USD, GBP, and HUF, no fees for deposit and withdrawal. Banks may charge a transfer fee. E-Wallet (PayPal, Skrill): accepting EUR, USD, GBP, HUF, PayPal - charging 2% of the deposit amount, Skrill - charging 2% of the deposit amount. Withdrawals below 100 USD / 80 EUR / 60 GBP / 12,000 HUF will be charged 20 USD / 16 EUR / 12 GBP / 3,000 HUF respectively.

Exposure

Although XTB got a decent WikiFX rating, we still received a couple of complaints against this broker within 3 months.

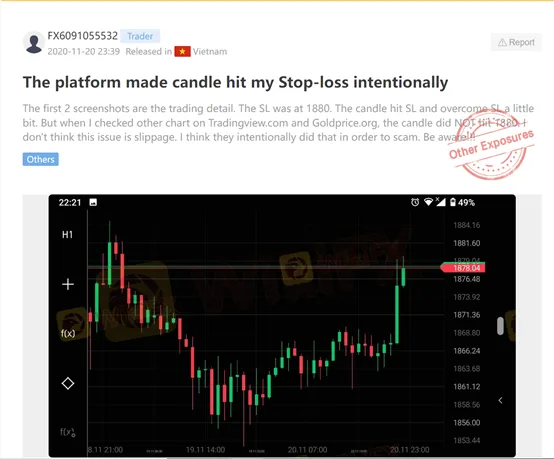

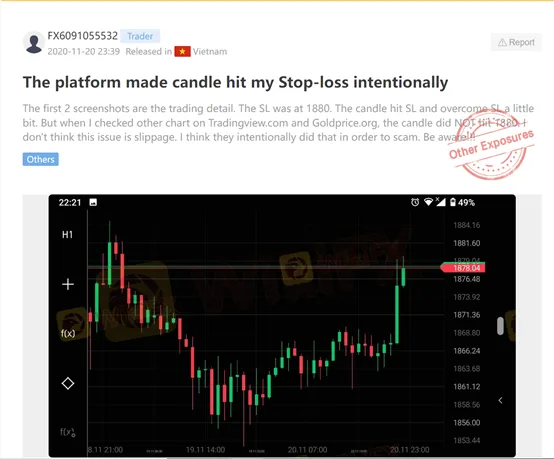

This trader from Vietnam claimed that this broker manipulates the trading process. he thinks that this broker is a scam.

One trader from Malaysia complained that he cannot withdraw his funds from this broker.

This trader from Vietnam claimed that the app of XTB is unresponsive multiple times.

One trader from Hong Kong complained that XTB block his withdrawal request. Even worse, XTB threatens him to deposit more money or his account will be frozen. Now, he cannot even log in to his account.

Field Survey

To help investors have a more comprehensive understanding of the brokers in the UK, the survey team is going to the UK for site visits. Unfortunately, we found no office at the address of XTB.

The survey team went to London, UK. And they did not find the broker XTBs office at its business address. It was supposed that the broker might just use that address to register its company. Please be prudent when trading with XTB.

Conclusion

XTB is a regulated broker with an experience of more than one decade. However, we cannot consider this broker a trustworthy broker as we received complaints, and our survey team did not find the office of this broker. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find the most trusted broker for yourself.