Abstract:As forex trading becomes more popular, more fraudulent brokers are beginning to lurk in this profitable market. Before one aims to make profits from the forex market, it is important to have the skills to identify fraudulent brokers. In today’s article, WikiFX will show you how to verify a broker’s regulatory status in just a few clicks.

There are 6 main regulatory bodies in the world that safeguard the forex industry, namely:

• United Kingdom: The United Kingdom Financial Services Authority

• United States: National Futures Association (NFA) and the Commodity Futures Trading Commission (CETC)

• Australia: Australian Securities and Investments Commission (ASIC)

• Switzerland: Swiss Federal Banking Commission (SFBC)

• Germany: German Federal Financial Supervisory Authority (BaFIN)

• France: French Financial Markets Authority (AMF)

In this article, to make it easier to understand and straightforward, we will focus on the UKs Financial Conduct Authority (FCA), which is formerly known as the UK Financial Services Authority (FSA).

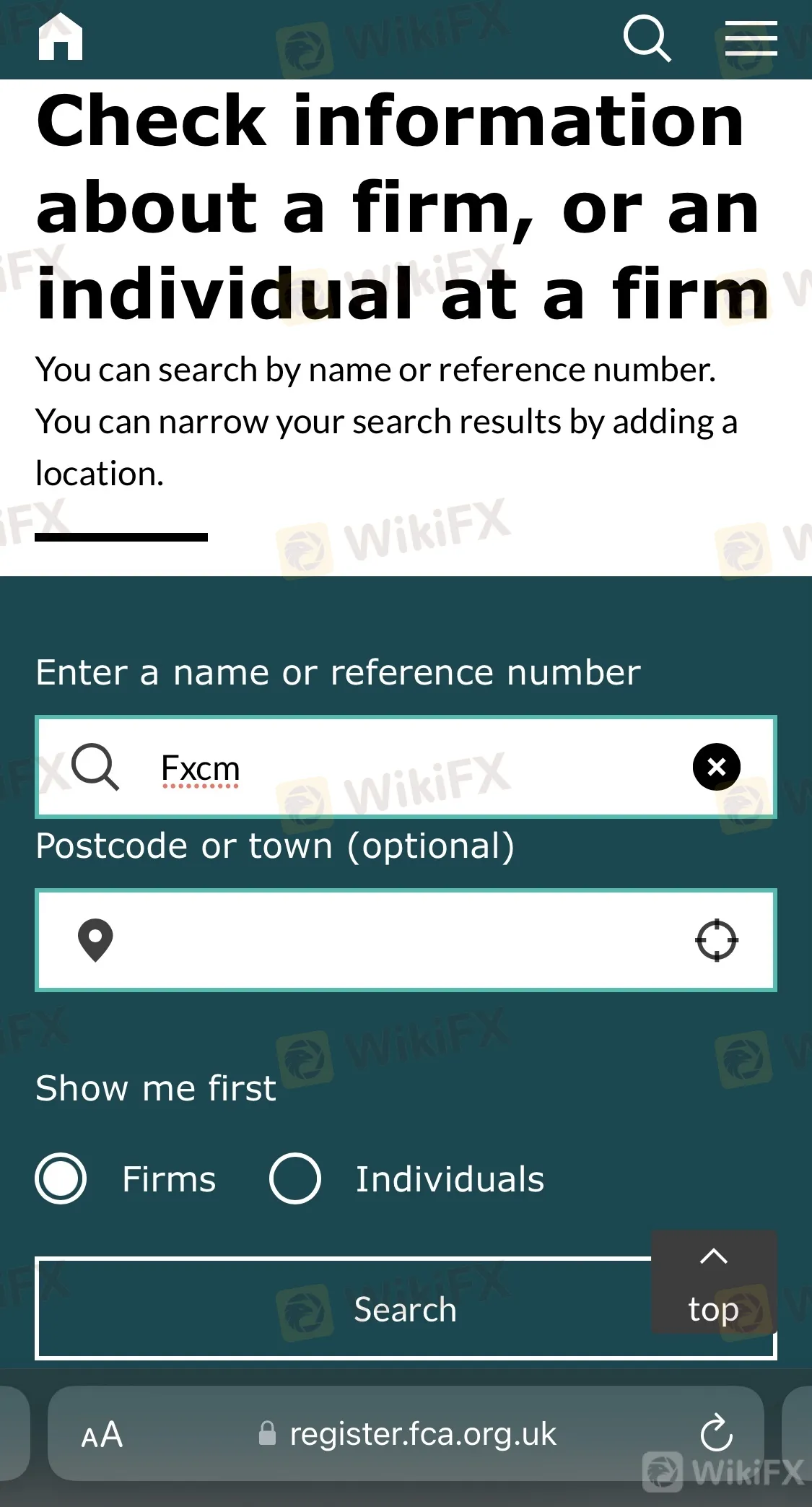

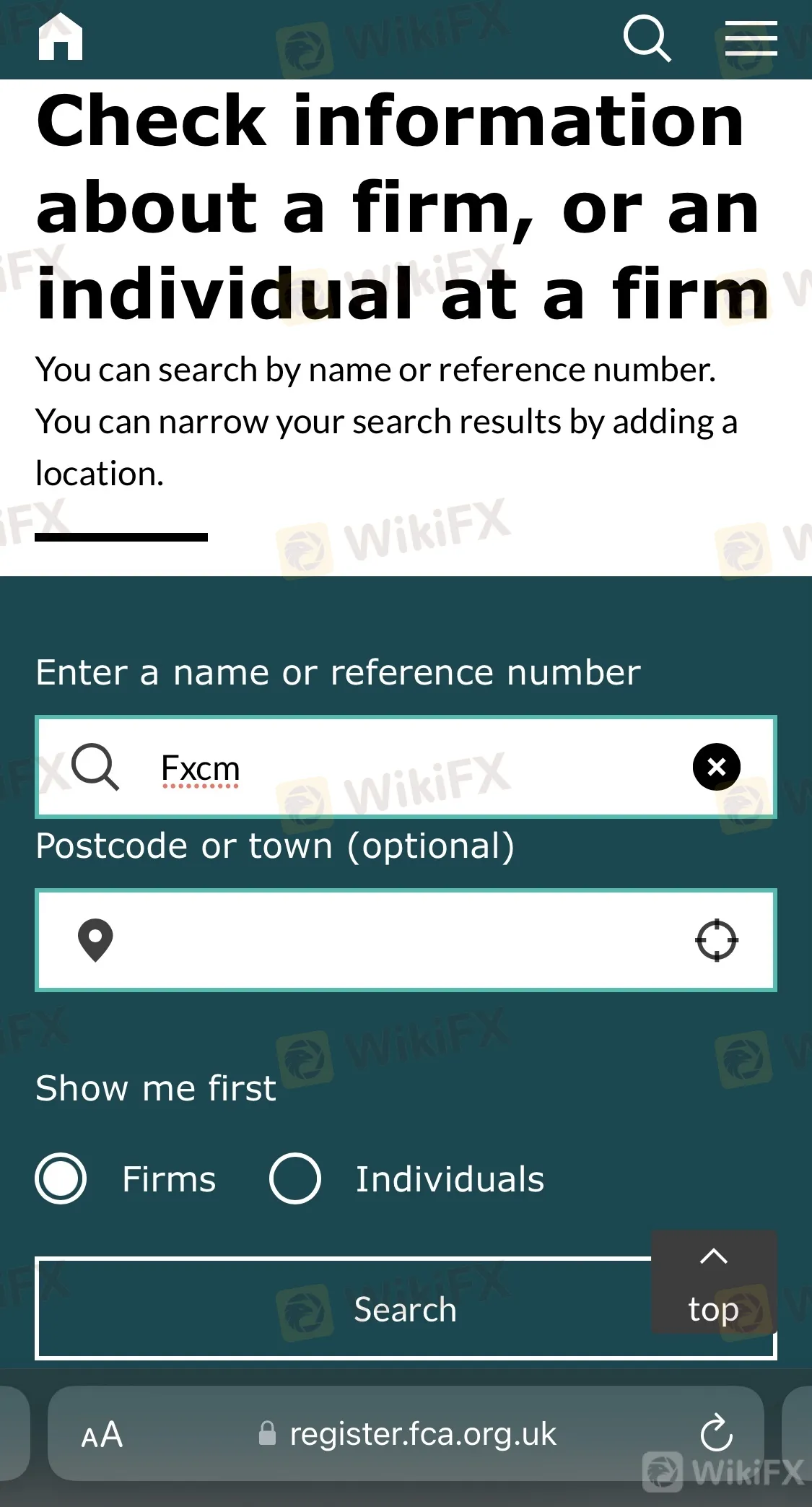

Firstly, log on to https://register.fca.org.uk/ which is the database of all registered entities under the regulation of the UKs FCA.

In this article, we will be using a forex broker named ‘FXCM’ as an example.

It is important to take note of the reference number of the entity in question.

From here, it is evident that FXCM is an authorized forex broker that is operating under the regulation of the UK FCA. With its reference number, we can easily cross-check its information.

For example, on FXCMs WikiFX profile, click on its FCA license.

Furthermore, from FXCM‘s WikiFX profile, we can also see that this forex broker has achieved a fairly high WikiFX score, which means it has been evaluated as a reliable forex broker. In addition, its registered business premise was also verified by WikiFX’s field survey team.

From all this available information, it can be concluded that FXCM is a reliable broker that traders can trust.

On the other hand, if a trader would like to find a forex broker that is under the regulation of the FCA but does not know where to begin searching, he can do this simply on the WikiFX free mobile app in just 2 steps:

With so many brokers available on the internet, it is always crucial for a trader to perform his due diligence to avoid falling into the traps of malicious forex brokers.

For more tips on what to look for when searching for the right forex broker, read this article here: https://www.wikifx.com/en/newsdetail/202206012274264618.html.