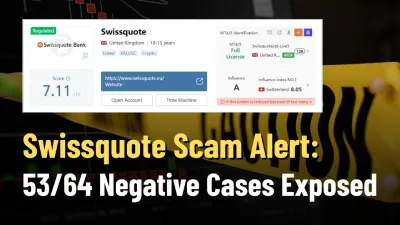

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract: Russian gas giant Gazprom said on Thursday that its shareholders had decided against distributing dividends on its 2021 results.

Russian gas giant Gazprom has decided not to pay dividends on last years results, the first time it will not pay out since 1998, sending its shares plunging 27%.

“The shareholders decided that in the current situation it is not advisable to pay dividends based on the 2021 results,” Deputy CEO Famil Sadygov said.

He added that Gazprom would rather focus on Russian regional gasification, preparation for the heating season and paying increased taxes.

Gazprom shares plunged by more than 27% on the decision, which reversed a board recommendation to pay a dividend of 52.53 roubles per share in what would have been its biggest payout.

Gazprom plans to spend 526 billion roubles ($10 billion) by 2025 to increase Russias gasification from its current level of 72%.

Lawmakers are also discussing imposing a higher mineral extraction tax on the company as the government boosts social payments.

“This is a disaster for Gazprom shares, as the company‘s only investment appeal was high dividends. The decision is also likely partly linked to the finance ministry’s willingness to increase… budget revenue,” Tinkoff Investments analysts said.

Gazproms decision comes as the Group of Seven economic powers looks to cap the price of Russian oil and gas as a way to prevent Moscow profiting from its actions in Ukraine, which have led to a sharp rise in energy prices.

Russian gas flows to Europe via Ukraine and the Nord Stream 1 pipeline have also fallen.

In its statement on Thursday, Gazprom did not mention either the G7 proposals to cap gas prices or the reduced flows to Europe, both of which threaten to cut its revenue and potentially its tax payments as a result.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

When looking at a forex broker, traders often find confusing and mixed information. This is exactly what happens with ACY Securities. On one side, it's a broker that has been operating for 10-15 years and has a good license from the Australian Securities and Investments Commission (ASIC). On the other hand, there are many serious complaints that show a very different story. As of early 2026, websites, such as WikiFX, have lowered the broker's score because they received over 156 user complaints, with a total of 182 "Exposure" reports filed. This creates a big problem for people who might want to use this broker. The main question this article will answer is: Is ACY SECURITIES legit, or are the many ACY SECURITIES scam claims actually true about how it does business? We will look at facts we can prove, study the broker's rules and regulations, examine the patterns in user complaints, and give a clear, fact-based answer about the risks of working with this broker. Our goal is to cut thr

ACY Securities shows a complicated picture for traders. On one side, it is a well-known broker that has been running for more than ten years and has a license from a top-level regulator. On the other side, it is a company that faces many serious complaints from users and official warnings from several international financial authorities. This ACY SECURITIES Review aims to explain these differences. We will give a fair and thorough analysis of both what the broker advertises and the serious risks that users have reported. At its heart, ACY Securities is a story of attractive trading conditions that are overshadowed by major user complaints and questions about whether it can be trusted. Our goal is to examine the facts, look at the evidence, and help you make a completely informed decision about your capital’s safety.