简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Locate Short Selling and Why?

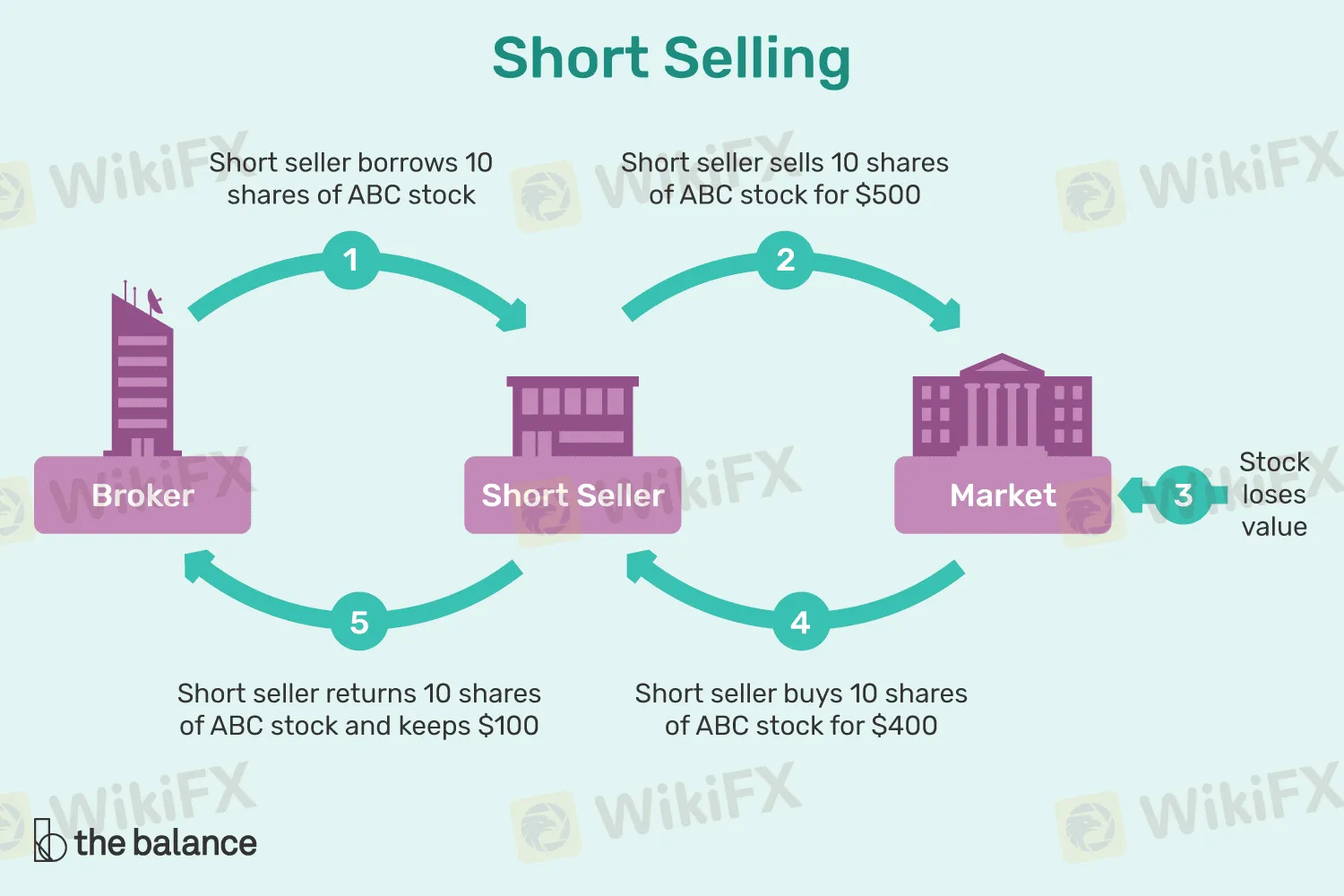

Abstract:Traders choose short selling because it is interesting to speculate and hedge. To speculate means creating a pure price bet for it would decline in the future. If the speculation is wrong, they should buy shares at a loss or higher.

Due to the use of margin in the short selling, the conduct is over a short time period, thus it is near to act of speculation. In addition, there are also people who do short selling to hedge a long position.

The example would be, if you are in the long positions you might aim to sell short against the long position to lock your profit in case you face loss. This is similar to a situation where you limit downside losses in the long position. If you want to create a profit in short selling position, you should consider this scenario. You trade at $50 for instance that would decline in price for the next few months. They would borrow 100 shares then sell them to other investors. So, the trader now short 100 shares to sell something they borrow or not they have. Short selling is possible only when you borrow the shares. So, it is not available sometimes, especially during the situation where traders flock for it.

Less than a month later, the company whose shares are borrowed announced the dismal financial condition, thus the stock fell to around $40. On this occasion, the trader would decide to close this short position and buy the 100 shares at $40 to replace borrowed shares. This is to note that this replacement of the borrowed shares do not include the commissions and margin account charge. The calculation is $1,000: ($50 – $40 = $10 x 100 shares = $1000, said Investopedia.

But it does not mean that it is not prone to failing. Imagine a trader did not close out the short position of the $40, but leave it open for further decline. Then, a competitor enters acquiring the company for $65 takeover per shares. Then, the trader encounters loss. Thus, trader might need to buy back the shares at the higher price.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

KKR Exposed: Traders Allege Fund Scams, Withdrawal Denials & Regulatory Concerns

Do you witness a negative trading account balance on the KKR broker login? Does the broker prevent you from withdrawing your funds after making profits? Do you need to pay an extra margin for withdrawals? These trading issues have become common for traders at KKR. In this KKR broker review article, we have elaborated on the complaints. Take a look!

Trive Regulation and Broker Licenses in Multiple Jurisdictions

Trive Regulation explained. Trive Broker is licensed in Australia, Malta, South Africa, UK, and BVI for secure global trading.

BitDelta Pro Review: Unregulated or Legit Broker?

BitDelta Pro Review: No valid regulation, risky spreads, and hidden broker issues. Traders should proceed with caution.

IG Launches 5% Cashback Offer for New UK Customers

IG cashback offer UK 2025 gives investors up to £100 back. Compare the best UK investment platforms with cashback today.

WikiFX Broker

Latest News

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

MH Markets Commission Fees and Spreads Analysis: A Data-Driven Breakdown for Traders

Alpha FX Allegations: Traders Claim Account Blocks, Withdrawal Denials and Security Breaches

How to Become a Profitable Forex Trader in Pakistan in 2025

CFTC Polymarket Approval Signals U.S. Relaunch 2025

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

Malaysia’s SkyLine Guide Top 25 Brokers Are Out!

Currency Calculator