Abstract:WikiFX caught wind of a investment platform making the rounds called OmegaPro. They have been actively holding seminars in different parts of the country and claim to have a host of trading instruments in which investors can trade on and get a profit.

OmegaPro has a referral program where you can earn by referring people to the platform.

This sort of referral system is frequently used by Ponzi schemes. This is the first red flag WikiFX noticed, and without a financial report, it is hard to determine if they make money from trading or from getting more people to join the platform.

At the bottom of their website, OmegaPro states its address is “Griffith Corporate Centre Kingstown St. Vincent And The Grenadines”

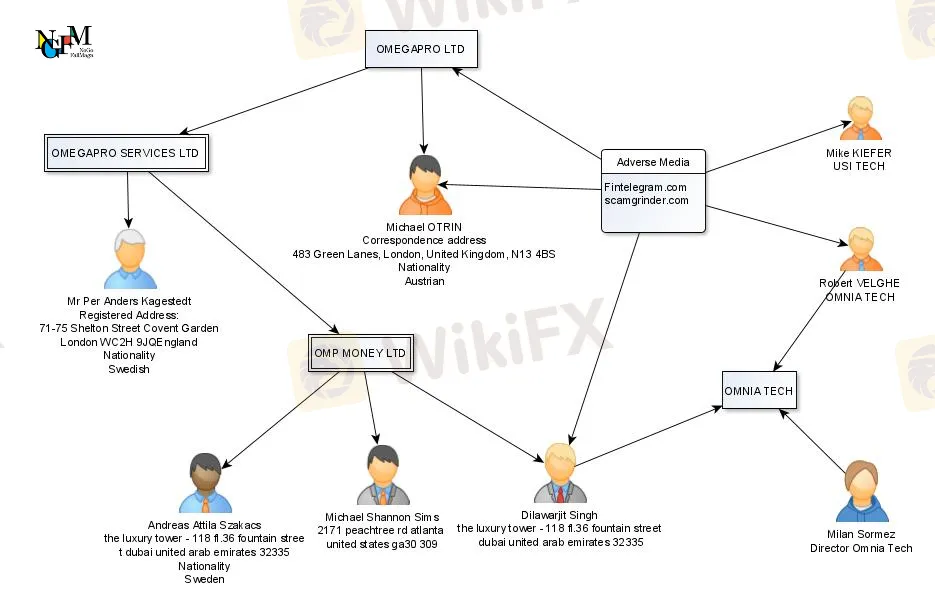

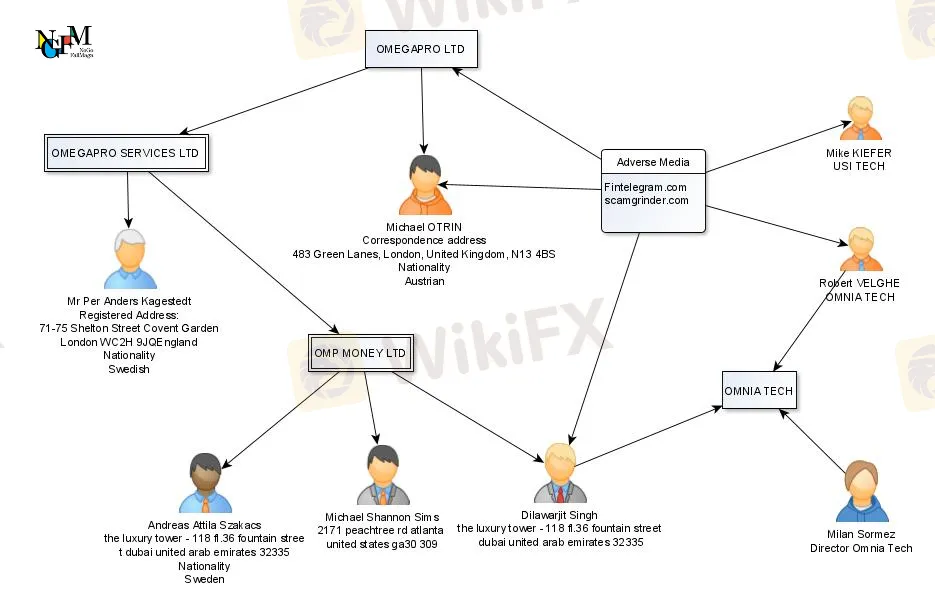

Doing a search for “OmegaPro Ltd” on opencorporates returned three companies, with none of the companies bearing the address listed on its website. Two of the companies were based in the UK and one in Belize, a country categorized by the US State Department as a Country/Jurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes.

Looking at the source code for the website we found the same address and company name of OMEGAPRO SERVICES LTD in our company search on open corporates.

This address is not displayed on the website because it was hidden using an HTML coding technique.

A google search for the address “71-75, Shelton Street, Covent Garden, London, United Kingdom” revealed that it is the current location of 1st formations which is a company that provides registration services for new limited companies online for clients from the UK and overseas. They also provide address services as stated on their website:

“1st Formations also provides a range of address services, including Registered Office and Service Addresses to keep your personal details off the public record. Furthermore, our Business Address Service allows you to use our prestigious address in Covent Garden, London for all of your business mail. This can help your company by establishing a presence in a prime business location, protecting your home address and developing an excellent corporate image.”

Pulling up the filling details of OmegaPro Services Ltd on opencorporates revealed that the SIC code of the business is 96.09

which means the company is licenced to carry out the following activities:

astrological and spiritualists activities

– social activities such as escort services, dating services, services of marriage bureaux

– pet care services such as boarding, grooming, sitting and training pets

– genealogical organisations

– activities of tattooing and piercing studios

– shoe shiners, porters, valet car parkers etc.

– concession operation of coin-operated personal service machines (photo booths, weighing machines, machines for checking blood pressure, coin-operated lockers etc.)

Notice that there is nothing among the above-listed activities which includes running a crypto, forex, or commodity investment platform. So we have a company that is registered by a formation agent with no physical office and operating an illegal investment scheme, this should be enough to set the alarm bells ringing.

Moving on, we noticed that on the OmegaPro website there is a link to an e-money firm called OMP Money Ltd which it claims to be in partnership with. The firm is registered in the UK and can distribute or redeem electronic money (e-money) and provide certain payment services on behalf of an e-money institution.

OMP Money Ltd operating address is listed as “No.1 Royal Exchange London EC3V 3DG UNITED KINGDOM.” Looking up this address on google we found that 466 other companies are listed as using the same address, which means this is a virtual office.

Digging into the companies records, we found that OMP Money Limited has three persons with significant control: Mr. Michael Shannon Sims, Mr Andreas Attila Szakacs, and Mr Dilawarjit Singh.

Of the three persons listed, Mr. Dilawarjit Singh has an interesting past. He is linked to a failed crypto mining multi-level marketing scheme called Omnia Tech.

The website scamgrinder says he has been working for years with Robert Velghe who has been described as a serial rip-off.

Putting it all together, OmegaPro Ltd is not licensed to carry out the activities it is currently handling, tries to hide that it is operating from a virtual office, and is linked to people who have been involved in failed crypto multi-level marketing schemes. WikiFX advises that you do not get involved with this company or any of its affiliates.