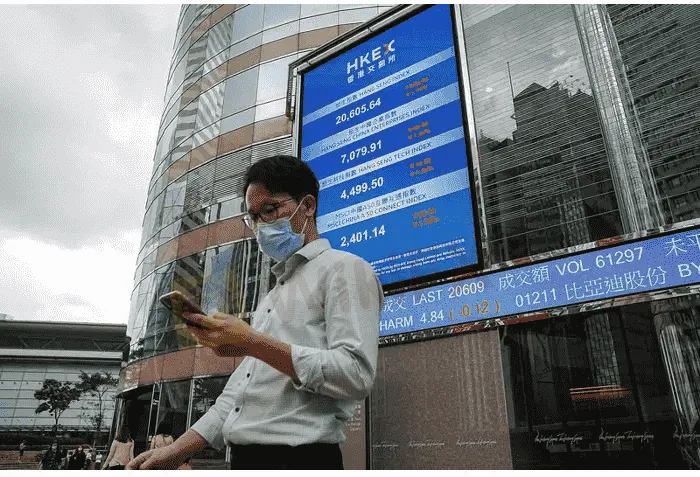

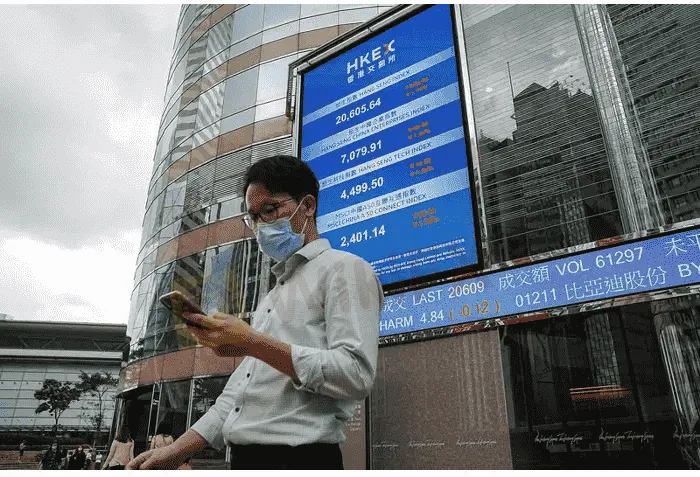

Abstract:Asian stocks declined on Friday, extending a global equity slide to a third day, as investors fretted over recession risks amid signs of further aggressive central bank policy tightening.

U.S. stocks tumbled on Friday after a stronger-than-expected jobs report locked in expectations that the Federal Reserve is sticking with a steady diet of rate hikes, while supply cuts continued to boost oil prices.

The Dow Jones Industrial Average closed down more than 600 points, sliding 2.11%, while the S&P 500 fell 2.8% and the Nasdaq Composite lopped off 3.8% in value as investors bet that the Feds inflation fight will continue apace.

The MSCI world equity index, which tracks shares in 45 nations, was down 2.45%.

The U.S. Labor Department reported that nonfarm payrolls increased by 263,000 in September – slightly above expectations – with the jobless rate dipping to 3.5%, below forecasts.

The data solidified the view that the Fed and other global central banks have a way to go before easing up on their tightening cycles, after stocks surged earlier in the week on hopes that such a pivot may be on the way.

“Today‘s employment data did little to change the narrative for a Fed committee that has been intensely focused on bringing down inflation,” said Charlie Ripley, senior investment strategist for Allianz Investment Management. “Timing the Fed’s pivot away from an aggressive policy stance is proving to be difficult, and the current conditions in the labor market are certainly not helping the situation.”

The likelihood of ongoing interest rate increases helped drive up the dollar and Treasury yields yet again. The dollar index, which tracks the greenback versus a basket of six currencies, was up 0.47%, and the yield on benchmark 10-year Treasury notes climbed 5.9 basis points to 3.881%.

Markets are currently pricing in a 92% chance of a 75-basis-point increase for next months Federal Open Market Committee meeting.

Investors will now turn to quarterly corporate earnings kicking off next week, as well as Thursdays latest monthly figures on U.S. inflation.

“The market‘s negative reaction may be a sign that investors are processing the likelihood that there will be no change in the Fed’s aggressive playbook in the near term,” said Mike Loewengart, head of model portfolio construction at Morgan Stanley‘s global investment office. “Keep in mind the next Fed decision isn’t until early November, so much more data will need to be digested, not least of which is next weeks inflation gauge.”

Crude oil continued to ride the announced supply cuts from OPEC+ to a five-week high, shaking off concerns of an economic slowdown.

Brent crude closed up 3.7% to $97.91 a barrel and U.S. crude prices were up 4.73% at $92.63 a barrel. [O/R]

Elsewhere, gold took a hit against the surging dollar, with spot prices falling 0.9% to $1,695.52 an ounce.